IBAN vs Routing number - Is IBAN the Same as Routing Number?

IBANs identify the exact location of the bank account and associated details while routing numbers are used only on US accounts to identify the bank, not your specific account details. The one you’ll need will depend on the location of your transfer.

This article explains the differences between these systems. It covers the format of each and where to find them.

Calculate an IBAN

Check IBAN

IBAN vs routing number: Key differences

Here's a quick summary of the main differences between IBAN and the routing number:

Features | IBAN (International Bank Account Number) | Routing Number |

|---|---|---|

Purpose | Used for international transactions to identify bank accounts | Used for domestic transactions to identify banks in the US |

Format | Alphanumeric code, up to 34 characters | Numeric code, 9 digits long |

Components | Country code, two check digits, and a Basic Bank Account Number (BBAN) | Bank code, branch code, and account number |

Scope | International | Domestic (primarily used in the United States) |

Countries used | Over 82 countries, mainly in Europe, Middle East, and the Caribbean | United States (USA) |

Standardization | ISO 13616-1:2007 | ABA (American Bankers Association) |

Examples | GB82 WEST 1234 5698 7654 32 | 123456789 |

Usage | Ensures accurate processing of cross-border transactions | Facilitates domestic money transfers and check processing |

Introduction Year | 1997 | Early 20th century |

Validation | Includes check digits for error detection and validation | Basic checksum validation |

What is an IBAN?

An IBAN is a unique identifier for bank accounts around the world, usually used for worldwide interbank financial telecommunication. If you’re transferring money to a contact located outside your country of residence, you’re likely to be asked for an IBAN to facilitate the transfer.

IBANs are specific to each individual bank account, so every account that uses the IBAN system globally will have a slightly different code, even if they’re held with the same financial institution.

What is a routing number?

A bank routing number is a unique set of nine digits used as a bank identifier code in the US. Also known as the American Bankers Association (ABA) routing number, or Routing Transfer Number (RTN), a routing number is assigned to a banking institution when it is set up.

Unlike IBANs, bank routing numbers are unique to banking institutions, but not individuals. This means two individuals who hold a US bank account with the same bank will have the same routing number on their checks; the bank account number differentiates between them.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

IBAN formatting

IBANs are composed of up to 34 alphanumeric characters, which include a two-letter country code, a check number, a bank identification code, a branch code, and a BBAN. Because countries use different systems for numbering their accounts, the IBAN length will vary from country to country.

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

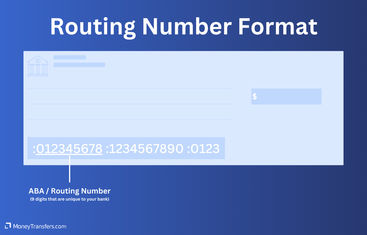

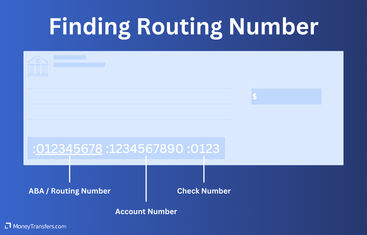

Routing number formatting

A routing number consists of nine digits that are unique to your bank, but do not identify your account. They include four digits identifying the location of the Federal Reserve bank your account is connected to, known as the Federal Reserve routing number, four digits identifying the specific financial institution you bank with, and a final digit to verify the accuracy of the routing number using a mathematical calculation.

Unlike an IBAN, a bank routing number only identifies the location of your financial institution, rather than the individual bank account you hold. They’re always exactly nine digits long as they do not need to incorporate differing lengths of identifiers.

IBAN usage: International money transfers

IBANs are used primarily for international bank transfers, as they identify the exact destination account for the transfer in one code. Some countries also use IBANs for domestic transfers, but they contain a lot of excess information in these cases that is not necessary for completing the transfer.

The US doesn’t use IBAN, so any international payments made to the US from overseas, whether in a country that uses IBANs or not, will require the routing transit number and account number.

When you make a cross-border transfer to a country that uses the IBAN system, the characters of the IBAN are scanned by the payments system your bank uses. By verifying the code against the international database, the system is able to confirm the location of the intended recipient’s account.

Find a better alternative to bank transfers

Routing number usage: Transfers from the US

You’ll be asked to provide your routing number if you're transferring money internationally from the US, so the recipient banks can identify exactly where the funds have come from. You’ll also need to supply the routing number of the recipient bank if you’re transferring money from overseas to the US.

As well as this, you’ll often be asked for both your account and routing number when you’re making a payment by phone or online, or if you’re making automatic payments for things like bills or direct deposits.

Finding IBAN

Your IBAN will often be available when you log in to your online banking account. Alternatively, you can check your bank statement, visit your local branch, or use an IBAN calculator below.

Calculate an IBAN

Finding routing number

As your bank’s routing number is not specific to your account, you should be able to find it on your bank’s website. Alternatively, you may find it when you log in to your online banking account, or you can check your bank statement, a personal check, or contact your local branch directly.

Your bank’s routing number is usually printed at the bottom of your bank statement, and in the bottom left-hand corner of your checks.

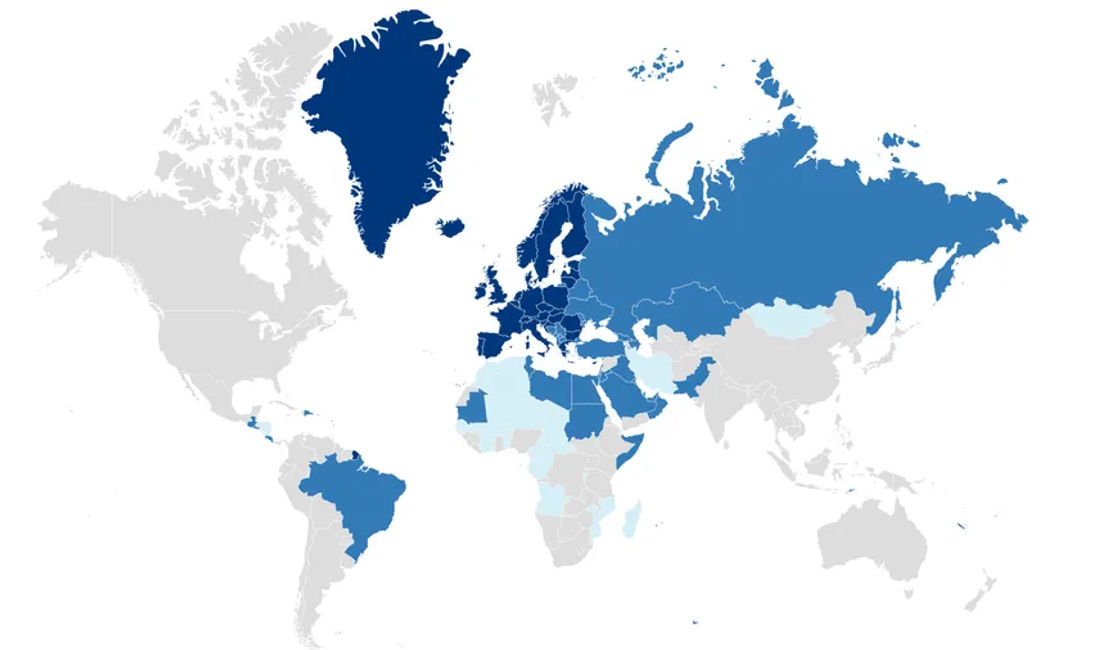

IBAN vs routing number coverage

The routing number is used for domestic (US) transfers, whereas IBAN is an international identifier.

Routing Number

The US is the only country that uses routing numbers.

IBAN

Over 82 countries and territories currently use the IBAN system.

SWIFT/BIC vs IBANs and routing numbers

SWIFT code/BIC is different from both IBANs and routing numbers.

A Bank Identifier Code (BIC) is assigned to a banking institution in order to identify it globally. During international transfers, BIC is communicated between the transferring and receiving banks via the secure SWIFT network. IBANs identify specific accounts, and routing numbers only identify the location of banks in the US.

When completing financial transactions internationally, it’s likely you’ll need both the BIC and either the IBAN or the routing number of the bank you’d like to transfer the money to.

How do I use IBANs and routing numbers when making an international money transfer?

When making an international money transfer, you’ll need to supply either the IBAN or the routing number of the recipient’s bank, depending on which country you’re transferring the money to. This allows banks to confirm the validity of the target location before any money is transferred.

In the case of routing numbers, you’ll also need to provide the recipient’s bank account number, as the routing number only defines the location of the bank where the account was opened.

Need to send money abroad? Find a cheaper alternative

A bit more about routing numbers

Is an IBAN the same as a routing number?

What part of an IBAN is the routing number?

Are routing numbers used in the UK

How many routing numbers does a bank have?

Is ABA number the same as routing number?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap: Is IBAN the same as the routing number?

No, IBANs and routing numbers are different. IBANs identify the location and details of your bank, whereas routing numbers are used to identify US-only banks. If you live in the US, you will need to provide a routing number regardless of the sender's location.

Sources and further reading

Related Content

Contributors