Navy Federal Credit Union for international wire transfers

Here’s an overview of how NFCU international transfers compare to international money transfer providers.

Transfer type | Navy Federal Credit Union | Money Transfer Companies |

|---|---|---|

Sending fees | $25.00 | $0 - $20 |

Receiving fees | $0 | $0 |

Exchange Markup | 3 - 5% | 0% - 2% |

Transfer Times | 5 - 7 working days | Instant - 3 business days |

Payment Methods |

|

|

Compare now to get the best transfer rate

Scoring Navy Federal Credit Union

We’ve looked at and analyzed the exchange rates, transfer costs, support, and online user reviews. Here’s a quick summary of the top highlights and drawbacks.

Pros

Cons

Navy Federal Credit Union fees and exchange rates

Fees and rates

The two key costs you need to be aware of when sending money internationally with Navy Federal Credit Union are:

Navy Federal exchange rates

Navy Federal international transfer fees

Exchange rates

According to the company website, the NFCU relies on its correspondent banking partners to provide the currency exchange rates for any international transfers.

NFCU is fairly transparent with its exchange rates. NFCU will display the full cost of conversion and what the recipient can expect to receive in their account.

However, as transparent as this process is, NFCU uses traditional banking methods to calculate foreign exchange rates, meaning international currency transfers are likely to incur mark-ups of 3 - 5% above the actual mid-market rate.

Can you exchange money for what it’s actually worth?

You can get the right value for your exchange if you use a provider that offers the mid-market rate on exchanges.

Online money transfer providers like Wise, Revolut, and Instarem all make exchanges using the mid-market rate, but there’s a small fee for your transfer.

We’ve looked at what users have to say about the exchange rates offered by NFCU. Here’s a quick summary of average reviews for the past year regarding their rates.

International transfer fees

Overseas payments typically incur fees, especially when a bank or credit union is involved.

In this case, Navy Federal Credit Union charges members a flat fee of $25 per transfer.

The $25 transfer fee is on the cheaper side when compared to other high street banks, but is still much more expensive when compared to international transfer providers.

It’s also worth noting that domestic transfers will cost you $14 per transfer. This is particularly expensive considering almost all banks based in the US offer this service for free.

On the bright side, there are no receiving fees for international wire transfers. This is particularly good, as many banks would charge you for this. For example, Bank of America will charge you $16 for receiving money into your account from abroad.

Here’s a summary of Navy Federal Credit Union fees:

Transfer Type | Fee |

|---|---|

Incoming Wire Transfer | No charge |

Domestic Outgoing Wire Transfer | $14.00 |

International Outgoing Wire Transfer | $25.00 |

Western Union Quick Cash Transaction (QCT) | $14.50 per QCT |

*Information is taken from the NFCU fees and charges page.

To give you an example, here's how it would look like if you were to send $1,000 from the US to the following countries:

Destination | NFCU transfer cost | Wise cost |

|---|---|---|

Australia (AUD) | $25 + ~4% markup | $6.50 + 0% markup |

Canada (CAD) | $25 + ~4% markup | $7.34 + 0% markup |

Germany (EUR) | $25 + ~4% markup | $10.36 + 0% markup |

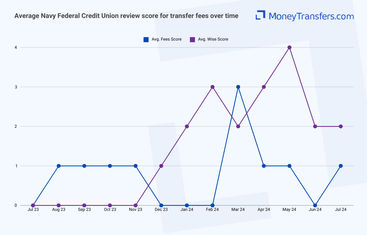

Similar to the exchange rates, we’ve looked at how users have reviewed NFCU in terms of their transfer fees. This is what it looks like:

Transfer speed

Transfer speed

Navy Federal Credit Union states that the expected waiting time for international transfers is 5 - 7 working days.

Whereas, domestic money transfers can be received the same working day, if processed before 7:30 pm, EST.

Here's a summary of processing times by deposit method:

Transfer method | Speed |

|---|---|

Zelle - Enrolled customers | Minutes |

Zelle - Not enrolled customers | 1-3 business days |

ACH | 2-3 business days |

Cashier’s Check via mail | 5-7 business days |

Cashier’s Check via branch pickup | 5-7 business days |

Cash transfer via Western Union | N/A |

Domestic wire transfer | 1-2 business days |

Internatinoal wire transfer | 5-7 business days |

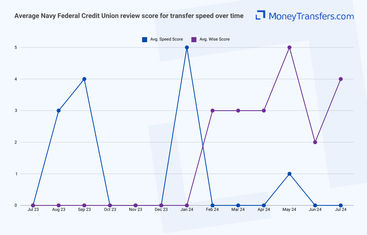

When it comes to user reviews, this is how it looks.

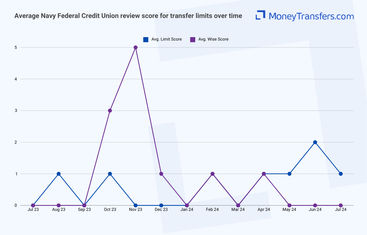

Transfer limits

Transfer limits

NFCU doesn’t specify exact transfer limits on international wire transfers. However, we know it’s more than $5000 as for transfers over $5,000 you must submit a wire transfer request.

Here’s a summary of NFCU transfer limits for all their transfer services.

Transfer method | Daily limit | Other limits |

|---|---|---|

Zelle instant transfer | $1,500 | $3,000 30-day limit |

Zelle 1-3 day transfer | $3,000 | $3,000 30-day limit |

ACH | $10,000 | $15,000 5-day limit |

Cashier’s Check via mail | $2,500 | None |

Cashier’s Check via branch pickup | Over $2,500 | None |

Cash transfer via Western Union | $10,000 per transaction | None |

Domestic wire transfer | $10,000 | $15,000 5-day limit |

Internatinoal wire transfer | $10,000 | $15,000 5-day limit |

As for online reviews, this is how others have rated NFCU based on their transfer limits.

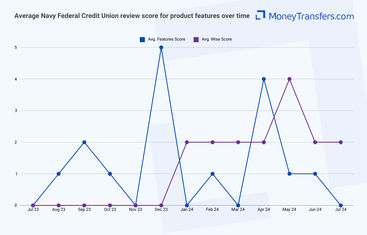

Product offering

Product offering

Cash transfer with Western Union Quick Cash

Navy Federal Credit Union (NFCU) offers a service called Western Union Quick Cash.

With Western Union Quick Cash you can collect cash transfers sent via Western Union directly at NFCU branches.

It is particularly useful for those who need to receive funds urgently or do not have access to traditional banking services while traveling or in remote locations.

Mobile App

The NFCU offers a mobile app that is free to download. It has been rated 3.9 and 4.8 stars on the Google Play and App Store respectively.

Here’s how other users have rated these features in the past year.

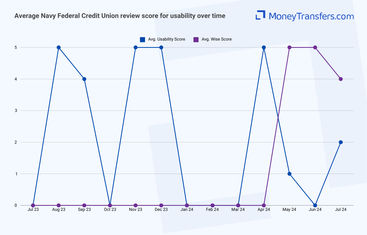

Ease of use

Ease of use

We’ve also looked at what other people had to say about it and created this graph featuring average ratings for the past year.

Customer service

Navy Federal offers many ways to contact them:

Phone support: Direct assistance for account inquiries, transactions, and other services.

Online chat: Real-time chat support is available through the NFCU website for quick questions and assistance.

Mobile app support: Access to account management, customer service, and support through the NFCU mobile app.

Email support: Email-based support for non-urgent inquiries.

In-person: In-person support at NFCU branches for detailed account assistance and services.

Mail: Send inquiries or documents via postal mail for support and services.

Social media: Support and updates through NFCU’s official social media channels.

24/7 member service: Comprehensive member service available around the clock for various banking needs.

Here’s a table summarizing NFCU contact information:

Customer Service Option | Contact Information | Availability |

|---|---|---|

Phone Support | 1-888-842-6328 (U.S.) | 24/7 |

Online Chat | NFCU Online Chat | Business Hours |

Mobile App Support | iOS & Android stores | 24/7 |

Branch Visits | Find a Branch | Branch Hours |

Navy Federal Credit Union, P.O. Box 3000, Merrifield, VA 22119-3000 | Business Days | |

Social Media | Varies | |

24/7 Member Service | 1-888-842-6328 (U.S.) | 24/7 |

As with other areas of this review, we’ve looked at what online users have said about their support features in the past year. Here’s how it looks.

Safety and trust

Safety and trust

Just like any other major high street bank in the US, NFCU offers a number of safety features:

Two-factor authentication (2FA): Adds an extra layer of security by requiring a second form of verification (e.g., a one-time code sent to your mobile device) in addition to your password.

Secure account alerts: You can set up account alerts for various activities such as transactions, logins, and changes to personal information. These alerts are sent via email or SMS.

Fraud monitoring: NFCU employs advanced fraud detection systems that monitor your account for suspicious activities and transactions in real-time.

Zero liability protection: You are not held liable for unauthorized transactions if reported promptly, ensuring protection against fraudulent activities.

Data encryption: All sensitive data transmitted between you and NFCU is encrypted using industry-standard encryption protocols to prevent unauthorized access.

Secure online and mobile banking: NFCU uses secure sockets layer (SSL) technology to ensure that your online and mobile banking sessions are secure and encrypted.

Card control: You can lock and unlock your debit and credit cards via the mobile app to prevent unauthorized use if a card is lost or stolen.

Biometric authentication: The mobile app supports biometric authentication methods such as fingerprint and facial recognition for secure and convenient access.

ID theft assistance: NFCU offers support and resources to help you recover if you fall victim to identity theft.

Security notifications: NFCU provides you with security notifications about potential threats and tips on how to safeguard your accounts.

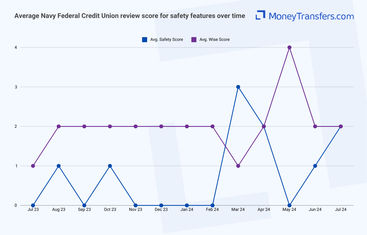

Here’s how NFCU users have rated the security features in the past year.

Customer feedback

Customer feedback

ANALYSIS OF USER REVIEWS

Customers like the ease and efficiency of the loan processes at Navy Federal, particularly for HELOC and vehicle purchases.

The helpful and communicative staff are frequently praised, and the ability to handle transactions online is seen as a significant advantage over other banks.

Many users also find the mobile app easy to navigate, which enhances their overall experience.

Traveling with Navy Federal cards is convenient, as they are widely accepted and notifications for travel plans add to this ease.

However, some users report complications in the loan process, citing confusion and inefficiencies once loan officers and processors become involved.

There are complaints about repeated requests for documentation and a lack of coordination between the portal and staff communications.

Disputes are also a point of frustration, with some users feeling that Navy Federal's dispute resolution process is unfair and poorly managed.

Finally, the bank's handling of complex income situations and high-earning clients is criticized for being inadequate and cumbersome.

Here's a summary of average user reviews this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

International Transfers | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Fees | 0 | 0 | 3 | 1 | 1 | 0 | 1 |

Exchange Rates | 3 | 0 | 5 | 0 | 1 | 1 | 1 |

Speed | 5 | 0 | 0 | 0 | 1 | 0 | 0 |

Limit | 0 | 1 | 0 | 1 | 1 | 2 | 1 |

Features | 0 | 1 | 0 | 4 | 1 | 1 | 0 |

Ease of Use | 0 | 0 | 0 | 5 | 1 | 0 | 2 |

Safety | 0 | 0 | 3 | 2 | 0 | 1 | 2 |

Customer Support | 3 | 1 | 1 | 5 | 0 | 2 | 0 |

Opening NFCU account

We will now run through how members can set up an account and send money overseas with Navy Federal.

Opening an Account

The Navy Federal sign-up process is a little different than the average bank. Customers will need to provide the following information to join as a member:

Social Security Number

Government ID such as driver's license or passport

Proof of current home address in the US

Credit card or bank account and routing number to fund your account

Completion of the online eligibility questionnaire

Once you have all the information needed, follow these steps to open an account with Navy Federal.

Check eligibility:

Gather required documents

Visit the Navy Federal website

Select account type

Complete the online application

Submit proof of eligibility

Review and confirm details

Make an initial deposit

Submit your application

Await confirmation

Log In and manage your account

Making international transfers

International transfer requirements & details

To make an international wire transfer with Navy Federal Credit Union (NFCU), you will need the following information:

Your details: including full full name, address, account number

Recipients details: full name, address, account number, account type (e.g., checking, savings, brokerage), IBAN or CLABE (Clave Bancaria Estandarizada) numbers.

Transfer details: amount, type, and purpose of wire, whether the transfer is to a third party (anyone other than yourself), remarks or additional wiring instructions, type of currency (U.S. dollars or foreign currency)

Receiver bank details: bank name and address, SWIFT/BIC code, routing number if needed.

Navy Federal Credit Union’s swift code is NFCUUS33

Making international wire transfers

The NFCU has helpfully provided a list of the exact information customers need to provide when arranging an international money transfer:

Gather Information

Complete the International Wire Transfer Form

Confirmation of Transfer

Reversing Navy Federal transfer

If you need to cancel an international payment, NFCU can submit a reversal request to the payee’s financial institution and attempt to retrieve the funds, but a refund is not guaranteed.

Use Wise to send money from your Navy Federal Credit Union account

It may be simpler to fund your transfer with your Navy Federal Credit Union account, but use a transfer provider like Wise to send your money overseas.

Register for a Wise account

Add the details of your transfer

Review the received amount

Send the money

Receive international transfers

To receive an international wire transfer to your Navy Federal Credit Union account, you’ll need to provide the following information to the sender.

Your ABA, RTN, or SWIFT code

For domestic wire transfers, you’ll need to supply the Wire Routing Transit Number (your ABA or RTN): 256074974.

For international wire transfers, you’ll need to supply your SWIFT code or BIC: NFCUUS33.

The bank name and address

Navy Federal Credit Union address for wire transfers is 820 Follin Lane SE, Vienna, VA 22180.

Your account number, name, and address

You’ll need to supply your complete Navy Federal Credit Union account number, the name on your account, and the complete address of your account as it appears on your bank account.

How Navy Federal Credit Union compares to money transfer services

Generally, money transfer companies are much cheaper than any high street bank. Here’s a list of top alternatives that are better suited for making international transfers.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Navy Federal Credit Union: Is it good for transfers abroad?

Navy Federal Credit Union offers a niche service and for servicemen and women working for the US forces, this credit union caters to their needs.

NFCU is probably one of the cheaper banks for international transfers when compared to other high street banks. However, it is still more expensive than using a money transfer service.

Their markup on the exchange rate is over 5% compared to 0% with money transfer services, as well as, their fees are at $25 compared to 0.3% with providers like Wise.

Given that you can fund your Wise account with a Navy Federal account, we’d suggest going down that route instead.

To get the best value out of your transfer, we suggest you use the form below to get the latest deal for your transfer needs.

Find the best rates for your transfer

A bit more about Navy Federal Credit Union

Can I open a Navy Federal Credit Union account in any country?

Can I use a Navy Federal Credit Union debit card when traveling abroad?

Does Navy Federal Credit Union offer foreign currency exchange?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Banks