Best International Money Transfer Apps in 2026

Money transfer apps make transferring money easy and convenient by syncing desktop and mobile experiences.

We've looked into the fees, speed, extra features, and usability of all the most popular apps, to guide you to the best option for overseas transfers.

Search Now & Save On Your Transfer

Wise has one of the best app options in the money transfer space. You can access accounts, sync to bank accounts, and use a virtual card for spending.

Using Airwallex you can track and submit expenses, manage currency risk, and carry out business transfers.

Money transfer apps enable secure, fast, and cost-effective international transfers across multiple devices. They typically offer low fees, competitive exchange rates, and features like multi-currency support. Popular choices include Wise, Revolut, and Remitly.

Sending money through PayPal can feel more convenient if you already have an account. It is often the go-to when considering which app to use.

More often than not, PayPal will not be the right choice. You will get a worse exchange rate and pay higher fees than sending through a money transfer company.

Thankfully, there is another way.

Specialist money transfer apps offer:

Better exchange rates than PayPal (and banks)

Low or no fees

Beyond this, an international money transfer app works by offering features like:

Multi-currency cards and virtual cards

P2P payment options

Better exchange rates and fees than using traditional banks

Open banking and syncing with accounts

Loyalty schemes and bonuses

The best transfer apps

Wise is the app that stands out for its offering across all platforms. The app serves as a multi-currency account, grants access to virtual cards and supports P2P transfers to other Wise users.

For those handling large sums, XE is the go-to app. With a generous limit of $535,000 per transaction, it's our preferred choice for substantial transfers.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"Aspora (formerly Vance) is built for Non-resident Indians sending money to India with zero markup, low flat fees, and on-time transfers."

"Aspora (formerly Vance) is built for Non-resident Indians sending money to India with zero markup, low flat fees, and on-time transfers."

"Aspora (formerly Vance) is built for Non-resident Indians sending money to India with zero markup, low flat fees, and on-time transfers."

"An exciting, fast-growing global payments company focusing on Latin America. Official fintech partner of FC Bayern Munich and offers a best price guarantee."

"An exciting, fast-growing global payments company focusing on Latin America. Official fintech partner of FC Bayern Munich and offers a best price guarantee."

"An exciting, fast-growing global payments company focusing on Latin America. Official fintech partner of FC Bayern Munich and offers a best price guarantee."

"Revolut has 50+ million customers globally. You can hold up to 36 currencies in the app and send money quickly in 70+ currencies to 160+ countries."

"Revolut has 50+ million customers globally. You can hold up to 36 currencies in the app and send money quickly in 70+ currencies to 160+ countries."

"Revolut has 50+ million customers globally. You can hold up to 36 currencies in the app and send money quickly in 70+ currencies to 160+ countries."

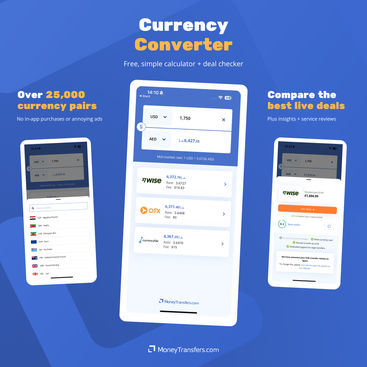

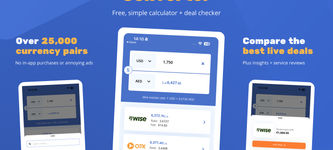

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Money transfer apps for business

"Wise Business is used by 300,000+ businesses each year. Easy integrations with Xero, QuickBooks, FreeAgent and more are available."

"Wise Business is used by 300,000+ businesses each year. Easy integrations with Xero, QuickBooks, FreeAgent and more are available."

"Wise Business is used by 300,000+ businesses each year. Easy integrations with Xero, QuickBooks, FreeAgent and more are available."

"Sokin is a global payments platform for businesses. Hold 75+ currencies with free IBAN accounts. Make up to 5,000 payments per batch transfer. Excellent ecommerce payment gateway available."

"Sokin is a global payments platform for businesses. Hold 75+ currencies with free IBAN accounts. Make up to 5,000 payments per batch transfer. Excellent ecommerce payment gateway available."

"Sokin is a global payments platform for businesses. Hold 75+ currencies with free IBAN accounts. Make up to 5,000 payments per batch transfer. Excellent ecommerce payment gateway available."

"Airwallex offers a comprehensive financial platform for businesses. Make global transfers to 150+ countries, receive funds in 20+ currencies. Connect with popular software for a seamless approach."

"Airwallex offers a comprehensive financial platform for businesses. Make global transfers to 150+ countries, receive funds in 20+ currencies. Connect with popular software for a seamless approach."

"Airwallex offers a comprehensive financial platform for businesses. Make global transfers to 150+ countries, receive funds in 20+ currencies. Connect with popular software for a seamless approach."

Choosing the best apps

Most companies will tell you that being able to send money at a better rate is what makes a good app.

We compare more companies than anyone on the market, and we think a good app is much more than that.

It's not good enough to say an app is one of the best because it is cheaper than using a bank.

Ultimately, money transfer companies will offer a better cost for sending money internationally than a bank.

But there's much more on offer than that. That's why we look at:

Fees, rates, and overall cost as standard

Additional features exclusive to apps

Ability to move between mobile, tablet, and desktop

Speed and performance of the app

Design and user experience

Customer reviews of apps

So when pitted against each other, particularly for apps, it's important to look at features, user reviews, and performance of an app as well.

Each app and what it offers

Wise is one of the stronger apps for sending and receiving money. The cost of a transfer is around 0.35% vs the 4-5% you will pay with PayPal.

There are a lot of other good features as well, like a multi-currency account and virtual or physical cards.

This makes it a good choice for small, regular transfers and also for travel money spending as well.

Exchange rate | 0% (mid-market rate) |

|---|---|

Fees | from 0.35% |

Multi-currency option | Yes, 10 local accounts |

Virtual cards | Yes |

Supports P2P | Yes |

Open banking and syncing | Yes |

Pros

Cons

The XE app allows you to send up to $535,000 per transfer making it a good option for larger transfers.

There are also options for monitoring currencies and setting rate alerts to a mobile - a useful feature for beating changing exchange rates.

No fees are charged for any transfer amounts above $500, making them highly competitive in the high-value remittance market.

In total, the app supports transfers to 65 currencies across 170 countries. You can monitor 10 of these as well for alerts on currency changes.

Exchange rate | 0.4%-1.2% |

|---|---|

Fees | No fee above $500, between $1-$4 |

Multi-currency option | No |

Virtual cards | No |

Supports P2P | No |

Open banking and syncing | No |

The account doesn't have the same bells and whistles as the likes of Wise or Zing with multi-currency options, but does offer currency conversion and historical charts.

Pros

Cons

Overall, XE is a solid choice as a money transfer app, particularly for larger transfers that do not need currency risk.

For those looking for management of a transfer, TorFX might be a better option as an app.

What makes TorFX stand out is its personalized approach to international transfers.

The app offering is one of the best from an account-managed service, that bridges the gap nicely into a self-service option.

Through the website, you'll work directly with a specialist account manager when using TorFX for large transfers.

However, this does not work in the same way through the app, although, you can call TorFX from the app and request help on transfers.

We always recommend contacting your account manager for particularly large transfers, as they would offer to use a forward contract which could help you get a better rate.

Exchange rate | 0.4% |

|---|---|

Fees | No fees |

Multi-currency option | No, but has a wallet option for up to 24 currencies |

Virtual cards | No |

Supports P2P | No |

Open banking and syncing | No - but can be synced to a debit card |

There's also an option for a wallet, particularly useful for buying currency you want to send and receive.

Recipients can be set up as personal or business, whilst a small touch, it does make using the app easier, and due to the nature of using a currency broker like TorFX, this distinction will aid in keeping finances clean.

Pros

Cons

Currencies Direct offers no-fee transfers at low exchange rates between 0.12% and 1.32%.

They also offer account management and are listed as our cheapest account-managed money transfer service provider.

Their transfer limits are not the highest, capped at $50,000, and they only accept bank account transfers, and credit & debit card payments, making them less versatile than some competitors.

Exchange rate | 0.12%- 1.32% |

|---|---|

Fees | No fees |

Multi-currency option | Yes - wallet and multi-currency card |

Virtual cards | Yes (and physical) |

Supports P2P | No |

Open banking and syncing | Yes |

There's access to a multi-currency card available, both virtual and physical.

A nice point here, the physical card is free to order (but is only available to European users at the moment). As a comparison, for Wise, you would pay $9 / £7 for the initial card to be sent.

Pros

Cons

With the Remitly app, you can exchange over 100 currencies.

They take payments by credit and debit card, or by bank transfer/wire transfer, and service over 170 countries.

The company makes the list of best apps as they are they offer the best service when it comes to cash pickup than most alternatives.

With access to Asian markets from the US, UK, and Europe in particular, Remitly is a great choice for sending money to friends and family.

Exchange rate | from 1.5% |

|---|---|

Fees | from 0.7% |

Multi-currency option | No |

Virtual cards | No |

Supports P2P | No |

Open banking and syncing | No |

The perk of the app is the cash pickup option, fees aren't overly competitive and for regular bank transfers Wise or Zing (UK only) are likely the better option.

Pros

Cons

Similar to Remitly, WorldRemit makes the list of top apps based on giving access to a range of payout options - directly from the app.

With WorldRemit you can send an airtime top-up to a mobile money account, making it the best money transfer app for transfers to Africa.

The company also offers bank transfers and, like Remitly, cash pickup.

These can be funded through the app with a bank, debit card, or credit card.

Be careful using a credit card as this could incur additional fees from a provider.

Exchange rate | 0.5% - 1.25% |

|---|---|

Fees | from $1.99 |

Multi-currency option | No |

Virtual cards | No |

Supports P2P | No |

Open banking and syncing | Yes |

Exchanges come with a small markup fee, depending on the currency of the transfer. You can calculate exactly how much your transfer will cost by using their calculator before submitting.

The main downside of the service is that WorldRemit doesn’t allow you to send money to many countries in Europe, so check which countries are serviced below before opening an account.

Pros

Cons

Aspora (ex Vance) is one of the newer money transfer apps specializing in money transfers to India.

They offer cheap transfers from the UK, UAE, Ireland, and Italy to India at the mid-market rate (same as Wise).

However, Aspora is cheaper than Wise when it comes to GBP/INR transfers.

Aspora charges up to £3/€3 for transfers from the UK, IE, and IT, while transfers from the UAE are free at the moment.

Exchange rate | Mid-market rate |

|---|---|

Fees | £3/€3 from the UK, IE, IT, and free from the UAE |

Multi-currency option | No |

Virtual cards | No |

Supports P2P | No |

Open banking and syncing | No |

Pros

Cons

With instant peer-to-peer transfers (P2P) to other app users, Global66 is one of the fastest transfer apps on the market.

Domestic P2P transfers with Global66 are free, while international payments come with a small fee.

In particular, the app offers access to South American markets not always supported by other apps.

Exchange rate | 0% (mid-market rate) |

|---|---|

Fees | from $1.99 |

Multi-currency option | No |

Virtual cards | No |

Supports P2P | Yes |

Open banking and syncing | Yes |

The P2P instant transfer service is limited to users in Chile, Peru, Argentina, Brazil, Ecuador, and Mexico, meaning users elsewhere will need to send money directly to their recipient’s bank account (costing you more in fees).

The setup process for Global66 can also be a bit more difficult than average, so it’s a good idea to sign up in advance of your transfer to avoid any delays.

Pros

Cons

Revolut is a neobank offering international transfers and P2P payment options through its app.

The company has recently confirmed a banking license in the UK, so is going through a growth stage that will make it an interesting watch.

Unlike the other companies in the list, Revolut is very much app first, there's no desktop option really. Although businesses can access one.

The main reason Revolut makes our list is its P2P payment option.

With this, transfers are immediate and exchange rates are hugely competitive.

For regular transfers between countries, for sending money home, for example, it is a fantastic option to consider.

Exchange rate | from 0.4% |

|---|---|

Fees | 0% up to £500 per month, then 0.2% |

Multi-currency option | Yes |

Virtual cards | Yes |

Supports P2P | Yes |

Open banking and syncing | Yes |

Pros

Cons

Airwallex is a money transfer app exclusively for businesses.

In almost all areas it is one of the best products on the market and a lot of what Airwallex does well, translates to the app.

This app is particularly good for expense management and card spending.

At both a business and department level, cards can be created, distributed, used, and tracked for expenses.

The company also exchanges rates that would be considered competitive for personal use, let alone at a business level. These also come with no fees.

Exchange rate | from 0.5% |

|---|---|

Fees | No fees |

Multi-currency option | Yes |

Virtual cards | Yes |

Supports P2P | Yes |

Open banking and syncing | Yes |

Airwallex offers an app that is specifically for businesses making international payments and managing global finance.

If you are looking for support for international business transfers, we recommend comparing all specific business providers.

Where is PayPal?

PayPal is probably the biggest app when it comes to international payments and finance - and can offer convenience, but it is unlikely you will get a good price.

In fact, with high fees and worse exchange rates, PayPal a even more expensive than transferring with a bank.

Here's the data:

Method | Detail | Mid-Market Rate | Exchange Rate ($1 = €XX) | Fees | Received amount |

|---|---|---|---|---|---|

Money transfer company | A company online, or through an account manager, offering competitive rates on international transfers. | 0.9302 | 0.9378 | $6.42 | €931.73 ✅ |

Bank account | Every day banks, like Chase, offer weaker exchange rates and slower transfers. | 0.9302 | 0.9058 | $5.00 | €900.80 ❌ |

PayPal | Apps like PayPal generally offer the worst exchange rates and add a fee percentage on top. | 0.9302 | 0.8996 | $4.99 + 4.5% | €858.64 ❌ |

PayPal is not good value for money on international money transfers.

We will only ever recommend sending money with an app we think offers a great service, and good value for money.

Other domestic money transfer apps

Peer-to-peer (P2P) payment apps like Venmo, Cash App, and Zelle allow you to add a linked bank account.

Some are even better than PayPal. For example, Zelle is directly built into most banking apps (such as Bank of America, Wells Fargo, and others), giving you even more convenient domestic transfers.

However, like PayPal, these do not offer much in the way of international transfers and there are better alternatives available as listed above.

Outside of this, Revolut and Wise both other P2P services for international transfers.

Money transfer apps in action

Money transfer apps allow you to transfer money electronically.

You can do this by moving money between bank accounts, transferring a card payment, or using an online wallet to send and receive money.

Some of the best money transfer apps on the market, like Wise and WorldRemit, can send money internationally.

Others, like Venmo and Zelle, can only be used for domestic payments. They usually work differently.

Wise, our top pick in the remittance market, allows you to make both domestic and international transfers.

International money transfer apps

International money transfer companies have bank accounts in many different countries around the world.

When you send money via an international money transfer app, the company can credit the amount to their local account, and send the equivalent - minus any fees and markups - to the recipient via the local account in their country.

This is what makes transfer apps so much faster than traditional bank transfers.

The money itself doesn’t cross international borders, the amount is simply sent from the local account.

Are payment wallets the same as money transfer apps?

Payment wallets are different from money transfer apps, but some transfer providers offer digital wallets as well.

A payment wallet is a digital wallet held on your phone. It stores your payment card information so you can make contactless payments.

Whereas a money transfer app is used to send money from one bank account to another, often internationally.

A good example of a digital wallet is Apple Pay (also known as Apple Cash). You connect your bank to it, and your details are securely stored.

When you request or make a payment, money is taken from the linked account without needing you to add any bank details again.

Some apps offer money transfer services and digital wallets. With PayPal, for example, you can send money directly from your PayPal balance to somebody else’s linked bank account.

Timeframes on transfers through money transfer apps

Sending money through a transfer app is generally faster than a standard bank transfer, but different things can affect the speed of your transfer.

This is because a money transfer company will use its own network (particularly where P2P payments are used), whereas banks can result in need to pay intermediary fees and use correspondent banks to complete a transfer.

Even when using a money transfer app, there are a few things that could impact the overall cost and timeframe of a money transfer.

💱 Currency being sent

Exchanging currency generally takes longer than transferring the same currency. Using a multi-currency account can sometimes speed up a transfer.

Some currencies are subject to more checks than others. For example, most transfers from US dollars into Canadian dollars can be completed in minutes, while transfers between the USD and NGN can take over a day.

🗺️ Destination country

💳 Payment method used

Instant bank transfers

Some apps can be associated directly to a bank account. This means you do not have to top up the account ahead of sending.

This is a great option for regular transfers.

Alternatives to money transfer apps

You can transfer money without using a money transfer app, but there are some drawbacks.

The main alternatives are:

Bank wire transfers

Most banks in the US offer wire transfers at a fee, but they’re often not quite as fast as the best money transfer apps and are considerably more expensive.

Wire transfers average about $15, with international wire transfers reaching amounts as high as $30.

Turnaround times are typically within a day but can be up to 3 business days.

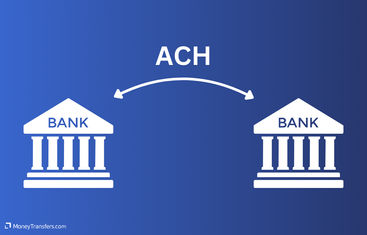

The main difference between ACH and wire is the fees vs speed. But both are worse when compared to the money transfer app.

ACH bank transfers

ACH bank transfers are becoming more and more accessible, with lots of providers offering ACH transfers free of charge.

However, they take at least 3 working days to clear and you can only make ACH transfers within the US.

It's particularly popular with making regular small payments, such as paying employees or paying bills within the US.

If you need to transfer money overseas, use a different method.

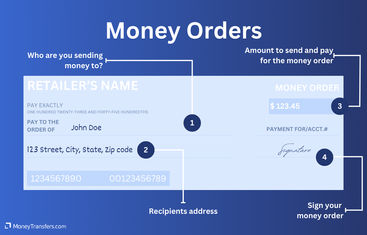

Money orders

Money orders let you securely send up to $1,000, but they come with a fee. Most banks and credit unions will be able to give you a money order, as well as the US Post Office and some supermarkets.

They allow the recipient to benefit from the security of a check, without the risk that they may ‘bounce’ - i.e. that the money won’t be deposited.

If you need to send more than $1,000, a money order isn’t the best option for you.

Money orders have a limit of $1,000 and they cost more than most international money transfers.

Should I use my online banking app to send money internationally?

Online banking apps can be used to send money internationally, but these will still incur the same fees as standard ACH or wire transfers.

Money transfer apps are also faster, so there may be a better option.

Finding the best app for you

The best app for you will depend on the specific details of the transfer being made and any ongoing needs for the app.

The key things to consider are:

Cost: Don’t just consider fees here. Some providers charge a markup on their exchange rate, so an app offering ‘no fees’ might end up costing more than one with no markup. Wise is a good example of this, fees are charged at 0.35%, but the markup is 0%. So overall, they're one of the cheapest ways to send money.

Speed: The fastest ways to send money will differ based on the specific transfer amount and route, but generally most providers can get your money to its destination quickly.

The amount you want to send: To send a large amount, use an app that can specialize in managing currency risk and forward contracts, like TorFX.

Payment method you want to use: Some providers only accept digital transfers to other app users. Others can process a variety of payment methods, including ACH transfers, card payments, and P2P payments.

Currency you’re transferring to and from: Some apps only deal in the local currency, while others allow you to hold multiple currencies in one bank account. Check your desired currency is supported before choosing an app.

Safety and security

Money transfer apps are some of the most secure means of sending money overseas.

They come with robust security features to ensure your money goes to the intended recipient.

Look out for:

Customer support

Customer support provides security on anything you are unsure of, from requests for details through to aiding with big payments through apps.

Pick a company with a level of support you are comfortable with.

Secure logins

Secure and encrypted logins are standard across financial products and money transfer apps are no different.

Ensure you know what data is being shared.

For P2P payments, this could be contact details for example.

Facial Recognition

Technology like facial or fingerprint recognition can help protect an app from being accessed, even if a phone is lost or stolen.

Not all apps offer this, but Wise, TorFX, and Zing (UK only) all do.

Fraud detection teams

Like banks, international money transfer app providers will often have fraud detection in place.

These teams work to find any unexpected or unusual activity on accounts.

Using a specialist in large transfers can aid in any unnecessary hold-ups on transfers as well.

Despite this, you must check the details of all transfers you make within your transfer app.

If you accidentally send money to the wrong recipient by inputting incorrect information, you’re unlikely to get your money back.

This is why most apps ask you to confirm the information you’ve entered before making the transfer.

Money transfer regulators

Money transfer companies are regulated slightly differently from banks.

Discover how regulators in each country operate.

Save money and time with a money transfer app

Money transfer apps are easier and cheaper to use for money transfer than traditional methods of transferring money.

This applies whether you’re sending money to an account at home or overseas.

With apps like Wise, you can make an instant money transfer to lots of different countries from your cell phone, without the fuss.

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sources and further reading

Related Content

Contributors

.svg)

.svg)