Equals Money international business offering

Features | Insight |

|---|---|

Monthly Fee | No monthly fees for international payments customers (from £25 for cards & expenses platform) |

Exchange rate | Agreed during onboarding |

International transfer fees | No fees for international payments |

Multi-currency account | ✅ (35 supported currencies) |

Multi-currency account rates & fees | Mastercard rates (and 1.5% fee for unsupported currencies) |

IBAN accounts | 1 IBAN account |

Batch payments | ✅ (10,000 payments at a time) |

Expense management and tracking | ✅ |

Pay invoices | ✅ |

Receive payments | ✅ |

Marketplace integration | ❌ |

API options | ✅ |

Manage payroll | ✅ |

Forward contracts | ✅ (24 months) |

ATM access | ✅ (within limit) |

Scoring Equals Money

Before going into more details, here’s a quick summary of the benefits and drawbacks of Equals Money.

Pros

Cons

Product offering

Equals Money provides a well-rounded product that covers most needs for UK and EU-based SMEs dealing with international payments, expense management, and multi-currency operations.

While a few competitors like Airwallex offer broader features or deeper integrations, the core tools here are polished and robust.

Fees and rates

Transfer speed

Transfer limits

Ease of use

Safety and trust

Customer feedback

Product offering

Equals Money product offering

Equals Money is mostly suitable for UK businesses making cross-border payments, but they are rapidly expanding across Europe and the US.

In this review, I’m mainly going to focus on the UK offering, but will touch on the other countries as well.

Currently, Equals Money offers services to businesses in the UK, the US, Spain, France, and the Netherlands.

They offer all the services and features your business will need, and are on par with competitors like Sokin, Wise Business, and Airwallex.

Multi-currency account

Equals Money offers a generous multi-currency account supporting 35+ currencies, meaning you can hold balance in your account in these currencies.

Business can manage all 35+ with a single local IBAN number, meaning you can easily receive payments directly onto your account.

This is not the biggest coverage, but better than many competitors.

If you do need more coverage and more local accounts, Sokin offers over 75 currencies, while Wise Business has 29 local accounts (and not just IBANs).

In addition, 21 of the currencies can be converted at the Mastercard exchange rate, for prepaid cards customers.

However, for customers solely using the platform for international payments, 35+ currencies can be transferred at favourable rates and agreed with Equals Money on transfer.

Again, this is very competitive, for example, Wise Business charges transfer fees from 0.33% per transfer.

If your business deals in the supported currencies (outlined below), you will get a better deal with Equals Money, if you need a bigger coverage, there are better alternatives.

Here’s a breakdown of supported currencies.

Cards customers pay transaction fees on currencies outside of the 21, however international transfers are fee-free.

Business Prepaid Card customers that make card transactions in any other currency, outside of the 21 card-supported currencies will be charged an additional fee of 1.5%.

In addition, you can make wire payments to 137 currencies (including more exotic ones), but again, outside of the supported ones, you will be charged a 1.5% fee as mentioned above.

Spend management software

Just like other cross-border platforms, Equals Money offers a dedicated platform for managing your company expenses.

Within the platform, you can:

Manage users and set granular controls

Prevent unauthorised spending

Create and manage individual and shared cards

Create physical and virtual cards

Set card limits

Add and manage recipients

Make batch payments

Set up integrations with Xero and SAP Concur

Set and manage balances

Make and request payments

View, export, and annotate transactions

Receive low balance alerts

Off-ramp USDC

And much more.

This is a fairly standard offering with exception of a few points (e.g. converting USDC), and companies such as Airwallex and WorldFirst offer more integrations and features, Equals Money offers one of the more polished products.

As a whole it might seem like it’s lacking features, but individually, each feature can stand against the giants in international business transfers space.

Cards

Equals Money offers multiple card options including virtual and physical cards. There aren’t many other companies offering physical cards, especially at £10 per card.

With Equals Money you have access to:

Prepaid expense cards

Business debit cards

Corporate cards

Purchasing cards

Credit card alternative

Fuel card solutions

Virtual cards

Up 100 virtual cards are free to use depending on your pricing tier and can be created in your account.

One thing to note, depending on the plan, you will have a limited access to the number of cards you can have.

For example, Business tier is limited to 20 cards, while Business Plus users can have up to 50.

If your business heavily relies on physical cards AND your currency needs to fit within the 21 currencies that can be converted at Mastercard exchange rates, there is no better option for the features you get.

However, if you need more than 20 cards, or even 50, and need a bigger coverage, we suggest taking a look at Wise Business account, which offers physical cards at £5 per card and has a bigger coverage.

Payments

As I’ve mentioned a few times, you can make international payments using Equals Money. Their payments offering is tailored to international and domestic transfers, as well as suits startups and SMEs.

Most of the international payments are made via SWIFT, UK Faster Payments, and SEPA networks.

These networks align well with their coverage, however, can be slow and more expensive depending on your currency needs:

SEPA

Used within the EU/EEA. If you largely deal payments to / from the EU, this is a good option for you. SEPA transfers are relatively low-cost and can be considered almost domestic.

UK Faster Payments

A domestic transfers system for payments within the UK. If you are based in the UK, and mainly make domestic payments, this is ideal.

SWIFT

Used for the rest of the world, it is slow, and expensive. It is almost a traditional banking system. If your business requires making payments outside the UK, EU, or EEA, you may want to consider alternatives such as Wise Business (who use local accounts instead of banking networks).

Equals Money also offers batch payments, with a 10,000 limit per transaction. This is a lot. When we say a lot, we mean it.

For comparison, Wise and Airwallex allow 1,000 payments per transaction, and Sokin is limited to 5,000.

On the other hand, Multipass offers 10,000 payments per batch as well, however, their system is more limited compared to Equals Money.

FX risk management

Just like others, Equals Money comes with a set of risk management tools. These include:

Limit orders

With limit orders you have the control to set the minimum price at which you want to execute the trade. This is handy if you have a set rate in mind and don’t mind waiting for it.

Forward contracts (up to 24 months)

With forward contracts you can lock today's rate for up to 24 months. This is good for making future large transfers or purchases if you expect the rates to fluctuate.

Spot trades

With spot trades you can make conversions at any time you want while the market is open. The transfers will be executed instantly. This is useful for when you need to make a transfer now, especially small.

The 24 months forward contract is extremely good if your business makes especially large payments or purchases. Most other business platforms either don’t offer forward contracts or limit them to 6-12 months.

For example, Moneycorp is limited to 6 months, while Regency FX is limited to 12 months.

Not to say Equals Money is the only one, Xe Business account also offers 24 months, but their offering is more suited for larger corporations.

Integrations & API

Equals Money only offers two integrations: Xero and SAP Concur. For many businesses this is enough, but if you deal with marketplaces, POS, Sage, or other systems, you may want to look for an alternative.

For example, Payoneer is by far the leader in marketplaces integrations, while Xe offers the most accounting integrations.

As for the API, Equals money offers a very powerful payments API that can be integrated into any custom system.

Their API supports:

Creating and managing multi currency accounts

Sending domestic and international payments

Issuing virtual, physical, and tokenised cards

Access to webhooks for real time notifications

In addition, Equals Money offers a white label service with a ready-built payment management system.

This is a rare offering, and good if your business needs more flexibility than Equals Money can provide, but doesn’t need to create a full custom product from scratch, making it perfect especially for startups.

Personal transfers

In addition to business money transfers, Equals Money offers personal money transfers through their sister company, FairFX (also owned by Equals Group plc.).

You can check out our FairFX review to learn more about them, or run a comparison if you need to make a personal money transfer.

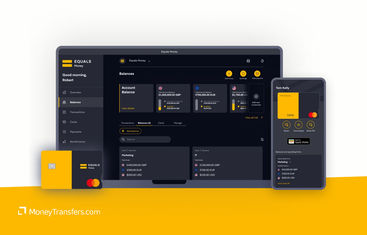

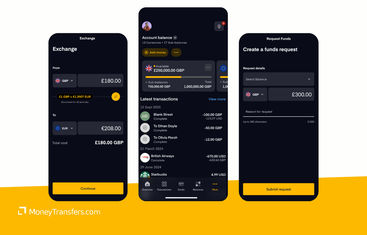

Mobile app

Just like other international business transfer services, Equals Money has an app available on Google Play store and Apple Store.

Firstly, let’s get the basics out of the way. On Google Play store the app was downloaded over 10,000 times but has no reviews. On the Apple Store, the app has 3.7 / 5 rating from 29 reviews.

In general, reviews are extremely positive, with a few notes on bugs here and there. Considering the rating and the available reviews, I’d personally avoid basing my decision solely on these.

It’s worth noting that the app is fairly new, only launched around May 2025, so it’s still expanding its features.

Based on their updates history, they are constantly pushing multiple monthly fixes and new features. This is a great and promising sign.

With the app you can:

Create balances

Issue virtual cards

Convert currencies

Make payments on the go

In the world of cross border transfers, this is a fairly standard offering as you’re more likely to do most of your work on desktop and use the app for small tasks and checking.

For example, WorldFirst and Airwallex apps offer more or less similar features.

However, I have to note that if you do need a good money transfers app, I suggest checking out our Wise Business review and Xe business review.

Equals Money pricing & fees

Equals Money fees & rates

One of the things I particularly like about Equals Money is their pricing and fee structure.

Not to say it’s absolutely the best on the market, but it’s clear, transparent and easy to understand.

This is a really big benefit, because usually it is much harder to figure out the pricing (check our WouldFirst review to see what I mean).

Cards & expenses platform fees

Equals Money comes in 3 tiers: Business, Business Plus, and Enterprise. Each is paid and comes with different limits.

These are applicable for card related services and expenses platform.

For each tier, you can get monthly or yearly subscriptions. At the time of writing, you can get a 17% discount on the yearly subscription.

Here’s a roundup of the differences and pricing for each of the tiers under cards & expenses platforms:

Feature | Business | Business Plus | Enterprise |

|---|---|---|---|

Monthly fee | £25 | £35 | Custom |

Physical cards allowance | Up to 20 cards | Up to 50 cards | 50+ cards |

Virtual cards allowance | Up to 50 free | Up to 100 free | 100+ virtual cards |

Platform users | Unlimited | Unlimited | Unlimited |

Use in 21 major currencies | Free | Free | Free |

Physical card issuance fee | £10 one-off (per card) | £10 one-off (per card) | Custom pricing |

Cash withdrawals (UK & abroad) | £1.50 | £1.50 | £1.50 |

*Pricing data collected in December 2025.

Each tier also offers different fees and features, here is the full summary of the costs:

Category | Business Account | Business Plus | Enterprise |

|---|---|---|---|

Account Maintenance | £25/month or £250/year | £35/month or £350/year | Bespoke pricing |

Physical Card Issuance | £10 + VAT per card | £10 + VAT per card | £10 + VAT per card |

Virtual Card Issuance | Free | Free | Bespoke pricing |

Virtual Card Management Fees | Fees apply if >50 cards (monthly or quarterly basis) | Fees apply if >100 cards (monthly or quarterly) | Bespoke pricing |

Card-to-Card Transfers | Free | ||

UK POS Transactions | Free when spending in card currency | ||

International POS Transactions | Free when spending in card currency | ||

Out-of-Currency Fee | 1.5% | 1.5% | Bespoke |

UK ATM Withdrawal | £1.50 | £1.50 | £1.50 |

International ATM Withdrawal | £1.50 | £1.50 | £1.50 |

Over-the-Counter Bank Withdrawal | 1.5% (min £5) | 1.5% (min £5) | 1.5% (min £5) |

Lost/Stolen Card Replacement | Free | Free | Free |

Maximum Liability Before Reporting Card Lost/Stolen | £35 | £35 | £35 |

Dispute Administration Fee | £10 per disputed transaction | £10 | £10 |

Refund Fee on Active Cards | £10 | £10 | £10 |

Moving Funds from Dormant Cards | £10 | £10 | £10 |

Dormancy Fee | The monthly fee continues up to 24 months | ||

Onboarding Fee | Case-by-case | Case-by-case | Bespoke pricing |

*Pricing data collected in December 2025.

It’s worth noting, their website covers most of the core card fees and account charges, but it misses a few key details.

I’ve read through all their T&Cs and couldn’t find much information relating to:

FX margins, spreads, forward points, settlement fees, or the actual cost of closing forward contracts early.

Payment fees such as international transfers (SWIFT, SEPA, USD wires), incoming payment charges, Faster Payments or CHAPS fees, and costs for failed or returned payments.

Enterprise-tier pricing is entirely bespoke with no public guidance, and there’s no information on potential platform or API usage fees.

Cashback terms don’t include the actual retailer cashback rates or any administration/partner costs.

The closest you get is “it varies by volume and your needs”.

However, most of this information will be provided to you during onboarding.

In a way, this is good because it’s not a blanket pricing and you will get tailored rates and fees based on your business needs.

If you need more streamlined pricing, I’d recommend checking out our Wise Business account review. With Wise Business you get mid-market rates, and fees from 0.33% on all transfers.

International payments fees

There are no transfer fees and no monthly fees for customers wanting to make international payments.

Payments speed

Equals Money transfer speed

Considering that most payments are made via SEPA, UK FPS, SWIFT, and they offer a multi-currency account to store local currencies, you can expect all payments and transfers to be made the same day.

However, just like with any international transfer it heavily depends on the volume, time of day, and the currencies involved.

If you make a large transfer, in exotic currency, outside of business hours, it can take up to 3 days to process and complete (that’s not including any delays from your or receivers banks).

If you need a more robust timeline for your transfers, you can easily contact their support and they will provide more information.

Transfer limits

Equals Money transfer limits

There is no clear information on the minimum and maximum limits.

However, judging by the dozens of other business money transfer companies we’ve reviewed, it’s fair to say that the limits are likely to be high and fit within your business needs.

Aside from that, there is an ATM withdrawal limit.

Daily cash withdrawals are limited up to £2,000 over 5 withdrawals within 24 hours.

As for the card limits, you can easily set maximum caps within your Equals Money account per card.

What I found interesting is that they can limit:

The types of payments you can make

The value of each payment

The number of payments

The amounts you can hold in your account

The number of cards you can have

And again, this is based on individual business needs and will be discussed during the onboarding process.

Equals Money use cases & eligibility

Equals Money usability

Judging by their offering and the banking rails used, it’s safe to say that Equals Money is best suited for startups or SMEs based in the UK or EEA.

If your business is based in the US, we .

Based on their offering, they are more tailored to:

Companies needing granular expense management

Companies dealing with procurement

Companies dealing with multiple international clients

Companies managing international payroll

Companies sending and receiving domestic or international payments

If any of these match your need, Equals Money is a good option to consider.

Eligibility

When it comes to cross-border payment solutions, one of the key areas to consider is the industry your business is in.

Many companies will limit who can and who can’t be using their services. For example, a lot of payment platforms will deny business in iGaming, trading and CFDs.

Equals Money is best suited for companies in the following industries:

CFD

Digital asset firms

iGaming

Film and TV production

Accountancy firms

Hospitality

Manufacturing

Travel

Wholesale

However, they do not support business dealing with the sanctioned countries.

Customer service

Equals Money is one of the few companies that offers extremely well crafted FAQs and product walkthroughs. If you can’t figure something out, chances are it is covered in there or in their guides.

If you do end up needing to contact the support, you can do it via:

Detail | Cards & expenses platform | International payments | Broker platforms |

|---|---|---|---|

Phone | +44 (0)20 7778 9302 | +44 (0)20 7778 7500 | +44 (0)20 3196 2137 |

Business hours | Mon–Thu: 09:00–17:00Fri: 09:00–16:00 | Mon–Thu: 09:00–17:30Fri: 09:00–17:00 | Mon–Thu: 09:00–17:30Fri: 09:00–17:00 |

When you get approved and onboarded, you also get access to the live chat within the platform.

Safety and regulation

Equals Money safety & trust

Equals Money is a trustworthy, regulated provider with strong operational security.

However, businesses should understand the reduced legal protections compared to consumer accounts and the extra risks that come with advanced FX products.

Legitimacy

Equals Money is a legitimate and well-regulated UK financial services provider.

They operate through three FCA-authorised companies: two licensed to provide payment services and one licensed to issue e-money and prepaid cards.

This means the business must follow strict UK rules on safeguarding customer funds, verifying users, preventing financial crime, and handling payments securely.

Money held in an Equals Money account is kept in segregated safeguarding accounts, separate from the company’s own funds.

It isn’t covered by the FSCS, but safeguarding rules are designed to protect your money if Equals Money were ever to go out of business.

Card services also sit under Mastercard’s global network, which adds further monitoring, dispute and fraud-prevention standards.

However, if you use the FX service, be aware that currency conversions and forwards are not FCA-regulated.

Also, margin deposits aren’t safeguarded, exit fees can be high, and Equals Money acts as the counterparty in FX trades, meaning you take on more direct financial risk.

Security

Corporate limitations

Opening an account with Equals Money

Getting started with Equals Money is quick and easy. Simply follow these steps:

Register with Equals Money

Navigate to their website and complete the registration forms.

Speak with them

Once you provide your details, one of their experts will contact you to discuss your business, your needs, and give you a better understanding on the fees and offering they can provide.

Verify your account

After discussing your business needs, your account will get approved and you will need to verify your details. This includes providing directors details as well as the business details.

This will trigger the final review process and your account will get verified once it is done.

Set up your account

At this point you should be ready to start managing your business and making payments.

After verification, you can set up your account, invite team members, create physical cards, set up limits, create local currency accounts, etc.

Customer Feedback

Equals Money has overall great reviews from other users.

On Trustpilot they have a rating of 4.7/5 from 480 reviews and 94% of those are 4 & 5 star reviews.

As I’ve mentioned earlier, their app doesn’t have many reviews, but there is some positive chatter around Reddit about the product as well.

Based on the reviews this year, most users mention the quality of its customer support.

Individual agents are repeatedly praised for being friendly, patient, and genuinely committed to solving problems, often staying on the phone until everything is fixed.

People also highlight the quick response times, knowledgeable guidance, and the personal, human approach that makes resolving issues feel easy.

Most users say that the transactions run smoothly, rates are competitive, and the platform is generally straightforward to use once set up.

However, there are some consistent frustrations, largely related to the product itself.

A few users have mentioned the platform outages, slow communication during technical issues, and long delays relating to compliance checks.

As well as a few users have mentioned failed or delayed transactions.

This is extremely reassuring and good, considering that in the digital payments space, most complaints are usually around customer service.

Not keen on Equals Money?

If you are unsure of whether Equals Money is for you, here's how they stack up in the market.

Is Equals Money right for your business?

Equals Money is a strong fit for UK and EEA businesses that need a reliable multi-currency account, polished spend management, and competitive FX for supported currencies.

Its customer support, card features, and API tools make it especially appealing for SMEs that want control, automation, and flexibility without the complexity of a full corporate banking setup.

The main trade-offs are the limited integrations, unclear FX margins for some transfers, and reliance on SWIFT for many international corridors.

If your business operates in the currencies they support and values hands-on service, it’s an excellent option.

But if you need maximum global coverage, full fee transparency, or a mature app ecosystem, competitors like Wise Business or Airwallex may suit you better.