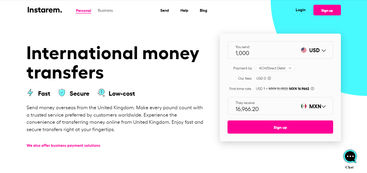

We have analyzed Instarem’s money transfer service from head to toe, breaking it down into its costs, service, ease of use, safety and trust, and customer feedback.

We’ve also signed up and sent money using the app, so we’re in the best position to give an honest and full picture on how good Instarem really is.

How MoneyTransfers.com rates Instarem

Fees & Rates

Instarem’s lack of transparency with fees isn’t ideal, but upon looking into the most popular routes we found most of them to be fee-free. Exchange rates can tend to be a little high, however

Service

Ease of Use

Safety & Trust

Customer Feedback

“Instarem is a good money transfer provider, easy enough to use and placing a great deal of importance on security. While their service could be improved, if they cater to your selected route you might find you get a good deal with Instarem.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

Why do we like Instarem?

Its low fees: Instarem’s fees do have some variables, but in most cases when sending money from the US you won’t have to pay

Its easy to use app: Once you’ve signed up to Instarem, its app is very straightforward and intuitive

Its limited coverage: Instarem doesn’t offer the biggest range of supported countries and currencies

Its slow signing up process: The signup process took a little longer than we thought it would, with a few complicated steps

No transparency: You don’t get much of a view into its pricing structure, nor does it tell you that most of the cost is hidden in the rate markup

How much does it cost to send money with Instarem?

Here's how we rated Instarem based on its fees and exchange rates. Find the best rates for your specific transfer with our comparison tool.

Provider

Instarem does not publish any official information regarding their fees or exchange rates, and you’ll only be able to see the fees for any specific transfer you initiate on their homepage. However it appears that many transfers do not incur a fee, and those that do face a fixed fee rather than a percentage of the total amount.

When sending money with Instarem, the overall cost will depend on:

How much you send: Instarem will often charge a higher fee for bigger transfers, but it’s frustrating that there is no information about this

The country and currency you use: Most currencies do not come with a fee, but some do - while sending dollars to be received without conversion is usually more expensive

How you pay: ACH and bank transfers have lower fees than debit and credit card payments

What are Instarem’s transfer fees?

From our experience using their service, many transfers come without a fee if you’re sending dollars to be converted into local currency. But transfers to certain places, including Brazil, Argentina and Nigeria, do incur a fee of $30-$45 for a $2,000 transfer.

If you’re sending $2,000 to be received in dollars at the destination, rather than the local currency, you’ll then incur further transfer fees.

We looked at some of our most popular transfer routes made with Instarem, to better understand the fees people may face:

Sending €2,000 from the US

Destination | ACH Fee | Credit card fee | Debit card fee | Wire transfer fee | Instarem as Payee fee |

Philippines | $0 | $0 | $0 | $0 | $0 |

India | $0 | $0 | $0 | $0 | $0 |

UK | $0 | $0 | $0 | $0 | $0 |

Australia | $0 | $0 | $0 | $0 | $0 |

Germany | $0 | $0 | $0 | $0 | $0 |

It’s hard to complain at a fee table with all zeroes - so for most transfer routes you’ll find their fees to be more than acceptable.

What exchange rate does Instarem charge for international transfers?

Instarem also charges a markup on the mid-market exchange rate, which varies depending on how much you’re sending and which currencies are involved. We looked into Instarem’s exchange rates for a few different transfers, and found their rate markup to be relatively low - especially for EUR-USD, GBP-USD, and GBP-EUR transactions.

As you might expect, Instarem offers much better exchange rates for bigger transfers - but a plus point is that they also offer a discounted rate for your first transfer.

“As you can see from the table we’ve included, there aren’t any fees for some of the most common routes Instarem is used for. Its rates are good for transfers involving GBP, USD and EUR, so you’re likely to get a good deal if you need to send money to these places.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How good is Instarem's money transfer service?

This is how we rated Instarem based on the overall quality of service they offer. This puts them outside of our top ten provider list, with providers like XE, Wise, and WorldRemit all scoring much higher.

Provider

Instarem’s money transfer service is popular and powerful, offering money transfers to a range of countries around the world. However it does have its limitations - we’ve analyzed Instarem’s service from top to bottom, including its fees, limits and available routes, to see how it fares.

How fast are Instarem’s transfers?

Instarem’s money transfers can take up to two business days to process for most currencies, with some more exotic ones taking longer. However, they say on their homepage that most transfers are instant or same-day. Two business days is still a little better than most banks, but Instarem does not tell you how long your actual transfer will take, even once you’ve made it. This isn’t the strongest showing, in our opinion.

How much can I send with Instarem?

Instarem publish a list of all their outward and inward transfer limits, which we’ve included below:

Instarem outward remittance limits

Country | Minimum amount (Native currency) | Minimum amount (Other currencies) | Maximum amount by payment method |

Australia | AUD 1 | None | $20,000 by credit or debit card, no limits for bank transfers, POLi transfers and PayID transfers |

Hong Kong | HKD 1 | USD 1 | HKD30,000 by debit card, no limit by bank transfer |

Singapore | SGD 1 | USD 1 | SGD 20,000 by debit or credit card, SGD 2,00,000 by PayNow, and no limit by bank transfer |

Malaysia | MYR 1 | None | MYR 30,000 per day by FPX or bank transfer. Malaysian citizens and expats can send up to MYR 30,000 per day but foreign workers can only send MYR 5,000 per month |

India | USD 50 equivalent | USD 50 equivalent | USD 5,000 equivalent by bank transfer. USD 245,000 equivalent per financial year (from April 1 to March 31 the following year) |

Europe | EUR 1 | None | EUR 10,000 by debit card, no limit by bank transfer |

UK | GBP 1 | None | GBP 10,000 by debit card, no limit by bank transfer |

USA | USD 1 | None | Per transaction: $2,500 by debit or credit card, $3,000 by ACH and no limit by wire transfer or Instarem as Payee. Monthly limits: $1,000 by debit or credit card, $3,000 by ACH and no limit by wire transfer or Instarem as Payee |

Canada | CAD 1 | None | CAD 3,000 a day, CAD 10,000 a week, CAD 20,000 a month - can only pay by Interac e-Transfer |

Instarem inward remittance limits

Country | Individual to individual limit |

Philippines | <150,000 PHP, no limits on transfers made in USD |

Thailand | THB 2,000,000 per remitter per day, per Kasikorn bank beneficiary. THB 49,999 per day per non-Kasikorn bank beneficiary. No limits on transfers made in USD |

Vietnam | Minimum of VND 500,000 and maximum of VND 250,000,000 per transaction. No limits on transfers made in USD |

China (CNY) | USD 5,000 per transaction and USD 10,000 per day with Money Express. USD 3,000 per day for Bank Channel, two transactions per day and yearly quota of USD 50,000. |

South Korea | USD 3,000 equivalent per transaction, no USD payout available |

Pakistan | USD 3,000 equivalent per transaction, no USD payout available |

Ghana | Minimum of GHS 50 and maximum of GHS 5,000 |

Nigeria | Minimum of NGN 50, no maximum limit |

Uganda | Minimum of UGX 50, no maximum limit |

These limits aren’t too complicated to understand, although they are quite low in certain countries and payment methods. Fortunately, bank transfers from the UK and EU, and wire transfers from the US, have no limits.

What kind of transfers can I make with Instarem?

Instarem allows different payment methods depending on the country you’re registered in - see the below table:

Country | Payment methods allowed |

Australia | PayID, POLi, bank transfer, credit and debit card |

Singapore | PayNow, bank transfer, credit and debit card |

USA | ACH/direct debit, wire transfer, Instarem as Payee, credit and debit card |

Canada | INTERAC e-Transfer |

Hong Kong | Bank transfer and debit card |

Malaysia | FPX and bank transfer |

UK | Bank transfer and debit card |

Europe | Bank transfer and debit card |

In most countries you’ll only be able to deposit the money in the recipient’s bank account, however for transfers to the Philippines you can arrange a cash pickup. For transfers to China you can send it to the recipient’s Alipay wallet. These payment options are varied enough in most countries, giving you flexibility in how you pay, but the limited availability of other payout options isn’t ideal, particularly for those needing alternatives to bank deposits.

Where can I send money with Instarem?

You’ll be able to send money to over 50 countries with Instarem, and you can see a specific list of receiving countries available depending on the sending country on their website. For example, from the US you can send money to:

Individual transfers | Business transfers |

Argentina | Argentina |

Austria | Austria |

Australia | Australia |

Bangladesh | Bangladesh |

Belgium | Belgium |

Bulgaria | Bulgaria |

Brazil | Brazil |

Canada | Canada |

Switzerland | Switzerland |

China | China |

Cyprus | Cyprus |

Czech Republic | Czech Republic |

Germany | Germany |

Denmark | Denmark |

Estonia | Estonia |

Spain | Spain |

Finland | Finland |

France | France |

United Kingdom | United Kingdom |

Ghana | Ghana |

Greece | Greece |

Hong Kong | Hong Kong |

Croatia | Croatia |

Hungary | Hungary |

Indonesia | Indonesia |

Ireland | Ireland |

India | India |

Iceland | Iceland |

Italy | Italy |

Japan | Japan |

Kenya | NA |

South Korea | South Korea |

Sri Lanka | Sri Lanka |

Lithuania | Lithuania |

Luxembourg | Luxembourg |

Latvia | Latvia |

Monaco | Monaco |

Malta | Malta |

Mexico | Mexico |

Malaysia | Malaysia |

NA | Nigeria |

Netherlands | Netherlands |

Norway | Norway |

Nepal | Nepal |

New Zealand | New Zealand |

Philippines | Philippines |

Pakistan | NA |

Poland | Poland |

Portugal | Portugal |

Romania | Romania |

Sweden | Sweden |

Singapore | Singapore |

Slovenia | Slovenia |

Slovakia | Slovakia |

San Marino | San Marino |

Thailand | Thailand |

Tanzania | Tanzania |

Uganda | Uganda |

Vietnam | NA |

You’ll be able to send your native currency from all origin countries, but you can also send US dollars from Singapore and Hong Kong, and Euros from the UK. The total number of supported countries is lower than some other providers, but if they cater to a route you commonly use it may be worth a punt.

How good is Instarem’s customer service?

Instarem’s customer service options are limited to a live chat and a ticket system, while there is also a small help section.

Live chat

Availability | 24/7 |

Response time | Minutes |

Languages | English |

We connected to their live chat to ask a few questions about their money transfer service, and other ways to get in touch as its website only shows a live chat and ticket system. The agent was very quick to respond to all of our queries, and confirmed there was no phone line available. Every response was clear, fully explained, and they were helpful in answering all of our questions.

Ticket system and email

Availability | 24/7 |

Response time | Within 24 hours |

Languages | English |

When logged in, you’ll have the option of creating a ticket for an issue you are experiencing. While we did not have any particular issues to present, we created a ticket to ask for some more information regarding their fee structure. However after 24 hours they had yet to reply.

Help center FAQs

Availability | 24/7 |

Languages | English |

Instarem’s help center has a few topics to explore - but interestingly their help section for sending money actually directed us to their ‘send money page’, rather than any guides. This wasn’t a great experience as this should be where the bulk of the useful and helpful information would be. There were some more guides about different bank codes, transferring money on holidays, and limits by country, but the useful information we wanted was still unavailable.

What else can I do with Instarem?

Instarem offers money transfer services for individuals and businesses, but it does not provide any other services for most customers at the moment.

“Instarem’s service isn’t quite as well developed as other providers, with fewer currencies and countries supported. However with low fees and relatively good rates, they could provide a good option for certain money transfer routes. ”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How easy is Instarem to use?

Here's how we rated Instarem based on how easy it is to open an account and send money. Instarem came high in this ranking, alongside providers like XE, TransferGo and CurrencyFair.

Provider

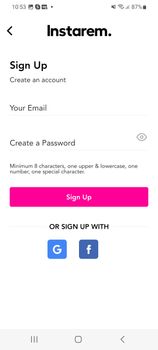

We went through the process of signing up to Instarem on their desktop site and app, as well as sending money on both platforms - we’ve reviewed them in detail below.

Signing up with Instarem

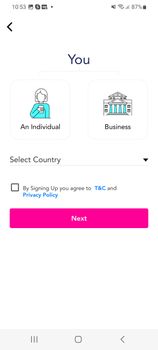

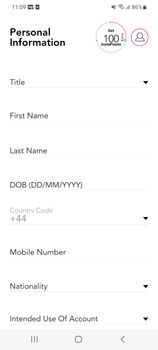

Here’s how we signed up to Instarem:

Email and password

We gave our email address and created a password

Individual or business

We selected the option for individual and said which country we were in

Security

We enabled fingerprint login for the mobile app

Personal information

We gave details like our first and last name, date of birth, phone number, nationality, intended use of the account, estimated monthly transfer, countries we’ll send money to, and our address

Identity verification

We uploaded documents to prove and verify our identity, then took a selfie and verified our phone number, and then we had successfully signed up

It's an easy enough process to sign up to Instarem, although it’s an extra and somewhat uncommon step to have to provide verification before you can sign up. You won’t be able to send money until your documents have been verified by Instarem.

Sending money with Instarem

Once we’d signed up to Instarem and our identity had been verified, we tried to send some money - here’s how it went:

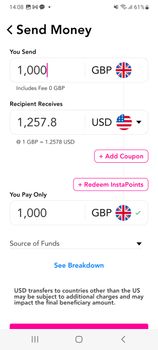

Initiate transfer

We began a transfer and chose the amount to be sent, the currencies, and the source of funds

Add beneficiary details

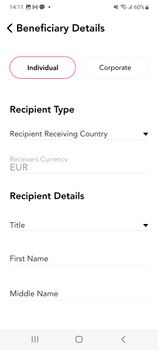

We said whether the recipient was an individual or corporate, then chose the receiving country and currency, and their title, name, relationship to us, country code, mobile number and email, country of residence, and their IBAN, SWIFT and bank name

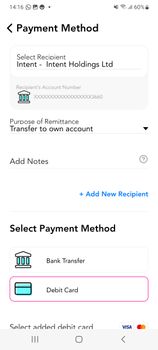

Add payment method

We chose our payment method, in this case a debit card, giving the card number, name, expiry date and CVV

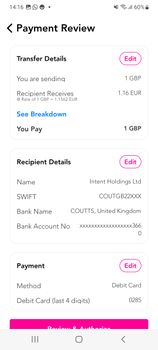

Review details

We reviewed the details of the transfer, including the amount to be sent, the recipient’s details, and the payment method

Confirm transfer and track

Once the transfer was confirmed, we could track every step until it was completed

The entire process took around half an hour from start to finish - it wasn’t lightning quick compared to other providers, but was simple enough.

“Verification took a little while, but overall it was easy to navigate Instarem’s app and fill in all the information required, both for signing up and sending money. There were no significant issues at all on our side.”Mehdi Punjwani, Lead Writer and Editor, MoneyTransfers.comMehdi Punjwani

How safe is Instarem?

This is how we rated Instarem based on their safety, security, transparency and trustworthiness. They make our top ten list, alongside major providers like WorldRemit and CurrencyFair, however Instarem still falls behind others such as Wise and XE.

Provider

Instarem claims to handle around $5 billion in transactions every year, with offices worldwide and a customer base of over two million. Though it only launched in 2015, Instarem has grown into one of the most recognized money transfer providers on the market.

Like all providers we compare on MoneyTransfers.com, Instarem is fully regulated and authorized to provide money transfer services in every country it operates in. We took a deep dive into how Instarem practices, who they’re regulated by, and what security features they use.

Is Instarem authorized to provide money transfers?

Instarem is the trading name of NIUM Pte Ltd, the parent company of NIUM Subsidiaries globally. It is fully authorized by a series of financial regulatory boards in every country it provides money transfer services in. This includes:

Australia: Instarem is registered with AUSTRAC, with AFS Licence Number 464627, and is regulated by ASIC

Canada: Regulated by the Financial Transactions and Reports Analysis Centre of Canada, license number M15569293

Hong Kong: Instarem is regulated by the Hong Kong Customs and Excise Department with MSO license number 16-010-01797

India: Operate in association with SBM bank and is regulated by the reserve Bank of India

Indonesia: Regulated by the Bank of Indonesia, with license number 21/251/Jkt/1

Japan: Registered with the Kanto Local Finance Bureau with registration number 00073

Lithuania: Regulated by Lietuvos Bank, with license number 14

Malaysia: Regulated by the Central Bank of Malaysia with license number 00222

Singapore: Regulated by the Monetary Authority of Singapore, with license number PS20200276

USA: Operates under a program sponsored by Community Federal Savings Bank, to which NIUM is a service provider, with ID number 1528562

UK: Regulated by the Financial Conduct Authority, with reference number 901024

Is Instarem safe and secure?

Instarem is a safe and secure money transfer provider complying with high standards of security, taking stringent measures to protect your information and data. All transactions undergo screenings for anti-money laundering and their website employs multiple technologically advanced methods of preventing malpractices.

Instarem also practices safeguarding which means all customer funds are separated from business funds in order to keep them safe should it go into administration.

Is Instarem transparent?

Instarem is not entirely transparent with its service. It doesn’t clearly state that most of its costs are hidden in the exchange rate, and does not give a pricing structure anywhere on its website. You’ll have to input the details of your specific transaction in order to see the fees and rates involved.

What do other customers think of Instarem?

This is how we rated Instarem based on their reviews on Trustpilot, the Apple App Store and the Google Play Store. It ranks highly on our list of providers, alongside major names like Wise, Currencies Direct and TorFX.

Provider

Instarem has been used by millions of people to move money, and it’s always valuable to hear about their experiences directly. This way you’ll be able to see what kind of experience real life customers have had with Instarem. We looked at their reviews on Trustpilot and both major app stores to see what people thought…

What is Instarem rated on Trustpilot?

Instarem is rated as ‘Excellent’ on Trustpilot, with a score of 4.4 from over 7,000 reviews when this article was written. This is a good score, albeit with a relatively low number of reviews compared to other providers - for example, WorldRemit have a score of 4.1 from over 70,000 reviews, and Wise have a score of 4.4 from over 190,000 reviews.

There are many positive reviews that cite their speed and reliability, praising the overall experience. However, some negative reviews highlight that their transfers took a few days longer than expected and the customer service was not always helpful.

According to Trustpilot, Instarem replies to 83% of negative reviews, usually in under a week.

What is Instarem rated on the Apple App Store?

Instarem’s iOS app is rated 3.5 out of 5 on the UK App Store, from just over 60 ratings. It’s also rated 4.1 on the Singapore App Store, from over 800 ratings. Many of the positive reviews cite their fast delivery and low fees, as well as the overall user interface of the app. However there are a few negative reviews too, citing trouble taking payment or processing their transactions.

It should be noted that with not many reviews it’s a bit harder to get the real picture.

What is Instarem rated on the Google Play Store?

Instarem looks much more promising on the Google Play Store, with a rating of 4.3 from over 7,000 reviews - with 100,000+ downloads. Many of the positive reviews cite their fast and cheap transfers, and their exchange rates in particular. However, there are many complaints about the app’s functionality, and occasional delays in processing.

“While Instarem does have its weak points, overall we found it to be a relatively good money transfer service. We’d recommend it for transfers to the USA from the UK or the EU - you’ll get decent rates and no fees - just remember to compare your options first!”Financial content specialist, MoneyTransfers.comArtiom Pucinskij

Our final verdict: Should you use Instarem for transfers abroad?

The team of experts at MoneyTransfers.com rates Instarem as a good money transfer provider, with a few limitations.

While it may not be at the top of our list, you might be able to find good rates with Instarem if they cater to your specific transfer route, so it’s worth keeping them in mind when you compare providers.

Frequently asked questions about Instarem

Do I need an account to receive money with Instarem?

Do I need a bank account to join Instarem?

Is Instarem legal to use?

Who owns Instarem?

Can I open an Instarem account in any country?

Compare Instarem with other providers

Instarem user feedback

Comments

Ashish Jain

I transferred money from UK to USA on 05th June.

However, until now the money has not reached the recipient account. I have been trying to contact Instarem by logging in to my account but I can't log in as I have been banned temporarily by instarem as per the error message . There is no other way of contacting instarem as they send dontreply emails. The recent email I have received today is that there is delay in your money transfer and we will get back to you asap. After I wrote review on Trustpilot and Monito, Instarem contacted me - "We acknowledge receipt of your complaint dated 8th June 2025 and have assigned a ticket to it.

We would like to inform you that we have received the bank statement shared by you. However, we also request you to please share a selfie with proof of identity (Passport/Driving License), so that we can process the transaction for you."

It's a ridiculous response as firstly I had already provided my passport image before money transfer and now if I want to provide my passport and selfie (as requested) I can't do it as I can't log in to their website and there is no email address to write to.

I am wondering whether I have been scammed?

Can you please help me in contacting Instarem as I can't contact them.

warren

I dont use phone verification

Anonymous

Expensive rate of charge

Jaime A

Excellent online service, so far

Anonymous

Reliable fast trustworthy

.svg)