GBP to CAD Forecast - February 2026

If you're planning to send money from the UK to Canada, or the other way around, this month, it's important to understand the current GBP to CAD exchange rate trends.

The rate has been somewhat volatile, hovering around 1.849623. In the short term, it could dip slightly, but there's also a chance it will rebound in the coming weeks.

Here’s what this means for your money and what we expect over the next month.

Search Now & Save On Your Transfer

What is likely to happen to GBP/CAD in February 2026

GBP to CAD is likely to stay choppy but tradable within a range next month. The upside case depends on the Bank of England not sounding too dovish, while the downside risk is stronger Canadian data or firmer oil supporting CAD. The clearest practical levels are 1.8650 resistance and 1.8400 to 1.8326 support, which can help you time transfers with less guesswork.

GBP to CAD: Where It Stands

At the start of 2025, GBP to CAD is sitting in a familiar tug of war. Sterling has had bursts of strength, but the Canadian dollar has proved it can fight back quickly.

Recently, GBP to CAD has been trading in a broad range, with rallies fading after good Canadian data and dips being supported when UK rate cut fears ease.

What’s Driving GBP to CAD?

Two big themes are steering this pair: interest rate expectations and Canada’s oil link.

1) Bank of England vs Bank of Canada expectations

Sterling tends to rise when markets think the Bank of England will not cut rates much further or will cut slowly. The pound has been supported recently because traders have slightly cooled expectations for quick follow up cuts.

For Canada, the Bank of Canada is also a major driver. If the BoC sounds steady and not in a rush to cut, CAD usually benefits and GBP to CAD can drift lower.

2) Canadian jobs and inflation surprises

Strong Canadian jobs numbers have recently boosted CAD and pushed GBP to CAD down. On the flip side, softer Canadian inflation has recently weakened CAD and lifted GBP to CAD.

3) Oil prices matter for CAD

Canada is a major oil exporter, so a rising oil price often supports CAD. If oil drops, CAD often weakens, which can lift GBP to CAD.

What Do the Charts Say?

The pair has been trying to break higher, but follow through has been inconsistent.

Key levels to know:

Level | Why it matters |

|---|---|

1.8650 | Main upside ceiling. A tough area where GBP gains have stalled. |

1.8477 | Around the 21 day average. Often a “line in the sand” for short term direction. |

1.8400 to 1.8326 | Main support zone. If it breaks, GBP to CAD can slide faster. |

Right now, the chart picture suggests a range with a slight upward lean, but only if the pair stays above the mid 1.84s.

What to Watch in the Next Month

A few near term events could decide whether GBP to CAD pushes higher or slips back again.

Bank of Canada decision and messaging: No change in rates is widely expected, so the wording matters most. A firm tone can lift CAD. A more cut friendly tone can weaken CAD.

UK GDP and UK jobs data: Weak growth or softer wage data can revive Bank of England cut talk, which is usually negative for GBP.

Oil price direction: Any sharp move in crude can quickly move CAD, sometimes even more than economic data.

Risks Ahead

Some risks could cause sudden swings, even if the overall month looks range bound.

Surprise shift in rate cut expectations: If UK data disappoints, GBP can fall quickly. If Canadian data disappoints, CAD can weaken quickly.

Oil shocks: Geopolitics or supply news can jolt oil and therefore CAD.

Headline driven volatility: Political uncertainty in the UK can still weigh on the pound at short notice.

What This Means If You’re Sending GBP to CAD Abroad

Think of GBP to CAD as your “bang for your buck” rate:

If GBP to CAD rises, you get more Canadian dollars for each pound sent.

If GBP to CAD falls, you get fewer Canadian dollars for each pound sent.

If you’re sending GBP/CAD this month, consider this:

If the rate approaches 1.8650, consider sending at least part of your money, because this area has been hard to break.

If the rate drops into 1.8400 to 1.8326, that is a danger zone. If it breaks lower, your transfer could become more expensive fast.

If you have flexibility, consider splitting the transfer (for example 50 percent now, 50 percent later) to reduce regret risk.

Also, remember the rate you see online is often not the exact rate you will receive. Providers add a margin, so comparing quotes can materially change how many CAD arrive.

Live GBP to CAD exchange rates

Converting GBP to CAD

If you are planning to send GBP to Canada, you need to pick the right money transfer company to get the most CAD on the other end.

Depending on your needs, it's best to use one of the following companies in February:

Money transfer company | GBP/CAD exchange rate | GBP/CAD fee | GBP/CAD transfer time | CAD received |

|---|---|---|---|---|

Wise (Best GBP/CAD rate) | 1.8481 GBP/CAD | 20.01 | next day | 11,051.38 |

Key Currency (Lowest Fee) | 1.8434 GBP/CAD | 0 | minutes - 3 days | 11,060.3 |

Key Currency (Overall cheapest) | 1.8434 GBP/CAD | 0 | minutes - 3 days | 11,060.3 |

Currencyflow (Fastest Option) | 1.8432 GBP/CAD | 0 | minutes - 24 hours | 11,059.2 |

*Based on our data of £6,000 transfer from the UK to Canada in February 2026. For other amounts, please .

History of the GBP to CAD pair

The GBP/CAD pair has had a long history due to the close trading relationship between the UK and Canada.

They both are western allies and members of the G7, G20, OECD, and other organizations.

The British pound was first introduced in 1,489 and was the most used currency for centuries.

It was also used in most British colonial countries, including Canada which shifted from sterling to the Canadian dollar in 1,858.

The Canadian dollar has done better than the British pound over the years as the role of the UK in global affairs has diminished.

Indeed, the GBP to CAD pair has dropped from a high of 2.8 in December 1980 to the current 1.61, which is a ~44% decline.

The British pound has struggled because of the rising challenges faced by the country.

In 2016, the country voted to leave the European Union (EU), its biggest trading partner but this resulted in struggles faced by several core sectors in the country.

For example, the automobile sector which employed millions of people has shrunk as the number of cars manufactured in 2022 dropped to the lowest point since the 1950s.

On the other hand, Canada has benefited from its close relationship with the United States and the robust energy markets.

It has emerged as a top player in other commodities like gold and silver; and is the fourth-biggest oil producer in the world after the US, Saudi Arabia, and Russia.

The chart below shows the performance of the GBP/CAD pair since 1975.

| Date | 1 Pound Sterling in CAD |

|---|---|

| Feb 16, 2026 | 1.858308 CAD |

| Feb 17, 2026 | 1.849884 CAD |

| Feb 18, 2026 | 1.848394 CAD |

| Feb 19, 2026 | 1.842436 CAD |

| Feb 20, 2026 | 1.844667 CAD |

| Feb 21, 2026 | 1.844468 CAD |

| Feb 22, 2026 | 1.847147 CAD |

| Feb 23, 2026 | 1.848266 CAD |

| Feb 24, 2026 | 1.849182 CAD |

| Feb 25, 2026 | 1.849623 CAD |

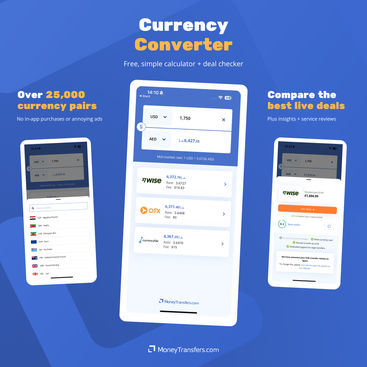

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors