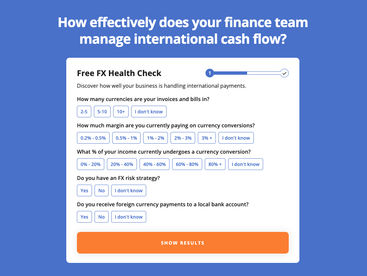

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

How to send money from Equatorial Guinea to United Arab Emirates

Sending money from Equatorial Guinea to United Arab Emirates doesn’t have a huge amount of options. Because of this, we would recommend sending money via:

How to send money from Equatorial Guinea to United Arab Emirates

Sending money from Equatorial Guinea to United Arab Emirates: key insights and tips

Don't settle for the first option. Always compare ways to send money from Equatorial Guinea to United Arab Emirates to find out about fees, speed, and reliability.

Your analysis should include all the providers that operate between Equatorial Guinea and United Arab Emirates. Through this, you get a comprehensive view of all the options you have in Equatorial Guinea when you need to send money to United Arab Emirates.

Cheapest way to send money from Equatorial Guinea to United Arab Emirates

Without any money transfer providers serving the Equatorial Guinea to United Arab Emirates route, the cheapest money transfer options are limited.

We would recommend using:

Understanding the costs involved when moving money from Equatorial Guinea to United Arab Emirates

When calculating the costs of money transfers between Equatorial Guinea and United Arab Emirates, here's what really matters:

The Mid-Market Rate: Today, the XAF-AED mid-market rate equals to 0.0059. Keep in mind that this rate fluctuates all the time.

The XAF-AED average exchange rate of the past three months has been 0.006, with a highest of 0.006 and a lowest of 0.006.

Fees and Markups: When you pick a service with competitive exchange rates and low fees, you get to make the most out of your XAF to AED transfers. This strategy keeps your costs down, offering a smart way to handle your international transactions.

Finding the best exchange rate between CFA Franc BEAC and UAE Dirham

Getting a strong exchange rate between XAF and AED is essential. The exchange rate you secure impacts how much AED you get for your XAF.

It can pay to track rates, and keep on top of currency trends.

Over the past six months, the mid-market rate from XAF to AED has averaged 0.006.

In this period there was a high of 0.006, and a low of 0.006.

, which is our recommended service to send money online from Equatorial Guinea to United Arab Emirates offers an exchange rate with a mark up of % above the mid-market rate.

Want to secure the best XAF-UAE Dirham exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Equatorial Guinea to United Arab Emirates!

What payment methods are available when sending money from Equatorial Guinea to United Arab Emirates?

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between United Arab Emirates and Equatorial Guinea.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Equatorial Guinea to United Arab Emirates.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send XAF to AED.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

.svg)