How to Find Sort Code From IBAN

The sort code is the 9th to 14th digit in your IBAN. If you're just looking to find sort code from IBAN, that is it. However, there's more information you can find in your IBAN. In this guide, we will outline what sort codes and IBANs are, look at when they are required, how to decode them, and other details you can find in your IBAN.

Calculate an IBAN

Check IBAN

Sort code vs IBAN: Key differences

Feature | IBAN (International Bank Account Number) | Sort Code |

|---|---|---|

Purpose | Used for international transactions to identify bank accounts | Used for domestic transactions to identify banks in the UK |

Format | Alphanumeric code, up to 34 characters | Numeric code, 6 digits long |

Components | Country code, two check digits, and a Basic Bank Account Number (BBAN) | Bank code and branch code |

Scope | International | Domestic (primarily used in the United Kingdom) |

Countries Used | Over 70 countries, mainly in Europe, Middle East, and the Caribbean | United Kingdom |

Standardization | ISO 13616-1:2007 | Domestic UK standard |

Examples | GB82 WEST 1234 5698 7654 32 | 12-34-56 |

Usage | Ensures accurate processing of cross-border transactions | Facilitates domestic money transfers and check processing |

Introduction Year | 1997 | Early 20th century |

Validation | Includes check digits for error detection and validation | Basic validation |

Sort Code

A sort code is the domestic bank code used to identify bank branches in the United Kingdom and the Republic of Ireland. To make a domestic transfer, you need both the recipient’s sort code and account number.

IBAN

An IBAN, or International Bank Account Number, is a unique identifier for bank accounts around the world, making it easier to correctly route money using only one cataloging system.

It’s used for international transfers by financial institutions in over 82 countries and territories worldwide and includes unique details allowing you to identify banks in each country, including a sort code for the UK and Ireland.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

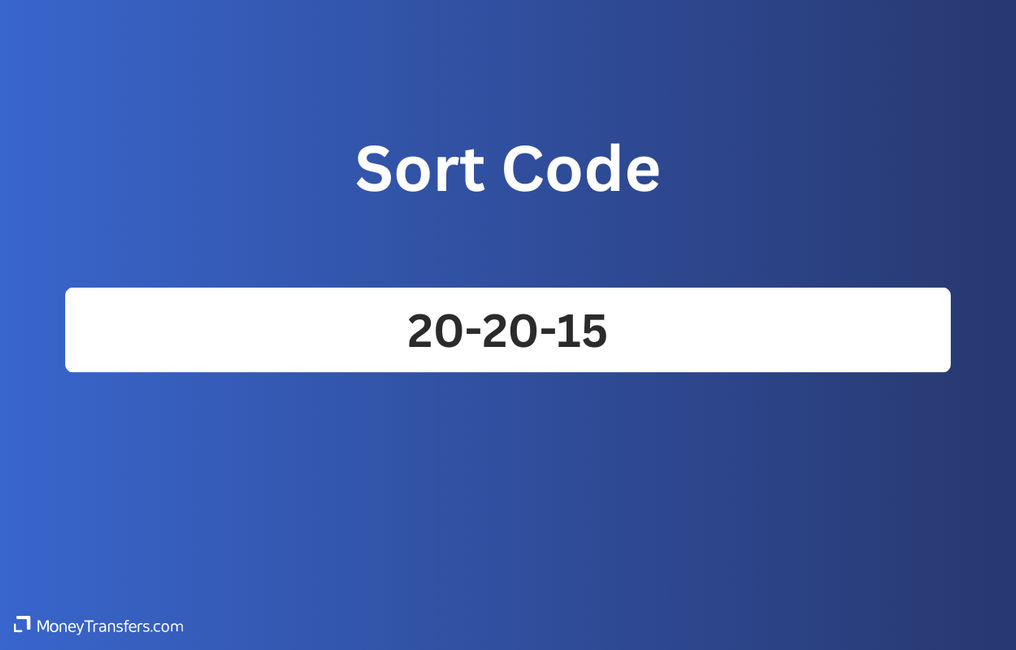

Sort code format explained

A sort code is made up of six digits, split into three, often hyphenated pairs. The first pair is typically used to identify banks, and the remaining four digits identify which branch of the bank it is. A sort code may appear in the following formats: 202015 or 20-20-15. You can find sort code from IBAN by looking at the 9th to 14th digit of the code.

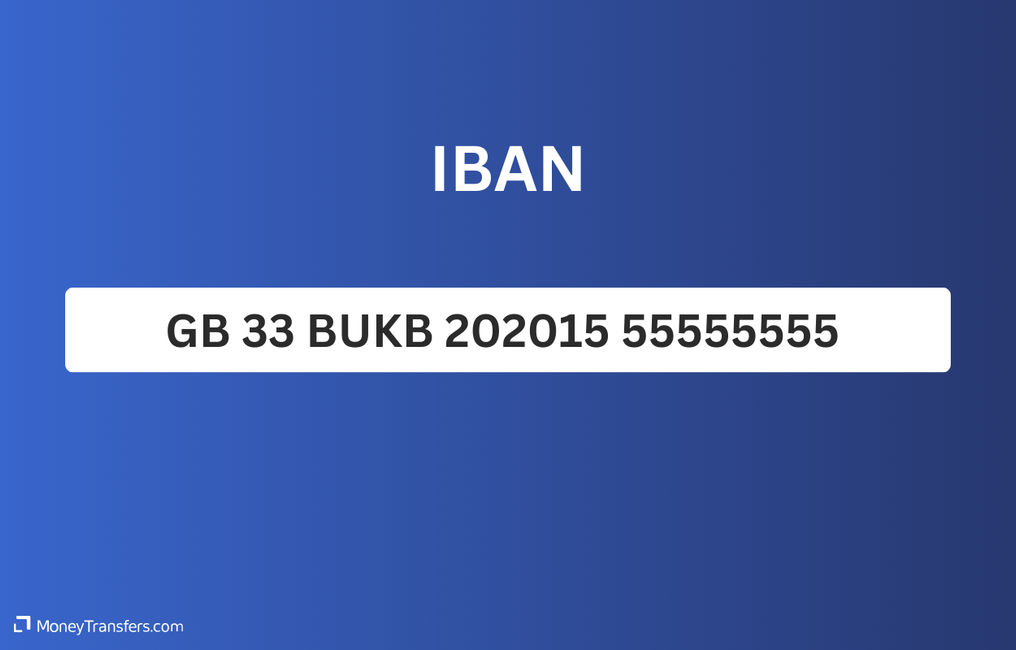

IBAN format explained

IBANs are composed of up to 34 alphanumeric characters, which include a country code, a check number, a bank code, a branch code, and an account number. Because countries use different systems for numbering their accounts, the IBAN length will vary from country to country.

Using IBAN to find the sort code in the UK

The IBAN for UK accounts starts with "GB" followed by two check digits, the four-character bank identifier (which includes the bank code), the six-digit sort code, and the eight-digit account number.

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

When would you need to find a sort code using an IBAN?

You might need to provide a sort code when conducting certain banking transactions, such as:

Setting Up Direct Debits

Some organizations might request your sort code and account number specifically when setting up direct debits, even if you provide an IBAN initially.

International money transfers

Local Transactions in the UK

Verification and Validation

Payment Instructions

Bank Reconciliation and Statements

Here's where you can find your IBAN

If you need to find the sort code from IBAN, you’ll need your IBAN. You can find it by doing one of the following:

Use our IBAN calculator

The quickest way to find IBAN is to use our calculator. Simply select the country and enter your details below. However, always cross-verify the generated IBAN with your bank, especially if you are going to use it for international transfers. Incorrect IBANs can lead to delays or lost funds.

Calculate an IBAN

Other ways to find IBAN

Bank statements

Your IBAN is often listed on your bank statements. Whether you receive your statements in the mail or access them online, look for the account summary section where your account details are listed.

Online banking

Log in to your bank's online banking portal or mobile app. Navigate to the account details section for the specific account you are interested in. The IBAN is usually displayed alongside your account number and sort code.

Bank branch

You can visit your local bank branch and ask a representative for your IBAN. They will be able to provide it to you.

Bank's customer service

Contact your bank’s customer service via phone or email. They can provide your IBAN after verifying your identity.

Other details you can find from IBAN

Sort code is not the only detail you can find using your IBAN. Here are a few more details:

Country Code: The first two letters of the IBAN represent the country where the bank account is held. For example, "GB" stands for the United Kingdom, "DE" for Germany, and "FR" for France.

Check Digits: The next two digits serve as a checksum that helps verify the integrity of the IBAN. They are used to detect errors in the IBAN during data entry or transmission.

Bank Code: Following the check digits, there is typically a bank code, which identifies the specific bank where the account is held. This code varies in length and format depending on the country.

Branch Code: In some countries, the IBAN includes a branch code that specifies the particular branch of the bank where the account is located.

Sort Code: In countries like the United Kingdom and Ireland, the IBAN may include the sort code, which identifies the bank branch.

Account Number: The remaining digits of the IBAN represent the account number associated with the bank account. The length and format of the account number can vary depending on the country and bank.

Because your IBAN displays your country codes, your sort code, and your account number, you can use it to pinpoint the address of your bank branch. The country code identifies the country of the banking institution, and each individual branch has its own sort code. Using this, you can pinpoint the address of a branch using an IBAN.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

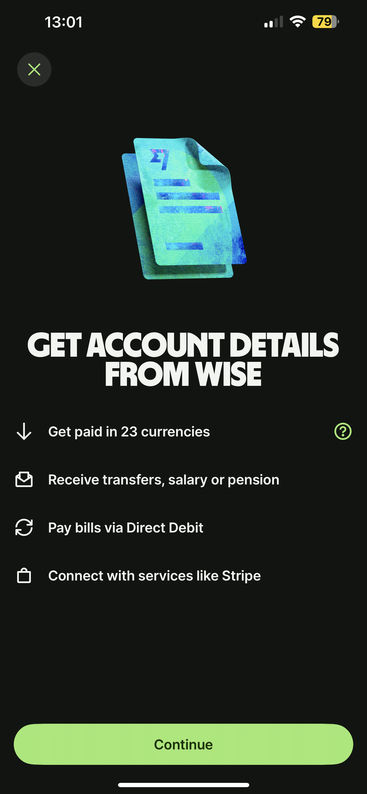

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

More about sort codes

Are sort codes only used in the UK and Ireland?

When would I need my sort code?

Is the UK sort code in the IBAN?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Are you planning to send money?

Since you're looking for a sort code, you're likely interested in sending money somewhere. You might want to consider a money transfer service to enjoy the cheapest transfer. They have lower overheads than banks, which means they are in a position to offer lower fees to customers. Also, their currency conversions match the mid-market rate for many currency pairs. Banks charge large markup percentages that are essentially an added fee. Use our comparison form below to find the best money transfer provider for your needs.

Find money transfer provider for your needs

Sources & further reading

Related Content

Contributors