Where & How to Get the Best Exchange Rate?

Getting the best exchange rate is crucial, especially for international money transfers. Sudden fluctuations impose many FX risks not only for businesses but regular people.

Here, we'll explain how to find the best exchange rate. We'll explain transfer methods, your transfer options, and ways to get the rates you want.

Search Now & Save On Your Transfer

Getting the best exchange rate

Finding the best exchange rate for your international money transfer is easier by doing the following:

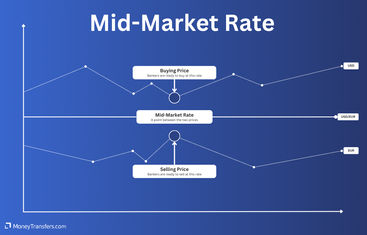

Keep an eye on the mid-market rate

The mid-market rate essentially determines how much your currency will be worth before your money transfer provider adds their own markup.

If you know what the current mid-market rate is for your currency exchange, you’ll find it easier to spot better deals when comparing your options online as you’ll be able to see which providers are sticking closest to it.

Avoid using banks

Avoid credit and debit cards

Focus on the final sum

Consider multi-currency accounts

If you just need to make a quick transfers abroad and need an overall best provider, we suggest using Wise.

They offer the mid-market rates and low fees for most transfers.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

If you transfer is more exotic or you need to send a large amount, we recommend .

Who offers the best exchange rates?

When you send money abroad, the transfer is facilitated by a third party - normally a money transfer provider, or in some cases a bank or digital wallet.

These companies have to make a profit somehow, so they’ll normally charge a transfer fee or a markup on the exchange rate - or both, in some cases.

This is why it’s so important to compare different providers, so you can see who charges what in fees and exchange rate markups and find the best deal for your money transfer.

To illustrate how the exchange rate you get can affect the overall amount of money received by the recipient of your money transfer, we’ll run through examples below:

Sending £200 from the UK 🇬🇧 to Spain 🇪🇸

Provider | Rate | Fees | Total amount received |

|---|---|---|---|

XE | 1.11 | £0 | €222.67 |

PassTo | 1.12 | £2.5 | €221.44 |

Wise | 1.13 | £1.02 | €224.05 |

Barclays | 1.1287 | £10 | €214 |

HSBC | 1.1243 | £15 | €208 |

How to find the best euro 🇪🇺 exchange rate?

Finding the best euro exchange rate is easiest when you compare your options online. Rates are constantly changing, so check now to see what’s available.

Find the latest deals in our guide to sending money from the UK to India.

Sending £1,000 from the UK 🇬🇧 to India 🇮🇳

Provider | Rate | Fees | Total amount received |

|---|---|---|---|

WorldRemit | 99.23 | £1.99 | ₹99229.00 |

XE | 98.62 | £0 | ₹98624.99 |

Wise | 99.59 | £6.54 | ₹98939.58 |

Santander | 97.78 | £20 | ₹95824 |

RBS | 97.98 | £15 | ₹96510 |

How to find the best pound 🇬🇧 exchange rate?

GBP exchange rates are always going up and down, so compare rates now to find the best available deal.

Find the latest deals in our guide to sending money from the UK to India.

Sending $10,000 from the USA 🇺🇸 to Mexico 🇲🇽

Provider | Rate | Fees | Total amount received |

|---|---|---|---|

XE | 17.02 | $0 | 170,200 MXN |

Currencies Direct | 17.0266 | $0 | 170,266 MXN |

Wise | 17.12 | $74.29 | 169,928.16 MXN |

Capital One | 15.81 | $30 | 157,626 MXN |

Bank of America | 15.84 | $45 | 157,687 MXN |

How to find the best dollar 🇺🇲 exchange rate?

Compare USD exchange rates to find the best deal when sending dollars abroad - remember, USD exchange rates are always changing so look for deals today.

Find the latest deals in our guide to sending money from the US to Mexico.

Compare rates with MoneyTransfers.com

The easiest way to find favorable currency exchange rates is by comparing your options with MoneyTransfers.com. You’ll be able to see all the providers offering transfers for your desired route, so you can find the best rate and get the best deal possible.

Find the best currency exchange rates

Tools to help you get a better exchange rate

Depending on the provider, amount, and reason for your transfer, you may be able to access certain types of tools to hedge your risk in the foreign exchange market:

Forward contracts

A forward contract enables you to lock in a decent exchange rate which protects you against unexpected movements in exchange rates.

However, there is a chance that the rate will improve and you could get locked into a lower rate.

Forward contracts are ideal for those making regular transfers or for businesses. The agreement will guarantee you a rate between 30 days and two years.

A deposit is required, and the balance is paid upon execution of the contract.

Limit orders

You state your ideal exchange rate, it is locked in once the market reaches that rate, and the transfer company will contact you to authorize and complete the transfer.

Stop-Loss Orders

A stop-loss order is the opposite of a limit order, it involves specifying the rate you want to avoid dropping below.

Your currency is purchased automatically when the market falls to that rate.

People often combine stop-loss orders and limit orders together.

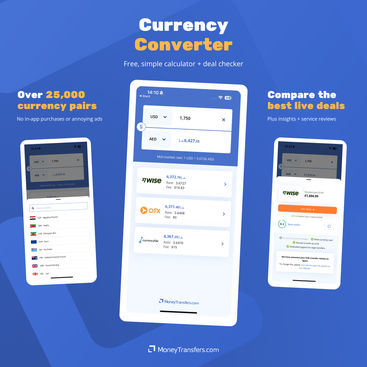

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

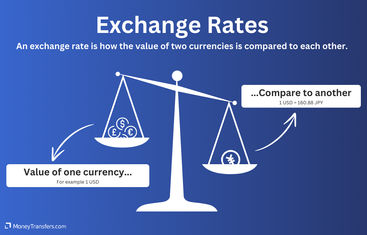

Exchange rates explained

An exchange rate is how the value of two currencies is compared to each other. When you send money from one country to another, more likely than not this will involve exchanging currencies.

For example

If you send $200 from the USA to the UK, the person receiving the money in the UK will need to get the money in pounds for it to be useful.

Swapping dollars for pounds means getting an amount in pounds that is the same value as the amount you’re sending in dollars - and this value is determined by the exchange rate.

How do exchange rates work

Why are exchange rates important?

Current exchange rate

A bit more on the exchange rates

What is the difference between 'buy' and 'sell' exchange rate?

Can I use my credit card to buy foreign currencies?

Is my money protected if a provider goes bust?

When is the right time to exchange currencies?

Money transfer providers or foreign exchange brokers?

How to calculate an exchange rate markup?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap: How to find the best exchange rate?

Exchange rates are always changing and it’s impossible to determine the direction they will go.

But as you have read, the question of how to get the best exchange rate has steps you can take to ensure you get the best rate available at that time.

Now that you know that money transfer providers usually offer better rates, use our form below to find the money transfer provider with the best rates.

Find th ebest exchange rates

Sources & further reading

Related Content

Contributors

Mehdi Punjwani