Fifth Third Bank for international wire transfers

We’ve compared Fifth Third Bank to the average money transfer company, and here you can see the summary of our analysis.

Transfer type | Fifth Third Bank | Money Transfer Companies |

|---|---|---|

Sending fees | $50 - $85 | $0 - $20 |

Receiving fees | $15 | $0 |

Exchange Markup | 4% - 6% | 0% - 2% |

Transfer Times | 1 - 5 working days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Fifth Third Bank

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Fifth Third Bank fees and exchange rates

Fees and rates

First and foremost, if you are debating whether or not to use your bank to send money overseas, it is important to always consider Fifth Third foreign currency exchange and the various fees that will be incurred.

Many banks, including Fifth Third Bank, add a margin on top of the exchange rate. This is called markup.

In many cases, these margins added to foreign currency exchange rates can affect the amount of money the receiver gets.

As well as many high street banks will charge a fee for making international transfers in the first place.

Exchange rates

When making an international wire transfer with Fifth Third Bank, customers can choose from 70 available foreign currencies, but the price of each currency comes with an added markup.

This is because, unlike specialist money transfer companies who promise to match the mid-market rate for foreign currency exchange, most banks add a markup of up to 4 - 6% when converting currency.

Unfortunately, there isn’t a great deal of transparency available online regarding the foreign currency exchange rates offered by Fifth Third Bank; they are simply advertised as “competitive.”

This usually means that the rates are calculated at the time of the transfer and are affected by many factors, including currency pair, transfer amount, and destination.

In addition to this, Fifth Third Bank foreign currency exchange and international wire transfers can only be dealt with in person at a Fifth Third Bank branch.

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

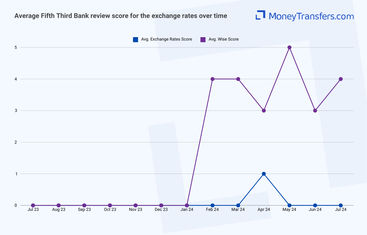

We’ve looked at how users have rated their exchange rates in the past 12 months and here’s how it looks when compared to international transfer provider Wise.

International transfer fees

Apart from the Fifth Third Bank exchange rates, there is a substantial list of fees that customers may be charged for using Fifth Third Bank’s international wire transfer services.

The transfer fees are as follows:

$15 fee to receive an international (or domestic) wire transfer

$50 fee to send an international wire transfer using a foreign currency

$85 fee to send an international wire transfer using USD currency

$30 fee to send a domestic wire transfer using USD currency

$15 to return an international transfer

$33 to halt an international payment

In addition to the lengthy list of fees above, Fifth Third Bank states that “other bank fees and taxes may apply.”

This suggests that the fees listed above do not include potential costs incurred by any other banks or third parties involved in the international wire transfer.

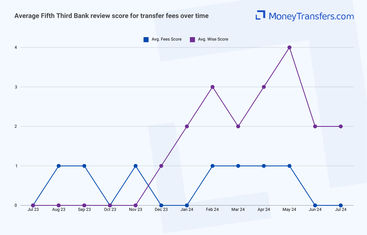

Fifth Third Bank does not hold up well when compared to leaders in the money transfer industry, due to the many different fees charged for international wire transfers.

And here's what we mean by that, here's what it would look like if you were to send $1,000 from the US to the following countries via 53 Bank:

Destination | Fifth-Third Bank fees | Navy Federal fee | Wise fee |

|---|---|---|---|

$85 + ~5% markup | $25 + ~4% markup | $6.50 + 0% markup | |

$85 + ~5% markup | $25 + ~4% markup | $7.34 + 0% markup | |

$85 + ~5% markup | $25 + ~4% markup | $10.36 + 0% markup |

Similar to the exchange rates, we’ve checked how online reviews stack up against their competitors.

Transfer speed

Transfer speed

According to our research, Fifth Third Bank international wire transfers can take anywhere between 1 to 5 working days.

Here’s how users have rated Fifth Third Bank in terms of transfer speed in the past year.

Transfer limits

Transfer limits

This is unclear, customers will need to enquire about transfer limits in person when setting up an international wire transfer in their local bank branch.

However, it's also worth noting, Fifth Third customers have no minimum or maximum limits on foreign currency exchange. Whereas Non-Fifth Third customers can exchange $1,500 per day and up to $4,000 per month

Here’s how users have rated Fifth Third Bank in terms of transfer limits in the past year.

Product offering

Product offering

Foreign currency orders

Fifth-Third Bank offers 70 foreign currencies. However, they do not disclose what currencies they have.

You will need to contact your local branch to check what currencies they have and their availability.

In addition to the foreign currency exchange, 53 Bank offers the following features.

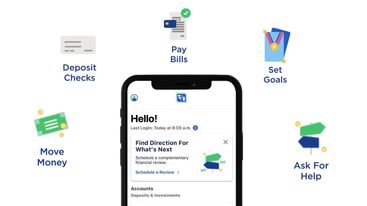

Mobile app

The Fifth Third Mobile Banking app is available to download for free on Google Play or App Store.

Android users have given the app 4.3/5 and iPhone users have given it 4.4/5.

Unlike challenger banks such as Monzo and Starling, it is not possible to arrange or manage international transfers through Fifth Third Bank’s mobile app.

Here’s how users have rated Fifth Third Bank in terms of their product features.

Ease of use

Ease of use

When it comes to usability and convenience, the best way to assess how good it is, is by checking what others have to say. And that’s exactly what we did.

Here’s an overview of how users have rated Fifth Third Bank in terms of usability.

Customer service

You can contact Fifth Third Bank using the following options:

Phone support: Available 24/7 for general inquiries, account information, and transaction assistance. The main customer service number is 1-800-972-3030.

Online banking support: Assistance with online banking issues, including login problems and technical support, is accessible via the online banking portal.

Mobile app support: Help with the Fifth Third Bank mobile app, including troubleshooting and feature guidance, is available through the app's help section.

Branch locator: Find the nearest branch or ATM using the branch locator tool on the Fifth Third Bank website.

Chat support: Real-time chat assistance with customer service representatives is available through the Fifth Third Bank website.

Social media support: Reach out to Fifth Third Bank on social media platforms like Twitter and Facebook for quick responses to inquiries.

Email support: Send secure messages through the online banking portal for non-urgent issues.

Mail support: Send mail to Fifth Third Bank, Madisonville Operations Center, 5050 Kingsley Drive, Cincinnati, OH 45227, for formal requests or documentation.

Lost or stolen card support: Report lost or stolen cards immediately by calling 1-800-782-0279.

Fraud reporting: Report suspicious activity or fraud by calling 1-877-833-6197.

Customer complaints: Submit complaints through the online form available on the Fifth Third Bank website.

Here’s a summary of all contact options with details.

Support Option | Contact Details |

|---|---|

Phone Support | 1-800-972-3030 (24/7) |

Online Banking Support | Access through the online banking portal |

Mobile App Support | Available within the mobile app |

Branch Locator | Available on Fifth Third Bank website |

Chat Support | Available on Fifth Third Bank website |

Social Media Support | Twitter: @FifthThird, Facebook: facebook.com/FifthThirdBank |

Email Support | Send secure messages via the online banking portal |

Mail Support | Fifth Third Bank, Madisonville Operations Center, 5050 Kingsley Drive, Cincinnati, OH 45227 |

Lost Or Stolen Card Support | 1-800-782-0279 |

Fraud Reporting | 1-877-833-6197 |

Customer Complaints | Online form available on Fifth Third Bank website |

Here’s how users view their customer support quality over the past year.

Safety and trust

Safety and trust

Fifth Third Bank offers multiple security features. Here’s a quick summary of the key ones:

Multi-factor authentication (MFA): Requires multiple forms of verification for online and mobile banking access.

Fraud detection systems: Monitors accounts for unusual or suspicious activity to detect potential fraud.

Encryption: Utilizes advanced encryption techniques to protect customer data.

Biometric authentication: Supports fingerprint and facial recognition for mobile app access.

Card controls: Allows customers to manage their debit and credit cards, including locking and unlocking.

Automatic logout: Logs users out automatically after a period of inactivity.

Identity theft protection: Offers services to help detect and resolve identity theft issues.

Transaction monitoring: Continuously monitors and analyzes transactions for signs of fraud.

Mobile banking security: Implements robust security measures for mobile banking, including app-specific protections.

Password protection: Enforces strong password policies and regular updates.

Security software and firewalls: Uses advanced security software and firewalls to guard against cyber threats.

Digital security tokens: Offers digital security tokens for an added layer of protection in online banking transactions.

Here’s an overview of how users have rated Fifth Third Bank in terms of safety features.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

Customers like the ease of opening new accounts and find the mobile app user-friendly.

Many had positive experiences with the helpful and friendly staff, and some have remained loyal for over a decade. The account setup process is often mentioned as being easy, convenient, and efficient, typically taking around 30 minutes.

However, many users report significant issues with online transfers, which can take over seven days.

Customer service is frequently criticized for being unresponsive, both via phone and email.

Some customers have experienced multiple account errors, such as incorrect ATM cards and locked accounts, leading to severe inconveniences.

Additionally, there are complaints about overly aggressive fraud detection measures that block legitimate transactions.

Here's a summary of average user reviews this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

International Transfers | 0 | 0 | 1 | 0 | 0 | 0 | 0 |

Fees | 0 | 1 | 1 | 1 | 1 | 0 | 0 |

Exchange Rates | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

Speed | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Limit | 0 | 1 | 1 | 1 | 0 | 1 | 1 |

Features | 1 | 0 | 1 | 1 | 2 | 1 | 1 |

Ease of Use | 0 | 0 | 0 | 0 | 5 | 0 | 0 |

Safety | 0 | 0 | 1 | 1 | 0 | 0 | 2 |

Customer Support | 0 | 0 | 0 | 0 | 1 | 0 | 1 |

Opening an account

To open a Fifth Third Bank account online, you will need the following:

Proof of identification: driver's license, state ID, or passport are all acceptable

Social security number: this will be securely stored and encrypted

Smartphone with a working camera: this will be used to scan your chosen ID

Once you have everything on the list, you will be able to get started with the signup process:

Choose the type of account you want

Gather necessary documentation

Visit a Fifth Third Bank branch or website

Complete the application form

Submit identification and documentation

Review and agree to the terms

Make an initial deposit

Receive account details

Making international transfers

International transfer requirements & details

To make an international wire transfer with Fifth Third Bank, you will need the following details:

Recipient’s full name: The complete name of the person or entity receiving the funds.

Recipient’s address: The full address of the recipient, including the country.

Recipient’s bank name: The name of the recipient’s bank.

Recipient’s bank address: The address of the recipient’s bank.

Recipient’s bank account number: The account number where the funds will be deposited.

Recipient’s IBAN (International Bank Account Number): Required for transfers to countries that use IBANs.

Recipient’s SWIFT/BIC code: The unique identifier for the recipient’s bank.

Transfer amount: The amount of money you wish to send.

Currency of the transfer: The currency in which you want the funds to be received.

Purpose of transfer: Some transfers may require you to specify the purpose of the transaction.

Sender's information: Your full name, address, and account details at Fifth Third Bank.

Fifth Third Bank's swift code is FTBCUS3C

Making wire transfers

Once you have all the details ready, follow these steps to make your transfer.

Log into your Fifth Third online banking account

Navigate to the wire transfer section

Select international wire transfer

Enter recipient details

Enter the recipient’s bank details

Specify the transfer amount and currency

Review exchange rates and fees

Verify recipient information

Confirm and authorize the transfer

Receive confirmation

Track your transfer

Alternatively, you can make an international transfer from the branch. Find your nearest branch by searching your ZIP code using the Fifth Third Bank branch locator tool.

Use Wise to send money from your Fifth Third Bank account

It may be simpler to fund your transfer with your Fifth Third Bank account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your Fifth Third Bank account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN): 042000314.

For international wire transfers, you’ll need to supply your SWIFT code or BIC: FTBCUS3CXXX (where XXX is your branch number).

The bank name and address

Fifth Third Bank's address for wire transfers is 38 Fountain Square Plaza, Cincinnati OH 45263.

Your account number, name, and address

You’ll need to supply your complete Fifth Third Bank account number, the name on your account, and the complete address of your account as it appears on your bank account.

How Fifth Third Bank compares to money transfer services

Fifth Third Bank is a decent banking option for daily finance management, however, their international transfer features are no match to international money transfer providers.

Here are a few money transfer services that we think will be a better fit for your needs.

Fifth Third Bank: Is it good for transfers abroad?

There are a few reasons why we would not recommend Fifth Third Bank to those sending and receiving international transfers.

The first is the relatively long list of fees incurred for both incoming and outgoing transfers.

The second reason this bank is not a viable option for most is the fact customers must arrange international wire transfers in person, with a customer representative at a local bank branch.

While many people value face-to-face customer service, there should be alternative options for those who want to send and receive international wire transfers online.

After reviewing Fifth Third Bank's international services at length, it is clear this brick-and-mortar bank does not keep up with the convenient, digitally-accessible offerings of money transfer companies and digital-only banks.

We suggest you get a better alternative for international transfers. Use the form below to find the best service for your needs.

Find the best rates for your transfer

A bit more about Fifth Third Bank

Can I open a Fifth Third Bank account in any country?

Can I use a Fifth Third Bank debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks