USD to EUR Forecast - February 2026

In simple terms, the U.S. dollar is weakening, and the euro is getting stronger

Over the past few months, the euro has strengthened against the U.S. dollar.

Right now, $1 only gets you around €0.848875 (with EUR/USD trading near 1.17), the euro is near its strongest point in over four years.

This means it now takes more dollars to buy the same amount of euros.

If you're sending money from the U.S. to Europe (for example, Spain), it's currently more expensive than earlier this year. You’ll get fewer euros for each dollar.

Search Now & Save On Your Transfer

What is likely to happen to USD/EUR in February 2026

USD to EUR should stay choppy next month, with the market reacting to every major US inflation and jobs update. The most likely outcome is range trading, with mild support for the euro unless US inflation re accelerates and lifts the dollar.

USD to EUR: Where It Stands

Right now, the USD has softened overall, which has helped the euro stay relatively strong. That means one US dollar is generally buying fewer euros than earlier in 2025, even if moves have been choppy day to day.

Over the last couple of weeks, USD to EUR has mostly moved sideways, with short bursts up or down depending on US data and Federal Reserve messaging.

What’s Driving USD to EUR?

The biggest driver is interest rate expectations in the US versus the Eurozone. When markets think the Fed will cut rates sooner or more than expected, the dollar often weakens and USD to EUR tends to improve for people holding euros, not dollars.

US inflation has been cooling, and some recent US growth signals have looked softer. That keeps the “more Fed cuts later” story alive, which can weigh on the dollar.

In Europe, the euro has had a headwind from fiscal concerns, especially higher government borrowing plans in Germany. More debt issuance can pressure the euro in the short run, even if the European Central Bank is not rushing to cut rates.

Also important, the Fed has been adding liquidity through T bill purchases, which historically can lean against USD strength over time.

What Do the Charts Say?

The pair is still stuck in a broad range, which usually means no clean trend and more back and forth moves.

Key levels to know (EUR/USD):

Level type | Area | What it means in plain English |

|---|---|---|

Major support | 1.1510 | If price falls below here, the euro is likely weakening more. |

Near support | 1.1710 then 1.1650 to 1.1620 | If these break, USD strength can pick up quickly. |

Near resistance | 1.1760 to 1.1780 | A tough ceiling. If price clears it, euro strength can extend. |

Major resistance | 1.1823 | A breakout above suggests a stronger euro phase. |

Momentum has been fading near the highs, which often signals consolidation first, not a straight move up.

What to Watch in the Next Month

Expect the next month to be driven by a simple question: is the Fed done cutting for now, or is more easing coming?

Watch these catalysts closely:

Fed communication, especially minutes and speeches about “pause” versus “more cuts”

US inflation updates (PCE and CPI trends)

US jobs data and any revisions that confirm weakening hiring

Eurozone headlines around government borrowing and bond supply

Most likely path: a sideways month with a slight bias toward EUR strength, unless US inflation surprises higher. A practical trading range to expect is roughly 1.16 to 1.18, with short spikes outside that band possible around major data.

Risks Ahead

Two way volatility is the main risk. A single inflation print or a strongly worded Fed message can swing rates and move USD to EUR quickly.

The biggest upside risk for the dollar is re accelerating US inflation, which could reduce expectations for Fed cuts. The biggest downside risk for the dollar is weakening US jobs data that makes more cuts look necessary.

On the euro side, sudden stress in European bond markets from heavy debt issuance could weaken EUR even if the US story is soft.

What This Means If You’re Sending USD to EUR Abroad

If you are sending dollars to euros, you want EUR/USD higher because that usually means your dollars buy more euros.

Given the likely 1.16 to 1.18 type range, timing matters. If EUR/USD dips toward 1.1650 to 1.1620, that is often a better window to convert USD to EUR than when it is near 1.1780 to 1.1820.

Before sending USD/EUR, consider this:

If you can wait, consider splitting your transfer into 2 or 3 smaller conversions to reduce bad timing risk.

If you have a fixed deadline, watch the 1.1760 to 1.1780 area. If price fails there and turns down, you may get a better rate later.

If EUR/USD breaks above 1.1823 and holds, rates may improve further for converting USD to EUR, but moves can reverse fast on US inflation news.

Live USD to EUR exchange rates

Converting USD to EUR

If you are planning to send USD to EUR, you need to pick the right money transfer company to get the most EUR on the other end.

Depending on your needs, it's best to use one of the following companies in February:

History of the USD to EUR

Europe and the United States always had close economic and social ties which were done using the US dollar and local currencies for a long time.

Germany had Deutsche Mark while France had the franc and Italy had the lira, all these changed on January 1999 when the European Union introduced using a common currency known as the euro.

The euro currency was then officially launched on January 1, 2002. 20 of the 27 EU member countries use the euro.

In most cases, the USD and euro exchange rate is identified as per the ISO standard- EUR/USD.

Over the years, the performance of the pair has favored the US dollar because of the overall strength of the American economy and the fact that the dollar is the reserve currency of the world.

In 2022, the EUR/USD price crashed below the parity level for the first time in two decades.

The USD to EUR is the most liquid currency pair internationally because of the volume of trade between the US and Europe.

Euro is often seen as a safe currency, which makes it the second-biggest reserve currency in the world.

As shown below, the USD to EUR price has generally been in a strong bullish trend since the 2008/9 financial crisis.

| Date | 1 US Dollar in EUR |

|---|---|

| Feb 11, 2026 | 0.842060 EUR |

| Feb 12, 2026 | 0.842610 EUR |

| Feb 13, 2026 | 0.842404 EUR |

| Feb 14, 2026 | 0.842404 EUR |

| Feb 15, 2026 | 0.842670 EUR |

| Feb 16, 2026 | 0.843920 EUR |

| Feb 17, 2026 | 0.843790 EUR |

| Feb 18, 2026 | 0.848305 EUR |

| Feb 19, 2026 | 0.849710 EUR |

| Feb 20, 2026 | 0.848875 EUR |

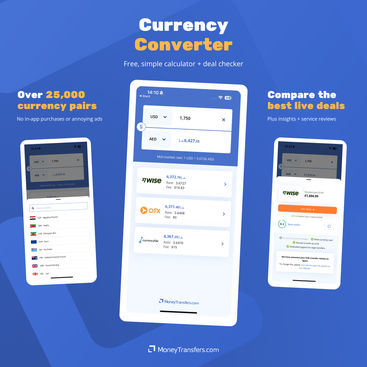

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors