EUR to CAD Forecast - February 2026

The EUR/CAD exchange rate is currently around 1.613699. That means 1 euro buys about 1.613699 Canadian dollars.

This rate has been rising lately, mostly due to a weakening Canadian dollar while the euro has remained relatively stable.

Search Now & Save On Your Transfer

What is likely to happen to EUR/CAD in February 2026

EUR to CAD enters the next month with a mild downside bias, with 1.60 a key area to watch.

Expect choppy trading around central bank headlines, and if you are sending money, consider staging transfers or using target-rate tools to avoid unlucky timing.

EUR to CAD: Where It Stands

EUR to CAD has turned softer recently, meaning one euro has been buying fewer Canadian dollars than it did earlier. The pair is sitting below a previously important support area, which often signals that sellers still have the upper hand.

The near-term tone is cautious because traders are bracing for big moves around central bank decisions, especially from the Bank of Canada and the US Federal Reserve, which can ripple into CAD pairs like EUR to CAD.

What’s Driving EUR to CAD?

Here are the main factors likely to steer EUR to CAD over the next month.

1) Bank of Canada expectations (supports CAD)

Markets broadly expect the Bank of Canada to sound “hawkish,” meaning it may keep rates higher for longer to control inflation. Higher Canadian rates often help the Canadian dollar, which can push EUR to CAD lower.

2) US rate expectations (indirect, but important)

Even though this is not a USD pair, shifts in US yields and Fed messaging can change global risk appetite and CAD demand. When markets feel confident and yields move in a way that supports North American currencies, CAD often holds up well.

3) Oil prices (can sway CAD quickly)

Canada is a major energy exporter, so weaker oil can weigh on CAD and lift EUR to CAD. If oil stabilises or rebounds, it can do the opposite and pull EUR to CAD down.

What Do the Charts Say?

EUR to CAD looks like it broke below an old uptrend area and is now struggling to recover it, which is often a bearish sign.

Key levels people are watching

Resistance (ceilings): the October low area (now acting like a cap), plus the nearby zone around the 200 day moving averages. If EUR to CAD rallies into these areas and stalls, it often suggests the bounce is temporary.

Support (floors): 1.60 is the big psychological and technical area. If EUR to CAD drops toward 1.60, buyers may try to defend it, at least on the first test.

Pattern to know in plain EnglishThe current setup looks like a “bounce that may not last.” That means EUR to CAD could pop higher briefly, then slip again if CAD strength returns.

What to Watch in the Next Month

A few upcoming things that can move EUR/CAD rate quickly.

Central bank messaging and market volatilityThe window around major rate decisions can create sudden jumps in EUR to CAD, sometimes in both directions within the same day. Even if nothing changes, the tone of the statements can move the rate.

Canadian data and oil directionStrong Canadian data or firmer oil often supports CAD, which can drag EUR to CAD lower. Weak oil or softer Canadian numbers can give EUR to CAD some breathing room.

Base case for the month (most likely path)EUR to CAD may see short, sharp bounces, but the bias stays slightly downward unless it reclaims and holds above the resistance zones mentioned earlier. A drift toward 1.60 looks plausible if CAD support continues.

Risks Ahead

A short list of what could quickly change the outlook.

A surprise from the Bank of Canada: If the BoC sounds less hawkish than expected, CAD could weaken and EUR to CAD could jump higher.

Oil suddenly drops: This can hit CAD fast and lift EUR to CAD.

Big risk-off market move: If markets get nervous globally, CAD can weaken, and EUR to CAD can rise even if Europe is not the main story.

What This Means If You’re Sending EUR to CAD Abroad

If you are converting EUR to CAD, a lower EUR to CAD rate is worse for you, because each euro buys fewer Canadian dollars. Consider this if you're planning to send EUR/CAD:

If you can be flexible, consider splitting your transfer into 2 to 4 smaller parts across a few weeks, reducing the risk of converting on a bad day.

If you have a target rate in mind, ask your provider about a rate alert or limit order so you do not have to watch the market constantly.

Always compare the “real” rate you will get after fees, since small FX moves can be wiped out by wide spreads.

Live EUR to CAD exchange rates

Converting EUR to CAD

If you are planning to send EUR to Canada, you need to pick the right money transfer company to get the most CAD on the other end.

Depending on your needs, it's best to use one of the following companies in February:

Money transfer company | EUR/CAD exchange rate | EUR/CAD fee | EUR/CAD transfer time | CAD received |

|---|---|---|---|---|

Wise (Best EUR/CAD rate) | 1.6139 EUR/CAD | 31.26 | next day | 11,246.57 |

Key Currency (Lowest Fee) | 1.6099 EUR/CAD | 0 | minutes - 3 days | 11,269.27 |

Key Currency (Overall cheapest) | 1.6099 EUR/CAD | 0 | minutes - 3 days | 11,269.27 |

Currencyflow (Fastest Option) | 1.6097 EUR/CAD | 0 | minutes - 24 hours | 11,268.14 |

*Based on our data of 7,000 EUR transfer from Germany to Canada in February 2026. For other amounts, please .

History of the EUR to CAD Price

The euro to Canadian dollar pair is a forex cross-currency pair made up of the European Union and Canadian currencies.

The EU is the second-biggest economy in the world, with a combined GDP of over $16 trillion and a population of over 447 million people.

Canada, on the other hand, is the tenth largest economy with a GDP of over $1.6 trillion and 36 million people.

Canada and countries in the European Union have had a long relationship and share unique characteristics.

For example, they are both democracies and are members of key organizations like the OECD, G20, and G7.

The EUR/CAD pair was started in 2002 when the EU shifted to the euro.

Before that, trade was mainly dominated by the Canadian dollar and the respective currencies.

For example, Germany used the Deutsche mark currency.

For years, the EUR to CAD pair has been relatively stable. It reached a peak of 1.7507 in December 2008 and then moved to its all-time low of 1.2138, according to TradingView.

At its lowest point, the pair was about 30% below its all-time high. The pair has dropped by about 7.50% in the past five years and risen by ~10% from its lowest level in 2022.

| Date | 1 Euro in CAD |

|---|---|

| Feb 16, 2026 | 1.615924 CAD |

| Feb 17, 2026 | 1.616332 CAD |

| Feb 18, 2026 | 1.614628 CAD |

| Feb 19, 2026 | 1.610849 CAD |

| Feb 20, 2026 | 1.613498 CAD |

| Feb 21, 2026 | 1.613144 CAD |

| Feb 22, 2026 | 1.615280 CAD |

| Feb 23, 2026 | 1.615045 CAD |

| Feb 24, 2026 | 1.613245 CAD |

| Feb 25, 2026 | 1.613699 CAD |

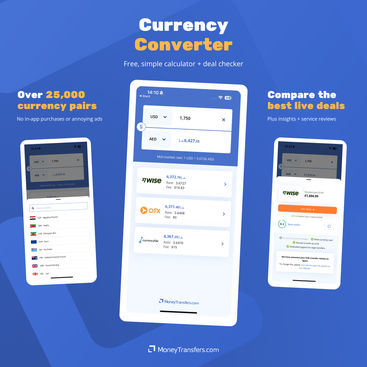

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors