USD to INR Forecast - March 2026

If you're planning to send money to India from the U.S., the exchange rate between the Indian Rupee (INR) and the U.S. Dollar (USD) is an important factor.

Here's a simple breakdown of where things stand right now, what might happen next, and how it could affect your transfers in the coming weeks.

USD/INR is currently trading at 92.074102.

Search Now & Save On Your Transfer

What is likely to happen to USD/INR in March 2026

USD to INR is likely to stay volatile next month, with a probable range of 89 to 91, and a real chance of spikes toward 91.5 to 92. RBI may limit extreme moves, but underlying pressure on INR from flows and dollar demand still matters.

For most senders, the most sensible plan is to split transfers over time rather than betting everything on one rate.

USD to INR: Where It Stands

Right now, USD to INR is trading around a historic zone after the rupee weakened past 90 per US dollar in December 2025. Since May, the rupee has fallen sharply, but it has also shown quick rebounds when the Reserve Bank of India (RBI) steps in.

For the next month, the most likely outcome is a choppy, back and forth market around 89 to 91, with sudden spikes possible.

What’s Driving USD to INR?

A few big things are pushing this pair around, and they matter more than day to day “news noise.”

1) Dollar demand is high in India: Importers, overseas payments, loan repayments, and outward remittances create steady buying of US dollars. This keeps pressure on the rupee even when it briefly improves.

2) Foreign investor money has been leaving India: Foreign portfolio investors have been pulling money out of Indian equities, which reduces demand for INR and supports a higher USD to INR rate.

3) Trade deficit and gold and oil effects: A wider trade deficit means India needs more dollars to pay for imports. If crude oil prices rise, that typically weakens INR because India imports a lot of oil.

4) RBI is smoothing the ride: The RBI has shown it will act to reduce extreme moves, especially near big psychological levels like 90 and 91. That usually creates sharp pullbacks, but not always a long lasting reversal.

What Do the Charts Say?

This market is treating 90 as the main “battle line.” When USD to INR holds above 90, the bias stays slightly in favor of a stronger dollar.

Key levels to know:

Level | Why it matters | What it could mean |

|---|---|---|

89.45 to 89.85 | Key support zone | Below this, INR recovery could extend |

90.00 | Psychological pivot | Above it, USD stays supported |

91.25 | Major resistance | Break above can pull in momentum buying |

91.50 to 92.00 | Next upside zone | Possible spike area if pressure returns |

Most signs point to range trading with an upside tilt unless USD to INR falls and stays below roughly 89.5.

What to Watch in the Next Month

These are the things most likely to move your exchange rate.

RBI intervention signals: sudden drops from 91 toward 90 can happen quickly if RBI sells dollars.

US inflation and Fed rate expectations: a stronger US data print can lift the dollar broadly, pushing USD to INR higher.

Oil prices: higher oil usually hurts INR.

Foreign investor flows: if outflows slow or reverse, INR can stabilize or strengthen.

Risks Ahead

The biggest risk is sudden volatility around round numbers:

Upside risk (USD to INR goes higher):If foreign outflows continue, oil rises, or US data boosts the dollar, USD to INR could test 91.5 to 92.

Downside risk (USD to INR drops):If RBI support becomes more aggressive or global dollar strength fades, USD to INR could slip toward 89.5, and if that breaks, toward 88.5.

What This Means If You’re Sending USD to INR Abroad

If you are converting USD to INR, a higher USD to INR rate means you get more rupees for each dollar.

Given the expected choppiness, trying to pick the perfect day is risky. A simple, practical approach many people use is staggering:

Convert 50 to 60 percent now (locking in today’s high-ish levels near 90).

Convert the rest in 2 to 4 smaller transfers over the next month.

This helps if the rupee suddenly strengthens after RBI action, and it also helps if USD to INR spikes higher later.

Live USD to INR exchange rates

Converting USD to INR

If you are planning to send USD to India, you need to pick the right money transfer company to get the most INR on the other end.

Depending on your needs, it's best to use one of the following companies in March:

.svg)

History of the USD to INR

The US and India are among the biggest economies in the world in terms of GDP.

The US has a combined GDP of over $23 trillion while India recently overtook the UK to become the fifth biggest economy in the world after the US, China, Japan, and Germany.

India has a GDP of over $3.5 trillion as of 2022.

The USD to INR is therefore an important currency cross because of the vast volume of trade that happens between the two countries.

This volume started growing in the 1990s when India started to reopen its economy.

While India’s economy has been growing, its currency has been in a downward trend over the years.

Today, it is trading at about 82 against the US Dollar.

The Indian rupee has dropped by 28% in the past five years against the U.S. dollar.

It has also dropped by about 9% in the past 12 months even after the Federal Reserve and the Reserve Bank of India (RBI) have embraced an extremely hawkish tone.

The USD/INR pair is often influenced by a number of factors, including the actions of the Fed and RBI, economic numbers between the two countries, and global macro factors.

It is also affected by the overall trade volume between the US and India, which averages over $146 billion per year.

| Date | 1 US Dollar in INR |

|---|---|

| Feb 23, 2026 | 91.020350 INR |

| Feb 24, 2026 | 90.918250 INR |

| Feb 25, 2026 | 90.951250 INR |

| Feb 26, 2026 | 91.007650 INR |

| Feb 27, 2026 | 91.080850 INR |

| Feb 28, 2026 | 91.076504 INR |

| Mar 01, 2026 | 91.079850 INR |

| Mar 02, 2026 | 91.563650 INR |

| Mar 03, 2026 | 92.008850 INR |

| Mar 04, 2026 | 92.074102 INR |

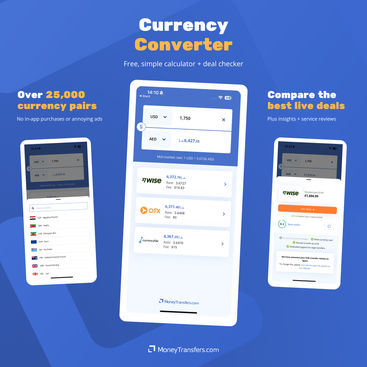

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors