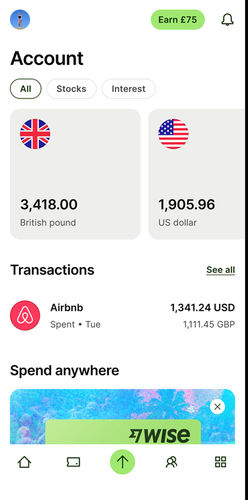

Overall best choice: Wise

We tested & reviewed 17 best money transfer providers to Indonesia, and Wise scored the highest.

Wise appeared in 94.6% of IDR searches, and was the best way to send money to Indonesia out of 17 that support Rupiah transfers.

So for a great mix of cost, speed & features, make your Indonesia transfer using Wise via Bank transfer.

How to send money to Indonesia with the best rate

Consider this before sending money to Indonesia

Don't settle for the first option. Always compare ways to send money to Indonesia to find out about fees, speed, and reliability.

Our analysis included 17 providers that operate in Indonesia.

Through this, you get a comprehensive view of all the options you have when sending money to Indonesia.

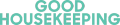

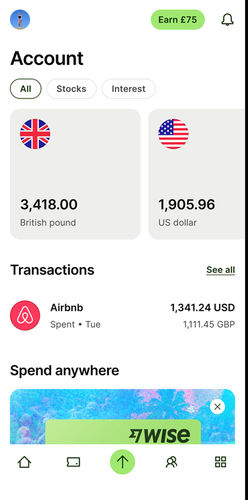

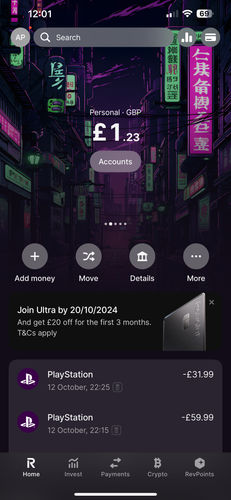

The cheapest way to send money to Indonesia: Revolut

From the 17 companies tested in the past 6 months, Revolut consistently offers the cheapest money transfer IDR to Indonesia.

Revolut appeared in 73.4% of our searches as the most cost-effective option, being 0.7% cheaper than the second cheapest provider.

Revolut charges $0 per transfer to Indonesia and applies a 0.11% markup on the IDR exchange rate.

For the best value, use a Bank transfer deposit to maximize the amount of IDR received.

The fastest way to send money to Indonesia: Paysend

Based on a $2,000 transfer and six months of comparison data for IDR transfers, Paysend appeared 51 times in our searches as the quickest option for sending IDR to Indonesia.

They charge $0 in fees and apply a 1.58% markup on the ‘real’ IDR rate. This is 0% cheaper than the second-best provider.

For the best balance between speed and cost, we suggest using a deposit for Rupiah transfers.

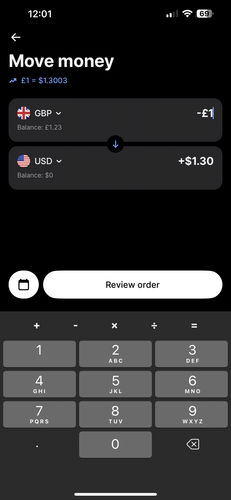

The easiest way to send money to Indonesia: Wise

Wise ranked as the top-rated money transfer provider in 94.6% of searches related to Indonesia based on 6 months of comparison data from MoneyTransfers.com.

They offer transparent fees, charging $26.18 per transfer with 0% markup added to the IDR rate.

Getting started with Wise takes less than 3 minutes, making it a fast, affordable, and user-friendly choice for sending Rupiahs.

Making large money transfers to Indonesia

When sending large amounts of Rupiah to Indonesia, it's important to consider factors like the limits, IDR rates, customer support, as well as legal and government-imposed restrictions in Indonesia.

Wise is our top recommendation for moving large amounts of IDR.

Whether you're purchasing property in Indonesia, need to pay tuition fees, have a wedding there, or transfer money for business in Indonesia, Wise will ensure a smooth and secure transaction.

Of all the companies we’ve tested and reviewed that specialize in large IDR transfers, Wise consistently ranked as the top-rated choice.

They charge $26.18 per transfer and apply 0% markup on top of the IDR exchange rate, making them perfect for moving big amounts.

Understand the costs of money transfers to Indonesia

The total cost of IDR transfers depends on your location, the amount of IDR sent, the delivery/deposit methods, transfer fees, and the markup applied to the IDR exchange rate.

Transfer fee

The money transfer service you use to send Rupiah can apply a fixed fee, a percentage-based fee, or a combination of both.

For example, a $2,000 transfer to Indonesia will cost you $0 in fees with Xoom, based on our November 2024 analysis of 17 services supporting Rupiah transfers.

IDR exchange rate markup

An exchange rate markup is the percentage added to the mid-market IDR rate.

Using the same example, Wise offers the best IDR exchange rates, with a -0.04% markup on the USD- IDR rate. This means for every USD sent, you receive 15,927.25 IDR with -0.04% deducted from it.

Deposit method

How you fund your transfer can significantly impact the overall cost.

Bank transfer is the most common option, costing up to $4 per transfer to Indonesia.

Debit card transfers can go as high as $0.54 in fees, while credit cards can reach $0.57 per IDR transfer and may include additional cash advance fees and other fees.

Bank transfer is the cheapest payment method for sending IDR.

How to find the best exchange rate for Rupiah transfers

An exchange rate is a constantly changing value of IDR in relation to another currency. The exchange rate you secure impacts how much IDR you will get, so timing your transfer is essential to get the most out of it.

Let's dive into some recent IDR trends.

Over the past six months, the exchange rate from USD to IDR has seen some fluctuation. On average, it stood at 15,813.233 Rupiah.

During this period, the highest value recorded for Rupiah was 16,489.55, while the lowest was 15,096.65.

Wise, which is our recommended service for sending money online to Indonesia offers an exchange rate that is only 0% above the mid-market rate.

Want to secure the best Rupiah exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money to Indonesia!

Top payment methods to use for transfers to Indonesia

Money transfer companies will offer different ways to fund your transfer to Indonesia. Depending on the service used, deposit options can affect the speed, the cost of your transfer, and the amount of IDR received.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Indonesia.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Indonesia.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Indonesia

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

Related transfer routes

Send money from Indonesia

Send money to Indonesia

Keep your money safe

Making sure your funds are safe when transferring to Indonesia is really important. Ensure you send money to the recipients in Indonesia you know and trust.

Always choose providers that are regulated by financial authorities.

If you don’t know what the key regulatory bodies are in Indonesia, please refer to our directory of financial regulators worldwide.

FAQs

Find answers to the most common questions on our dedicated FAQ page.

.svg)