Federal Bank for international wire transfers

We’ve had a look at how Federal Bank is compared to money transfer providers, and here’s a quick summary of the two.

Transfer type | Federal Bank | Money Transfer Companies |

|---|---|---|

Sending fees | ~₹1860 on ₹50,000 transfer (+TCS & GST where applicable) | $0 - $20 |

Receiving fees | ~₹0 | $0 |

Exchange Markup | ~1-6% | 0% - 2% |

Transfer Times | ~2 - 5 business days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Federal Bank

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Federal Bank fees and exchange rates

Fees and rates

Exchange rates

The Federal Bank offers conversions to widely used currencies, such as INR (Indian Rupee), EUR (Euro), and GBP (British Pound).

The Federal Bank doesn’t explicitly state their exchange rates.

This usually means that the exchange rate is affected by many factors such as transfer amounts and currencies involved.

As per its T&Cs, Federal Bank charges around Rs 180 per Rs 100,000 sent, however, this will depend on your personal circumstances and does not include any other fees (more on that below).

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

International transfer fees

According to Federal Banks T&Cs, the following charges apply to remittance transfers:

Fee | Amount |

|---|---|

Commission amount | Rs 1,000 (Excluding GST) |

Tax | 18% of the commission amount |

Swift charge | Rs 590 |

Forex conversion tax - Below Rs 100,000 | INR Amount X .0018 |

Forex conversion tax - Rs 100,000 to Rs 999,999 | (Amount - 100,000) X .0009 + 180 |

Forex conversion tax - Rs 1,000,000 and above | (Amount - 1,000,000) X .00018 + 990 |

Most of the transfer methods that the Federal Bank employs are for inward remittances, meaning it’s coming from abroad to India.

Most high street banks charge a fixed fee for making international wire transfers, and most will charge a fee for receiving (with a few exceptions like HSBC and NFCU)

In comparison to a money transfer provider, you will be overpaying by a fair bit.

Let’s assume you’re making a ₹50,000 transfer from India to a bank via Fed-e-Remit to an account in the following countries:

Country | Fed-e-Remit transfer cost | Wise transfer cost |

|---|---|---|

~₹1860 (+TCS & GST where applicable) | 1,141.63 INR + 0% markup | |

~₹1860 (+TCS & GST where applicable) | 1,316.30 INR + 0% markup | |

~₹1860 (+TCS & GST where applicable) | 1,139.46 INR + 0% markup |

As you can see, you're looking at saving around 500-700 INR per transfer with Wise.

Transfer speed

Transfer speed

Local transfers with the Federal Bank all happen in real time after successful transactions.

Based on our research and testing, the only option you have to send money from India abroad is using Fed-e-Remit.

Fed-e-Remit transfers can take between 2 - 5 days, depending on the amount you send and the delivery method.

In addition, transactions made before 16:00 IST will be processed on the same day, anything after will be processed the next business day, adding 1 more day to your transfer time.

This is somewhat in line with other high street banks. However, it’s much slower than the international money transfer providers.

Money transfer services are faster due to how they process the payments and are usually instant.

Transfer limits

Transfer limits

Federal Bank offers a few transfer types for transfers to India from abroad with different transfer limits. Here’s a quick overview of each:

The National Electronic Funds Transfer (NEFT): has a 50,000 INR transfer limit per transaction for local money transfers.

The Real Time Gross Settlement (RTGS): has no maximum transfer limit as long as the customer’s minimum total transfer amount is 200,000 INR.

The Immediate Payment Service (IMPS): has a 50,000 INR transfer limit per day.

When it comes to sending money from India to other countries, you can use Fed-e-Remit for your transfer.

With Fed-e-Remit you can send up to $25,000 per day or USD 250,000 per year.

You can make a bigger transfer if you need to, but you will have to visit your local branch.

If you are looking to transfer a large amount of money to or from India, we’d recommend using a currency broker such as RegencyFX or OFX.

Product offering

Product offering

Fed-e-Remit

Federal Bank offers a remittance service called Fed-e-Remit for transfers from India.

You can make transfers in 13 currencies, including:

AED (United Arab Emirates)

AUD (Australia)

CAD (Canada)

CHF (Switzerland)

EUR (Europe)

GBP (United Kingdom)

HKD (Hong Kong)

JPY (Japan)

NZD (New Zealand)

QAR (Qatar)

SAR (Saudi Arabia)

SGD (Singapore)

USD (United States)

The service is primarily aimed at making remittances as opposed to business transfers. With main purposes including education abroad and student fees, immigration, working abroad, supporting relatives, touring, and sending gifts.

You can send up to 25,000 USD per day and it will take around 2-5 days to arrive (as transfers are made over the SWIFT network).

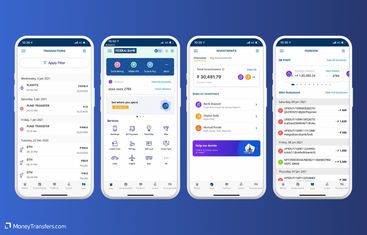

Mobile app

Federal Bank customers can only register in the app using the same mobile number they used to register with the bank.

Customers can download the FedMobile app from Google Play, the App Store, and the Windows Store.

Its rating is 3.3 out of 5 in Google Play and 3.2 out of 5 in App Store.

Here are some of its key features:

Funds transfer and bill payment: Customers can use FedMobile to transfer funds to any bank account nationwide. FedMobile also allows customers to settle utility, school, and mobile payments within the app.

Opening term deposits, loans, and investment options: Customers can view options within the app for term deposits, loans, and investment options. They can open, close, or avail of their chosen options from the app as well. Mutual funds and insurance can be opened under-investment options.

Bookings: Hotel, bus, cab, movie, and event bookings are functions available in the app to increase the convenience for Federal Bank customers.

Ease of use

Ease of use

Customer service

Here's a list of customer support options available at Federal Bank:

Customer care toll-free number: Call 1800-425-1199 or 1800-420-1199 for general inquiries, banking services, and support.

Email support: Send queries and complaints to contact@federalbank.co.in.

Missed call service: Give a missed call to 84319 60000 for account balance and 84319 50000 for a mini statement.

SMS banking: Send predefined keywords to 98950 88888 for various banking services.

Net banking helpdesk: Call 1800-425-1199 or email nrb@federalbank.co.in for assistance with online banking services.

Branch locator: Use the branch locator tool on the website to find the nearest branches and contact information.

Relationship manager: Contact your assigned relationship manager for personalized banking assistance.

Feedback and complaints form: Submit feedback or complaints through the form available on the bank's website.

Social media support: Reach out through Facebook, Twitter, and LinkedIn for assistance and updates.

WhatsApp banking: Send 'Hi' to 98950 88888 for various banking services via WhatsApp.

Chatbot: Use the AI-powered chatbot on the bank’s website for instant help and information.

Personal information such as address registered with Federal Bank, customer ID, and last three transactions will be requested for verification.

Use the following details to contact them if you have any issues or need help.

Support Option | Contact Details |

|---|---|

Customer Care Toll-Free | 1800-425-1199 / 1800-420-1199 |

Email Support | |

Missed Call Service | 84319 60000 (Balance), 84319 50000 (Mini Statement) |

SMS Banking | 98950 88888 |

Net Banking Helpdesk | 1800-425-1199 / nrb@federalbank.co.in |

Branch Locator | Available on the website |

Relationship Manager | Contact Assigned Relationship Manager |

Feedback And Complaints | Form available on the website |

Social Media Support | Facebook, Twitter, LinkedIn |

WhatsApp Banking | 98950 88888 |

Chatbot | Available on the website |

Safety and trust

Safety and trust

Just like any other high street bank, Federal Bank has several safety features in place, including:

Multi-factor authentication (MFA): Requires multiple forms of verification for online and mobile banking access.

Fraud detection systems: Monitors accounts for unusual or suspicious activity to detect potential fraud and notifies customers immediately if fraudulent activity is detected.

Encryption: Utilizes advanced encryption techniques to protect customer data.

Secure login: Ensures secure access through encrypted login processes.

Biometric authentication: Supports fingerprint and facial recognition for mobile app access.

Card controls: Allows customers to manage their debit and credit cards, including locking and unlocking.

Automatic logout: Logs users out automatically after a period of inactivity.

Identity theft protection: Offers services to help detect and resolve identity theft issues.

Online security center: Provides resources and tips for protecting personal information.

EMV chip technology: Issues cards with EMV chip technology for secure transactions.

Virtual keypad: Uses a virtual keyboard to enter passwords, preventing keylogging malware from capturing keystrokes.

Customer feedback

Customer feedback

We couldn’t find many objective reviews for the Federal Bank.

Opening an account

To open an account with Federal Bank, you'll need to provide the following details and documents:

Full name

Date of birth

Gender

Nationality

Marital status

Occupation

Residential address

Permanent address (if different from residential)

Contact phone number

Email address

Government-issued ID (e.g., passport, driver’s license)

Proof of address (e.g., utility bill, bank statement)

Passport-sized photograph

Once you’ve gathered everything you need, follow these steps to open an account with Federal Bank.

Visit the Federal Bank website

Choose the type of account

Fill out the online application form

Submit necessary documents

Review and confirm the information

Verify your identity

Await confirmation

Activate your account

Start using your account

Making international transfers

International transfer requirements & details

Once you’re ready to make a transfer abroad, you will need the following information:

Recipient's full name

Recipient's address

Recipient's bank account number

Recipient's bank name

Recipient's bank address

SWIFT/BIC code of the recipient’s bank

Amount to be transferred

Currency of the transfer

Purpose of the transfer (if required)

Your Federal Bank account number

Any intermediary bank details (if applicable)

Federal Bank’s SWIFT code is FDRLINBBIBD.

Making wire transfers

Transfers with the Federal Bank can be done through mobile or Internet banking.

Federal Bank customers have three local transfer options:

National Electronic Funds Transfer (NEFT)

NEFT is used for interbank transfers within India, as well as paying off credit card debts and loans.

Real-Time Gross Settlement (RTGS)

RTGS is used for large transactions because it has a minimum amount requirement of 200,000 INR (no maximum requirement).

Immediate Payment Service (IMPS)

IMPS is used for interbank transfers within India.

All transfer options are done in real time.

Here’s how to make an international transfer using NEFT.

Log in to your online banking account

Navigate to the wire transfer section

Select international wire transfer

Enter recipient details

Input bank details

Specify the transfer amount and currency

Review and confirm the transfer

Authenticate the transfer

Save the confirmation

Monitor the transfer

Remittance services

The Federal Bank offers remittance services through cash pickup options. These are endorsed to NRIs (non-resident Indians) to remit to India.

The bank does not disclose additional information on the whole process of receiving money, so you will need to contact the bank or visit the nearest branch to inquire about these services.

Use Wise to send money from your Federal Bank account

It may be simpler to fund your transfer with your Federal Bank account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your Federal Bank account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN).

For international wire transfers, you’ll need to supply your SWIFT code or BIC: FDRLINBBIBD

Your account number, name, and address

You’ll need to supply your complete Federal Bank account number, the name on your account, and the complete address of your account as it appears on your bank account.

How Federal Bank compares to money transfer services

As you’ve probably guessed, the Federal Bank is not the best option for sending money abroad due to its lack of transparency and lack of international transfer features.

We suggest you take a look at the following alternatives to get more value out of your transfer.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Federal Bank: Is it good for transfers abroad?

Although Federal Bank attempts to offer money transfer options to make it convenient for its customers, it is not the best option to use.

They don’t provide enough information to make informed transfer decisions. Also, their lack of transfer features and partnerships indicates that they are more of a day-to-day bank.

If you’re looking to send money abroad from India, we strongly suggest you use one of the provided alternatives. Alternatively, use our form below to get the best deal for your specific needs.

Find the best rates for your transfer

A bit more about Federal Bank

Can I open a Federal Bank account in any country?

Can I use a Federal Bank debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks