Domestic Money Transfers

Sending money domestically is as easy as it’s ever been.

Today, services like online banking, P2P apps, and money transfer providers offer instant and cheap ways to transfer money.

Here’s how domestic money transfers work, who provides them, and what the best overall method is.

Search Now & Save On Your Transfer

Domestic money transfers allow you to send funds within your country via banks, P2P apps, and specialized providers. Options vary by speed and cost, with banks being reliable but sometimes slower and costlier. P2P apps offer convenience and low fees, while some transfer providers also cater to domestic needs.

Domestic transfers explained

Domestic transfers are used for paying friends and family, for goods and services, and for anything else that might require you to send money to someone in your country.

Best ways to send money domestically

Money transfer providers

While you might think money transfer providers specialize in international money transfers, some also offer domestic transfers too.

This means you can take advantage of their low fees and fast transfers, and skip exchange rates altogether.

Local bank transfers

Banks are a reliable and trusted way to send money to friends and family, and depending on where you are this might be the easiest and fastest option.

However, domestic bank transfers are not free and instant in every country, which leads us to peer-to-peer money transfer apps.

Money transfer providers

Money transfer providers specialize in sending money abroad, but some also allow domestic transfers based on where you are and which currency you’re sending.

While it’s not their primary service, you might find it a quick and easy way to complete a domestic money transfer if you’re already signed up for a service.

We’ve gone through the best ones below.

Provider | Domestic transfers available in | Transfer fees | Transfer speeds |

|---|---|---|---|

UK | £0.00 | Next working day | |

Select countries in Europe | €8.49 | In minutes | |

Select currencies | $0.00 | In minutes | |

USA | €4.22 | Next working day | |

USA | $74.99 | Next working day | |

USA | $4.99 | Next working day |

Compare the best money transfer providers

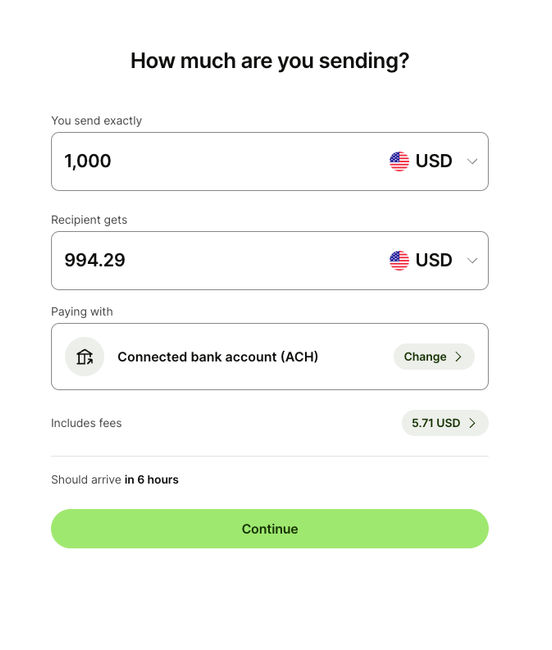

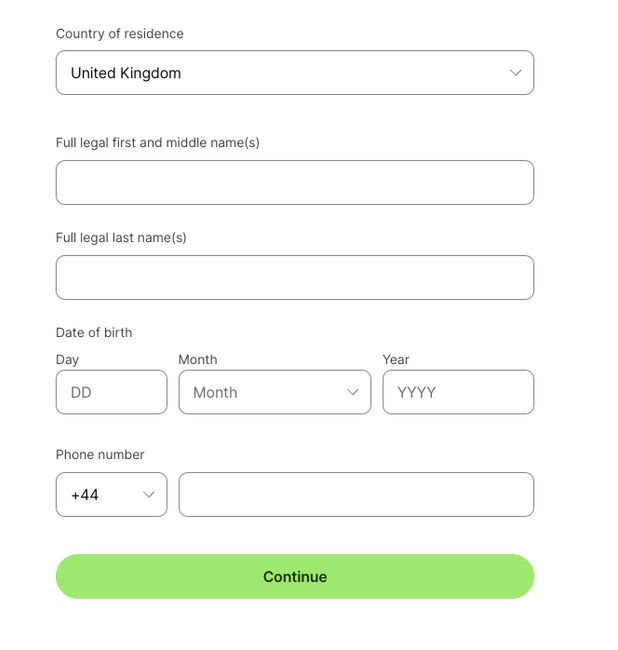

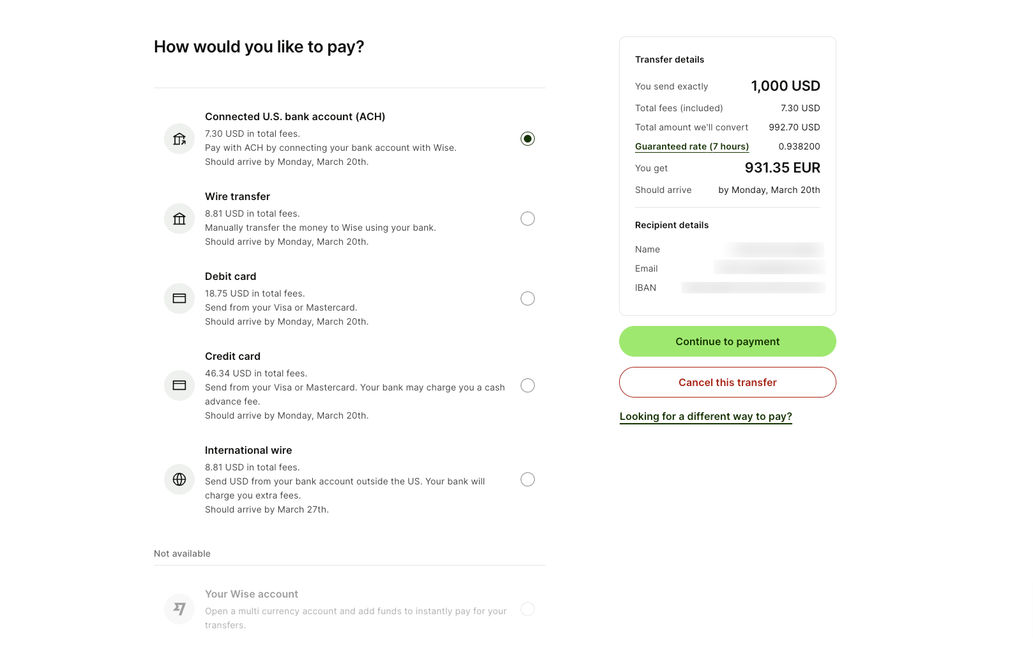

Domestic money transfers: Step-by-step

The process of making a domestic money transfer with your chosen money transfer service may vary by provider, but in general, you’ll need to do the following:

Log in

Open the provider’s app or website, log in or sign up, and initiate a transfer

Add transfer details

Choose the same sending and receiving country if possible - some providers will let you choose currencies instead, so ensure you’re sending the same currency that is being received

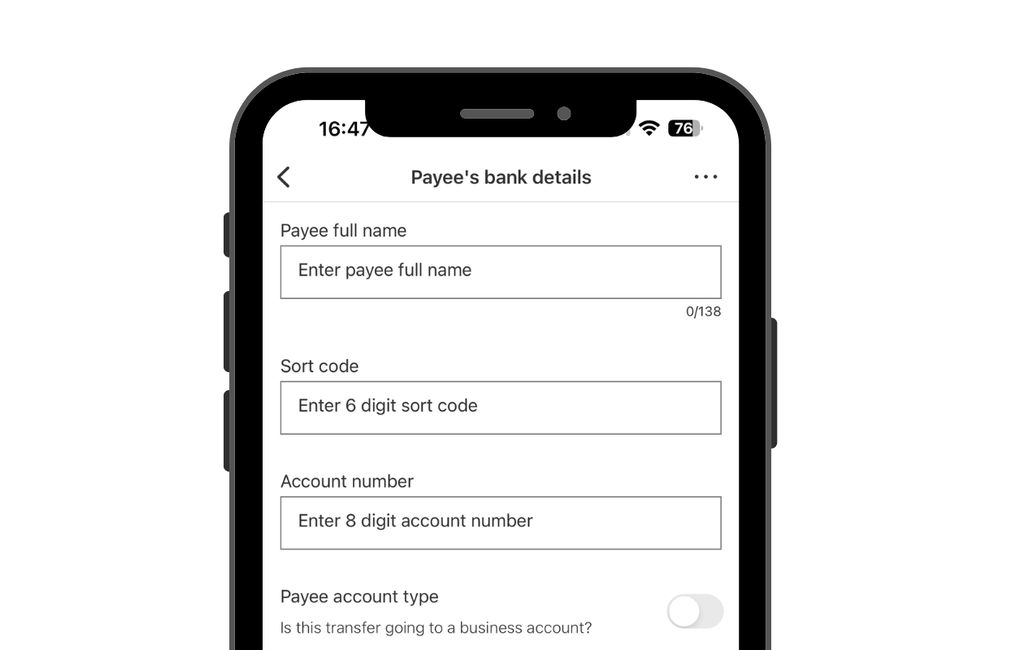

Add recipient details

Input the required information about the recipient, including their bank details if necessary

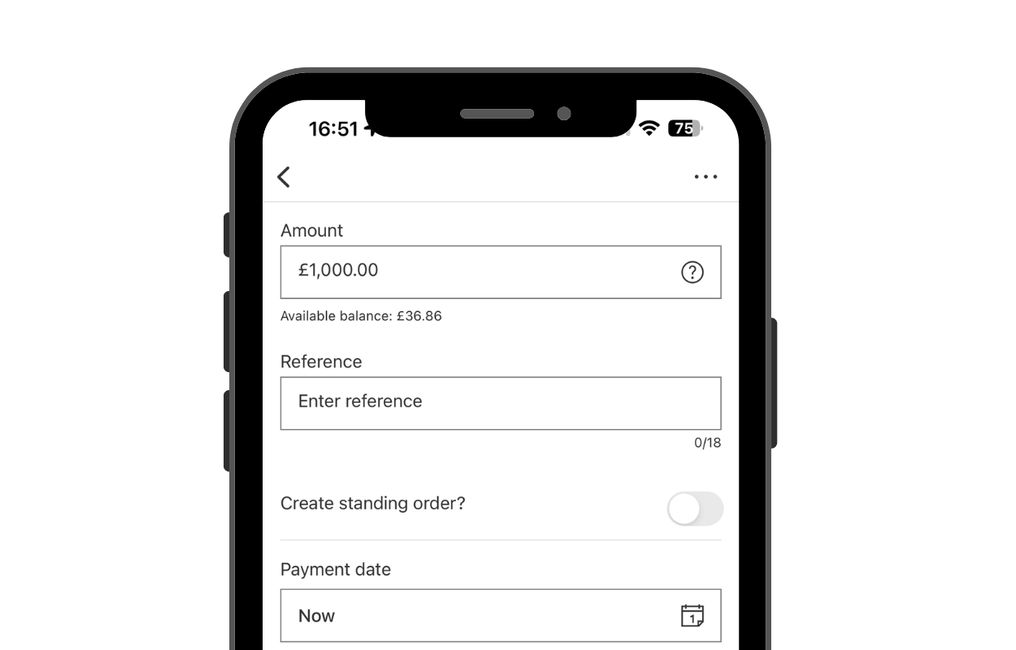

Pay for your transfer

Pay for your transfer with your preferred payment method

Local bank transfers

The more traditional option for sending money domestically is usually through a local bank transfer, and depending on where you are, this could be the best option.

If you’re in the UK or the EU it’s especially convenient; however, if you’re in the USA you might find that local bank transfers are a little more expensive.

Domestic bank transfers in the USA 🇺🇸

If you want to make a domestic wire transfer to someone else in the USA, the likelihood is you’ll be charged an outgoing fee in the region of $10-50 depending on the bank.

Some banks also charge an incoming fee for domestic wire transfers, which is usually a little lower and charged to the recipient of the transfer.

Here are the domestic wire transfer fees for some of the biggest banks in the USA:

Bank | Outgoing fee | Incoming fee | Transfer speed |

|---|---|---|---|

$30 | $15 | 1-2 business days | |

PNC | $30 if agent-assisted, $25 if self-service | $15 | 1-2 business days |

$35 if agent-assisted, $25 if self-service | $15 | 1-2 business days |

This can make domestic wire transfers inconvenient for smaller amounts of money, given the high fees and slow transfer speeds.

Another way to send money domestically in the US is through the Automated Clearing House or ACH.

This isn’t intended for peer-to-peer payments, for example, if you wanted to send money to a friend’s bank account - it’s more for the following type of payments:

Direct deposits: You can use the ACH bank transfer method to pay employees

Business payments: You can also make business-to-business payments and send funds to suppliers

Tax payments: Federal, state, and local tax payments are processed through the ACH

Bill payments: When you pay bills for utilities, insurance, or mortgage payments these are also made through ACH

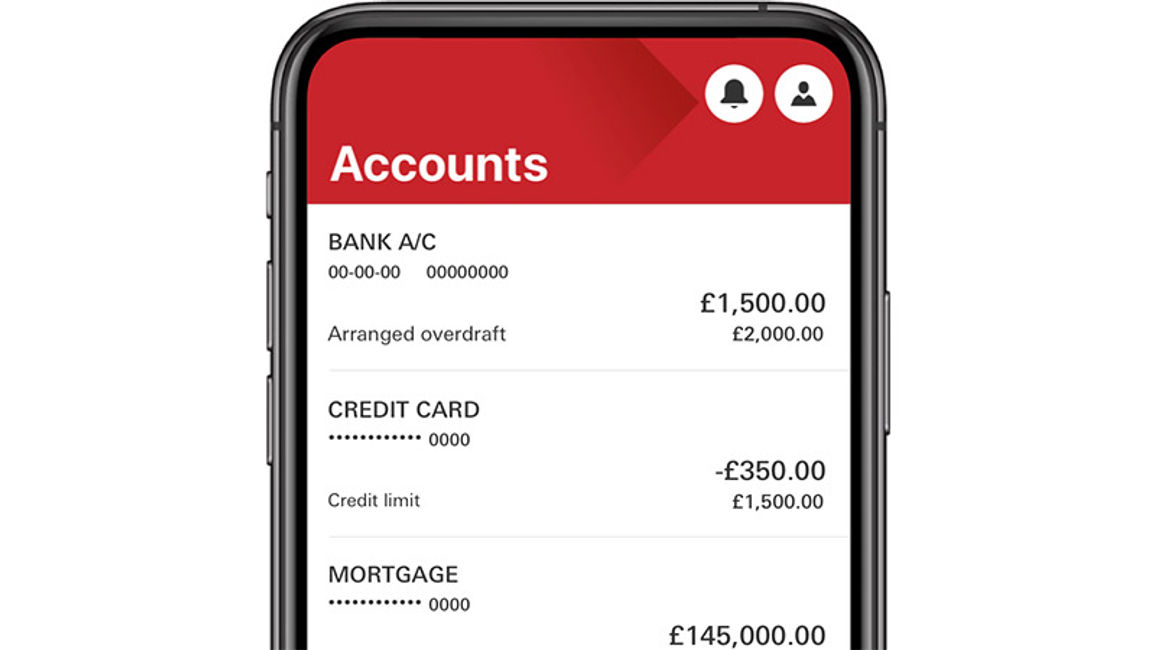

Domestic bank transfers in the UK 🇬🇧

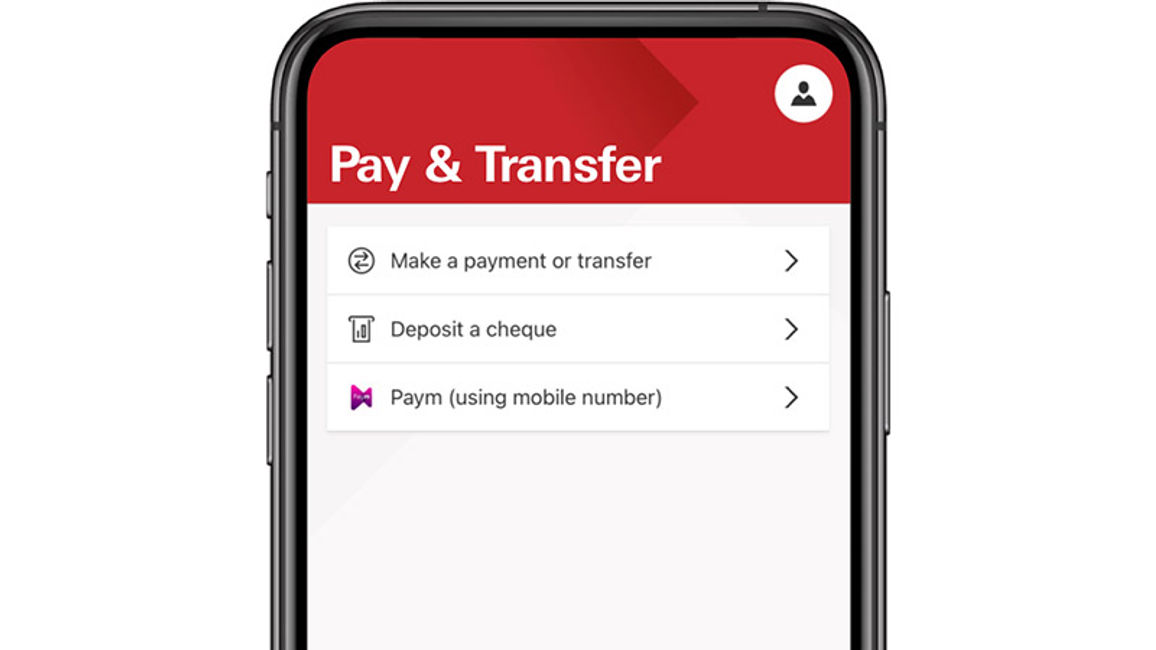

Domestic bank transfers: Step-by-step

Making a domestic bank transfer should be relatively easy - you’ll usually need to do the following:

Log into online banking

Open your online banking app or website and log in

Start transfer

Initiate a money transfer by clicking on 'Pay & Transfer' or something similar

Add recipient details

Enter the bank details of your recipient, or choose from existing recipients if you’ve sent money to them before

Set amount & confrim

Enter the amount you want to send.

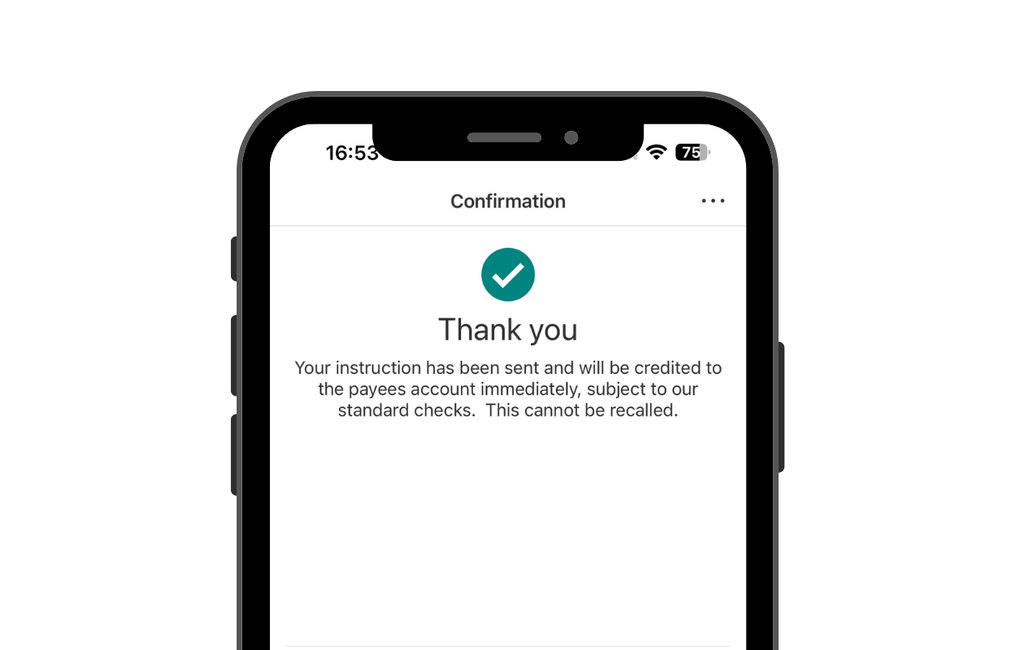

Confirm the transfer and pass any verification checks if required, such as one-time-passcodes

Confirm transfer

Your money should arrive in the recipient’s bank account in the given time frame

What do I need to make a domestic bank transfer?

To send money domestically with your bank, you’ll usually need the recipient’s full name as it appears on their bank account, and their bank account details.

This includes their bank account number, and often a special bank code which will vary depending on the country you’re in.

For example:

USA: In the USA you’ll need the recipient’s routing number or ABA number, a 9-digit code to identify the location of a domestic bank

UK: In the UK you’ll need a six-digit sort code

Ireland: In Ireland, you’ll need a six-digit national sort code

Australia: To send money in Australia you’ll need a six-digit BSB or Bank State Branch Number

India: India uses the 11-character IFSC or Indian Financial System Code

Germany: In Germany, you’ll need a six-digit BLZ or Bankleitzahl number

P2P apps

Finally, you can also send money domestically through peer-to-peer payment apps.

These often allow you to link your bank account to your mobile wallet, so you can top up and withdraw money as you please.

P2P payment apps don’t require you to share bank details to send and receive money - in most cases, a phone number, email address, or username will do.

As a result of high domestic bank transfer fees in the USA, P2P payment apps have been well-received by customers as they offer an easier, faster, and cheaper way to send money to friends and family.

However, companies like PayPal are popular around the world, accepting domestic transfers in many countries as well as international transfers.

Best P2P apps for domestic transfers

App | Domestic transfer fee | Domestic transfer speed | Cash-out |

|---|---|---|---|

2.9% plus $0.30 if paying by credit card, no fee if paying from your bank account or PayPal balance | Instant | Free if you have a linked bank account and can wait usually one working day, or instant for a fee of 1.75% | |

3% if paying by credit card, no fee if paying by debit card | Instant | Free if you can wait a few business days, or instant debit card deposit for a fee of 0.5% to 1.75% | |

3% fee if paying by credit card, no fee if paying by debit card, bank account balance, or Venmo balance | Instant | Free if you can wait three business days, or instant withdrawal for a fee of 1.75% | |

No fees | From ten minutes | Money goes directly to your connected bank account | |

No fees if sending from a bank account, but 1.5% or $0.31 for debit card transfers, whichever is higher | 3-5 days | Free, takes three to five days | |

No fees | Instant | Can take a day or longer to appear on bank balance |

Domestic money transfer fees & costs

The cost of sending money domestically varies depending on where you are and the method you use.

USA

For example, if you’re in the USA and you use a bank to send money domestically, you might face fees of over $30 for sending, and the recipient may have to pay a slightly lower fee to receive the money.

However, you may be able to avoid these fees if you’re paying someone with an account at the same bank as you.

UK

Domestic bank transfers in the UK work differently, and are entirely free in most cases, as is the case with many countries in the EU.

Australia

Domestic transfers via online banking are free for most account types with Australia’s big four banks.

P2P apps fees

Peer-to-peer providers offer a convenient and in some cases much cheaper way to send money.

PayPal, Cash App, and Venmo all charge up to 1.75% for instant money transfers, but they offer free transfers if you’re willing to wait 1-3 business days.

Zelle does not charge any fees for money transfers, as it works slightly differently.

Instead of letting you keep your money in an e-wallet, as with PayPal, Cash App, and Venmo, money sent to Zelle goes automatically into your linked bank account.

Not all banks support Zelle transfers, but hundreds do - you can find the complete list on Zelle’s website.

Money transfer providers fees

Money transfer providers like Wise and Western Union are also worth considering, but keep in mind these companies usually cater to international transfers so you might not get the best deals if sending domestically.

What is the cheapest way to send money domestically?

Based on our analysis of 50+ money transfer companies, we found that Remitly is the cheapest money transfer company for domestic transfers within the US.

They appeared 100% of the time in our comparison system, as the cheapest provider to use.

Their exchange rates are just 0% of the mid-market rate and offer low fees on international transfers.

How long does it take to send money domestically?

Sending money domestically should theoretically be much quicker than sending money abroad, though again it will depend on the method you choose as well as where you are.

UK

Domestic bank transfers in some countries are instant - in the UK this is facilitated by Faster Payments.

Australia

In Australia, the Pay Anyone service processes most transfers overnight, so if you send money before the cutoff time the recipient should get it the next day.

USA

In the US it will depend on the sending and receiving bank. Some transfers between US banks can take a couple of business days to complete, which is why many people use peer-to-peer services.

P2P apps speed

PayPal, Venmo, and Cash App all offer instant transfers for much lower fees than you’d get with banks, while Zelle links directly to your bank account to offer faster transfers. Cash App is also available in the UK, while PayPal is used practically worldwide, so you can use it to make instant domestic transfers in most countries.

What is the fastest way to send money domestically?

Based on our analysis of 50+ money transfer companies, we found that Wise is the cheapest money transfer company for domestic transfers within the US.

They appeared 100% of the time in our comparison system, as the cheapest provider to use.

Their exchange rates are just 0% of the mid-market rate and offer low fees on international transfers.

A bit more on domestic money transfers

Are domestic money transfers safe?

Can I track the status of my domestic money transfer?

Are there limits to how much I can send with a domestic money transfer?

What’s the difference between a domestic wire transfer and an ACH transfer?

Can I cancel a domestic money transfer?

Do I need a bank account to send or receive money domestically?

Do I pay tax on domestic money transfers?

What if I make mistakes when giving details for a domestic money transfer?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sources & further reading

Contributors

Mehdi Punjwani