How to send money from Indonesia to Philippines with the best IDR/PHP exchange rate

Compare and find the best ways to send money to the Philippines from Indonesia.

To make it easier, here are your best options:

Wise is the best way to send money from Indonesia to the Philippines

Wise is the cheapest way to send IDR to the Philippines

Wise is the fastest way to transfer IDR/PHP

Otherwise, keep reading to find more deals, expert information, and learn everything you need to know about IDR/PHPtransfers.

Transferring the other way? Send PHP from Philippines to Indonesia instead."Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

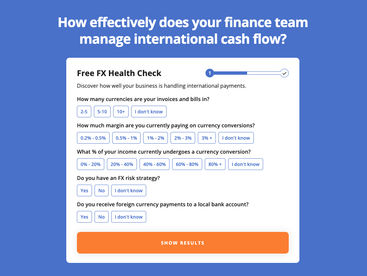

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

Latest IDR to PHP exchange rates

Exchange rates constantly change, so it’s very important to keep an eye on the current IDR/PHP mid-market rate.

This way, you will be able to get the most Philippine Pesos per Rupiah.

Here are the latest IDR/PHP conversion rates for the most popular transfer amounts.

| IDR | PHP Price |

|---|---|

| 1 IDR | 0.00 |

| 5 IDR | 0.02 |

| 10 IDR | 0.03 |

| 25 IDR | 0.09 |

| 50 IDR | 0.17 |

| 100 IDR | 0.34 |

| 150 IDR | 0.51 |

| 200 IDR | 0.69 |

| 250 IDR | 0.86 |

| 300 IDR | 1.03 |

| 400 IDR | 1.37 |

| 500 IDR | 1.71 |

| 600 IDR | 2.06 |

| 700 IDR | 2.40 |

| 800 IDR | 2.74 |

| 1000 IDR | 3.43 |

| 1500 IDR | 5.14 |

| 2000 IDR | 6.85 |

| 2500 IDR | 8.56 |

| 3000 IDR | 10.28 |

| 4000 IDR | 13.70 |

| 5000 IDR | 17.13 |

| 10000 IDR | 34.25 |

| 15000 IDR | 51.38 |

| 20000 IDR | 68.50 |

| 30000 IDR | 102.75 |

| 40000 IDR | 137.00 |

| 50000 IDR | 171.25 |

| 100000 IDR | 342.50 |

| PHP | IDR Price |

|---|---|

| 1 PHP | 291.99 |

| 5 PHP | 1459.97 |

| 10 PHP | 2919.93 |

| 25 PHP | 7299.83 |

| 50 PHP | 14599.66 |

| 100 PHP | 29199.32 |

| 150 PHP | 43798.97 |

| 200 PHP | 58398.63 |

| 250 PHP | 72998.29 |

| 300 PHP | 87597.95 |

| 400 PHP | 116797.27 |

| 500 PHP | 145996.58 |

| 600 PHP | 175195.90 |

| 700 PHP | 204395.21 |

| 800 PHP | 233594.53 |

| 1000 PHP | 291993.16 |

| 1500 PHP | 437989.75 |

| 2000 PHP | 583986.33 |

| 2500 PHP | 729982.91 |

| 3000 PHP | 875979.49 |

| 4000 PHP | 1167972.66 |

| 5000 PHP | 1459965.82 |

| 10000 PHP | 2919931.64 |

| 15000 PHP | 4379897.46 |

| 20000 PHP | 5839863.28 |

| 30000 PHP | 8759794.92 |

| 40000 PHP | 11679726.56 |

| 50000 PHP | 14599658.20 |

| 100000 PHP | 29199316.40 |

*Based on the mid-market rates (also known as the interbank rates or the "real" exchange rates). The actual rate offered during the transfer may vary depending on the FX markup added by the money transfer companies.

Everything you need to know about sending IDR to PHP

We’ve compared 4 money transfer companies for IDR/PHP transfers.

Wise is currently the cheapest and the best overall option. It offers the best IDR/PHP exchange rate (1 IDR = 0.0034 PHP) and the lowest fees of 62175 IDR.

For a 4,200,000 IDR transfer, you will receive 14,172.34 PHP with Wise.

If you need money quickly, Wise is the fastest way to send Rupiahs to the the Philippines.

It will cost you 62175 IDR, and PHP will arrive in within minutes.

If you didn’t find what you were looking for or have any questions, send us a quick message using the chat below or to our email contact@moneytransfers.com.

How to get the best exchange rate for your money transfers from Indonesia to Philippines?

Keeping an eye on the exchange rate is extremely important, a small change in the interbank rate can get you over 100s PHP more per transfer from Indonesia.

Our comparison above already shows you the best exchange rates on the market for sending money from Indonesia to Philippines.

To get an even better exchange rate, we recommend creating a free account on MoneyTransfers.com and saving this search, as well as setting up IDR/PHP .

This will let you quickly access this search in your dashboard, and you will receive email notifications when the rate changes.

Want to secure the best IDR-Philippine Peso exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to send your money from Indonesia to Philippines!

Our methodology

We’ve compared and analyzed 4 money transfer companies that support money transfers from Indonesia to the Philippines.

First of all, every single remittance provider on the list is regulated, legit, and safe to send money abroad.

When testing IDR/PHP transfer specialists, we went through unbiased editorial process and rated each company on a scale of 1-10 based on 7 different categories.

To ensure this page remains up to date, we use our first-party data from our comparison engine and merge it with the live data feeds and APIs from the remittance companies.

This page updates daily with the latest rates and fees.

If you want to know more about our methodology and standards, check these guides:

If you want to see the full money transfer companies list, check out our company reviews page.

Related transfer routes

Send money from Indonesia

Send money to Philippines

Contributors