Monzo was founded in 2015, storming onto the scene as an online-only solution aimed at customers looking to make the switch to digital banking.

Starting as a prepaid Mastercard and accompanying mobile transfer app, Monzo was originally designed as a type of pay-as-you-go travel card.

In response to the notable shift in consumer banking, Monzo began to develop its offerings, evolving into an intuitive alternative banking service in the UK and the US.

As a result, Monzo has expanded into an FCA-approved bank offering UK transfers, current accounts, and credit products such as loans and overdrafts, making them a strong competitor to the likes of Revolut or Starling Bank.

Scoring Monzo

Using our unique scoring system we've looked at the fees, exchange rates, limits, and customer feedback for international transfers. Here's a quick summary.

Pros

Cons

In addition, we've looked at how Monzo users score the international transfer features. Overall on average, users really like Monzo transfer features.

Monzo fees and exchange rates

Monzo fees and rates

The expensive nature of international bank transfers is well documented and specialist money transfer providers are known to offer more favourable overseas payment services.

However, due to a new wave of banks challenging the status quo, this is no longer always the case.

Unlike traditional high street banks, online-only challenger banks like Monzo can keep their overheads down by avoiding certain costs, such as physical locations, among other expenses.

As a result, challenger banks can offer the mid-market rate on currency pairings as well as fee-free (or low-fee) transfers.

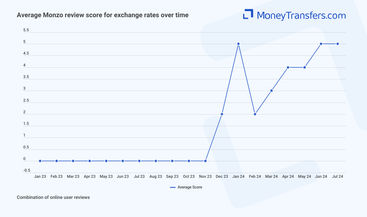

Here's how users review Monzo exchange rates are rated online.

Exchange rate

The infamous coral-colored Monzo debit card is issued by Mastercard, therefore it is this financial institution that sets the conversion rate for all international payments.

Occasionally the standard Mastercard exchange rate will include small markups. Usually, it is identical to the interbank rate but sometimes can be up to 2% depending on the amount and transfer location.

Transfer fees

There are zero transfer fees for depositing money into other Monzo bank accounts or any other UK bank accounts.

However, small fees are incurred for international bank transfers.

Due to Monzo’s partnership with international money transfer company Wise, the fees for overseas payments are set by Wise.

From our research, Wise transfer fees are determined by the amount of money sent, the destination country, and currency pairing.

How do Monzo bank transfer fees compare to using a money transfer provider?

Due to the integration of Wise, Monzo can offer specialized international money transfer services, mirroring the same low-cost services provided by the biggest money transfer competitors.

As one of the leading names in global remittances, Wise guarantees bank-beating exchange rates along with substantially lower transfer fees.

Here's how users review Mozno fees online.

Transfer speed

Monzo transfer speed

Monzo transfers are normally instant but may take up to 2 hours in some cases.

When sending an international bank transfer through Monzo, longer delivery times should be expected.

However, funds sent in standard currencies to popular destinations will be transferred within 1 working day.

Here's how users review Monzo's transfer speed.

Transfer limits

Monzo transfer limit

There is no limit to the amount you can send via bank transfer but £10,000 is the transfer limit when moving money between Monzo accounts.

If you need to move more, it is possible to increase your limit by contacting their customer service.

Here's how users review Monzo transfer limits online.

Product offering

Monzo product offering

The Monzo app has integrated the services of money transfer company Wise and as a result, all transfer fees and exchange rates are set by Wise.

As the UK’s leading overseas payments provider, Wise is considered to be a reputable and transparent service offering favorable currency rates that typically match the mid-market rate.

It is not currently possible to receive international money transfers with Monzo, as it stands, it is only possible to send international bank transfers.

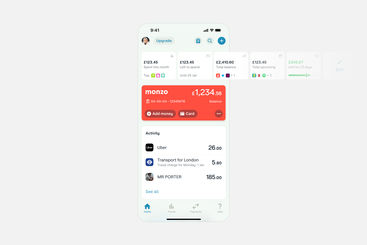

Tracking transfers & spend

You can review all transactions by clicking on the payment as it appears on the Home screen; this is a very handy feature for tracking spending habits both overseas and at home.

Domestic transfers will display the amount sent, the payment category, the reference details, as well as the total amount of previous payments sent to and received from this recipient.

International transfers will display identical details as domestic transfers, with the additional information of:

The international money transfer provider

The status of your payment

The exchange rate

The transfer fee

The estimated delivery date

Overall, there seems to be a positive trend from online user reviews in terms of the features.

Ease of use

Monzo ease of use

As a pioneer of digital challenger banking, Monzo functions primarily as a mobile money app.

Although Monzo has a website, users must download the app via Google Play or App Store to log into their account and take advantage of key features.

The app is free to download and easy to use.

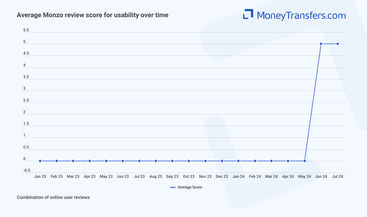

There aren't many online reviews for the usability of Monzo. However, a few that do exist seem to like the recent updates.

As for the support, Monzo customers can get in touch with customer support queries via the in-app services, phone number, or email address.

In addition to this, there is a Monzo Community Forum for up-to-date customer help and advice.

Here's how users view customer support based on Monzo online reviews over time.

Safety and trust

Monzo safety and trust

Online users are leaving mixed reviews regarding Monzo's safety features.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

The online reviews for Monzo are overwhelmingly positive, with many highlighting the ease of use and the various banking features.

Many users highlight the user-friendly app, which makes managing accounts straightforward and efficient.

Users seem to love the seamless banking experience, the convenience of the Monzo card, and the excellent customer service.

However, there are some recurring issues mentioned by users. A few reviewers have experienced problems with customer service, particularly in terms of slow response times or unhelpful support.

Some users have also encountered difficulties with account verification processes or unexpected account freezes, which can be frustrating and inconvenient.

Here's a summary of average user reviews this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

Customer Support | 5 | 0 | 5 | 5 | 5 | 5 | 0 |

Ease of Use | 2 | 1 | 3 | 4 | 4 | 2 | 0 |

Exchange Rates | 5 | 2 | 3 | 4 | 4 | 5 | 5 |

Features | 0 | 0 | 0 | 0 | 5 | 0 | 0 |

Fees | 3 | 1 | 3 | 5 | 4 | 0 | 0 |

International Transfers | 0 | 3 | 3 | 5 | 5 | 4 | 5 |

Limit | 0 | 0 | 0 | 0 | 0 | 5 | 5 |

Safety | 2 | 2 | 1 | 3 | 3 | 3 | 3 |

Speed | 0 | 0 | 0 | 0 | 2 | 2 | 2 |

*0s represent no reviews for the given month.

How to sign up for Monzo

Here's how to open a Monzo account - using the app - and, once set up, how to send funds (domestically or abroad).

Download Monzo app

Download the Monzo app and follow the on-screen instructions to Sign Up

Enter your details

Enter personal details such as full name, home address, contact information and valid ID

Confirm your identity

Confirm your identity by recording a selfie video - this is compared to your ID

Get your card

Once your identity has been verified you will be asked to choose an address for receiving your Monzo card

Activate your card

Once you receive your card, you will be required to activate your Monzo card when it arrives - this can be done via the app

Making domestic transfers to another Monzo app

Open Monzo

Open the app and select the Payments tab at the bottom of the screen

Find the receiver

Tap the Pay Someone option and select your recipient from your list of contacts - alternatively, you can choose to Pay Someone Nearby

Enter amount

Once you have chosen the recipient you will be asked to enter the amount you wish to send, along with a Private Message for the recipient

Click Send

As a safety precaution, you will be asked to enter your card’s 4-digit PIN to confirm payment

Categorise the transfer

You will have the option to categorize the payment from a list of common spending habits and the transfer will appear on your Home screen

Making international transfer

Open Monzo

Open the app and select the Payments tab at the bottom of the screen

Click Pay

Tap the Pay Someone option and select Make a Bank Transfer

Select International Transfer

Select the International Transfer tab at the top of the screen; you will be taken to Wise’s website, where you will need to sign in to your Wise account and grant Monzo access

Enter receipient details

You will then be asked to enter the recipient’s name, destination country, and currency, and confirm your understanding of the New Payee Warning

Review the fees

When you enter the amount you wish to send, Wise will display the exchange rate (ensure this is as close to the mid-market rate as possible) and any transfer fees.

Review this information and add a Payment Reference (optional) before clicking Continue

Enter payee details

You will be asked to enter Payee Details including Recipient Type, Account Type, and the recipient’s banking information

Review the fees and send

Review your international transfer in full, including the Guaranteed Exchange Rate displayed at the bottom of the screen.

If you are happy with the data, tap Confirm Transfer

International transfer requirements & details

To make an international transfer with Monzo, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with Monzo and their app.

Monzo's SWIFT code is MONZGB2L.

Monzo alternatives

Monzo is one of the more popular neobanks, especially in the UK. Recent data shows they have over 7.4 million users with almost 6 billion customer deposits.

However, even though it's a great challenger bank for domestic transfers, it is not as good for international payments due to higher fees, and inability to receive international payments.

If you're looking to make an international transfer, we'd suggest looking at these alternatives.

Monzo - A new way to bank online

Monzo is a fantastic option for UK-based customers who frequently send and receive funds with contacts in the country.

Due to the fact, that it is not yet possible to receive international transfers to your Monzo account, we would recommend customers who frequently move money between foreign accounts to look into using an alternative provider.

In terms of international money transfers, Monzo’s services are not yet as well-rounded as specialized long-standing companies like WorldRemit or OFX.

However, if you're looking for a digital bank for local transfers and only need to make an occasional international transfer, Monzo might be a good choice for you.

A bit more about Monzo

Can I open a Monzo bank account in any country?

Can I use my Monzo debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks