Compare the best ways to send money to Libya

Get the best deals when you transfer money to Libya. Find the cheapest, fastest, and most reliable providers with the best LYD exchange rates.

Read on for the best LYD deals, expert information, and all you need to transfer money to Libya.

Send money to Libya

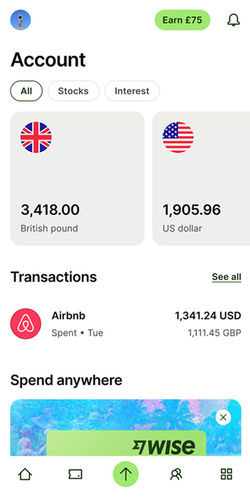

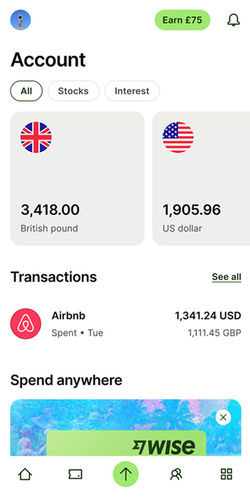

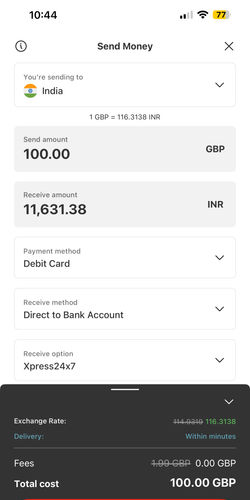

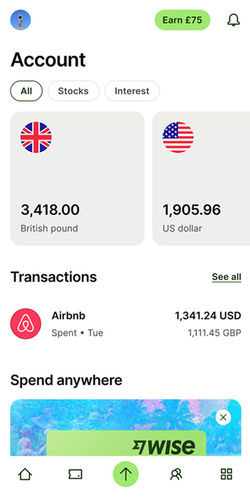

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

How to get the best rate when sending money to Libya

Always compare rates

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates on LYD transfers.

Choose a provider

Select the provider that offers you the most LYD and fits your transfer needs.

Click, sign up & send

Follow the steps & make your transfer. Your transfer to Libya will soon be on its way.

We found Wise to be the best way to send money to Libya.

After testing and reviewing 2 money transfer providers servicing Libya, Wise came out on top.

Wise offers quick transfers, adds a 0.76% markup on LYD transfers, and costs $60.74 in fees.

This makes it the best option for a mix of cost, speed & features for LYD transfers.

Cheapest way to send money to Libya: Wise

If you want to make the most of your LYD transfer, the cheapest way is to use Wise and pay for your transfer with a bank transfer.

With just $60.74 in fees and 0.76% markup, Wise is 7.36% cheaper than the next best option.

With Wise, if you were to send 7,000 USD to LYD, your recipient would get 43,627.82 Libyan Dinar, this is more than with other providers on our list.

*Based on 7,000 USD transfer.

The fastest way to send money to Libya: MoneyGram

Based on a $7,000 transfer and our comparison data for LYD transfers, MoneyGram is the quickest option for sending LYD to Libya.

With MoneyGram, the transfer time to Libya is minutes - 24 hours.

They charge $490.00000000000006 in fees and apply a 2% markup on the ‘real’ LYD rate. This is 0% cheaper than the second-best provider.

For the best balance between speed and cost, we suggest using a deposit for Libyan Dinar transfers.

The easiest way to send money to Libya: Wise

They offer transparent fees, charging $60.74 per transfer with 0.76% markup added to the LYD rate.

Getting started with Wise takes less than 3 minutes, making it a fast, affordable, and user-friendly choice for sending Libyan Dinar.

Consider this before sending money to Libya

Don't settle for the first option. Always compare ways to send money to Libya to find out about fees, speed, and reliability.

Our analysis included 2 providers that operate in Libya.

Through this, you get a comprehensive view of all the options you have when sending money to Libya.

Need to send over $10,000?

For transfers over $10,000, your best bet is Wise.

While Wise may not always be the cheapest or fastest way to send LYD, but they offer the best exchange rate, years of experience, and will offer you the peace of mind you need when sending large amounts abroad.

Understand the costs of money transfers to Libya

The cost of sending LYD depends on where you're sending from, the amount of LYD sent, deposit and delivery methods, transfer fees, and the markup applied to the LYD mid-market rate.

For example, if you're transferring $7,000 from the US to Libya, you can expect the following:

Transfer fees to Libya

Depending on the service you use to send Libyan Dinar, transfer fees can be percentage-based, fixed, or a combination of both.

Wise charges only $60.74 per transfer based on our analysis of 2 services supporting LYD transfers in February 2026.

Markup on LYD exchange rate

A markup is a percentage added to the LYD mid-market rate by a money transfer service (or a bank).

Wise offers the best LYD exchange rates by applying a 0.76% markup on the USD-LYD rate. This means for every US Dollar sent, you receive 6.3087 LYD minus 0.76% deducted from it.

Funding transfer to Libya

How you fund your transfer to Libya can impact the cost:

Bank transfers typically have the lowest fees, often costing up to $60.74 per transfer.

Debit cards may cost up to $ per transfer.

Credit cards may come with cash advance fees and increased rates.

Overall, bank transfer is the cheapest funding method for LYD transfers.

Get the best LYD exchange rate

The exchange rate is the value of the LYD (Libyan Dinar) against other currencies, and since it fluctuates, it will affect how much LYD the recipient will get. Sending money when LYD reaches the highest value will result in more LYD for your recipient.

Over the past 7 days, the LYD exchange rate has:

Averaged at 6.3087 Libyan Dinar per USD

Reached a high of 6.3352 LYD/USD

Dropped to a low of 6.296 LYD per US Dollar

You should aim to make a transfer when the rate is closer to 6.3352 LYD/USD . This will give your recipient in Libya more Libyan Dinar.

Pair your transfer with Wise (who offers the best exchange rate), and you will maximize the amount of LYD received.

Get notified when it’s the best time to send LYD

Sign up for our rate alerts, and we’ll notify you when it’s the best time to send LYD!

Payment methods available for money transfers to Libya

The way you fund your transfer to Libya will impact the speed, cost, and amount of LYD your recipient receives.

Bank transfers

Bank transfer deposits are a common and reliable funding method for sending LYD, offered by most services covering Libya.

While bank transfers are typically more affordable, it may take up to 3 business days for the LYD to arrive in Libya.

In our testing of 2 providers, Wise appeared as the cheapest option for bank transfers to Libya, charging $60.74 per transfer with a 0.76% markup (7.36% cheaper than the next cheapest money transfer company).

Avoid using wire transfers to Libya over the SWIFT network, as they are slower and more expensive due to the bank intermediaries on the way to Libya. Instead, choose ACH or your local network option.

Credit cards

A credit card deposit is another option for LYD transfers.

Based on our comparison of 2 companies serving Libya, there are a few available options.

To get the best deal, we as CC transfer fees and rates can vary a lot depending on where you are.

CC deposits are usually more expensive when sending Libyan Dinar, so if you can, opt for a bank transfer deposit or a debit card deposit.

Money transfer to Libya is an international transaction.

Your credit card company may apply a cash advance fee and higher interest rates for international payments to Libya. We recommend avoiding credit cards when sending money to Libya.

Debit and prepaid cards

Debit cards are typically faster but more expensive than bank deposits, with most LYD transfers completed within a few hours.

We recommend using for debit or prepaid card deposits.

With , you’ll pay a % markup on the LYD rate and $ in fees when depositing money via the card. This is % cheaper than using the next cheapest option for transferring money to Libya.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in Libya.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to Libya.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to Libya

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Libya

Send money to Libya

FAQs

Find answers to the most common questions on our dedicated FAQ page.

Are there tax implications when sending money to Libya?

Are there any limits on how much LYD I can send to Libya?

Can I make regular LYD transfers/payments to Libya?

How long does it take to transfer money to Libya?

What are the fees and exchange rates for sending LYD from abroad?

Why can’t I use my bank to wire money to Libya?

What is the official currency used in Libya?

Can I transfer money to Libya from any country?

What should I do if something goes wrong with my transfer to Libya?

Can I use MoneyTransfers.com to transfer funds to Libya?

Tools & resources

Contributors