USD to PHP Forecast - February 2026

If you're planning to send U.S. dollars to the Philippines this month, here’s a clear breakdown of what’s happening with the exchange rate in February 2026 and what it could mean for your wallet.

USD/PHP is currently trading at 57.577009.

Search Now & Save On Your Transfer

What is likely to happen to USD/PHP in February 2026

USD to PHP is near record highs because the peso is under pressure from rate cut expectations and US dollar resilience. Over the next month, expect choppy trading around 59, with Fed and BSP signals deciding whether USD pushes higher or the peso gets short-term relief.

USD to PHP: Where It Stands

Right now, the peso is weak and the US dollar is expensive. USD to PHP has been trading around the high 58s to low 59s, with recent prices pushing to fresh record lows for PHP near 59.22 per $1.

That means sending USD to the Philippines currently converts into more pesos than usual, but the rate is also moving quickly around big policy events.

What’s Driving USD to PHP?

Two central banks are shaping the next month: the US Federal Reserve (Fed) and the Bangko Sentral ng Pilipinas (BSP).

Markets expect the Fed to cut rates by about 0.25%, but the bigger question is what the Fed says about further cuts after that.

If the Fed signals fewer cuts ahead (more cautious tone), the dollar can stay strong, keeping USD to PHP elevated. If the Fed sounds more open to easing, the dollar may soften, helping the peso recover.

On the Philippines side, expectations of a BSP rate cut are pressuring the peso because lower local interest rates make PHP less attractive to global investors. Even if cuts are small, the expectation alone can weaken PHP.

Seasonally, OFW remittances and holiday conversions can increase USD selling and PHP buying, which can temporarily support the peso later in the month.

What Do the Charts Say?

The pair has been in a clear upward trend, meaning USD has been rising versus PHP. A fresh break to record highs tells us momentum is still favoring the dollar unless a major catalyst flips sentiment.

Key USD/PHP levels to watch:

Level | Why it matters |

|---|---|

59.00 | Psychological pivot. Above it, USD strength feels “confirmed.” |

59.05 to 59.35 | Near-term trading band where price has been clustering. |

59.30 to 59.35 | Stress zone. A break above can trigger another fast jump. |

58.80 to 58.85 | First support area. Falling below suggests peso relief. |

What to Watch in the Next Month

First, watch Fed messaging. The cut itself is expected, but the tone can move USD to PHP quickly within hours.

Second, watch the BSP decision and guidance. If BSP cuts as expected and signals more easing, PHP could weaken again.

Third, look for late-month seasonality. Strong remittance conversions can slow or reverse USD to PHP gains for short periods, even if the bigger trend still favors USD.

Base case for the next month: USD to PHP likely stays elevated, with a working range around 58.80 to 59.50, leaning slightly higher unless the Fed turns clearly more dovish than expected.

Risks Ahead

Fed surprise: If the Fed sounds hawkish, USD can jump and push USD to PHP above 59.35.

BSP bigger cut: A larger than expected BSP cut could weaken PHP quickly.

Thin liquidity days: Around policy events, sudden spikes are more common and rates can overshoot.

Holiday support fades: Remittance support can be temporary and may not last into the next cycle.

What This Means If You’re Sending USD to PHP Abroad

If you are sending USD to the Philippines, a higher USD to PHP rate means your recipient gets more pesos for the same dollars. The current environment is generally favorable for senders, but timing matters because swings can be sharp.

Before sending USD/PHP, consider this:

If you can wait, consider splitting your transfer into 2 to 3 smaller sends across a couple of weeks to reduce bad timing risk.

If USD to PHP spikes into 59.30 to 59.50, that is a strong window to consider sending.

Always compare providers because the “online rate” is not what you actually get after fees and markups.

Live USD to PHP exchange rates

Converting USD to PHP

If you are planning to send USD to the Philippines, you need to pick the right money transfer company to get the most PHP on the other end.

Depending on your needs, it's best to use one of the following companies in February:

History of the USD/PHP pair

The US and the Philippines have a long economic and social relationship.

After going through a major war between 1899 and 1902, the two countries maintained a cordial relationship over the years and do trade worth billions of dollars.

According to the Trade Department, the Philippines is the 31st goods trading partner of the US, with a total volume being over $18 billion.

The USD/PHP cross is classified as a minor pair since the Philippines is not classified as a developed country.

The USD to PHP pair has been traded for many years; however, the Philippine Peso became a free-floating currency in 1993.

At the time, the USD/PHP exchange rate was trading at 26.46. The pair has been on an upward trajectory since then and reached a high of 55.9 in 2023.

In other words, the Philippine Peso has crashed by over 100% since 1993 as the dollar dominance has gained.

Between its lowest and highest points, the pair has jumped by 151%.

As shown above, the Philippine Peso had a strong run between 2005 and 2008, at the time of the Global Financial Crisis (GFC) and the USD/PHP pair crashed to ~40.

Since then, the pair has done well and has risen by over 46%.

This happened because many investors and businesses moved to the US dollar and other foreign currencies like the euro and Swiss franc.

It then jumped during the Covid-19 pandemic as jitters spread in the emerging market and the Philippines economy plunged to $361.75 billion.

The economy expanded to $394 billion in 2022 and is expected to remain stable.

| Date | 1 US Dollar in PHP |

|---|---|

| Feb 16, 2026 | 57.994975 PHP |

| Feb 17, 2026 | 57.810147 PHP |

| Feb 18, 2026 | 58.039652 PHP |

| Feb 19, 2026 | 58.105003 PHP |

| Feb 20, 2026 | 57.958504 PHP |

| Feb 21, 2026 | 57.958504 PHP |

| Feb 22, 2026 | 57.958498 PHP |

| Feb 23, 2026 | 57.685006 PHP |

| Feb 24, 2026 | 57.659019 PHP |

| Feb 25, 2026 | 57.577009 PHP |

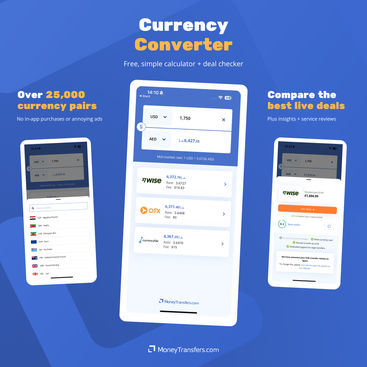

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors