How to send money from India to Philippines with the best INR/PHP exchange rate

Compare and find the best ways to send money to the Philippines from India.

To make it easier, here are your best options:

Wise is the best way to send money from India to the Philippines

Ria Money Transfer is the cheapest way to send INR to the Philippines

PayPal App is the fastest way to transfer INR/PHP

Otherwise, keep reading to find more deals, expert information, and learn everything you need to know about INR/PHPtransfers.

Transferring the other way? Send PHP from Philippines to India instead."Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"Western Union agents help you send money from a wide variety of countries. Find a local branch near you to deposit cash and send your funds abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

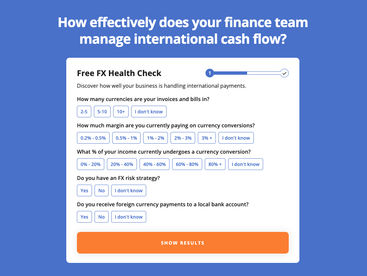

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

Latest INR to PHP exchange rates

Exchange rates constantly change, so it’s very important to keep an eye on the current INR/PHP mid-market rate.

This way, you will be able to get the most Philippine Pesos per Indian Rupee.

Here are the latest INR/PHP conversion rates for the most popular transfer amounts.

| INR | PHP Price |

|---|---|

| 1 INR | 0.63 |

| 5 INR | 3.17 |

| 10 INR | 6.33 |

| 25 INR | 15.83 |

| 50 INR | 31.66 |

| 100 INR | 63.32 |

| 150 INR | 94.98 |

| 200 INR | 126.64 |

| 250 INR | 158.30 |

| 300 INR | 189.96 |

| 400 INR | 253.28 |

| 500 INR | 316.61 |

| 600 INR | 379.93 |

| 700 INR | 443.25 |

| 800 INR | 506.57 |

| 1000 INR | 633.21 |

| 1500 INR | 949.82 |

| 2000 INR | 1266.42 |

| 2500 INR | 1583.03 |

| 3000 INR | 1899.63 |

| 4000 INR | 2532.84 |

| 5000 INR | 3166.05 |

| 10000 INR | 6332.10 |

| 15000 INR | 9498.15 |

| 20000 INR | 12664.20 |

| 30000 INR | 18996.30 |

| 40000 INR | 25328.40 |

| 50000 INR | 31660.50 |

| 100000 INR | 63321.00 |

| PHP | INR Price |

|---|---|

| 1 PHP | 1.58 |

| 5 PHP | 7.90 |

| 10 PHP | 15.79 |

| 25 PHP | 39.48 |

| 50 PHP | 78.96 |

| 100 PHP | 157.93 |

| 150 PHP | 236.89 |

| 200 PHP | 315.85 |

| 250 PHP | 394.81 |

| 300 PHP | 473.78 |

| 400 PHP | 631.70 |

| 500 PHP | 789.63 |

| 600 PHP | 947.55 |

| 700 PHP | 1105.48 |

| 800 PHP | 1263.40 |

| 1000 PHP | 1579.26 |

| 1500 PHP | 2368.88 |

| 2000 PHP | 3158.51 |

| 2500 PHP | 3948.14 |

| 3000 PHP | 4737.77 |

| 4000 PHP | 6317.02 |

| 5000 PHP | 7896.28 |

| 10000 PHP | 15792.55 |

| 15000 PHP | 23688.83 |

| 20000 PHP | 31585.10 |

| 30000 PHP | 47377.65 |

| 40000 PHP | 63170.20 |

| 50000 PHP | 78962.75 |

| 100000 PHP | 157925.50 |

*Based on the mid-market rates (also known as the interbank rates or the "real" exchange rates). The actual rate offered during the transfer may vary depending on the FX markup added by the money transfer companies.

Everything you need to know about sending INR to PHP

We’ve compared 5 money transfer companies for INR/PHP transfers.

Ria Money Transfer is currently the cheapest and the best overall option. It offers the best INR/PHP exchange rate (1 INR = 0.6183 PHP) and the lowest fees of 4 INR.

For a 22,100 INR transfer, you will receive 13,661.83 PHP with Ria Money Transfer.

If you need money quickly, PayPal App is the fastest way to send Indian Rupees to the the Philippines.

It will cost you 4 INR, and PHP will arrive in minutes.

If you didn’t find what you were looking for or have any questions, send us a quick message using the chat below or to our email contact@moneytransfers.com.

The fastest way to send money to Philippines from India is by sending cash

Cash transfers are almost instant in most cases.

However, in some cases, it can take a few days to process, depending on your branch, how much you are sending, and the deposit method you use.

Considering there aren’t many INR/PHP transfer options available, this is by far the fastest way to do it.

How to get the best exchange rate for your money transfers from India to Philippines?

Keeping an eye on the exchange rate is extremely important, a small change in the interbank rate can get you over 100s PHP more per transfer from India.

Our comparison above already shows you the best exchange rates on the market for sending money from India to Philippines.

To get an even better exchange rate, we recommend creating a free account on MoneyTransfers.com and saving this search, as well as setting up INR/PHP .

This will let you quickly access this search in your dashboard, and you will receive email notifications when the rate changes.

Want to secure the best INR-Philippine Peso exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to send your money from India to Philippines!

Our methodology

We’ve compared and analyzed 5 money transfer companies that support money transfers from India to the Philippines.

First of all, every single remittance provider on the list is regulated, legit, and safe to send money abroad.

When testing INR/PHP transfer specialists, we went through unbiased editorial process and rated each company on a scale of 1-10 based on 7 different categories.

To ensure this page remains up to date, we use our first-party data from our comparison engine and merge it with the live data feeds and APIs from the remittance companies.

This page updates daily with the latest rates and fees.

If you want to know more about our methodology and standards, check these guides:

If you want to see the full money transfer companies list, check out our company reviews page.

Related transfer routes

Send money from India

Send money to Philippines

Contributors