USD to COP Forecast - March 2026

Right now, in July 2025, 1 U.S. dollar buys more Colombian pesos (COP) than it did earlier this year. It is currently trading at 3790.44.

The Colombian peso has weakened significantly since mid-2024, and that trend may continue into July.

This means your dollars could stretch even further in the coming weeks if you're sending money to Colombia.

Search Now & Save On Your Transfer

What is likely to happen to USD/COP in March 2026

USD to COP is near 3,770 and the next month looks range bound with a mild upward bias.

Oil softness and a firmer global dollar are the main reasons. For senders, better USD to COP spikes may appear near 3,850 to 3,900, while 3,700 is the key level that would signal a stronger peso.

USD to COP: Where It Stands

After a softer Colombian peso session, USD to COP is sitting near 3,770. That means it now takes about 3,770 pesos to buy 1 US dollar, and the near term tone has tilted slightly in favor of the dollar.

For the next month, the most likely base case is sideways to mildly higher USD to COP, unless oil prices rebound meaningfully or global risk sentiment improves.

What’s Driving USD to COP?

A few big forces are shaping the peso right now, and they mostly come from outside Colombia.

1) The US dollar’s mood matters a lot.

When the global dollar is firmer, emerging market currencies like COP often weaken because investors prefer safety and liquidity.

2) Oil prices are a key peso driver.

Colombia is closely linked to oil through exports and government revenues. Recent expectations for softer oil prices reduce support for COP, which can push USD to COP higher.

3) Colombia is getting some positive inflows, but they are gradual.

Policies like incentives that attract foreign spending (for example, international productions paying local costs) can bring hard currency into Colombia. This helps the peso, but it tends to be slow moving, not a quick fix in one month.

What Do the Charts Say?

Price action is showing COP weakness, with USD to COP pushing higher recently.

Key levels to keep in mind are simple “floors and ceilings” where the market often stalls:

Level | Why it matters | What it could mean |

|---|---|---|

3,700 support | Recent area where USD struggled to stay above | If broken, COP could strengthen quickly |

3,770 to 3,800 zone | Current battle area | Choppy moves likely here |

3,850 resistance | A common “next ceiling” if USD keeps rising | A break above can accelerate USD gains |

3,900 psychological level | Big round number traders watch | Can attract headlines and volatility |

What to Watch in the Next Month

A few near term signals are likely to decide direction:

Weekly oil inventory and crude price trends: Soft oil usually means a softer peso.

Global risk appetite: If markets feel cautious, COP often loses ground.

Any sharp moves in Colombian energy names: Strength in oil related assets can sometimes cushion COP weakness.

Expected path of 3,720 to 3,850 is a reasonable working range for the month, with a slight bias toward testing the upper half if oil stays heavy.

Risks Ahead

Even in a “normal” month, USD to COP can move fast. Main risks are:

Oil drops faster than expected: Could push USD to COP toward 3,850 to 3,900.

Sudden risk off wave globally: Emerging market currencies can weaken quickly.

A surprise oil rally: Could strengthen COP and drag USD to COP back toward 3,700.

What This Means If You’re Sending USD to COP Abroad

If you are sending USD into COP, a higher USD to COP rate helps you because your dollars convert into more pesos.

If the rate approaches 3,850 to 3,900, that is generally a more favorable window to send USD.

If the rate falls toward 3,700, you may receive fewer pesos per dollar, so consider sending earlier or splitting transfers.

A simple strategy is to split your transfer into 2 or 3 parts over a few weeks, especially while the pair is swinging inside a wide range.

Live USD to COP exchange rates

Converting USD to COP

If you are planning to send USD to Colombia, you need to pick the right money transfer company to get the most COP on the other end.

Depending on your needs, it's best to use one of the following companies in March:

History of the USD to COP pair

The history of the USD to COP exchange rate can be traced from the historical ties between the US and Colombia.

The records show that Colombia initially used the Spanish real until 1820 and moved to Colombia real post-1820 till 1837.

After 1837, the Colombian Peso became the primary unit of currency.

At that time, Colombia was involved in trading activities with the US. The US dollar was introduced in 1792 when the US Mint started operations.

A lot has happened since the early days of the USD/COP exchange rate, including the end of the gold standard in 1971.

As shown below, the USD to COP pair has generally been in a strong bullish trend over the years.

The only time when the Colombian Peso strengthened against the US dollar was between 2002 and ~2012.

This period coincided with the end of the dot com bubble and the Global Financial Crisis (GFC) of 2008/2009.

Since 2012, the USD to COP pair has been in a broadly upward trend that saw a rise from a low of ~1,650 to over 5,000.

| Date | 1 US Dollar in COP |

|---|---|

| Feb 23, 2026 | 3693.690000 COP |

| Feb 24, 2026 | 3711.860000 COP |

| Feb 25, 2026 | 3699.440000 COP |

| Feb 26, 2026 | 3766.040000 COP |

| Feb 27, 2026 | 3761.680000 COP |

| Feb 28, 2026 | 3758.873049 COP |

| Mar 01, 2026 | 3758.873049 COP |

| Mar 02, 2026 | 3772.550000 COP |

| Mar 03, 2026 | 3803.010000 COP |

| Mar 04, 2026 | 3790.440000 COP |

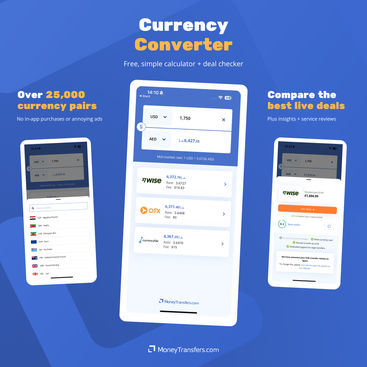

Our handy, modern currency app lets you:

Instantly convert 25,000+ currency pairs

Compare live transfer deals

Get reviews & insights

Our app is free for mobiles and tablets, with no intrusive ads or in-app purchases.

Related Content

Contributors