IBAN vs Account Number

This article is for those who struggle to tell IBANs from account numbers. So, what is IBAN vs account number? IBAN streamlines cross-border transactions. Meanwhile, the account number is for domestic payments. This guide will dive into formatting, key differences, use cases, and alternatives.

Calculate an IBAN

Check IBAN

IBAN vs account number: Key differences

Feature | IBAN | Account Number |

|---|---|---|

Purpose | Used for international transactions to identify bank accounts | Used for domestic transactions to identify specific accounts in the UK |

Format | Alphanumeric code, up to 34 characters | Numeric code, 8 digits long |

Components | Country code, two check digits, and a Basic Bank Account Number (BBAN) | Unique number identifying an individual account |

Scope | International | Domestic (primarily used in the United Kingdom) |

Countries Used | Over 82 countries, mainly in Europe, the Middle East, and the Caribbean | United Kingdom |

Standardization | ISO 13616-1:2007 | Domestic UK standard |

Examples | GB82 WEST 1234 5698 7654 32 | 12345678 |

Usage | Ensures accurate processing of cross-border transactions | Identifies specific bank accounts within the UK |

Introduction Year | 1997 | Early 20th century |

Validation | Includes check digits for error detection and validation | Basic validation |

What is an IBAN?

IBAN stands for International Bank Account Number, a code used around the world to identify individual bank accounts. They are required to identify the correct overseas bank account during a cross-border transaction.

What is an account number?

An account number is a unique set of numbers used to identify a specific bank account. If you have multiple bank accounts each of them will have its own account number. An account number provides information that is required to receive domestic money transfers.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

IBAN/account number formatting

Made up of alphanumeric characters, an IBAN can be no more than 34 characters long. Here's how it looks:

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

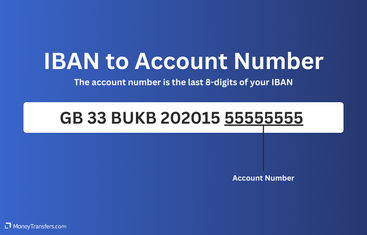

To identify an account number, you will need your IBAN. You can use our IBAN calculator to get it or find it in your online banking or bank statements. The account number is the last 8 - 12 digits of your IBAN. Using the previous example, the account number would be 55555555.

This will be the account number associated with whatever account is receiving funds and will have been assigned to the customer when opening the account.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

When will you need an IBAN/account number?

As the name suggests, an International Bank Account Number is used for sending and receiving interbank transfers from overseas contacts. They may also be called for during other international payment procedures such as setting up a wire transfer.

When making a credit transfer or authorizing a direct debit, customers will need to provide the account number of the beneficiary to enable the transfer. When sending money through an online money transfer provider directly to the recipient’s bank, customers will be asked to provide the recipient’s account number. Ordinarily, an account number will be used alongside a sort code.

Where is the IBAN/account number used?

The IBAN format is used mostly within the EU, but it is also used by financial institutions across the Caribbean, Middle East, and Africa (source). One key global market that does not use IBAN is the United States for money transfers. However, if you are based in the US and making a transfer to an account in Europe, you’ll likely need your recipient’s IBAN.

Account numbers are commonplace and used around the world, but the banking details they are accompanied by will depend entirely on the country.

For example, in the UK, an account number and sort code ordinarily work in conjunction to facilitate a money transfer. In the US, an account number will be used in conjunction with a routing number, to process a money transfer.

Finding IBAN

If you don’t have your IBAN to hand, you will be able to find out the number on your bank statements or online/mobile banking portal. Anywhere you can find your IBAN, you’ll be able to get your account number. To find the account number, use our IBAN calculator below:

Calculate an IBAN

Cheaper alternatives to bank transfers

Bank transfers are costly for international money transfers. Switch to a specialist provider like Wise or XE Money Transfer to save money. They offer better deals due to lower overheads. Banks charge higher FX rates, but many transfer companies match the mid-market rate. You'll also pay lower fees with alternatives like TorFX, which charges no fees regardless of the transfer amount.

Find a better alternative to bank transfers

A bit more on account numbers and IBAN

Is IBAN the same as account number?

What part of the IBAN is the account number?

When to use IBAN vs account number?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap on IBAN vs account number

As two very similar-sounding financial terms, you would be correct in assuming these banking terms are interlinked. A bank account number can be derived from an IBAN, and being able to decode an IBAN is a helpful trick for anyone making regular global money transfers.

Sources & further reading

Related Content

Contributors

April Summers