Top Cashless Countries in the World

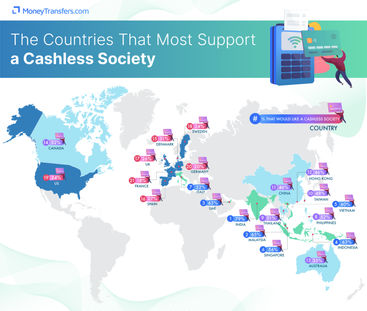

We've analyzed the data on opinions about a cashless society from 21 countries. The results show mixed feelings, with no continent fully in favor. Some countries welcome the change, while others prefer to stick with cash.

Here, we'll break down the data, and look at the challenges of moving towards a cashless society.

Worldwide research

Residents from 21 different countries around the world were surveyed on whether Britain's move towards a cashless society would be “positive” or “negative”.

The answers gave a clear idea of the countries most approving of the switch, and conversely, those that favor more traditional payment processes.

As you can see from the results, not one single continent voted overwhelmingly in favor of going cashless.

Countries analyzed in Europe, Asia, and North America are divided in their opinion; this may make the switch to a cashless society complicated.

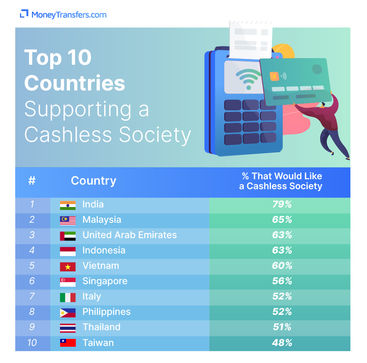

The top 10 countries supporting a cashless society

With the cashless movement given a ‘10 year boost’, more companies and customers are starting to shun traditional cash payments.

We looked at whether this comes as a welcome change to residents of each country, or if they would miss dealing with notes and coins.

Topping the list of countries most likely to support a completely cashless society is India, with 79% of respondents showing positive feelings towards the motion.

Out of these individuals, 21% stated they would use cashless payment even on small purchases, like buying a pack of chewing gum.

Coming in second place is Malaysia as 65% of residents had confidence that cashless was the way to go.

Not far behind are the United Arab Emirates and Indonesia, where 63% of individuals surveyed were welcoming of the idea of exclusively using electronic forms of money.

Of the remaining countries in the top 10, over half of the participants in Vietnam, Singapore, Italy, the Philippines, and Thailand would opt for a credit card, mobile wallet, or another cashless method when making a very expensive purchase, such as buying a new electronic device, thus voting in favor of a cashless society.

Which countries prefer traditional currency vs. cashless?

Not every country is largely in favor of an entirely cashless society.

Many respondents in our worldwide survey stated they would only be swayed away from physical currency when making a “very expensive purchase”.

Respondents from China and Hong Kong were on the fence about going fully cashless; in both countries, just under half (46%) of respondents said they felt positive about the thought of going cashless.

Interestingly, three-quarters of those surveyed from China find it easy to access cash from a free ATM, which may explain their preference.

Positivity plummets in Australia, with only 35% of respondents welcoming a cashless society. Canada is not far behind either, with only a third (32%) of respondents preferring to ditch their coins.

Denmark, Spain, and the United Kingdom follow behind, with 31%, 27% and 26% of respondents "happy" about turning cashless, respectively.

Our analysis found that most individuals surveyed from these European countries expressed they would not use an electronic form of payment for a cheap purchase.

However, it was France at the very bottom of our list, with French natives struggling to find enthusiasm for the idea of becoming a cashless society.

Germany (20%) followed closely behind with 20% of nationals welcoming a cashless society, and the USA and Sweden after that (24%).

Benefits and drawbacks of a cashless society

Interested in finding out more about the positives and negatives cited by respondents in the YouGov study, we delved deeper to identify the pros and cons of a cashless society.

Pros

Cons

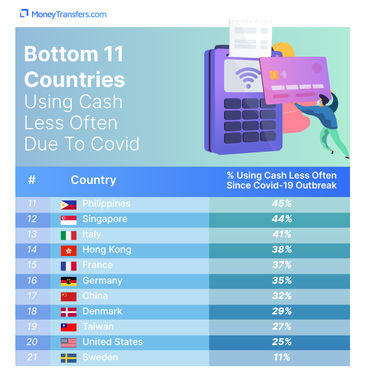

COVID-19 impact on cash

COVID-19 has affected almost every area of our lives and the money transfer industry is no different.

Due to the emergence of coronavirus, cashless payments are the preferred payment option for businesses and individuals alike, as the act of handing over banknotes could lead to an expedited spread of the virus.

To investigate the relationship between COVID-19 and cash, we investigated the countries less likely to use physical money since the outbreak began.

More than half of respondents in the top six countries reveal they have used less cash since the COVID-19 outbreak, with Thailand topping the list with a huge 57% of people choosing to forgo traditional payments.

Even though only 26% of those surveyed in the United Kingdom were supporting a cashless society, 50% said they have been wary of dealing with physical money since the pandemic started.

However, this could be due to the companies encouraging digital alternatives for making payments.

Although India was the most welcoming of going cashless, only 47% of survey-takers have used cash less often since the coronavirus outbreak.

However, this may be because the focus on cashless means was already solidified before the outbreak.

The payment methods of countries least affected by coronavirus include the Philippines, Singapore, and Italy as 45%, 44%, and 41% of respondents felt coronavirus affected the amount they use cash, respectively.

Denmark, Taiwan, and the United States are among the lowest with 29%, 27%, and 25% of people surveyed contributing a change in their payment habits to the virus.

However, it is Sweden at the bottom of the list, as only 11% of participants saw a decrease in their cash usage due to COVID-19.

But following the news that the country is already aiming to become the first cashless society, this low percentage does not look incredibly shocking.

Let's recap: Which countries are likely to support a cashless society?

In a fast-moving digital world, it seems inevitable to gravitate towards predominately digital forms of currency. By understanding the stance different countries take on this subject, we can anticipate the territories most likely to roll out cashless payments in the near future.

Socio-economic factors dictate the reasons for demonstrated desire or resistance towards the implementation of electronic forms of payment, and for obvious reasons, this differs from country to country.

MoneyTransfers is proud to conduct worldwide research and present important findings that can help better inform the outlook of diverse global economies.

Methodology

Sources & further reading

Related Content

Contributors

April Summers