EUR to TRY Forecast - March 2026

The euro (EUR) has reached an all-time high against the Turkish lira (TRY), and it may stay strong in the coming weeks.

If you’re sending money from Europe to Turkey, this is a highly favorable time. And, if you’re sending money from Turkey to Europe, it could be worth waiting, as the exchange rate is less favorable.

EUR/TRY is currently trading at 51.162213.

Search Now & Save On Your Transfer

What is likely to happen to EUR/TRY in March 2026

EUR/TRY is strong and near 50, with the trend still upward but prone to short pullbacks.

Over the next month, the most likely path is 49 to 50+, and your main risk is sudden volatility around policy news and the 50 level. Splitting transfers can help you avoid getting unlucky on a single bad day.

EUR to TRY: Where It Stands

EUR/TRY is trading close to multi year highs, sitting around 49.7 and pressing up against the big, round 50 level. The broader move has been steady for months, meaning one euro has been buying more Turkish lira over time.

For the next month, the most likely base case is a choppy move around the 49 to 50 area, with a slight bias for further EUR/TRY strength unless Türkiye delivers a clear policy surprise that supports the lira.

What’s Driving EUR to TRY?

Here is what’s currently driving EUR/TRY: 1) Türkiye’s inflation and interest rate directionInflation is easing but still very high at roughly 31 to 32%. The policy rate is still high too, but it has already been cut to about 39.5%, and markets remain sensitive to whether more cuts are coming soon.

If investors believe rates will be cut faster than inflation falls, they tend to lose confidence in the lira, which usually pushes EUR/TRY higher.

2) Global money flows and the euro’s toneLower US rates can encourage more risk taking globally, but Türkiye does not automatically benefit if investors still see high uncertainty. Meanwhile, the euro can get support or lose support based on European Central Bank messaging, even if the ECB does not change rates.

What Do the Charts Say?

The trend is still up, with EUR/TRY trading above its major moving averages. At the same time, momentum looks overheated, which often means short pullbacks can happen even inside an uptrend.

Key levels to know (next month):

Level type | Zone | Why it matters |

|---|---|---|

Resistance | 49.66 to 50.05 | Major pivot area and the psychological “50” barrier |

Support | 48.97 | First area where buyers may step back in |

Support | 48.32 | Near an important trend indicator (100 day average) |

Deeper support | 45.92 | Longer term trend support (200 day average) |

If EUR/TRY breaks and holds above 50, it can quickly become the new normal range. If it fails at 50, a pullback toward 49.0 or 48.3 becomes more likely.

What to Watch in the Next Month

The events and signals that could move EUR/TRY exchange rate.

Türkiye central bank signals: Any hint of faster rate cuts can weaken TRY. Any hint of staying tighter for longer can support TRY.

Inflation expectations and confidence: If people and markets believe inflation will fall sustainably, TRY can stabilize.

Risk sentiment headlines: Political or financing worries can trigger quick EUR/TRY jumps.

Risks Ahead

Here are some risks that can turn the rate around:

50 level volatility: Big round numbers often create sharp swings as many orders cluster there.

Policy surprise risk: Even one unexpected decision on rates or FX management can shift the market fast.

Crowded expectations: Many traders are positioned against the recent move, which can amplify spikes if EUR/TRY keeps rising.

What This Means If You’re Sending EUR to TRY Abroad

If you are sending EUR to Türkiye, a higher EUR/TRY means your recipient gets more lira for the same euros. With EUR/TRY near 50 but looking stretched, you may want to reduce timing risk.

If you’re sending EUR/TRY, consider this:

If your transfer is flexible: Consider splitting into 2 to 4 smaller transfers over the month.

If you see EUR/TRY near 50: That may be a good window to send at least part, because 50 is a key target area.

If it drops toward 49.0 or 48.3: That is a typical pullback zone where the rate may improve again later, but there is no guarantee.

Live EUR/TRY exchange rates

Converting EUR to TRY

If you are planning to send EUR to Turkey, you need to pick the right money transfer company to get the most TRY on the other end.

Depending on your needs, it's best to use one of the following companies in March:

Money transfer company | EUR/TRY exchange rate | EUR/TRY fee | EUR/TRY transfer time | TRY received |

|---|---|---|---|---|

Wise (Best EUR/TRY rate) | 51.0284 EUR/TRY | 37.81 | within an hour | 11,064.2 |

Key Currency (Lowest Fee) | 50.9028 EUR/TRY | 0 | minutes - 3 days | 356,319.73 |

Key Currency (Overall cheapest) | 50.9028 EUR/TRY | 0 | minutes - 3 days | 356,319.73 |

Wise (Fastest Option) | 51.0284 EUR/TRY | 37.81 | within an hour | 355,269.42 |

*Based on our data of 7,000 EUR transfer from the Spain to Turkey in March 2026. For other amounts, please .

History of the EUR to TRY pair

The euro to Turkish lira is a relatively popular cross-currency pair, thanks to the close relationship between the European Union and Turkey.

Both countries play an important role in the global economy since they are members of the North Atlantic Treaty Organisation (NATO).

Turkey’s geographical location also plays a crucial role in the economy because one part of the country is in the Middle East while the rest is in continental Europe.

As such, Turkey always had strong economic and social ties with European countries.

The EUR to TRY cross-currency pair was created when the European Union shifted to the Euro.

Before that, trade between Turkey and European countries used to happen with their local currencies.

Spain had Peseta while Germany, Italy, and France had Deutsche Mark, Italian lira, and French franc, respectively.

The overall trend of the EUR/TRY since its foundation has been upward as the Turkish lira has continued losing its value against most currencies.

| Date | 1 Euro in TRY |

|---|---|

| Feb 23, 2026 | 51.716069 TRY |

| Feb 24, 2026 | 51.643207 TRY |

| Feb 25, 2026 | 51.831599 TRY |

| Feb 26, 2026 | 51.883226 TRY |

| Feb 27, 2026 | 51.907694 TRY |

| Feb 28, 2026 | 51.902806 TRY |

| Mar 01, 2026 | 51.701114 TRY |

| Mar 02, 2026 | 51.428864 TRY |

| Mar 03, 2026 | 51.035998 TRY |

| Mar 04, 2026 | 51.162213 TRY |

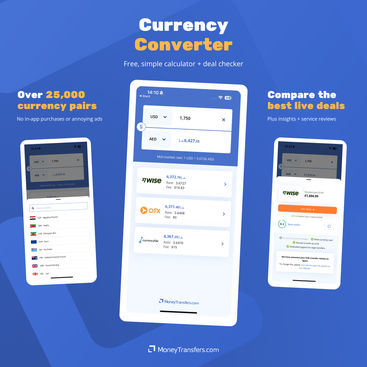

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors