SWIFT/BIC vs IBAN: How to Find Swift Code From IBAN?

IBAN does not contain a Swift/BIC code. However, finding the Swift code is quick and easy without IBAN. This guide will take you through your options, explain key differences between the codes, and answer your questions.

Calculate an IBAN

Check IBAN

Can you use an IBAN to find a SWIFT code?

Your IBAN will contain some of the same characters as the SWIFT code. However, these codes are not the same and therefore it is not possible to use an IBAN to find a SWIFT code.

Then... where do I find it?

Here's a list of places where you can find:

Online banking account

View your account details or search for the option to display your SWIFT code

Online or paper bank statements

These will display your SWIFT code

Call your bank branch

If the bank does not have the SWIFT code displayed on their website you can call the bank or visit the branch to find out your SWIFT code

IBAN vs SWIFT/BIC

IBAN and SWIFT codes are both used to identify and facilitate international money transfers but the key difference between the two lies in the information that each code conveys. An IBAN is a unique identifier of an individual account, while SWIFT codes specify the bank.

IBAN | SWIFT/BIC | |

|---|---|---|

Short for | International Bank Account Number | Society for Worldwide Interbank Financial Telecommunication or Business Identification Code |

Characters | Letters and numbers | Letters and numbers |

Length | Up to 34 characters | 8 to 11 characters |

Purpose | Used to identify specific bank accounts around the world | Used to identify specific banks around the world |

Example | GB33BUKB20201512345678 | BUKBGB22 |

IBAN explained

An International Bank Account Number – more commonly known in its shorter form IBAN – is a bank code consisting of up to 34 letters and numbers. It is used as a unique identifier for bank accounts around the world when initiating international money transfers. An IBAN contains the account holder’s country, bank, and bank account and is used to ensure funds are deposited to the right account.

Here's how IBAN number looks

The format of any IBAN number can be translated as follows:

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

When do I need an IBAN?

How do I find my IBAN number?

Where are IBANs used?

Basic Bank Account Number (BBAN)...?

All characters after the two-digit check numbers may be referred to as the basic bank account number. This will usually contain the actual individual bank account number as well as the bank code and bank branch reference.

Each country has its own specific format for basic bank account numbers, and depending on the country involved, it can be up to 30 digits long.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

SWIFT/BIC codes explained

A SWIFT code is another type of bank code, internationally recognized by banks and financial institutions as a method of identification when transferring money overseas. SWIFT codes are issued by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and should not be confused with IBANs.

SWIFT codes are shorter than IBAN numbers – made up of 8 to 11 characters – but they serve a similar purpose: to provide crucial details during the process of transferring funds to an overseas bank account. The SWIFT codes identify the bank, while the IBAN identifies the bank account.

SWIFT codes include the bank’s address, branch number, and destination country of the relevant global remittance. SWIFT codes may also be referred to as a BIC: this stands for Business Identification Code.

What does a SWIFT code look like?

This information is interpreted by banks and financial institutions and translated into the following:

Format of a SWIFT/BIC code

A SWIFT/BIC is an 8-11 character code that identifies your country, city, bank, and branch.

Bank code

A-Z4 letters representing the bank. It usually looks like a shortened version of that bank's name.

Country code

A-Z2 characters made up of letters or numbers. It says where that bank's head office is.

Location code

A-Z0-92 characters made up of letters or numbers. It says where that bank's head office is.

Branch code

A-Z0-93 digits specifying a particular branch. 'XXX' represents the bank’s head office.

When do I need a SWIFT code?

Where do I find a SWIFT code?

Do I need an IBAN if I have a SWIFT?

Where are SWIFT codes used?

Will you ever need both an IBAN and a SWIFT code?

You might need to use both an IBAN and SWIFT code for international bank transfers, as one specifies which bank the money is headed to and the other specifies which account within that bank. However, not all countries are on the IBAN system, so for transfers to these places you’ll only need a SWIFT code. Here's a map summarising IBAN usage around the world (and a breakdown below).

Here's a quick table summarising which countries are using the IBAN system.

Sending money in the UK and EU

For those based in the UK and EU, an IBAN number will be required for SEPA transfers, whereas SWIFT codes will be needed for international deposits from outside the EEA: check out our SEPA vs SWIFT code guide here. Every country within the European Union (EU) uses IBAN, so if you are making a Euro transfer you will need both IBAN and BIC.

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

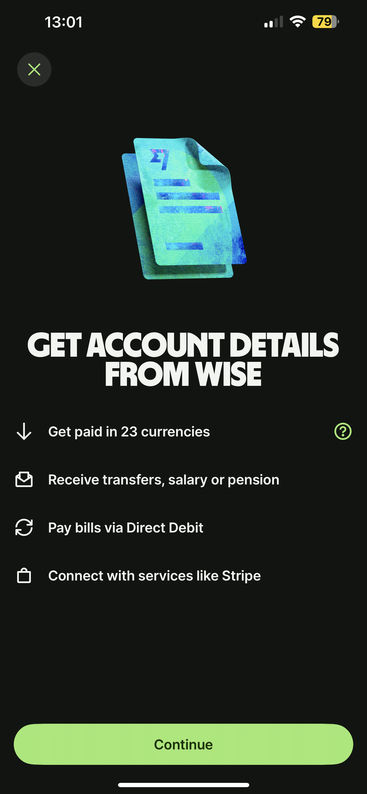

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

Making an international wire transfer

Here's how you can swiftly initiate and make a wire transfer.

Sign up to your provider

Fill in details about the recipient

Confirm your transfer

Cheaper alternative to international wire transfers

International wire transfers are expensive and time-consuming - if you’re looking for a cheaper alternative then you’ll find the best bet is a money transfer provider. These providers specialize in moving money abroad and have their own network of bank accounts around the world that lets them avoid using the SWIFT system.

As a result, money transfer providers like WorldRemit, Wise, and XE can offer faster and cheaper transfers abroad than traditional banks. They offer a range of options, from bank deposits to cash pickups, and often complete transfers faster and cheaper than banks can. To get started, fill in the form below.

Find cheaper alternative to international wire transfers

A bit more on IBANs and SWIFT codes

Is there a difference between BIC and SWIFT?

Is there a difference between SWIFT codes and account numbers?

Is there a difference between SWIFT codes and routing numbers?

Is there a difference between SWIFT codes and IFSC codes?

Is there a difference between SWIFT codes and sort codes?

Does the US use IBAN?

What is an ABA or routing number?

Do US banks use SWIFT?

What is my bank’s SWIFT?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Let's recap: How do you find swift code with IBAN?

The simple answer is you can't as both numbers have separate purposes and are used for international transfers. There is some overlap in the formatting and structure, however you can't get it directly from IBAN. To find BIC/Swift, look at your bank statements, in your online banking account or by calling your branch.

Sources & further reading

Related Content

Contributors

Mehdi Punjwani