Guide to Making PayPal Mass Payments in 2025

The requirements of each and every international money transfer is different, and in some cases, especially when businesses are concerned, multiple payments need to be processed at once. In this guide we will look at how to send money to numerous payees with PayPal, plus the total cost of fees and the overall efficiency of this service.

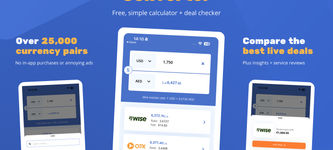

Search Now & Save On Your Transfer

About PayPal

This US-based online money transfer provider is one of the most popular payment platforms of all time and the company was one of the first of its kind when it launched in 1998. PayPal is now one of the leading electronic money institutions in the world, with an estimated 392 million customers as of early 2021. Customers can use their account, logging in via web or the PayPal app, to transfer and collect money, set up payments, and make in-store and online purchases.

How PayPal mass payments work

PayPal allows customers to send money to numerous contacts (such as family members, vendors or employees) at once. Funds will be deposited into the beneficiary’s PayPal account. Designed to streamline the process of mass payments, this transfer method is known as Payouts, and can be found under the Send Money tab on the PayPal website; there will be an option to “Make a mass payment.”

Fees applied to PayPal Payouts

PayPal, despite its popularity, is known for charging substantial fees and their Payout service is no different. The following fees apply:

Sending domestic Payouts: 2% of total transfer amount

Sending international Payouts in Euros or Swedish krona, between PayPal account holders in the European Economic Area (EEA): 2% of total transfer amount

Sending international Payouts outside of the EEA: 2% of total transfer amount

The aforementioned 2% is not to exceed the maximum fee cap for each currency, as listed on the fees page of the PayPal website.

How to set up a PayPal Payout

Before you can send a Payout with PayPal, you must upload a payment file containing all the relevant information for your recipients. To do this, the following information is required:

An active PayPal business account: set up as mentioned on the prerequisites page

Contact information (email, phone number, relevant payer ID) for each recipient

Payment amount (per recipient)

3-digit currency code (one currency per payout)

Note or reason for Payout

Once the above information has been collected, Payouts can be arranged by following these steps:

Step One

Step Two

Step Three

Step Four

Who can receive a PayPal Payout?

Recipients must have a PayPal or Venmo account to receive a Payout; Venmo is available to US customers only.

Key reasons to use PayPal Payouts

In addition to being a reputable, secure and long-standing global payments platform, there are a number of other reasons to use PayPal Payouts for mass payments:

Quick and easy currency conversion: Send international transfers in USD, CAD, AUD, EUR, MXN, and GBP, even if you don't have a balance in that currency

Full detailed list of previous payouts: Your total Payouts history is available online through your PayPal account; it is also possible to download transaction details into your accounting tools

Stress-free deposit: Anyone with a PayPal or Venmo account can access the funds as easily as opening an email or text message

Global network: The Payouts network extends to over 180 countries and territories

Safe and secure: PayPal's risk and compliance controls help protect both parties from fraud

The negatives of using PayPal Payouts

PayPal and Venmo deposits only: Funds cannot be sent to a bank account or any other digital wallet

Substantial fees: Compared to low-cost service providers such as Wise and PaySend, PayPal’s fees can quickly add up

Freezing accounts: PayPal maintains high standards of data security and encryption, and this sometimes results in the unexpected freezing of customer accounts

Maximum transfer limits apply: Not all money transfer providers apply limits but in PayPal’s case, each Payout payment cannot exceed $60,000 USD (or equivalent)

Additional factors

Customers must use their PayPal balance to send mass payments

An insufficient balance in your PayPal account will result in a failed payment

Any unclaimed funds shall be returned to the sender’s account after 30 days

PayPal Payouts - efficient mass payments for businesses

Overall PayPal appears to have thought of almost everything when it comes to arranging mass payments to multiple beneficiaries. While there are some negative aspects to their Payouts service, the pros outweigh the cons and generally, the process is likely to prove efficient and useful to many business owners.

Related content

Related Content

Contributors