USD to CAD Forecast - March 2026

If you're planning to send US dollars (USD) to Canada or Canadian dollars (CAD) abroad in March, here’s a straightforward update to help you make informed decisions.

This forecast focuses on the USD/CAD exchange rate, which is how much 1 US dollar buys in Canadian dollars.

Currently, the US dollar is relatively weak while the Canadian dollar is showing strength. It is currently trading at 1.366575 CAD per USD.

This trend has been in place for several months and is likely to continue into March, though some fluctuations may occur.

Search Now & Save On Your Transfer

What is likely to happen to USD/CAD in March 2026

USD/CAD is still biased lower, but it is sitting on support where bounces often start.

Expect a volatile month with key levels in play: support at 1.3750 and 1.3720, resistance at 1.3860 and 1.3910. For money transfers, consider staging payments and be ready to act quickly if USD/CAD either rebounds toward 1.40 or breaks below 1.3720.

USD to CAD: Where It Stands

USD to CAD has been sliding, but it is now sitting in an area where the market often pauses.

Over recent weeks, USD/CAD has trended lower, meaning the Canadian dollar has generally been gaining against the US dollar. Lately though, the fall has started to look “stretched,” which often leads to a short bounce or a choppy sideways period.

Right now, the pair is hovering around a key decision zone in the 1.37 to 1.39 area. What happens here will likely shape the next month.

What’s Driving USD to CAD?

The big story is interest rates and how strong each economy looks in the data.

1) Federal Reserve versus Bank of Canada (rate expectations)

Markets think the Bank of Canada is more likely to stay steady, while the US Federal Reserve is seen as closer to cutting rates or at least sounding cautious. When US rates are expected to fall faster than Canadian rates, USD/CAD usually drifts lower.

2) Jobs and growth surprises

Canada’s jobs data recently came in stronger than expected, which supported CAD. US jobs indicators have been mixed, and that keeps traders sensitive to every new release.

3) Oil and “risk mood”

CAD often does better when oil is firm and when markets are in a confident “risk-on” mood. But oil has also been weak at times, which can take support away from CAD and allow USD/CAD to bounce.

What Do the Charts Say?

Charts suggest the downtrend is still the main path, but the market is near levels that can trigger a rebound.

Key support (floors):

1.3800 (near-term floor)

1.3769 to 1.3750 (major decision area)

1.3722 to 1.3725 (make or break support)

If 1.3720 breaks and holds below, next area is around 1.3669 to 1.3657, then 1.3566.

Key resistance (ceilings):

1.3836 to 1.3860 (first selling zone on rebounds)

1.3881 to 1.3912 (big pivot area, near the 200 day average)

1.3977 to 1.4000 (stronger rebound target if momentum flips)

Momentum gauges have been near oversold, which often means downside becomes harder to extend without a pause.

What to Watch in the Next Month

The next month is likely to be driven by a few data releases and whether price can break or hold key levels.

Base case (most likely): choppy, with a slight downside biasUSD/CAD may bounce, but rallies could stall below 1.3880 to 1.3910 unless US data turns clearly stronger.

Bullish USD/CAD scenario (USD strengthens):If US jobs and inflation stay firm and the Fed signals fewer cuts, USD/CAD could grind up toward 1.3975 to 1.4000.

Bearish USD/CAD scenario (CAD strengthens):If US data weakens again or Canada prints stronger activity data, USD/CAD could break 1.3720 and slide toward 1.3670, with risk of deeper drops later.

Risks Ahead

This pair can move fast around headlines, and it is very sensitive to surprises.

Fed messaging surprises: A more hawkish or more dovish tone can swing USD quickly.

Canadian jobs data volatility: Canada’s employment numbers can reverse from month to month.

Oil swings: A sharp oil drop can hurt CAD, even if Canada’s data looks fine.

False breaks near support: The 1.3720 to 1.3750 zone can trigger whipsaws.

What This Means If You’re Sending USD to CAD Abroad

Your “deal” depends on whether USD/CAD is higher or lower when you transfer.

If you are sending USD to Canada (converting into CAD):A lower USD/CAD usually means your US dollars buy fewer Canadian dollars. If you need to send money soon, consider splitting the transfer into 2 or 3 parts over a few weeks to reduce bad timing risk.

If you can wait and want a better rate:Watch for rebounds toward 1.3880 to 1.4000. Those levels may offer better value for converting USD into CAD, if the bounce happens.

If USD/CAD breaks below 1.3720 and stays there:That would be a warning that CAD strength is accelerating, and waiting could mean getting fewer CAD later.

Live USD to CAD exchange rates

Converting USD to CAD

If you are planning to send USD to Canada, you need to pick the right money transfer company to get the most CAD on the other end.

Depending on your needs, it's best to use one of the following companies in March:

History of the USD to CAD

USD to CAD, also known as the loonie, is a popular forex pair because of the strong business relationship between the two countries.

They both are parts of the United States, Mexico, and Canada Agreement (USMCA), which replaced NAFTA in 2020. As a result, the two countries do goods trade every year.

The exchange rate is mostly affected by three main factors. First, the actions of the Federal Reserve and BoC. Historically, because of the role of the USD as the global currency reserve, the Fed has more weight compared to the BoC.

Second, the pair is also often impacted by the prices of crude oil. The US is the biggest oil producer while Canada is the fourth. However, in terms of exports, Canada exports most of its oil to the US. Therefore, higher oil prices have often resulted in a stronger Canadian dollar.

| Date | 1 US Dollar in CAD |

|---|---|

| Feb 23, 2026 | 1.369445 CAD |

| Feb 24, 2026 | 1.370105 CAD |

| Feb 25, 2026 | 1.367665 CAD |

| Feb 26, 2026 | 1.367645 CAD |

| Feb 27, 2026 | 1.364750 CAD |

| Feb 28, 2026 | 1.364450 CAD |

| Mar 01, 2026 | 1.366915 CAD |

| Mar 02, 2026 | 1.367165 CAD |

| Mar 03, 2026 | 1.367502 CAD |

| Mar 04, 2026 | 1.366575 CAD |

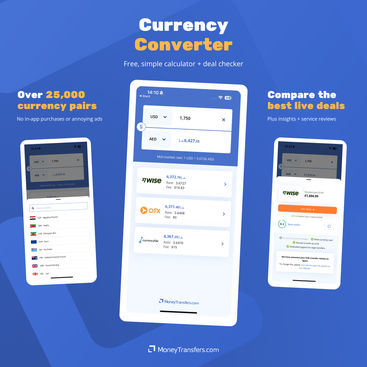

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors