IBAN Generator Explained

An IBAN generator comes in handy when arranging a cross-border payment to an individual or business with a foreign bank account. In this guide, we will explain what an IBAN is. We will also cover how to use an IBAN generator and other ways to ensure your funds are deposited in the right bank account.

Calculate an IBAN

Check IBAN

What is an IBAN generator?

IBAN generators are widely available on the internet, but how do they work? In terms of functionality, an IBAN generator is similar to an IBAN calculator in so much as they can both be used to convert alternate bank details into International Bank Account Numbers (IBAN). Thanks to special software which has been developed to calculate the details needed for an international money transfer, to remove the chance of errors or delays.

How does an IBAN work?

IBAN is an acronym that stands for International Bank Account Number. This is a code made up of a series of alphanumeric characters that identifies a bank account held in one of the 80 regions that use IBANs.

Countries using IBAN numbers with examples

All bank accounts within the European Union must be assigned an International Bank Account Number. Elsewhere, the IBAN system has been widely adopted in developing countries in the Caribbean, Middle East and Africa.

Did You Know...

The IBAN system was originally developed to simplify the money transfer process for people sending money from a bank in one European country to another bank in the Eurozone. The idea to create a system of internationally recognized bank codes preceded the SEPA Zone, which was introduced in 2008. Both systems were designed to help individuals and companies who were sending and receiving money from other EU countries.

Generating IBAN number

IBAN generators require different types of bank details depending on the country. Generally speaking, the domestic account number and bank code of a bank account can be used to generate an IBAN. Here are a few ways to generate and find IBAN.

Using our IBAN calculator

Use our calculator to quickly generate and calculate your IBAN by filling in the details below.

Calculate an IBAN

Alternatively, an IBAN can also be found in any of the following places:

Online banking

Log in to your online banking account, navigate to the account details section, and locate your IBAN displayed alongside your account number and sort code, often under "Account Information" or "International Banking."

Bank statements

Check your printed or electronic bank statements, where your IBAN is typically listed in the account information section near your account number and sort code.

On a personal check

Examine your personal check; while the IBAN may not be printed on standard checks in some countries, it might be included near the bank account information section in regions where IBAN is commonly used.

Enquiring with your bank

Visit your bank branch, call customer service, or use secure email or online chat to request your IBAN. A bank representative will provide it after verifying your identity. You can also check the bank's mobile app, which often lists your IBAN in the account details section.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

Cheaper alternatives to bank and wire transfers

If you're generating IBAN for money transfers you should know that bank transfers are not the cheapest way to send money abroad. Specialized money transfer providers such as Wise, OFX, or Currencies Direct offer better service at a fraction of the cost. Use our form below to find a suitable money transfer company for your needs.

Find a better alternative to bank transfers

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

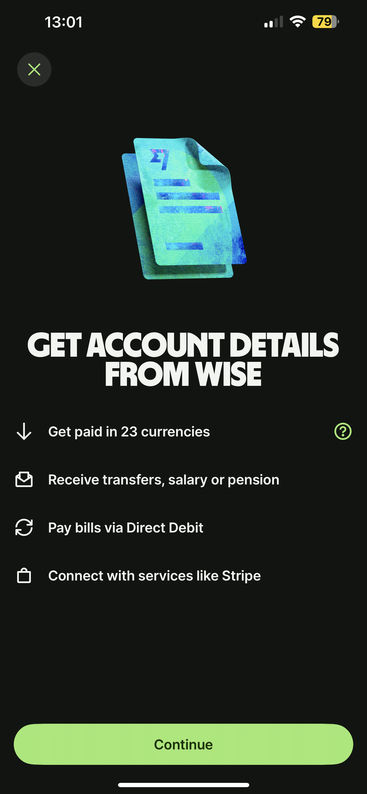

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

A bit more on IBAN generators

Is IBAN generator the same as IBAN calculator?

What is random IBAN generator?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap on IBAN generators

When using an IBAN generator or calculator it is important to double-check the information you are provided. This is easily done: make sure the length and format correctly match the country’s IBAN structure.

We would also recommend using an IBAN checker after generating an IBAN, to verify and validate the information before sending money overseas.

Sources & further reading

Related Content

Contributors

April Summers