Our Video Review of WorldRemit

WorldRemit review

Fees & Rates

While WorldRemit’s flat fee structure is a plus, their low transfer limits mean the cost can stack up if you have a lot of money to move.

Service

Ease of Use

Safety & Trust

Customer Feedback

“Since being founded in 2010, WorldRemit has become one of the biggest providers in the industry. Their app is extremely easy to use, making sending money a piece of cake, and their transfers are often completed rapidly. We’d recommend them as a money transfer provider.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like WorldRemit?

Huge network: WorldRemit has a network of agents in continents around the world

Multiple payout options: You’ll have multiple options for paying out money to your recipients

Easy to use: The app is simple and makes sending money straightforward and fast

Can sometimes be pricey: WorldRemit’s fees are variable, but you might find them to be higher than other providers

Low transfer limits: You won’t be able to send more than a few thousand dollars per week

Not widely available in Europe: It has limited options for sending money to countries in Europe

How much does it cost to send money with WorldRemit?

This is how we rated WorldRemit based on their fees and exchange rates - our rating puts them outside our top ten overall providers in terms of cost. Find the best rates for your specific transfer with our comparison tool.

Compare providers

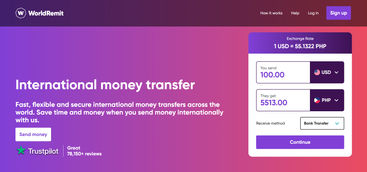

WorldRemit doesn’t publish its exact fee structure, but it usually charges a fixed fee plus a small markup on the mid market exchange rate. It will show you what your upfront fixed fee will be when you input the origin, destination and currency of your transfer. You’ll see the rate you get and the transfer time too, without having to sign up or log in - which is a plus.

On their website, WorldRemit states that they’re 41% cheaper than sending by most banks, and on average 5% cheaper than Ria, Moneygram and Xoom - using data sourced from the World Bank.

Overall, you’ll find the total cost of your transfer with WorldRemit depends on:

Origin, destination and currency: The flat fee and exchange rate you’ll get will vary depending on the currency you’re sending and the country the recipient is in - we’ve put a few examples in a table below

Payment method: Credit and debit card payments are likely to be more expensive than bank transfers, although they’ll also be quicker to process

Receive method: WorldRemit offer a few different receive methods but the one you choose will affect the flat fee you pay

What are WorldRemit’s transfer fees?

WorldRemit doesn't put a list of all their fees online, so you’ll have to input the details of your transfer to find out how much you’ll need to pay in fees. However, once you do, you’ll be shown what rate you get and what transfer fee you’ll pay depending on the destination, currency and payment method.

We’ve added a table below showing WorldRemit’s transfer fees for some of the most popular transfers from the US and around the world:

Transfers from the US

Route | Bank deposit fee | Cash pickup fee | Mobile money fee | Airtime top up fee |

|---|---|---|---|---|

USA to Philippines | $0.99 | $3.99 | $0.00 | Depends on amount |

USA to Mexico | $1.99-$2.99 | $2.99 | N/A | Depends on amount |

USA to Colombia | $0.99 | $3.99 | $0.00 | N/A |

USA to India | $2.99 | N/A | N/A | Depends on amount |

USA to UK | $1.99 | N/A | N/A | N/A |

Transfers around the world

Route | Bank transfer fee | Cash pickup fee | Mobile money fee | Airtime top up fee |

|---|---|---|---|---|

Canada to USA | $3.99 CAD | N/A | N/A | N/A |

Netherlands to USA | €1.99 | N/A | N/A | N/A |

Germany to Philippines | €0.99 | €2.99 | €1.99 | Depends on amount |

Malaysia to Indonesia | 5.00 MYR | N/A | 5.00 MYR | Depends on amount |

France to Morocco | €0.99 | €0.99 | N/A | Depends on amount |

Overall their fees aren’t bad at all - a flat fee is always preferable as you’ll know exactly how much you’re paying, and it won’t change depending on the amount. However, combined with their low transfer limits, you might find the fees stack up if you need to move large amounts of money abroad.

For this reason, we find WorldRemit good for one-off small transfers, but you might find better options if you’re more frequently sending money overseas.

What exchange rate does WorldRemit charge for international transfers?

We found WorldRemit’s exchange rates to be greatly dependent on the destination and origin of the transfer. Their exchange rates scored quite high for transfers from Europe to the US and the UK, while they were also not bad for transfers from the UK to the US.

However WorldRemit’s exchange rates for transfers from the US to Canada, Australia or India to be significantly worse than the mid-market rate - so for transfers out of the US we would suggest looking for other providers.

“WorldRemit’s fees aren’t the most or least expensive, but it will depend greatly on the transfer you’re making. We found them to be worth it for one-off transfers, thanks to the overall ease of the process, but it might work out expensive if you need to send money regularly.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is WorldRemit's money transfer service?

Here's our score based on the overall quality of service WorldRemit offers. This puts it high up on our list of providers for its services, alongside Currencies Direct and TorFX.

Compare providers

WorldRemit offers fast money transfers, with a wide array of destinations and currencies available for transfers - though its service is distinctly lacking in Europe. It also offers multiple ways of paying for transfers and receiving money, giving users great flexibility when sending money abroad. While WorldRemit’s maximum limits are quite low, they are a reliable service for smaller transfers to a range of countries in Africa, Asia and the Americas.

What kind of transfers can I make with WorldRemit?

When you send money with WorldRemit, you’ll be able to pay for your transfer via the following methods from the USA:

Bank deposit

You can fund your money transfer with WorldRemit directly from your bank account, one of the most common and easiest ways to pay for your transaction. These payments are not always the fastest, but you avoid the highest fees this way..

Debit card

You can also pay for your money transfer with WorldRemit by debit card, a popular and fast way to pay for any transaction - just be careful of any currency conversion fees attached.

Credit card

Credit cards are often just as fast as debit cards, but they come with more strings attached. While they’re secure, safe and convenient, they come with the risk of paying interest on the money you spend. Additionally, credit card transactions for money transfers will be seen as cash advances, which come with high fees and higher than normal interest rates.

Apple Pay

Finally, WorldRemit allows customers in the USA to pay by Apple Pay - a popular digital wallet used around the world.

It’s surprising that WorldRemit does not offer a way to pay for your transaction via a bank transfer from the US, as this is a common although slow way of financing money transfers. Bank transfers are currently only allowed in the UK, South Africa, Rwanda and Japan. However, WorldRemit does not charge an extra fee for card payments, which means you can benefit from their fast transfers at just the standard transfer fee they quote at the start.

Where can I send money with WorldRemit?

You can send money to over 130 countries around the world with WorldRemit, with a wide range of options in Africa, the Americas, Asia and Australasia. However in Europe you can only send money to Albania and Turkey, and in the Middle East your only options are Lebanon and the UAE.

It’s a different story for places you can send money from with WorldRemit, with over 50 countries available - including most of Europe, the USA, Canada, Brazil, and a handful of other countries across Africa, the Americas, Asia and Australasia.

How good is WorldRemit’s customer service?

WorldRemit offers a phone service and a series of FAQ pages, and while some parts of their website mention a live chat, this is currently unavailable at the time of writing (confirmed by phone).

Phone

Availability | 24/7 |

|---|---|

Response time | We were on hold for 16 minutes |

Languages | Phone numbers for over 20 countries, and a worldwide number available in English, Spanish and French |

We called WorldRemit to ask about their transfer limits as we found some inconsistencies in the information available online and on their website. We asked what the transfer limits were if sending money from the USA, and they informed us that it was dependent on the receiving country and method of payment and collection. They also told us that bank transfers were available when sending money from the USA, while their FAQs only mention card payments and Apple Pay. Their FAQs also mention prepaid cards, which their customer service agent said was not currently accepted.

After being on hold for 16 minutes, it took around ten minutes and many repeated questions to find out what we wanted to know. It wasn’t the best experience but in the end we got there.

Help center FAQs

Availability | Online |

|---|---|

Languages | English (UK, USA, AUS, Canada, NZ), Danish, French, German, Dutch, Spanish |

It appears that some of the information on their FAQs is incorrect, according to their customer service agent. This isn’t ideal, and we recommend calling their customer service if you have any questions.

That being said, it’s an easy enough system to use with a search function that allows you to look for specific topics by keyword.

What else can I do with WorldRemit?

WorldRemit only provides money transfer services - they used to offer a service called WorldRemit Wallet, which acted as a digital wallet, but this is no longer available.

“WorldRemit is one of the strongest money transfer providers on our panel in terms of the quality of service it offers. With multiple pay in and pay out options, a wide range of countries and currencies, and regularly fast transfers, it’s a good choice when you need to get money abroad quickly.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How easy is WorldRemit to use?

This is how we scored the simplicity of opening an account and sending money with WorldRemit. It came close to the top of our list in this ranking, alongside other providers like XE and Wise.

Compare providers

We went through the process of signing up to WorldRemit on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

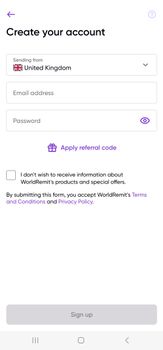

Signing up with WorldRemit

We signed up to WorldRemit by desktop and Android smartphone - here’s how we did it and how long it took:

Open the app

Download the app from your chosen app store and launch it

Add your details

Click ‘Get started’ and enter your email address and a password, plus where you’re sending money from

Verify your phone number

Enter your mobile phone number to receive an SMS verification, then enter the code you receive on your phone

Confirm sign up

Then you’ll be signed up and ready to start your first transfer

Signing up for WorldRemit took a few minutes, and was straightforward from start to finish with no complicated steps.

Sending money with WorldRemit

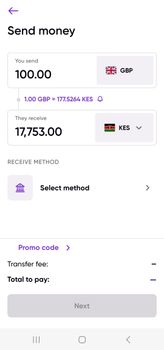

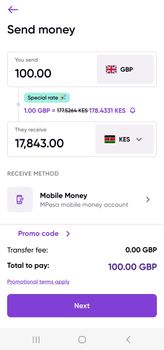

We tried sending money from the UK to Kenya via M-Pesa - here’s how it went:

Start transfer

We set the amount we wanted to send, and the receiving currency as KES

Choose receive method

We set the receive method as mobile money, and were shown that there was no transfer fee

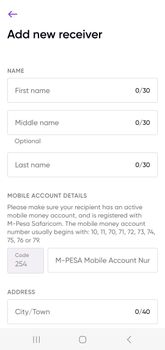

Add recipient

We had to add a new receiver, with details including their name, mobile account number and code, and their address

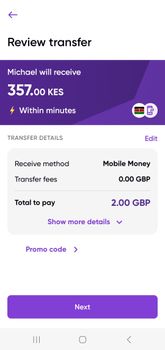

Review transfer

We reviewed the details of the transfer, including the receive method, any fees, the amount being received, and the total amount to pay

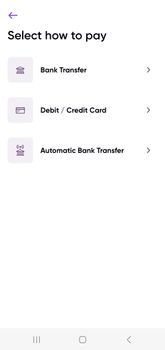

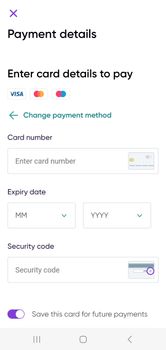

Choose payment

We chose our payment method, in this case using a card

Add card details

We added our card number, expiry date and security code

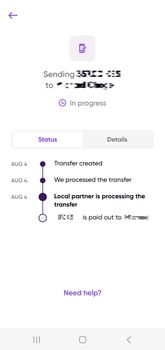

Confirm transfer

We confirmed the transfer and clicked on the link to track its progress

It was incredibly straightforward to send money with WorldRemit. There were no problems with the app, none of the steps felt complicated or time-consuming, and our transfer was completed in 11 minutes.

“Our experts tried sending mobile money via one of the biggest mobile network providers in Kenya - M-Pesa. WorldRemit made it easy - and our recipient had their account topped up in minutes, making it an exceptionally convenient way to send money.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How safe is WorldRemit?

This is our rating for WorldRemit's their safety, security, transparency and trustworthiness. It ranks high with a range of other providers, such as Instarem, CurrencyFair and PassTo, but falls behind companies like Wise and XE.

Compare providers

WorldRemit say they serve 5.7 million customers around the world, and as one of the biggest providers in the remittance industry they have earned a reputation for being trustworthy. Of course, we’ve made sure all providers we compare on MoneyTransfers.com are fully reputable and credible.

We took a deep dive into how WorldRemit practices, who it’s regulated by, and what security features it uses - here’s what we found.

Is WorldRemit authorized to provide money transfers?

WorldRemit, like all providers on MoneyTransfers.com, is fully authorized and regulated by all relevant institutions. This includes the Financial Conduct Authority in the UK (registration number 90089), and all other global regulatory bodies - though WorldRemit does not state them on its website.

Is WorldRemit safe and secure?

According to their website, WorldRemit ensures all connections to their website are encrypted and secure, with a sophisticated automated machine learning system to boot. All their payment systems are secure and trusted, and their website uses 3D Secure technology. They adhere to strict guidelines around compliance and GDPR, ensuring your data is safe at all times.

Is WorldRemit transparent?

WorldRemit are not entirely transparent with their fee structure, and don’t disclose that most of their charges are hidden in the exchange rate markup. However, you can see all the information relating to the cost of your transfer when inputting details in their calculator - which is helpful, compared to some providers with whom you have to sign up first or even get a quote.

What do other customers think of WorldRemit?

This is how we rated WorldRemit based on their reviews on Trustpilot, the Apple App Store and the Google Play Store. It ranks on our top ten provider list for customer feedback, alongside others like Payoneer, Profee and Transfergo.

Compare providers

Millions of customers have used WorldRemit to send money abroad, thanks to its low rates and fast transfer. Seeing how customers have reviewed their experience with the provider is always useful to see what it’s really like sending money with WorldRemit - so we’ve looked at their scores on Trustpilot and both App stores.

What is WorldRemit rated on Trustpilot?

WorldRemit is rated as Great on Trustpilot, with a score of 4.1 from over 71,000 reviews when this article was written - and almost 75% of all scores given were five stars. This is a solid result from a significant customer base, as only Wise has more reviews on Trustpilot than WorldRemit.

Many positive reviews cite their very easy-to-use service and fast transfers, but common negatives include poor customer service and incomplete transactions. Additionally, according to Trustpilot WorldRemit replies to 99% of negative reviews, averaging a response time of less than 24 hours - much better than providers like Wise.

What is WorldRemit rated on the Apple App Store?

WorldRemit has multiple regional versions of its app on the Apple App Store, most of them rated at 4.8 out of 5 stars. We’ll look at the US version specifically - which has been rated 4.8 out of 5 stars from over 167,000 reviews at the time of writing.

Users tend to praise the speed of their transfers as well as low fees, but many reviews seem to criticize their customer service and complain about the app being buggy.

What is WorldRemit rated on the Google Play Store?

WorldRemit is rated highly on the Google Play Store too, with a score of 4.7 out of 5 from over 169,000 reviews. It’s been downloaded over five million times. Many of the positive reviews for WorldRemit’s Android app reference its fast and easy transfers, while negative reviews again note poor customer service and a buggy app.

There are definitely common themes to these reviews, but their response rate to reviews is impressive and it seems they’re willing to reach out and help despite poor feedback on their customer service. Their speed is frequently complimented, as is the overall ease-of-use for their money transfers. It's actually listed as one of our top money transfer apps.

Our MoneyTransfers.com expert says…

“WorldRemit is one of the top rated money transfer providers on our panel, and they’ve got a reputation for providing fast transfers to a huge global network. While not always the most flexible with payment options, you still have multiple ways for people to receive money - and they’re a particularly good choice for money transfers to Africa and Asia.”Financial content specialist, MoneyTransfers.comArtiom Pucinskij

Compare WorldRemit to other providers

WorldRemit - Is it the best for transfers abroad?

The experts at MoneyTransfers.com rate WorldRemit very highly, thanks to the overall outstanding quality and flexibility of the service it provides. While it may not always be the cheapest option, if you need to send money to Asia or Africa you’ll find it often provides the best option for your transfer.

A bit more about WorldRemit

Do I need an account to receive money with WorldRemit?

Do I need a bank account to join WorldRemit?

Is WorldRemit legal to use?

Who owns WorldRemit?

Can I open a WorldRemit account in any country?

WorldRemit user feedback

Comments

Anonymous

different price from shown here

Anonymous

exchange rates on comparison website are quite high

Anonymous

Only phone app.

Stanley Davidson

After setting up a valid account with all true and real identity, the system blocked me without any valid reason. Upon calling Customer Service & requesting a reconsideration & a valid reason why I was blocked, Customer Service said that I "violated some TOUs" (Terms Of Use) without stating exactly what I did. My ONLY action was an ATTEMPT to do a normal wire transfer. One can't do anything but to do a wire transfer, & it WAS NOT completed. How do they block my account for something, whatever it was, that I supposedly committed? When I requested the reason for the block they'd said that "it's Company policy to not provide reason(s) why an account is blocked", so exactly how am I supposed to not do something if I re-read their Policy against such action when I can't find why I was blocked? It was asked repeatedly why/what Policy(ices) was/were broken enough to cause the account to be blocked, but they'd completely refused to answer or acknowledge the question, they'd just kept completely silent. That ended the conversation because anything further would remain in total silence, so it was useless to ask anymore questions.

I will be 💯% posting this exact statement on www.trustpilot.com for the world to see how undeserving this company is when mistreating a customer for no valid reason. Please enjoy the review!!!

Anonymous

Awesome service

.svg)