Companies for transfers from Japan to Curacao

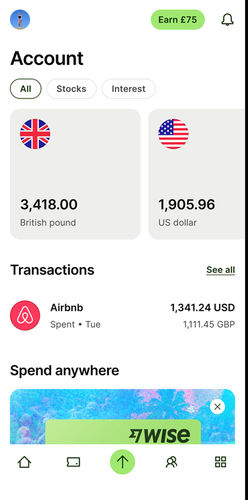

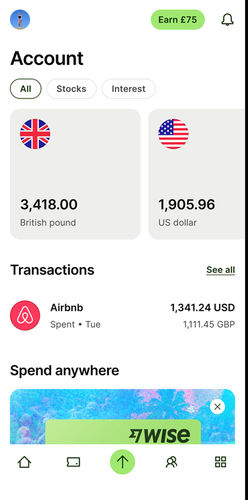

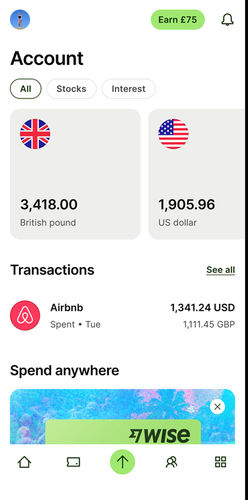

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

Overall best option: Wise

We tested & reviewed 1 money transfer companies, and Wise came out as one of the easiest options.

Wise appeared in 100% of searches for sending money from Japan to Curacao, and was the top rated company for JPY to ANG transfers.

So for a great mix of cost, speed & features, make your Japan to Curacao transfer using Wise.

How to get the best deal on sending money from Japan to Curacao

Considerations to make sending money from Japan to Curacao easy

Comparing the different providers offering services between Japan and Curacao, is the best way to send money with confidence.

The 1 providers we've compared ensures you will get the best options for your transfer to Curacao from Japan. By taking the time to compare you can save yourself in the region of 3% of the total transfer amount.

Whilst we rate Wise as the best overall, comparing gives you a comprehensive view of all the options for transferring Yen to Curacao.

Cheapest way to send money from Japan to Curacao: Wise

Our data shows, over the past six months, that Wise is 0% than the second-best option when sending via a bank transfer.

This measure includes an average fee of 11,988* JPY and a JPY-ANG exchange rate for international transfers that is 0.57% different to the mid-market rate.

Securing the best rates on a JPY to Curacao transfer can be done with Wise but you can always search for your specific amount.

*The most common fee applied by Wise when sending JPY-ANG, based on data from the past six months.

Fastest way to send money to Curacao from Japan: Wise.

In our comparison, we found Wise to be the fastest way to send Yens to Netherlands Antillean Guilder in 100% of transfers. For quick transfers between JPY and ANG, Wise comes highly recommended.

Sending money from Japan to Curacao through Wise has an average fee of 11,988 JPY.

To find the fastest company, we compared 1 money transfer providers for the overall speed of sending money from Japan to Curacao. This was made up of depositing Yen to a money transfer account and transfer times to Curacao.

When looking for the fastest money transfer, Wise is our best choice for sending into Curacao from Japan.

Send large sums of money abroad with Currencies Direct

From the 1 options we compared, Currencies Direct offers the strongest all-round option for large transfers to Curacao from Japan.

Whatever the reason, sending large sums of money can be expensive if you get a bad exchange rate from Netherlands Antillean Guilders to Netherlands Antillean Guilder.

As such, we recommend Currencies Direct for large transfers between Curacao and Japan.

Understanding the cost of transferring money from Japan to Curacao

The total cost of money transfers from Japan to Curacao is a combination of fees and exchange rates. Get the best of both, and you will be getting a good deal.

The Mid-Market and Exchange Rates: The mid-market rate for JPY-ANG is currently 0.0123 ANG per Yen. Providers offering services closer to this rate will ensure more Netherlands Antillean Guilder for your Yens.

To give a historic average, over the last three months the JPY-ANG mid-market rate has been 0.012 ANG per Yen, this has had a high of 0.012 and a low of 0.012.

From the 1 companies compared, Wise offers the best exchange rate on transfers to Curacao and Japan.

Generally, the exchange rate you receive on converting JPY to ANG will be the biggest factor impacting the cost of sending Yens to Curacao.

Fees: Transfer fees are charged alongside a transfer. The company offering the lowest fee is Wise at an average of 11,988 JPY per transfer over the last 6 months. In all cases, we recommend searching for your exact send amount as fees may change.

Amount Received: Money transfer companies will show you the amount eventually received in Netherlands Antillean Guilder. Simply, the higher the amount received in Japan, the lower the cost of sending from Curacao.

The best exchange rate for Yen to Netherlands Antillean Guilder transfers

When sending money between JPY and ANG getting a good deal on an exchange rate is essential. The exchange rate you secure impacts how much ANG you get for your JPY.

Here's how the mid-market rate has performed recently, which will impact the overall cost of the exchange rate.

Over the past six months, the mid-market rate from JPY to ANG has been 0.012.

During this period, there was a high of 0.012, and 0.012 being the lowest point.

Wise, which is our recommended service to send money online from Japan to Curacao offers an exchange rate with a 0.57% markup against the mid-market rate.

Want to secure the best JPY-Netherlands Antillean Guilder exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Japan to Curacao!

Payment options for Japan to Curacao money transfers

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between Curacao and Japan.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Japan to Curacao.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send JPY to ANG.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

.svg)