Truist Bank for international wire transfers

Here’s a quick overview of how Truis Bank compares to money transfer services.

Transfer type | Truist Bank | Money Transfer Companies |

|---|---|---|

Sending fees | $65 | $0 - $20 |

Receiving fees | $20 | $0 |

Exchange Markup | ~3-6% | 0% - 2% |

Transfer Times | 3-5 business days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Truist Bank

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Truist Bank fees and exchange rates

Fees and rates

When it comes to international transfers with high-street banks, there are two main fees you need to be aware of, mainly:

Transfer fees: a fee you pay for sending (and sometimes receiving) international wire transfers. These are usually fixed fees that are clearly displayed.

Exchange rate markup: an additional percentage added to the “real” exchange rate you see on Google or our currency converter.

Exchange rates

There’s no clear information on the exchange rate markup offered by Truist Bank post-merger.

We know that the average exchange rate for a high street bank can vary between 3-6% based on our internal data.

In the past, Truist Bank had clearly stated that their exchange rate is 3%, but since then, the page explaining the rates has been completely removed.

Even with a 3% markup, you will be overpaying compared to Wise’s 0% markup. However, it is cheaper than using other high street banks such as Wells Fargo (6% markup) or NFCU (5% markup).

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

Here’s a summary of average user reviews in terms of exchange rates for the past year.

International transfer fees

Truist Bank also charges fees for international and domestic transfers. Truist Bank charges $65 for sending money abroad, and $20 for receiving money into your account.

We’ve put together this table to summarize their fees:

Transfer Type | Truist Bank Fee |

|---|---|

Sending international transfer | $65.00 per transfer |

Receiving international transfer | $20.00 per transfer |

Sending domestic transfer | $30.00 per transfer |

Receiving domestic transfer | $15.00 per transfer |

Sending book transfer | $5.00 per transfer |

Receiving funds transfer | $5.00 per transfer |

To give you an idea of how much you'd be paying, this is how Truist international transfer fees stack up against the competition.

Let’s assume you’re making a $1000 transfer from the US to a bank via wire transfer to an account in the following countries:

Country | Truist Bank Fee | Wells Fargo | Wise |

|---|---|---|---|

$65 + ~3% markup | $30 + ~6% markup | $10.79 + 0% markup | |

$65 + ~3% markup | $30 + ~6% markup | $13.16 + 0% markup | |

$65 + ~3% markup | $30 + ~6% markup | $10.36 + 0% markup |

Here’s a summary of average user reviews in terms of transfer fees for the past year.

Transfer speed

Transfer speed

For international transfers made via the SWIFT network, the recipient typically receives funds within 3-5 business days.

Wire transfer requests submitted before 6 pm ET will be processed on the same day.

When it comes to speed, users seem to not care much, which is evident by the lack of online reviews.

Transfer limits

Transfer limits

Truist Bank doesn’t explicitly state the transfer limits for international transfers. Instead, it is reviewed on a per-transfer basis.

Here’s a breakdown of their transfer limits:

Online and mobile transfers: $5,000 per transaction and $10,000 per day.

External transfers: $5,000 per transaction and $10,000 per day.

Wire transfers: Limits may vary and specific details can be found by contacting Truist customer service.

Here’s a summary of average user reviews in terms of transfer limits for the past year.

Product offering

Product offering

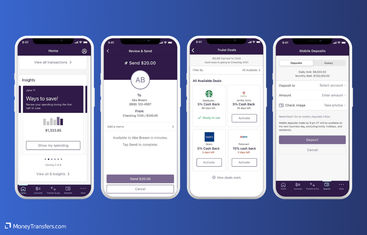

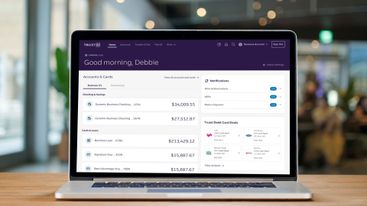

Mobile App

Truist Bank has an app called Truist Mobile, which now has over 1m downloads on the Play Store and 780K on the App Store. It is rated as 4.7 and 4.8 on both stores.

The app offers all the usual features you get with a digital banking account, including making international and domestic transfers.

Foreign currency exchange

Truist Bank offers foreign currency exchange services for international money transfers.

However, you should check Truist exchange rate margins on the same day before you make the international money transfer.

Here’s how other users have rated the product features offered by Truist Bank.

Ease of use

Ease of use

Ease of use and convenience are a must for any bank, especially if you’re using it day-to-day. Here’s a summary of user reviews regarding their product features.

Customer service

Truist Bank offers multiple support options, including:

Phone support: Customers can reach Truist's customer service by calling the dedicated phone numbers for various services such as general banking inquiries, credit card support, and mortgage support. Available 24/7 for general banking.

Online chat: Truist offers an online chat option for quick assistance through their website. This service connects customers with a live representative for immediate support.

Email support: Customers can send inquiries via email for non-urgent matters. Truist Bank typically responds within a few business days.

Mobile app support: Truist's mobile app includes a support feature where customers can send messages, find answers to frequently asked questions, and access account services.

In-person branch support: Customers can visit any Truist branch for face-to-face assistance with their banking needs. Branch hours may vary by location.

Social media support: Truist provides support through its official social media channels, including Twitter and Facebook, where customers can send direct messages or post inquiries.

Online banking support: Truist's online banking platform offers a support section with FAQs, troubleshooting guides, and secure messaging for account-specific help.

Secure message center: Through Truist's online banking portal, customers can send secure messages directly to customer service for assistance with their accounts.

Automated phone service: Truist offers an automated phone system for customers to check account balances, recent transactions, and other basic services without speaking to a representative.

ATM support: Truist ATMs provide on-screen help and support for transactions, including a customer service hotline for more complex issues.

Here are the details on how to contact Truist Bank customer support.

Support option | Truist contact details |

|---|---|

Phone support | General: 1-800-226-5228, Credit Cards: 1-844-487-8478, Mortgages: 1-800-827-3722 |

Online chat | Available on Truist's website |

Email support | Accessible through Truist's website contact form |

Mobile app support | Support feature within the Truist mobile app |

In-person branch support | Visit the local Truist branch (hours vary) |

Social media support | X: @TruistBank and Facebook: @Truist |

Online banking support | Support section on Truist online banking portal |

Secure message center | Available through Truist online banking portal |

Automated phone service | General: 1-800-226-5228 |

ATM support | On-screen help and customer service hotline provided at ATM locations |

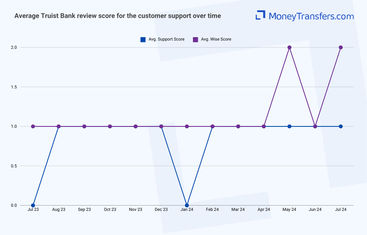

Similarly, here’s an overview of how other users see customer service at Truist Bank.

Safety and trust

Safety and trust

When it comes to safety, Truist offers the following security features for its customers:

Multi-factor authentication (MFA): Adds an extra layer of security by requiring multiple forms of verification.

Fraud monitoring: Continuous monitoring for suspicious activities and transactions.

Encryption: Uses advanced encryption to protect data in transit and at rest.

Secure login: Features like biometric login (e.g., fingerprint or facial recognition) for added security.

Account alerts: Real-time notifications for account activity and potential security breaches.

Secure messaging: Encrypted communication channels for exchanging sensitive information.

Identity theft protection: Offers services and tools to help detect and prevent identity theft.

Regular security updates: Frequent updates to software and systems to address new security threats.

Password management: Guidelines and tools for creating strong, unique passwords.

Customer education: Resources and tips for customers on how to protect their accounts and personal information.

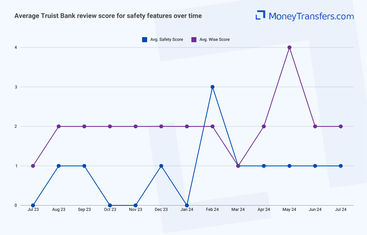

Here’s a summary of average user reviews in terms of security for the past year.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

Customers particularly like the helpful and knowledgeable staff at Truist Bank, particularly when opening new accounts or handling complex situations.

The online banking format is praised for its user-friendliness, and the overall customer experience is described as excellent.

Some long-term customers have had positive experiences with Truist, citing the bank as solid and reliable compared to other major banks.

However, many users report significant issues with account management and customer service.

Including locked accounts due to perceived fraudulent activity, difficulties in resolving these issues, and delays in accessing funds.

The transition from SunTrust to Truist has also caused frustration for some long-term customers, leading to a decline in service quality.

Finally, problems with debit card activation and fulfillment of promotional offers have resulted in many negative experiences.

Here's a summary of average user reviews so far this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

International Transfers | 0 | 0 | 0 | 0 | 1 | 1 | 5 |

Fees | 1 | 0 | 1 | 1 | 1 | 1 | 1 |

Exchange Rates | 1 | 0 | 1 | 1 | 0 | 0 | 1 |

Speed | 0 | 1 | 2 | 3 | 1 | 0 | 0 |

Limit | 1 | 0 | 0 | 0 | 1 | 1 | 1 |

Features | 0 | 0 | 0 | 1 | 1 | 1 | 1 |

Ease of Use | 0 | 0 | 0 | 5 | 0 | 1 | 1 |

Safety | 0 | 3 | 1 | 1 | 1 | 1 | 1 |

Customer Support | 0 | 1 | 1 | 1 | 1 | 1 | 1 |

Opening an account with Truist Bank

Opening an Account

Before sending money to Truist Bank, you will need to create an account. Here’s a list of steps on how to get started with Truist Bank.

Visit the Truist Bank website

Navigate to the account opening section

Choose the type of account you want to open

Click on Apply now or Get started

Fill out the online application form

Provide identification and verification documents

Review and agree to the terms and conditions

Submit your application

Verify your identity

Wait for confirmation

Receive account details

Making international transfers

International transfer requirements & details

To make an international wire transfer with Truist, you’ll need the following details:

Recipient’s full name: The full legal name of the person or organization receiving the funds.

Recipient’s address: The recipient’s complete address, including country.

Recipient’s bank name and address: The name and physical address of the recipient's bank.

Recipient’s bank account number or IBAN: The recipient’s bank account number, or an International Bank Account Number (IBAN) if required.

Recipient’s SWIFT/BIC code: The SWIFT or Bank Identifier Code (BIC) of the recipient’s bank, which identifies the bank internationally.

Currency of transfer: The currency in which the funds will be sent.

Amount to transfer: The amount of money you wish to send.

Your account details: Your bank account number and any necessary details required by your bank for processing the transfer.

Truist Bank’s swift code is SNTRUS3A

Making wire transfers

Once you have everything you need, to make an international wire transfer with Truist Bank, follow these steps:

Log in to your online banking account

Navigate to the wire transfer section

Select international wire transfer

Enter recipient details

Enter transfer details

Review and confirm

Authorize the transfer

Save or print the confirmation

Track your transfer

Use Wise to send money from your Truist Bank account

It may be simpler to fund your transfer with your Truist Bank account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your Truist Bank account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN): 061000104.

Double-check your routing number which may vary (after the merger).

For international wire transfers, you’ll need to supply your SWIFT code or BIC: SNTRUS3A

The bank name and address

Truist Bank's address for international wire transfers is 214 North Tryon Street, Charlotte.

Your account number, name, and address

You’ll need to supply your complete Truist Bank account number, the name on your account, and the complete address of your account as it appears on your bank account.

How Truist Bank compares to money transfer services

As we’ve established already, Truist Bank is not the best way to send money abroad.

Choosing an alternative transfer provider will save you significant sums of money, especially if you’re making large transfers. Here are a few alternatives we’d recommend:

For example, companies like XE and Wise are top-tier examples of services that offer the best value.

They match the mid-market rate for currency conversions and offer some of the lowest rates in the money transfer industry.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Truist Bank: Is it good for transfers abroad?

Truist Bank is a good bank for day-to-day transfers, but is significantly more expensive than an average bank, and even more expensive than a money transfer provider when it comes to international transfers.

If you already have an account, we’d recommend using it to make an international transfer through Wise. It is quick, simple and will save you a lot of money.

Alternatively, use our form below to get the best exchange rate deals for your needs.

Find the best rates for your transfer

A bit more about Truist Bank

Can I open a Truist Bank account in any country?

Can I use a Truist debit card when traveling abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks