IBAN Checker: Free IBAN Checker & Validator

Use our IBAN checker to check the validity and accuracy of an IBAN number. Read on to learn how to verify, validate and decode an International Bank Account Number (IBAN).

Check IBAN

What is an IBAN checker?

We've built our IBAN checker as a tool to validate the format and correctness of an IBAN. This is especially useful when you've generated an IBAN number and need to verify it.

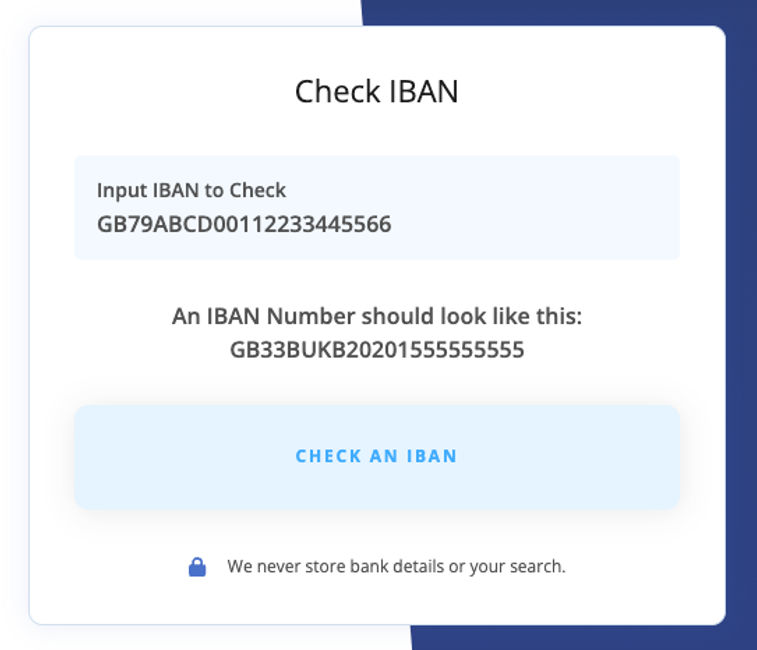

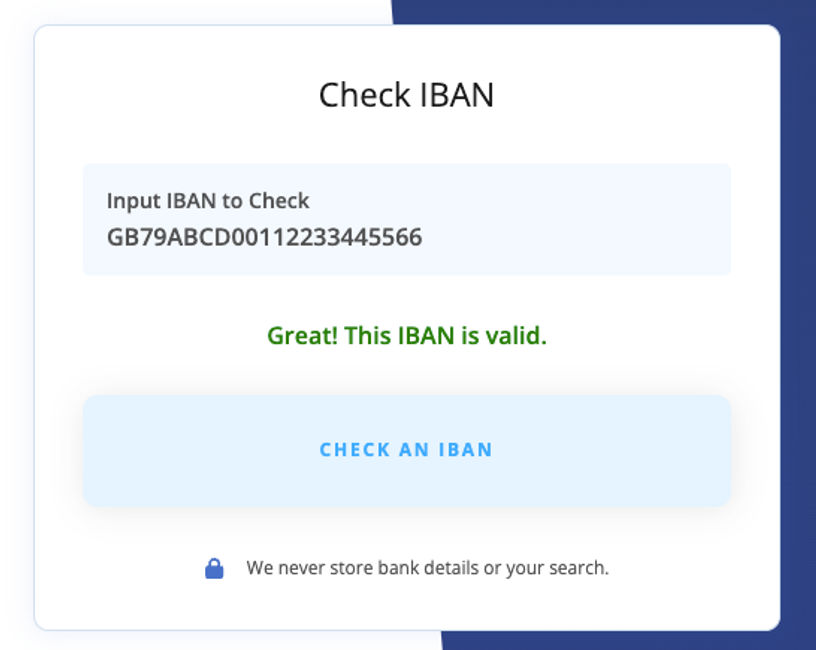

Using our IBAN checker: Step-by-step

Enter your IBAN

Enter your IBAN number into the form above and click the "Check an IBAN" button. Please note, that we never store any bank details or your search history.

Check the details of the IBAN

The form will tell you if your IBAN is wrong or correct.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

When would you need to use an IBAN checker?

You would need to use an IBAN checker in several scenarios, mainly related to international transfers to ensure the accuracy and validity of IBANs. Here are some common situations:

Sending money abroad

When you are sending money abroad, an IBAN checker ensures that the recipient's bank account number is correctly formatted, reducing the risk of the transaction being rejected or delayed.

Receiving money from abroad

Make business transactions

Regulatory compliance

Verifying details

A virtual IBAN lets you make and receive international payments as a local. Virtual IBANs are like "add-ons" to your main account, but for a specific location.

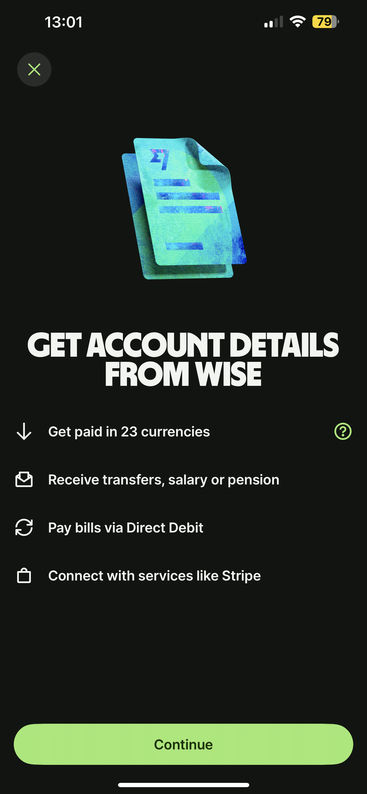

We recommend using Wise Business if you need a virtual IBAN. It offers:

10 Local accounts

Low transfer fees (sending fees from 0.33%)

Very simple & intuitive app

Wise Business has a one-time setup fee, which is cheaper than many other alternatives.

What are the benefits of using an IBAN checker?

An IBAN checker can check if an IBAN is correct, by confirming information such as the BIC/SWIFT code, bank name, address, and country. The benefits of using this online tool, ahead of sending a money transfer, include:

Accuracy: Ensures that the IBAN is correctly formatted and valid, reducing the risk of transaction errors.

Efficiency: Saves time and resources by catching errors early in the process.

Compliance: Helps meet regulatory and industry standards for international banking.

Validation: the IBAN checker can validate every single element of an IBAN (country regions, the bank code, branch code, and account number)

Briefly about IBANs

An IBAN, or International Bank Account Number, is used to identify the unique account of a customer at a financial institution in any of the 80 countries that use the system.

All IBANs share the same format and are compatible with the internationally agreed-upon system originally adopted by the European Committee of Banking Standards (ECBS) in 1997. Since then, the system has been extended by the SWIFT (Society of Worldwide Interbank Financial Telecommunication) network and now includes additional countries around the world, outside of Europe.

IBANs are made up of 34 - 35 alphanumeric characters, consisting of a two-digit country code, two check numbers, a four-digit bank code, a six-digit bank branch code, and an eight-digit bank account number, like so:

Format of an IBAN

As per the example, each part of an IBAN should follow this format.

Country

A-ZThe country that the bank account is held in - this is generally the universal country code.

Check Digits

0-9This enables the sending bank to perform a security check of the routing destination.

Bank Identifier

A-Z0-9This code identifies the recipient account holder’s bank.

Sort/Bank Code

0-9The sort/bank code for the bank transfer.

Account Number

0-9The account number for the bank transfer.

A bit more on IBAN checkers

What’s the difference between IBAN and SWIFT/BIC?

Why do I need an IBAN?

Are there any other IBAN checkers?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

Sending money abroad using IBAN

We'll assume you are looking to make a transaction since you're validating the IBAN. If you're planning on using your bank, we'd suggest you give a money transfer provider a go. These companies offer the same money transfer service as banks but at a much cheaper rate (especially if you're making a large payment). Use our form below to find the best provider for your needs.

Find a better alternative to banks

Let's recap on IBAN checker

Use our IBAN checker to validate the IBAN before making a transfer, simply input the IBAN and click the "Check an IBAN" button.

Validate IBAN

Sources and further reading

Related Content

Contributors

April Summers