Bank transfers explained

A bank transfer is a way to move money from one bank account to another bank account.

This can be moving money between your accounts, sending money abroad, or paying friends and family.

It's like when you give someone cash, but instead of handing them bills and coins, the bank moves the money for you electronically.

Here’s a simple example, say you want to pay someone in the UK but you’re located in the US.

You give the bank instructions: You tell your bank how much money to send and the details of the account you want to send it to.

The bank processes the transfer: Your bank takes the money out of your account and sends it to the other bank.

The other bank receives the money: The other bank puts the money into the recipient's account.

Before the bank can process the transfer, you need to pay the fees.

The fees will depend on multiple factors such as the amount and the location of the recipient.

In addition to the transfer fee, you will also pay the exchange rate margin (percentage added to the mid-market rate).

Are bank transfers the same as wire transfers?

Although both terms are used interchangeably, there’s a slight difference between the two.

The difference is in the way the transfers are processed.

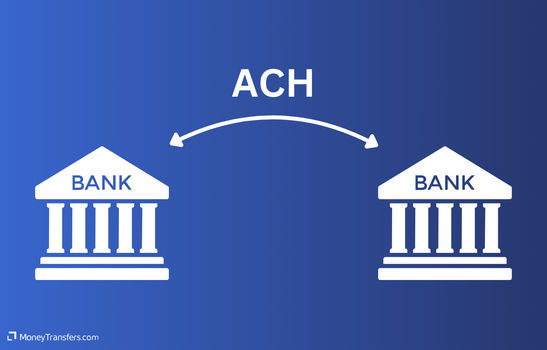

Bank transfers will usually process the transactions via ACH (Automated Clearing House), while wire transfers will use the SWIFT network for transfers.

The key differences between the two lie in their function, speed, cost, and geographical reach.

Here’s a quick breakdown of the two:

ACH transfers

ACH is a network used for electronic money transfers, used within the same country (usually the US).

It’s generally slower (2-3 days) than SWIFT but comes with lower fees. Hence, it is used largely for routine transactions such as direct deposits, bill payments, and transfers between accounts.

SWIFT payments

SWIFT on the other hand is a global messaging system that connects the banks for international transfers.

It is faster compared to ACH (minutes-2 days) but comes with higher fees (for both, the sender and the receiver).

SWIFT is usually used for international money transfers, making large payments, and urgent transfers.

Making international bank transfers

Here’s a quick overview of how to initiate a bank transfer when sending money to another country.

Get the recipient's details

You need the recipient's full name, bank account number, the name and address of their bank, and the SWIFT/BIC code of their bank. These details ensure the money goes to the right place.

Vist your bank or use online banking

Go to your bank or use their online banking service. Tell them you want to make an international transfer.

Provide the details

Give your bank all the recipient’s details mentioned earlier, along with the amount you want to send and any reference information.

Confirm and pay

Your bank will confirm everything with you, including any fees for the transfer. Once you agree, they’ll deduct the money from your account.

Wait for processing

International transfers can take a few business days to reach the recipient's account, depending on the countries and banks involved.

Check confirmation

After a few days, you can check with your bank or the recipient to make sure the money arrives safely.

Chances are, you already have a bank account. But if not, you will need to create one.

To open a bank account, simply navigate to the bank's website and sign up.

During the application process, you will need to provide your personal details, as well as an ID.

The process is slightly different if you’re opening an account overseas.

Details needed for international bank transfers

To make an international bank transfer, you’ll need your recipient’s:

Recipient's full name: The exact name associated with the recipient's bank account to ensure the transfer reaches the correct person or entity.

Recipient's bank account number: The unique account number where the money will be deposited. This is crucial to ensure the funds go to the intended recipient.

Recipient bank's name and address: The name of the bank where the recipient holds the account and its physical address. This helps in identifying the correct financial institution.

Recipient bank details: often you will need the recipient bank's routing number (for US transfers) or SWIFT/BIC Code (for international transfers).

Amount to transfer: The exact amount of money you wish to send. Double-check this to ensure accuracy.

Reference or memo (optional): A note or reference number that can help identify the purpose of the transfer. This is particularly useful for personal records or when providing information to the recipient.

Make sure you double-check these details, as it might be difficult to reverse your transfer if some of the details are incorrect.

For example, if you're sending money to Norway, you need to provide the correct Norwegian SWIFT code for the recipient's bank located in Norway.

Use our SWIFT/BIC calculator below to get these details

Banks vs money transfer services fees

You have two main options when making an international bank transfer: using your bank or using the services of a money transfer provider.

Using your bank to make an international transfer may seem like a convenient way to send your money abroad, but it often ends up being one of the most expensive methods.

This is because banks tend to add several fees to international transfers, including:

Upfront international banks' transfer fees

A bank transfer fee is added to your transfer at the time of setting up the transfer and usually varies from bank to bank

SWIFT network fees

These are the fees that add up while the transfer is in progress (usually charged by the intermediaries). This charge can apply to the sender or the receiver depending on the service you use. This fee is not involved when using most money transfer services (as there are no intermediaries involved).

A markup on the exchange rate

On average, banks add between 4-5% on top of the ‘real’ exchange rate. This fee is very difficult to see if you’re using the bank. Money transfer companies, on the other hand, will usually display it before making the transfer.

For that reason, it is important to always check the exchange rates before making your international money transfer.

Consider this before making bank transfers

Before making an international bank transfer, you need to consider the following:

Fees

Check if there are fees for sending the money. Banks and services may charge different amounts, so it’s good to know upfront.

Make sure to use our comparison system to find the service with the lowest fees.

Exchange rates

Speed

Recipient details

Security

Regulations

Country restrictions

Currency support

Documentation

Use of funds

Bank requirements

Transaction limits

Pros and cons of using bank transfers

Using bank transfers has its pros and cons compared to other payment methods.

- Security: Bank transfers are generally considered secure because they involve direct transactions between banks, minimizing the risk of theft or fraud compared to carrying cash.

- Convenience: It’s convenient because you can initiate transfers online or through your bank’s mobile app without needing to visit a physical location.

- Direct deposit: Bank transfers are ideal for direct deposits of salaries, benefits, or recurring payments like rent or utilities.

- Wide acceptance: Widely accepted for various transactions, including large payments and international transfers.

- Speed: Bank transfers can be slower than other methods like credit/debit cards or digital wallets. Domestic transfers can take a few days, while international transfers may take longer.

- Fees: Some banks charge fees for transfers, especially for international transactions. These fees can vary widely depending on the banks involved and the transfer amount.

- Information required: You need detailed information about the recipient’s bank account, which can be cumbersome and prone to human errors if not entered correctly.

- Regulations: International transfers may be subject to regulatory scrutiny, requiring additional documentation or information depending on the countries involved.

Best services for international bank transfers

Wise offers no exchange rate markup and low fees on top of your transfer, usually 0.35%. This is low compared to some banks that charge almost 17% in fees.

They offer 70 currencies, and where they don’t support the currency, you will need to pay an additional 2% fee to receive.

With Wise you can deposit your funds using a bank transfer and the receiver will get their money right to their bank account.

Here's our experience with Wise

WorldRemit boasts a 90% approval rate on international transfers being authorized within minutes and supports 70 currencies in 130 countries worldwide.

The service has a user-friendly app and website and supports sending money internationally via bank transfer, cash pickup, mobile money, and to WorldRemit e-Wallets.

As an example, if we were to send £1,000 to Australia, converting to Australian dollars, the bank transfer would take a maximum of 2 working days with a fee of £1.99, and a total of A$1827.39 received.

Here's our experience with WorldRemit

International bank transfer speed

In general, if you’re making a domestic transfer, the funds will be deposited almost instantly in most cases.

However, if you’re making an international transfer, it can take up to 3 days via the bank.

Bank transfer limits

Bank transfer limits will depend on several factors. Here’s a quick breakdown of each:

Daily limits

Transaction limits

Monthly limits

Country-specific limits

Purpose-specific limits

Bank policies

Alternatives to bank transfers

There are a few alternatives to banks when sending money via bank transfer. Here are a few of them:

Money transfer providers

Neobanks

P2P payment apps

A bit more on bank transfers

What is a BSB number?

Why can't I just use my bank to transfer money abroad?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let’s recap: what are international bank transfers?

Bank transfers are a secure and convenient way to electronically move money between accounts, domestically or internationally.

Fees and exchange rates will vary from bank to bank, as well as transfer speed can be anywhere between minutes to a few days.

We strongly suggest you consider alternatives like money transfer services for lower fees and competitive rates.

.svg)