Companies for transfers from Australia to India

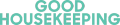

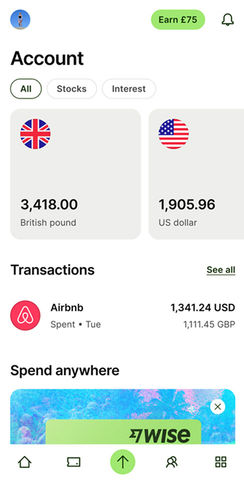

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

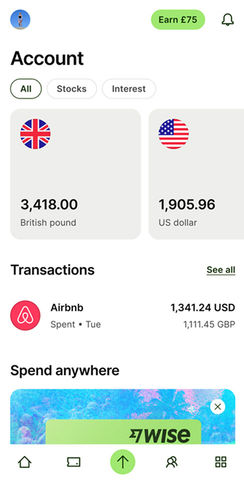

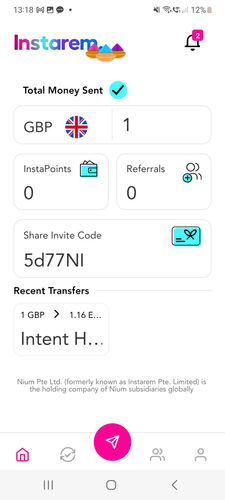

"Most transfers are instant or same-day. Customers can earn rewards on every transaction."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

Overall best choice: Wise

We tested & reviewed dozens of money transfer providers, and Wise scored highly.

Wise appeared in 100% of Australia to India searches, and was the top rated company out of 9 that support AUD to INR.

So for a great mix of cost, speed & features, make your Australia to India transfer using Wise.

How to get the best deal on your Australia to India transfer

Important things to consider before sending money from Australia to India

Compare providers

Don't settle for the first option. Always compare ways to send money from Australia to India to find out about fees, speed, and reliability.

Our analysis included 9 providers that operate between Australia and India.

Through this, you get a comprehensive view of all the options you have in Australia when you need to send money to India.

Think about the Australian Dollar-Indian Rupee exchange rate

Choose the right payment method

Keep your money safe

Consider transfer limits

How to receive money in India

Have your ID ready

Don't forget about taxes

Cheapest way to send money to India from Australia: Instarem

Data collected over the past 7 days shows that Instarem is 0.07% cheaper than the second-best option.

The $28.5 transfer cost represents the most common fee for AUD to INR international transfers, based on data from the past week.

If you want to secure the best rates on a AUD to India transfer, make sure you pick Instarem to send your money online.

*The most common fee applied to AUD-INR by Instarem, based on data from the past 7 days.

Fastest way to send money from Australia to India: Wise

Our data shows that Wise came up as the fastest way to send money from Australia to India in 100% of searches. This makes them well suited to urgent AUD to INR money transfers.

The 'fastest' way to send money is defined by the overall speed of sending money from Australia to India - this includes deposit, transfer and withdrawal timeframes and often differs per currency.

When speed matters, Wise is your best choice at the moment. This service emerged as the quickest way to send money to India from Australia in 100% of the searches on MoneyTransfers.com over the past six months.

Need to send over $10,000?

Opt for a service proven with large transfers when size matters. For transfers over $10,000, your best bet is Wise.

While Wise may not always be the cheapest or fastest way to send AUD from Australia to India, it’s the provider that will keep you safe and relaxed while your money moves into INR.

Understanding the costs involved when moving money from Australia to India

When calculating the costs of money transfers between Australia and India, here's what really matters:

The Mid-Market Rate: Today, the AUD-INR mid-market rate equals to 57.0176 INR per Australian Dollar.

The AUD-INR average exchange rate for the past three months has been 57.099 INR per Australian Dollar, with a high of 57.2167 and a low of 57.0167.

When looking to send money, we'd recommend Wise. On average Wise is -0.01% away from the average mid-market rate. Fees may be added on top, but they're still the cheapest provider on average from AUD to INR.

How to find the best exchange rate for Australian Dollar to Indian Rupee

Timing is essential for sending money between AUD and INR. The exchange rate you secure impacts how much INR you get for your AUD.

Let's dive into some interesting recent trends.

Over the past six months, the exchange rate from AUD to INR has seen some fluctuation. On average, it stood at 57.099.

During this period, the highest value recorded was 57.2167, while the lowest was 57.0167.

Wise, which is our recommended service to send money online from Australia to India offers an exchange rate that is only -0.01% above the mid-market rate.

Want to secure the best AUD-Indian Rupee exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Australia to India!

Payment methods available to fund your Australia to India transfer

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between India and Australia.

Our comparison engine and algorithms evaluate providers based on over 25 factors.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Australia to India .

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send AUD to INR.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

.svg)