USD to AUD Forecast - March 2026

If you're planning to send U.S. dollars (USD) to Australia this month, here’s a straightforward breakdown of what’s happening in the currency markets, and what it might mean for your transfer.

USD/AUD is currently trading at 1.416511

Search Now & Save On Your Transfer

What is likely to happen to USD/AUD in March 2026

USD to AUD is likely to be volatile next month, with a gentle lean toward AUD staying firm unless US data strongly revives USD strength. If you are transferring money, use staged transfers and watch the 0.6700 and 0.6600 zones as the key “decision points” for direction.

USD to AUD: Where It Stands

Right now, the USD to AUD rate is sitting near an important turning point. The Australian dollar has recently strengthened, meaning one US dollar has been buying fewer Australian dollars than it did a few weeks ago.

Over the next month, the most likely outcome is a choppy, event driven range rather than a smooth trend. Small headlines can move this pair quickly.

Working assumption for the next month: mild bias toward a lower USD to AUD rate (a slightly stronger AUD), but with frequent pullbacks.

What’s Driving USD to AUD?

A few big things are doing most of the work here.

1) Interest rate expectations (Fed vs RBA): If the US Federal Reserve is seen cutting rates sooner or more than expected, the USD often softens. If the Reserve Bank of Australia stays firm and sounds worried about inflation, the AUD can hold up better.

2) Risk appetite (markets feeling confident or nervous): The AUD is a “risk friendly” currency. When global shares are rising and investors feel confident, AUD often benefits and USD can lose its safe haven bid.

3) China and commodities: Australia’s economy is closely linked to commodity demand and China’s growth. Softer China data can weigh on AUD, while stable iron ore and commodity prices can support it.

What Do the Charts Say?

The pair (AUD/USD) has recently rallied but is now running into heavy resistance. That often leads to a pause or a pullback before the next move.

Because USD to AUD is the inverse of AUD/USD, think of it like this: if AUD/USD struggles to rise further, USD to AUD may bounce higher in the short term.

Key levels to know (AUD/USD):

Level | Why it matters | What it implies for USD to AUD |

|---|---|---|

0.6700 to 0.6723 | Major resistance zone | If AUD breaks above, USD to AUD likely falls |

0.6653 to 0.6670 | Pivot resistance | Failure here can lift USD to AUD temporarily |

0.6625 to 0.6600 | Near term support | Holding here keeps AUD supported |

0.6580 to 0.6570 | Line in the sand support | Break below can push USD to AUD up faster |

0.6500 | Big psychological level | A drop toward here would mean a noticeably better USD to AUD rate |

What to Watch in the Next Month

Several scheduled events can quickly change USD/AUD direction.

US jobs and inflation data: Strong numbers can boost USD and improve USD to AUD for buyers. Weak numbers can do the opposite.

Fed messaging: Markets will react to whether the Fed signals fewer or more rate cuts ahead.

RBA tone: Even if rates do not change, a “tough on inflation” message tends to support AUD.

Equity markets: A year end lift in shares can support AUD and reduce USD to AUD.

Risks Ahead

A few things could change the “mild AUD strength” outlook:

A surprise hawkish Fed shift: USD could rebound quickly.

China growth worries returning: AUD can drop if markets get nervous about China demand.

Crowded AUD positioning: After a strong run, even good news can trigger profit taking, causing sudden reversals.

What This Means If You’re Sending USD to AUD Abroad

If you need to buy AUD with USD (sending money to Australia), consider splitting your transfer into 2 to 4 parts over a few weeks to reduce the risk of picking a bad day.

Watch the 0.6700 area in AUD/USD. If AUD breaks higher, USD to AUD usually gets worse, so acting earlier may help.

If you can wait for a potentially better USD to AUD rate, a pullback in AUD/USD toward 0.6580 to 0.6500 would typically mean more AUD per USD.

Be ready for sudden swings around US data days and central bank speeches.

Also remember, the rate you see online is not always the rate you get. Providers add fees and a margin, so compare quotes.

Live USD to AUD exchange rates

Converting USD to AUD

If you are planning to send USD to Australia, you need to pick the right money transfer company to get the most AUD on the other end.

Depending on your needs, it's best to use one of the following companies in March:

Money transfer company | USD/AUD exchange rate | USD/AUD fee | USD/AUD transfer time | AUD received |

|---|---|---|---|---|

Wise (Best USD/AUD rate) | 1.4297 USD/AUD | 26.68 | same day | 9,969.69 |

Key Currency (Lowest Fee) | 1.4260 USD/AUD | 0 | minutes - 3 days | 9,982.25 |

Key Currency (Overall cheapest) | 1.4260 USD/AUD | 0 | minutes - 3 days | 9,982.25 |

Wise (Fastest Option) | 1.4297 USD/AUD | 26.68 | same day | 9,969.69 |

*Based on our data of $7,000 transfer from the USA to Australia in March 2026. For other amounts, please .

History of the USD to AUD pair

The US and Australia have had a friendly relationship and have always done trading with each other. In the past, the US dollar and the Australian pound were used for trading.

However, in February, Australia moved from the pound and introduced the Australian dollar, commonly known as the AUD.

The ISO standard for the Australian dollar and the US dollar is AUD/USD.

The USD/AUD pair has had its lows and downs over the years. Between 1980 and 2001, the pair jumped by 148% as it moved from a low of 0.8476 to a high of 2.10.

It then declined by ~56% from its highest level in 2001 to a low of 0.9101 in August 2011.

Since then, the pair has been in an overall upward trend. It has risen by about 15% in the past five years.

The Australian dollar is usually affected by a number of factors.

First, it is affected by the overall commodity prices since Australia is well-known for its vast natural resources, which include coal, copper, and iron ore.

Second, the Chinese economy plays a huge role in the Australian economy because of the vast volume of trade that happens between the two countries.

According to Lowy Institute, China buys more than two-thirds of all commodities that Australia produces.

Further, like other currency pairs, USD/AUD pair reacts to geopolitics and actions by the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed).

| Date | 1 US Dollar in AUD |

|---|---|

| Feb 23, 2026 | 1.416350 AUD |

| Feb 24, 2026 | 1.416631 AUD |

| Feb 25, 2026 | 1.404465 AUD |

| Feb 26, 2026 | 1.408163 AUD |

| Feb 27, 2026 | 1.406074 AUD |

| Feb 28, 2026 | 1.407460 AUD |

| Mar 01, 2026 | 1.416910 AUD |

| Mar 02, 2026 | 1.407351 AUD |

| Mar 03, 2026 | 1.420374 AUD |

| Mar 04, 2026 | 1.416511 AUD |

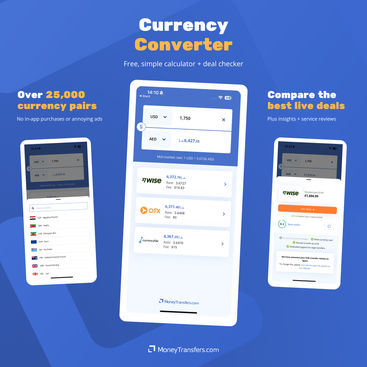

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors