Statrys is an excellent choice for sole traders or smaller institutions with global operations centered in the Asia Pacific region.

However, it is geared towards small to mid-size businesses as it lacks certain enterprise-level features, such as global payroll and the ability to make batch payments.

Provided that the currencies the business trades with are supported by Statrys, businesses with international shipping, importing, and service operations can save their hard-earned money by avoiding high and regular FX fees.

Like all financial service providers, there will be positives and negatives involved in using Statrys - we've laid them out for you so you can be well-informed when you make your decision.

Pros

Cons

About Statrys

Statrys is a Hong Kong-based local and international payment services provider launched in 2019. Currently, it’s located in Hong Kong, Singapore, London, and Bangkok.

The platform is designed solely for business customers and, therefore, does not provide money transfer services to individuals.

Statrys is not a bank

Statrys is a financial institution that has a Hong Kong Money Service Operator license (19-02-02726) and a United Kingdom Small Payment Institution license (FRM: 911226).

They are controlled by the Hong Kong Customs and Excise Department and the Financial Conduct Authority in the United Kingdom.

Statrys Fees and Exchange Rates

It’s crucial to understand what fees and charges are involved for the provider you choose so you know what the overall cost will be.

Exchange Rates

If you open a Hong Kong Business Account with Statrys, the FX fee you’ll be charged can be as low as 0.15%.

However, if you use a physical payment card to make a money transfer in currencies other than HKD, you’ll be charged 1.5% for foreign currency conversions.

Money transfer companies usually charge between 0.1% and 2% for popular currencies and around 3-4% for less common currencies. Banks often apply a markup fee of 4 - 6%.

Transfer Fees

With a Statrys Hong Kong Business Account, you’ll pay a fee of

HKD 5 for sending domestic payments in HKD or CNY within Hong Kong.

HKD 25 for local payments in USD, AUD, INR, EUR, GBP, SGD, IDR, or PHP.

HKD 35 for local payments in THB, TRY, or KRW.

HKD 50 for local payments in VND.

HKD 60 to receive international payments, and HKD 85 to send international payments.

In addition, here is a rundown of the other costs involved in using Statrys:

Hong Kong Business Accounts charge a monthly fee of HKD 88. This fee is waived if you make 5 or more outgoing transfers in a month.

Using your payment card will charge a 1.5% currency conversion fee and a 1.99% fee for ATM withdrawals

Like any bank and other financial institution, fees from intermediary banks may apply for certain international transfers, particularly transfers to countries with less common currencies.

Statrys Transfer Speed

Incoming payments are credited as soon as they are received by Statrys’ partner bank in Hong Kong - this is during business hours 8 am to 5 pm Hong Kong time, Monday to Friday except for bank holidays.

Local payments in HKD, CNY, or USD are typically credited on the same business day.

However, it will depend on how the sender has transferred the money.

If they’ve sent it from another Hong Kong bank account via Autopay, it should be the next working day. International payments are usually credited within 2 - 5 working days.

Statrys Transfer Limits

There are no limits on incoming or outgoing transactions with Statrys.

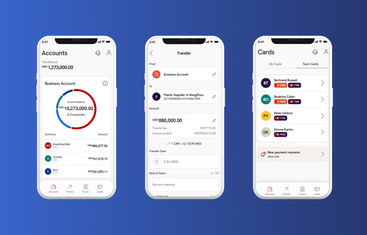

Statrys Mobile App

Statrys offers a mobile app available on both Google Play and the Apple Store.

For clients based in China, the APK file can also be downloaded directly from the Statrys website.

With the Statrys app, you can:

Log in with your business account details

Make payments to registered beneficiaries

Make international payments

Check your account balance

View recent transactions

Get notifications for new transactions

Manage payment cards by activating, topping up, locking, unlocking, or canceling them anytime

Manage team cards, set spending limits, and oversee all card expenses

They are planning to release many more features that are currently in development.

Statrys safety and trust

Statrys is a fully licensed and regulated money service provider in Hong Kong, regulated by both Hong Kong Customs and Excise and the UK Financial Conduct Authority.

They hold a money service operator license in Hong Kong (19-02-02726) and a small payment institution license in the UK (FRM: 911226).

All corporate customer funds are held in bank accounts opened with their partner bank in Hong Kong.

Getting Started With Statrys

To get started with Statrys, you will need the following details:

Personal information such as full name, email address, nationality, and country of residence.

Business details, including registered company name, registered company address, company structure details, and purpose of the account.

Supporting documents such as passport copy of directors and shareholders and business registration certificate

As well as any other documentation depending on the business industry and type.

Once you have these details ready, follow the steps below to open an account with Statrys.

Visit Statrys

Use any orange button on this page to go to Statrys website and click “Get Started”. Select the option to open a business account to begin the registration.

Select your business location

Choose the location where your business is incorporated.

If it’s outside of Hong Kong, Singapore, or the BVI, select “other jurisdictions” to check eligibility.

Add your details

Enter your contact and business details, including your full name, email address, nationality, country of residence, company name, address, and business details.

Upload the necessary documents, such as the passport(s) of directors and shareholders and the business registration certificate.

Submit the application

Complete and submit the application.

The Statrys onboarding team will review it and contact you within 48 hours to discuss the next steps.

How long will it take to open an account with Statrys?

If the application is complete (i.e. all required papers are submitted on time), it will take just a few days to examine it and set up users' accounts.

Most times, an account is opened within 3 days.

Types of Transfers You Can Make With Statrys

You can make local payments in Hong Kong via the Faster Payment System and the Clearing House Automated Transfer System to any Hong Kong local bank account.

You can also make international transfers via the SWIFT network to foreign bank accounts.

Statrys alternatives

If you need more enterprise-level features, we'd recommend the following alternatives.

A bit more about Statrys

Can I open a Statrys bank account in any country?

How long do transfers take with Statrys?

Can I use a Statrys payment card when traveling abroad?

What is the difference between opening a bank account with a traditional bank and Statrys?

Is my money safe with Statrys?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Similar Services

Statrys user feedback

Comments

Anonymous

I am satisfied with Statrys' business account service.