Send money to South Africa

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

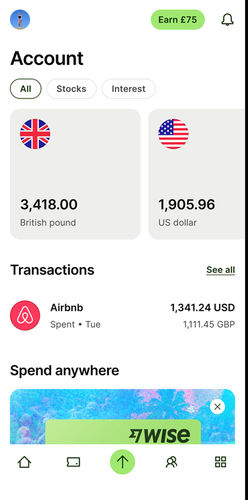

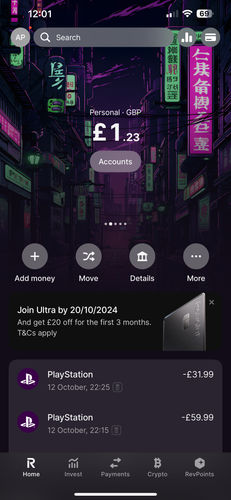

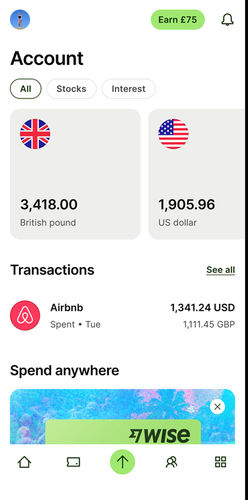

"Revolut has 50+ million customers globally. You can hold up to 36 currencies in the app and send money quickly in 70+ currencies to 160+ countries."

"24/7 live chat support provided in six languages. Special first transfer rates available, with airtime topup supported to many countries in Africa, Asia and South America."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Remitly focuses on sending money to friends and family in Asia, Africa and South America. Wide coverage and well-suited to regular transfers home."

"Lumon has cared for over 69,000 customers since 2000. Get support for larger transfers from dedicated currency specialists."

"Xoom, a PayPal service, allows you to send money in more than 160 countries. You can send cash for over-the-counter pickup or home delivery, as well as send by bank transfer or debit card."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

"Fast, secure internatinal transfers with no fees and transparent rates. They offer a free currency card for use at home and abroad."

"Paysend has transparent fees and rates, with transfer sent within seconds to your recipient's bank. They also have global 24/7 support for any enquiries, and bank-level security."

"Moneycorp is an established player in the market, with a focus on private clients and corporates. Make overseas payments in over 120 currencies and 190 countries."

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

Overall best choice: Wise

We tested & reviewed 20 best money transfer providers to South Africa, and Wise scored the highest.

Wise appeared in 94.9% of ZAR searches, and was the best way to send money to South Africa out of 20 that support Rand transfers.

So for a great mix of cost, speed & features, make your South Africa transfer using Wise via Bank transfer.

How to get the best rate when sending money to South Africa

Consider this before sending money to South Africa

Don't settle for the first option. Always compare ways to send money to South Africa to find out about fees, speed, and reliability.

Our analysis included 20 providers that operate in South Africa.

Through this, you get a comprehensive view of all the options you have when sending money to South Africa.

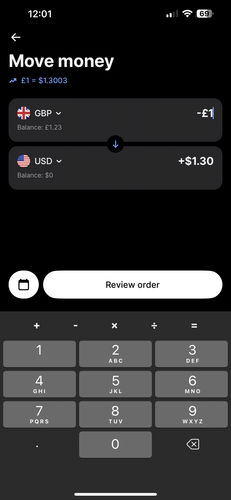

Revolut: The cheapest way to send money to South Africa

There are 20 providers servicing South Africa, and Revolut appeared as the cheapest option 259 times in our comparisons.

Revolut charges $0 per transfer to South Africa, with a 0.2% markup on the ZAR exchange rate. This is % cheaper than the second cheapest option.

To get the most out of your transfer to South Africa, use a Bank transfer deposit to maximize the amount of ZAR received.

Fastest way to send money to South Africa: Ria Money Transfer

Our data shows that Ria Money Transfer came up as the fastest way to transfer ZAR in 46.4% searches on MoneyTransfers.com over the past six months.

Ria Money Transfer charges $4 in fees on average and adds a 2.8% markup, which is also 0% cheaper than the next fastest option.

Pair it with a Bank transfer deposit to get your ZAR abroad fast and cheap.

Our ‘fastest’ way to transfer money to South Africa includes the transfer amount, deposit method, and transfer and withdrawal times.

Wise is the easiest way to send money to South Africa

Wise appeared 259 times in our searches involving South Africa as the top-rated money transfer company.

Wise is very transparent with its fees, charging $111 and -0.03% markup on ZAR transfers.

They offer multiple deposit options, have good customer service, and take less than 5 minutes to get started with.

Sending large amounts of money to South Africa

Sending large amounts to South Africa can be expensive. You should consider the exchange rate, transfer limits, customer service, safety, company experience with large transfers, and any legal requirements in South Africa.

In this case, Wise ticks all the boxes. Out of 20 money transfer companies serving South Africa, Wise came on top as the highest-rated company for ZAR transfers.

Whether you are buying a property in South Africa, funding your education, having a destination wedding, or just need to send a lot of ZAR, we recommend opting for a specialized provider such as Wise.

Understanding the costs involved when moving money to South Africa

When calculating the cost of money transfers to South Africa, here's what really matters: the country of origin, amount, payment method, fees, and the markup on the ZAR exchange rate.

Exchange rate markup

This is a percentage added on top of the "real" ZAR rate (known as the mid-market rate).

Wise, for example, offers the best exchange rate. It adds -0.05% markup to the USD-ZAR exchange rate (18.8086 ZAR - -0.05% per US Dollar).

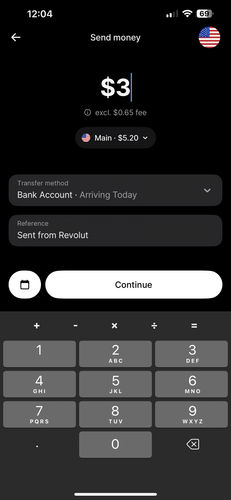

Transfer fees

These are fixed and/or percentage fees added for the service when sending money to South Africa.

Let's imagine you want to send $2,000 from the US to South Africa.

After analyzing 20 companies supporting Rand, we found Xoom to offer the lowest fees ($0 in fees and 2.38% markup).

However, exact fees vary by deposit method and the service, for example:

Bank transfers vary from $0 to $4

Debit cards range from $18.09 to $22.78

Credit cards can go from $0 to $0

Getting the best ZAR rate when sending money to Rand

The exchange rate is the value of the Rand (ZAR) compared to other currencies. Since it consistently moves up and down, sending at the high will give your receiver more ZAR compared to the low.

In the past 6-months, the ZAR exchange rate reached:

An average rate of 18.1353 Rand per US Dollar

A high of 19.1818 ZAR per USD

And a low of 17.0929 ZAR per US Dollar

The ZAR/USD exchange rate has seen some movements. Making a transfer when the rate is close to 19.1818 ZAR/USD will result in more ZAR received.

Wise is our top recommendation for sending Rand, offering a markup of -0.03% which is 0% better than the next cheapest option.

Get notified when it’s the best time to transfer Rands

Sign up for our rate alerts, and we’ll notify you when it’s the best time to send ZAR!

Payment methods available for money transfers to South Africa

How you fund your money transfer to South Africa directly affects the speed, cost, and the amount of ZAR your recipient will receive. Here are the most common options for funding your transfer to South Africa:

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in South Africa.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to South Africa.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to South Africa

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

Related transfer routes

Send money from South Africa

Send money to South Africa

Staying safe with money transfers to South Africa

The key to the safety of your funds is to only transfer Rands to those you know and trust, as well as using a regulated money transfer company.

All the money transfer services to South Africa we recommend are safe and regulated by financial bodies.

If you're unsure about the key regulatory authorities in South Africa or your home country, refer to our directory of financial regulators.

FAQs

Find answers to the most common questions on our dedicated FAQ page.

.svg)

.svg)