GBP to EUR Forecast - February 2026

If you're planning to send money between Britain and Europe, whether it's GBP to EUR (for example, to Spain) or the other way around, here’s what you need to know about current trends and what might happen in the coming weeks.

The British pound (GBP) has been losing ground against the euro (EUR) in recent weeks.

The exchange rate dropped to around 1.146646 GBP/EUR, a seven-week low, meaning 1 British pound now buys fewer euros than it did earlier this year.

Search Now & Save On Your Transfer

What is likely to happen to GBP/EUR in February 2026

GBP to EUR looks more like a range trade than a strong trend for the next month. The most likely path is choppy movement around the mid 1.14s, with 1.12 to 1.13 as the key downside area and 1.16 as the main upside hurdle.

For most people sending money, the main opportunity is to use any push toward the mid 1.15s as a window to lock in a better rate, while staying alert to UK data that could quickly knock the Pound back.

GBP to EUR: Where It Stands

GBP to EUR has pushed higher recently and is hovering around the mid 1.14s. The move reflects a modest Pound bounce rather than a big, confident trend.

The bigger picture still looks like a wide range market, with buyers stepping in on dips and sellers appearing when the rate gets closer to the mid 1.15s and above.

What’s Driving GBP to EUR?

1) Interest rate expectations are pulling in different directions.

The Bank of England has already started cutting rates, and markets expect more cuts ahead. Lower UK rates usually make the Pound less attractive, which can pull GBP to EUR down.

The European Central Bank story is less clear cut. Some ECB voices have sounded less keen to cut soon, and that can support the euro because it suggests Eurozone rates may stay higher for longer.

2) UK growth data is sending mixed signals.

Recent UK consumer and construction signals have been soft, which caps how far the Pound can rally. When UK data disappoints, traders tend to assume more BoE cuts, which is GBP-negative.

3) Eurozone data is not strong either, but the ECB tone matters.

Weak German data can weigh on the euro, but any hint that the ECB might stay firm on rates can offset that. In other words, the euro can rise even on mediocre growth if rate expectations shift upward.

What Do the Charts Say?

GBP to EUR is behaving like a range, not a one-way trend. Think of it as bouncing between a “floor” and a “ceiling” with some choppy trading in between.

Key levels for the next month:

Level | What it means |

|---|---|

1.120 to 1.130 | Strong support zone. If the rate drops here, it often finds buyers. |

~1.1410 to 1.1460 | Current “busy” area where the pair is chopping around. |

1.160 | Major resistance. If we reach it, it may struggle to push higher. |

There is also a downward sloping resistance line overhead, which often limits rallies unless there is a strong positive UK surprise.

What to Watch in the Next Month

The likely things that could move the GBP/EUR transfer rate.

UK data, especially GDP and jobs signals, will shape how quickly people think the BoE will cut again. Weak numbers usually hurt GBP to EUR.

ECB messaging will matter a lot. If more ECB officials lean against cuts, the euro could strengthen and pull GBP to EUR lower.

Risk mood and geopolitics can shift demand quickly. When investors feel nervous, moves can become sharper and more sudden, and the euro can sometimes benefit against sterling.

Risks Ahead

What could knock the forecast off course:

A sharper UK slowdown could trigger a faster BoE cutting narrative, pulling GBP to EUR down toward the low 1.13s.

A surprise shift toward tighter ECB policy could strengthen the euro broadly and pressure GBP to EUR.

A breakout either side of the range is possible if a big data surprise lands, meaning the rate may not stay “neatly” between 1.12 and 1.16.

What This Means If You’re Sending GBP to EUR Abroad

If you need to buy euros with pounds, the better moments are usually on spikes higher. In the next month, rallies toward 1.150 to 1.160 may offer stronger value for you, because you get more euros per pound.

If the rate falls toward 1.130, you may be paying more for the same euros. If your transfer is essential and timing is flexible, many people reduce regret by splitting the transfer into chunks over several days or weeks.

Live GBP/EUR exchange rates

Converting GBP to EUR

If you are planning to send GBP to the EU, you need to pick the right money transfer company to get the most EUR on the other end.

Depending on your needs, it's best to use one of the following companies in February:

History of the GBP to EUR pair

The UK and the European Union have had a long historical relationship. The UK joined the European Economic Community in 1973 which was a key part of the formation of the European Union (EU) in 1993.

However, the UK was among a group of countries like Poland, Romania, and Sweden that failed to sign to the single currency. Their idea was that they needed their central banks to manage the movements of their local currency.

Historically, the euro has been criticized for restricting the independence of sovereign countries. For example, it is common for the ECB to hike interest rates when big countries like Germany and France are doing well while smaller ones are struggling.

The euro has outperformed the British pound over the years because of its role as the second-biggest economy in the world. The EU has a GDP of over $16 trillion, making it smaller than the US $23 trillion.

In addition, the GBP/USD has dropped because of the impacts of Brexit, which introduced some trade barriers between the UK and the EU. The GBP to EUR exchange rate has crashed by ~39% from its peak in 1999.

| Date | 1 Pound Sterling in EUR |

|---|---|

| Feb 16, 2026 | 1.149997 EUR |

| Feb 17, 2026 | 1.144495 EUR |

| Feb 18, 2026 | 1.144780 EUR |

| Feb 19, 2026 | 1.143767 EUR |

| Feb 20, 2026 | 1.143272 EUR |

| Feb 21, 2026 | 1.143399 EUR |

| Feb 22, 2026 | 1.143546 EUR |

| Feb 23, 2026 | 1.144405 EUR |

| Feb 24, 2026 | 1.146250 EUR |

| Feb 25, 2026 | 1.146646 EUR |

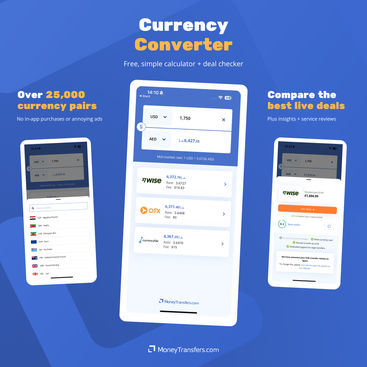

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors