GBP to USD Forecast - March 2026

If you're planning to send British pounds (GBP) to the US this coming month (March 2026), here’s what you need to know in plain, simple terms.

The British pound has been relatively strong lately, but not necessarily because the UK economy is performing well. Most of the strength comes from the recent weakness in the U.S. dollar.

Think of it this way, the pound looks strong in comparison to a struggling dollar. But when measured against other major currencies like the euro, its performance is less impressive.

That suggests the pound's strength may not last indefinitely.

GBP/USD is currently trading at 1.335675

Search Now & Save On Your Transfer

What is likely to happen to GBP/USD in March 2026

GBP to USD is most likely to swing around inside a 1.30 to 1.36 style range over the next month, with 1.34 as the key battleground. US inflation and jobs data, plus the Fed and BoE guidance, are the main triggers for the next move.

If you are sending GBP to USD, rallies toward 1.35+ may offer better value, while drops toward 1.32 or 1.30 can make the same transfer cost more.

GBP to USD: Where It Stands

Right now, GBP to USD is sitting in the mid 1.33s after a sharp bounce from the 1.30 area. The market has been jumpy, but the bigger picture is a “back and forth” pattern rather than a clear one way trend.

The pound has recovered as UK fiscal fears cooled and the US dollar lost some strength on rising expectations of US rate cuts. For the next month, the most likely outcome is more choppy trading inside a familiar range.

What’s Driving GBP to USD?

Two big forces are doing most of the work: interest rates and confidence.

1) Interest rate expectations (the main driver)

United States: Markets expect the Federal Reserve to keep leaning toward rate cuts, especially if jobs and inflation cool. Lower US rates often weaken the dollar, which can lift GBP to USD.

United Kingdom: The Bank of England is also expected to cut rates, but “how many cuts” and “how quickly” is the key. If the Bank sounds more cautious due to sticky inflation, the pound can hold up better.

2) Risk mood

When markets feel calm, the dollar tends to lose some “safe haven” demand. When markets get nervous, the dollar can strengthen quickly, pulling GBP to USD down.

3) UK headlines still matter

Recent moves showed that political and budget uncertainty can push GBP sharply. Certainty generally helps the pound.

What Do the Charts Say?

The charts suggest GBP to USD is still in a broad range, with a few important “line in the sand” levels.

Key levels to watch

Area | Level | Why it matters |

|---|---|---|

Major support | 1.3000 | Big floor that previously held during sell offs |

Support zone | 1.3200 to 1.3275 | If this breaks, the pair can slide faster |

Near term pivot | 1.3350 | Often acts like a balance point |

Resistance | 1.3400 | Market keeps testing this area |

Higher resistance | 1.3500 to 1.3600 | Next ceiling if 1.34 breaks cleanly |

Price action also hints at “pause and pullback risk” after the recent climb. In plain English: it can go higher, but it might dip first.

What to Watch in the Next Month

The next month is likely to be driven by a small number of major events.

US data that can move the dollar fast

US jobs updates (like payrolls and jobless claims)

US inflation readings (CPI)

Weak US numbers usually push GBP to USD up. Strong US numbers usually pull it down.

Central bank messaging

Federal Reserve guidance about how many cuts could come in 2026

Bank of England guidance on whether UK cuts could accelerate

It is not just the decision, it is the tone that moves markets.

Risks Ahead

A few things could knock the pair out of its current zone.

Stronger US inflation or jobs: could revive the dollar and drag GBP to USD back toward 1.32 or even 1.30.

A more dovish Bank of England than expected: could pressure the pound, even if the dollar is not especially strong.

Sudden risk off mood: any global shock can create a rush into USD, usually bad for GBP to USD.

What This Means If You’re Sending GBP to USD Abroad

If you are converting pounds into dollars, a higher GBP to USD rate is better because your pounds buy more dollars.

For transfers from the UK to the US, consider this:

If GBP to USD pushes into 1.35 to 1.36, that is likely a relatively good window to send, because the pair is near the top of its recent range.

If it drops toward 1.32, it may feel expensive to buy dollars, and some people choose to wait or split transfers into smaller chunks.

If it falls near 1.30, that is the “danger zone” where your transfer could get noticeably worse versus recent weeks.

If you have a deadline, consider setting a target rate and using a limit order, or stagger your transfer to reduce the risk of picking a bad day.

Live GBP to USD exchange rates

Converting GBP to USD

If you are planning to send GBP to USA, you need to pick the right money transfer company to get the most USD on the other end.

Depending on your needs, it's best to use one of the following companies in March:

History of the GBP to USD

The GBP/USD forex exchange rate has had a long history because of the strong business and social ties between the United States and the United Kingdom.

The British pound was created in 1694 after the UK formed the Bank of England (BoE) while the US dollar was created in 1794.

The GBP/USD currency pair was nicknamed the cable because of the transatlantic cables that connected the UK and the US.

These cables were connected to submarines, which relayed the exchange rate between the two currencies.

For a long time, the decline of the British economy on the global stage has witnessed a fall in its market share.

This decline accelerated when the UK gave up many of its colonial countries in Europe, Asia, and South America.

At the same time, this decline coincided with the strong performance of the United States as a superpower.

| Date | 1 Pound Sterling in USD |

|---|---|

| Feb 23, 2026 | 1.349646 USD |

| Feb 24, 2026 | 1.349664 USD |

| Feb 25, 2026 | 1.355758 USD |

| Feb 26, 2026 | 1.349073 USD |

| Feb 27, 2026 | 1.348300 USD |

| Feb 28, 2026 | 1.345250 USD |

| Mar 01, 2026 | 1.340590 USD |

| Mar 02, 2026 | 1.340986 USD |

| Mar 03, 2026 | 1.335256 USD |

| Mar 04, 2026 | 1.335836 USD |

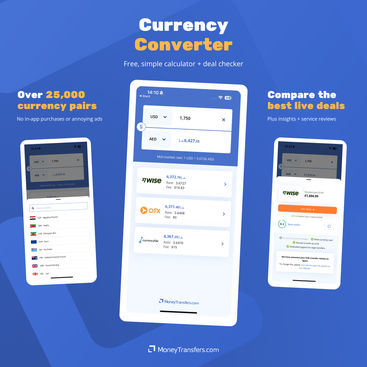

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors