Amazing Venmo Statistics & Facts (2026 Update)

Venmo is a mobile money transfer company that was founded in 2009 and has been owned by PayPal since 2012. Initially, Venmo was developed on the idea of allowing family and friends to split the bill when going out. The peer-to-peer technology also allows users to hold money in their accounts.

Search Now & Save On Your Transfer

In this article, we’ll uncover key Venmo statistics that outline its popularity, revenue, and why it’s still going strong in 2026.

Let’s dive right into it!

Top 10 Venmo Statistics & Facts for 2026:

There are over 83 million Venmo users

80% of top US retailers accept Venmo.

Over two million merchants accept Venmo

People aged 25 to 34 are Venmo’s biggest demographic

Venmo’s revenue in 2020 reached $850 million

Venmo has a yearly growth rate of 29%

There are over 516 million daily Venmo transactions

Venmo reported a payment volume of $244 billion in 2022

83 million people use the Venmo app

Over a period of one year, 68,000 Venmo transactions included an emoji

General Venmo Statistics

Over 85.1 million people use Venmo.

This is an impressive figure considering the fact that Venmo is only available in the US. Moreover, it’s the most commonly used app to send money between friends. The lack of fees is the main reason why Venmo claimed the top spot in this category.

(Venmo)

PayPal acquired Venmo when they bought Braintree for $800 million in 2013.

Braintree, a Chicago-based company that focuses on web and mobile payment solutions, first acquired Venmo for $26.2 million in 2012. Merely a year later, Venmo was part of the package when PayPal acquired Braintree. However, it proved to be a great investment for PayPal because Venmo’s valuation hit $38 billion in 2020!

(Forbes)

Between March 2020 and March 2021, 68,000 Venmo transactions included an emoji.

You can send emojis with money using Venmo. This allows Venmo’s active users to express a thought or feeling with an emoji instead of using text.

The high use of emojis indicates that many transactions are based on sending love or celebrating an event. The heart-shaped emoji accounted for 3% of transactions and was the most commonly used emoji.

(QUARTZ)

39% of 2022 survey respondents said they used Venmo in that year.

With about a third of randomly surveyed people confirming that they use Venmo, it’s clear how widespread Venmo use is in the United States. However, the parent company, PayPal, still dominated in the same survey with 85% of active users. Overall, Venmo is showing promise since it is filling a gap in the marketplace and the number of Venmo users is growing by the day.

(Statista)

39% of 2022 survey respondents said they used Venmo in that year.

With about a third of randomly surveyed people confirming that they use Venmo, it’s clear how widespread Venmo use is in the United States. However, the parent company, PayPal, still dominated in the same survey with 85% of active users. Overall, Venmo is showing promise since it is filling a gap in the marketplace and the number of Venmo users is growing by the day.

(Statista)

Over 2,000,000 merchants accept Venmo in the United States.

The large number of merchants accepting Venmo in the US contributes to the growing user base and transaction volume. Merchants understand that Venmo is an increasingly desired method of checking out to pay for goods and services.

Therefore, it is in the best interests of an online store to provide Venmo as a payment method. This can potentially increase sales for the store as some people may only use Venmo for purchases.

(Venmo)

47% of Amazon customers expressed a desire to pay with Venmo.

Amazon is the biggest ecommerce platform in the world. Also, almost half of its users showing interest in Venmo is a strong sign of approval for the payment app. Eventually, Venmo usage was allowed on Amazon’s platform, so it is now an accepted payment method.

(Statista)

Venmo User Demographics

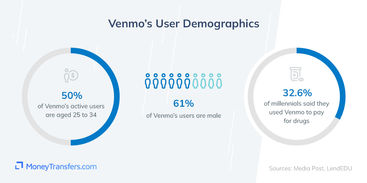

61% of Venmo’s users are male.

According to a 2019 survey, Venmo user statistics show that there are more males using Venmo than females. In contrast, the ratio of male vs female PayPal users is 53/47. Therefore, the gender balance of users on PayPal is more evenly split.

(Media Post)

32.6% of millennials said in a survey that they used Venmo to pay for drugs.

Venmo is a discreet and accessible method for sending money to other users. Therefore, it is a viable method of illegal activity. The lack of regulation and oversight over new fintech technologies means users have more freedom than with traditional banks.

From the same survey group, 21% shared that they used Venmo to pay for gambling activities. This includes poker, fantasy football, and sports betting.

(LendEDU)

50% of Venmo’s active users are aged 25 to 34.

This means that half of all Venmo users are millennials. This is not surprising since the young population is more likely to adopt new technologies. At the same time, only 30% of PayPal users fall into this age group. Therefore, Venmo can acquire new users by making its service more appealing to older generations.

(Media Post)

Venmo Trends

Venmo reported a payment volume of $244 billion in 2022, up 6% over the previous year.

The increase in Venmo’s annual revenue during 2021 is partly because of the explosion of ecommerce during the Covid-19 pandemic. This was marked by an explosive growth of over 40%. However, its growth continued, increasing by 6%.

(Statista)

In 2021, Venmo generated around $850 million – an increase of 88% over 2020.

These Venmo revenue numbers indicate enormous growth. The brand is constantly developing to improve the quality of its service. Also, having the backing of its parent company, PayPal, ensures they are in the best position to capitalize on the market.

(Money Pantry)

Venmo’s growth saw a 50.5% growth increase between 2020 and 2022.

This massive growth rate indicates that Venmo kept reinventing itself, especially since the Pandemic. Under the stewardship of PayPal, they are doing things right to attract many Americans and expand their user base. The rise of ecommerce in recent years is contributing to the growth of Venmo, but they are also proving good value that competitors are having trouble matching.

(Statista)

New US tax rule means people will need to file taxes on any earnings over $600 on mobile payment apps.

Before 2023, however, the threshold was $20,000. Many small businesses and people with side hustles are worried, as this can significantly complicate their finances.

While the IRS claims that money exchanged between friends and family will not be taxed, individuals are still worried.

Small business owners are especially concerned about the extra paperwork, and whether mistakes made on said paperwork can lead to fines and penalties.

(CBS News)

PayPal’s increase in transaction losses was caused by fraud schemes relating to Venmo.

As part of PayPal’s (Venmo’s parent company) annual financial report, it was noted that fraud schemes, or rather their recoupment to defrauded customers, lead to an increase in transaction losses in 2022 - an increase of 1% compared to 2021.

(PayPal Financial Report)

Venmo Mobile App Statistics

Venmo has a Google Play rating of 4.4 and an App Store rating of 4.9 out of 5.

This indicates that the Venmo app offers excellent functionality and the features perform as expected. The higher rating on the App Store indicates the iOS version is doing better than the Android one. However, both have relatively high scores compared to competing apps. This is a strong indication that a high number of Venmo users are happy with the app.

(Google Play, App Store)

83 million people use the Venmo app.

The 83 million people using the Venmo app are located in the United States. That’s because the app is currently only offered to users who are physically in the US. Users that try to sign up abroad will receive an error message.

(Tax Policy Center)

65% of young people who use mobile payments share that Venmo is their primary option.

It is no surprise at all that the younger population makes up a large percentage of Venmo’s user base. They are the group that traditionally accepts new technology at the fastest rate. Moreover, Venmo’s marketing efforts actively target younger people as a growing market of online payment and money transfer users.

(LendEDU)

Venmo FAQs

How long has Venmo been around?

How much is Venmo worth?

How many people use Venmo?

How much does Venmo make a year?

How many Venmo transactions are there per day in the world?

Is Venmo only in the US?

The Bottom Line

The Venmo stats above indicate that this fintech company is one of the market leaders in the United States. Over the last decade, it has constantly increased the number of users, revenue, and transactions. During the last few years, in particular, Venmo received an explosion in activity, and therefore its valuation skyrocketed.

However, they are still a shadow of their Parent company, PayPal. Perhaps more funds and investment will be poured into Venmo to capitalize on the success they have had in recent years. We’ll keep an eye on this company in the coming years to likely watch the Venmo market cap explode even further.

Sources:

Related Content

Contributors