Calculate an IBAN

Check IBAN

Can you convert IBAN to BIC?

Converting an IBAN to a BIC number directly is not possible, as the BIC (Bank Identifier Code) is not embedded within the IBAN (International Bank Account Number).

However, if you need to find your BIC number using IBAN, you can do one of the following:

Find it on your bank statements: often, your bank statement or the account details provided by your bank will include both the IBAN and the BIC.

Find it in your online banking account: Many banks provide the BIC in the account information section of their online banking portals.

Contact your bank: If you cannot find the BIC using the methods above, contact your bank directly. The bank's customer service can provide the BIC.

IBAN vs BIC: The key differences

Both IBAN and BIC are essential for ensuring funds are transferred to the correct bank account and both are written in a standard, internationally recognised format. They help banks process international payments automatically, quickly, and securely.

Here's a quick summary of the key differences between IBAN and BIC codes.

Feature | IBAN (International Bank Account Number) | BIC (Bank Identifier Code) |

|---|---|---|

Purpose | Used for international transactions to identify bank accounts | Used to uniquely identify a bank or financial institution globally |

Format | Alphanumeric code, up to 34 characters | Alphanumeric code, 8 or 11 characters long |

Components | Country code, two check digits, and a Basic Bank Account Number (BBAN) | Bank code, country code, location code, and optionally a branch code |

Scope | International | International |

Countries Used | Over 82+ countries, mainly in Europe, Middle East, and the Caribbean | |

Standardization | ISO 13616-1:2007 | ISO 9362 |

Examples | GB82 WEST 1234 5698 7654 32 | DEUTDEFF (8 characters) or DEUTDEFF500 (11 characters) |

Usage | Ensures accurate processing of cross-border transactions | Identifies the specific bank involved in the transaction |

Introduction Year | 1997 | 1973 |

Validation | Includes check digits for error detection and validation | Structured format allows for verification |

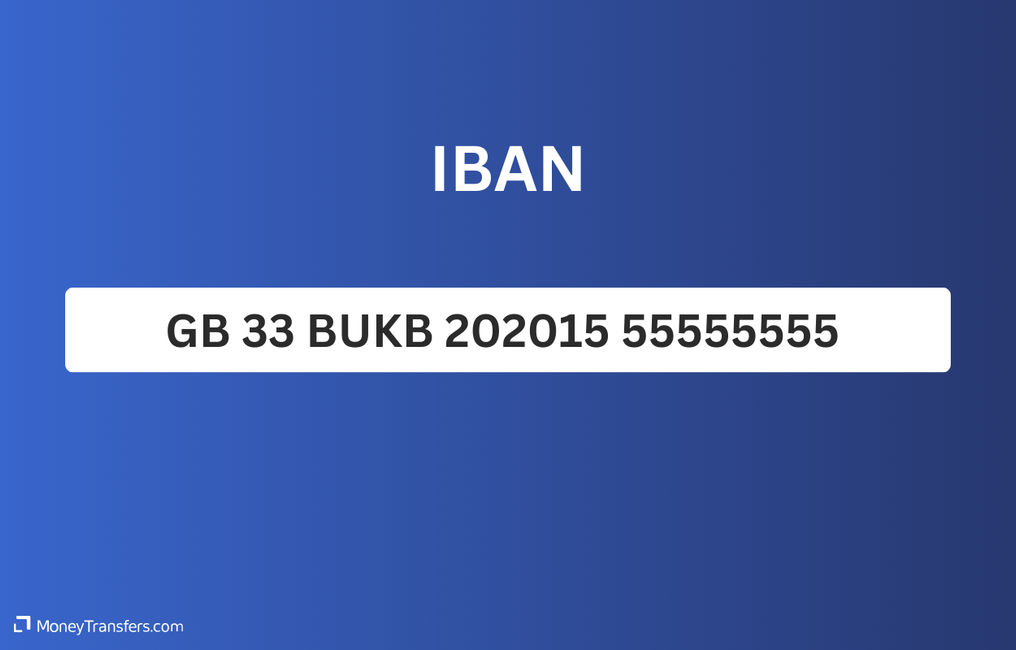

IBAN

IBAN stands for International Bank Account Number, a type of identification code used by banks and financial institutions in 82+ regions around the world. An IBAN consists of an international component, a country code, check digits, and a domestic bank account number. This information helps identify an individual’s bank account.

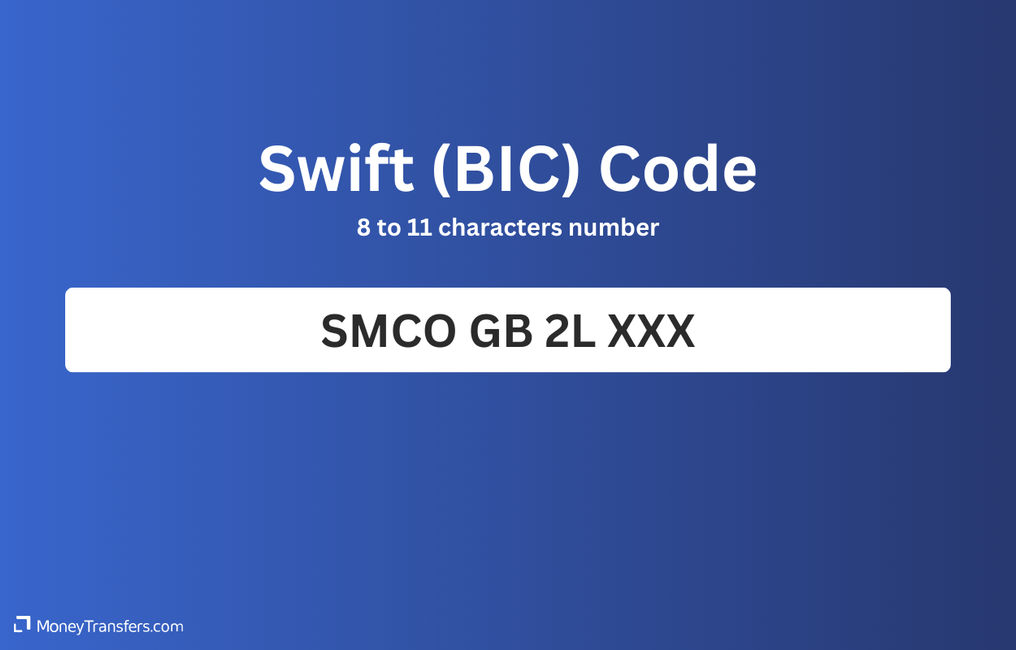

BIC (Swfit)

A Bank Identifier Code (BIC) or Swift code simply identifies the bank that an account is held with.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

What does an IBAN look like?

Every country using IBANs will issue the same length codes, but the number of total characters in an IBAN varies by country.

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

What does a BIC code look like?

BIC is an acronym for Business Identifier Code, and it is used to identify the bank related to the account. Also known as a SWIFT (the Society for Worldwide Interbank Financial Telecommunication) code, the two terms are used interchangeably.

Format of a SWIFT/BIC code

A SWIFT/BIC is an 8-11 character code that identifies your country, city, bank, and branch.

Bank code

A-Z4 letters representing the bank. It usually looks like a shortened version of that bank's name.

Country code

A-Z2 characters made up of letters or numbers. It says where that bank's head office is.

Location code

A-Z0-92 characters made up of letters or numbers. It says where that bank's head office is.

Branch code

A-Z0-93 digits specifying a particular branch. 'XXX' represents the bank’s head office.

As a component of the SWIFT network, which has existed for over 40 years, BIC codes provide a secure way for banks to communicate between themselves across the world.

Will I ever need both an IBAN and a BIC?

BIC codes existed before IBANs were developed and countries that recognize the IBAN system will likely ask for both codes when processing a transaction in a foreign currency.

Every country within the European Union (EU) uses IBAN, so if you are making a Euro transfer you will need both IBAN and BIC

Other countries across Central and South America, Africa, and the Middle East have adopted the IBAN system and may request both an IBAN and BIC

Canada does not use IBANs, instead processing international money transfers using their systems. The United States however does use IBANs to process international payments.

Any reputable service provider, like the ones listed in our top 10 money transfer companies, will let you know the specific bank details which are needed, to guarantee your global remittance is safely and securely processed.

Finding BIC using IBAN

An IBAN contains a bank code but this is not branch-specific information which means it is not possible to extract a BIC code from an IBAN. This is because a bank code will vary based on each individual account.

However, wherever you find your IBAN, you will also find your BIC or SWIFT code stated in the same place. This information can be found via the following:

Check bank documents: Often, the BIC is listed on bank statements, account opening documents, or other communications from the bank.

Bank's website or online banking: Many banks provide a tool or information on their website where you can enter your IBAN to retrieve the BIC. Log into your online banking portal and check the account details section.

IBAN calculator tools: Several online tools and websites offer IBAN to BIC conversion services. Simply enter the IBAN, and the tool will provide the corresponding BIC. Examples include:

Contact your bank: If you can't find the BIC using the methods above, contact your bank directly. Customer service should be able to provide you with the BIC.

Bank directory services: Some websites and databases compile bank information, including BICs, which you can search by entering the IBAN.

How to send money with IBAN and BIC codes?

Once you have both codes, the most common way is to use the bank transfer through your bank. Log in to your online banking, initiate the transfer (varies by bank), enter the transfer details (along with IBAN and BIC / Swift code), review, and send.

However, banks often charge higher fees for international transfers and add a markup to the exchange rate. An alternative is to use a money transfer provider. Money transfer companies are much cheaper while remaining just as quick and easy as banks.

Use the form below to find a better alternative for your needs.

Find a better alternative to bank transfers

A bit more on IBANs and BIC codes

Where can I find my IBAN?

Where to find IBAN and BIC number on check?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap: can you convert IBAN to BIC?

Since IBAN does not contain brach-specific information, it's impossible to extract a BIC code from an IBAN. In case you do need it, you can find SWIFT/BIC codes in the same places you find IBAN. IBAN is a type of identification code used by banks and financial institutions while a SWIFT/BIC simply identifies the bank that an account is held with.

If you're looking for a BIC code to send money abroad, there's a cheaper alternative to bank transfers, we suggest you use the form below to find the best provider to suit your needs.

Find cheaper alternative to bank transfers

Sources and further reading

Related Content

Contributors

April Summers