Is Xoom right for you?

Xoom is best for when you need to make in-store transfers, or planning on making multiple recurring payments to hard-to-reach areas.

Xoom is good if… | Find an alternative if… |

|---|---|

|

|

Scoring Xoom

The key areas of our Xoom review are focused on the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety, and customer feedback.

Below is a quick summary of Xoom. Each area is covered in more detail below.

Exchange rates & fees

Overall, Xoom is expensive compared to many other companies.

However, they do offer good deals on transfers to certain countries (especially to Central America), and certain payment methods (using USD PayPal balance is free).

On average, Xoom adds 4.49% markup and $5.43 in transfer fees.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with Xoom, here’s a quick summary of the benefits and drawbacks.

Pros

- Though it varies per destination, Xoom allows for cash pickups, direct transfers to bank accounts and debit cards, mobile wallet deposits, and door-to-door cash deliveries.

- Xoom covers 136 transfer destinations, in 84 currencies. This is more than the usual money transfer provider. For example, with Wise you can convert to 55 currencies from the US.

- As part of the PayPal family, Xoom has benefited from a harmonized and well-established customer support system available on both email and phone.

- You can top up your recipient's mobile phone directly from the Xoom platform.

Cons

- Xoom has an extremely high markup of around 4.49%. This is almost as much as traditional banks such as Wells Fargo and BoA will charge you.

- Although there are a few free transfer options, the average fee is $5.43, again, much higher than other money transfer services. For example, Wise charges around 0.33%.

- You can only send 4 currencies: USD, EUR, GBP, USD.

Xoom fees and exchange rates

Fees and rates

Just like many other money transfer companies, Xoom charges a fixed fee and adds a markup on top of the mid-market rate.

Exchange rates

On average, Xoom adds around 4.49% on top of the mid-market rate.

This is extremely high compared to many other money transfer companies, and even higher than some banks.

For example, Wise adds no markup on top of the exchange rate, Discover Bank adds 1.5% and HSBC adds 3.5%.

Of course, the exchange rate varies from country to country, and in some cases, the exchange rate is actually better than the mid-market rate.

Here is a summary of Xoom exchange rates when sending USD:

Destination Currency | Exchange Rate | Mid-market rate | Markup |

|---|---|---|---|

TOP | 2.1236 | 2.34137204 | -9.30% |

GMD | 63.4262 | 69.5 | -8.74% |

CRC | 471.7139 | 513.697487 | -8.17% |

CLP | 869.3455 | 945.33 | -8.04% |

MYR | 3.9626 | 4.3044985 | -7.94% |

JPY | 138.3647 | 149.737495 | -7.60% |

RWF | 1,258.81 | 1358.183 | -7.32% |

GYD | 193.9865 | 209.2309 | -7.29% |

PEN | 3.5077 | 3.769124 | -6.94% |

NOK | 10.1784 | 10.9080398 | -6.69% |

KMF | 424.9819 | 454.849584 | -6.57% |

EUR | 0.8607 | 0.921073235 | -6.55% |

HUF | 344.5032 | 368.27 | -6.45% |

ETB | 112.225 | 119.9597 | -6.45% |

XOF | 566.4269 | 604.908713 | -6.36% |

XAF | 566.8649 | 604.9088 | -6.29% |

SEK | 9.8646 | 10.5248545 | -6.27% |

PLN | 3.7211 | 3.96709847 | -6.20% |

MAD | 9.3007 | 9.903632 | -6.09% |

MZN | 60.0141 | 63.8984985 | -6.08% |

NZD | 1.5474 | 1.64636154 | -6.01% |

MGA | 4,305.88 | 4579.99185 | -5.99% |

TND | 2.9104 | 3.094274 | -5.94% |

PHP | 54.0936 | 57.5084796 | -5.94% |

ZAR | 16.5365 | 17.56865 | -5.87% |

KRW | 1,289.10 | 1369.02997 | -5.84% |

BRL | 5.3416 | 5.6717 | -5.82% |

BWP | 12.5619 | 13.3330525 | -5.78% |

CZK | 21.9071 | 23.231 | -5.70% |

DOP | 56.8566 | 60.2368271 | -5.61% |

THB | 31.3148 | 33.1534867 | -5.55% |

DJF | 168.2571 | 177.992571 | -5.47% |

RON | 4.3329 | 4.58099474 | -5.42% |

JMD | 150.5519 | 158.8727 | -5.24% |

DKK | 6.5102 | 6.86924057 | -5.23% |

BGN | 1.707 | 1.80096 | -5.22% |

IDR | 14,682.05 | 15487.35 | -5.20% |

COP | 4,027.31 | 4245.94 | -5.15% |

ZMW | 25.2286 | 26.5779954 | -5.08% |

BAM | 1.7134 | 1.80354751 | -5.00% |

UGX | 3,485.94 | 3667.95204 | -4.96% |

CAD | 1.3114 | 1.37987181 | -4.96% |

PYG | 7,526.52 | 7916.00172 | -4.92% |

TZS | 2,587.20 | 2720 | -4.88% |

MWK | 1,650.84 | 1733.94639 | -4.79% |

GBP | 0.7298 | 0.766325 | -4.77% |

SGD | 1.2489 | 1.311065 | -4.74% |

VND | 24,015.88 | 25165 | -4.57% |

GNF | 8,238.13 | 8626.17025 | -4.50% |

CHF | 0.8269 | 0.86557 | -4.47% |

MXN | 18.8492 | 19.71801 | -4.41% |

KES | 123.8323 | 129.505043 | -4.38% |

QAR | 3.4881 | 3.647488 | -4.37% |

JOD | 0.6787 | 0.7088 | -4.25% |

BIF | 2,786.98 | 2908.0419 | -4.16% |

AUD | 1.4295 | 1.49025744 | -4.08% |

BHD | 0.3617 | 0.376966303 | -4.05% |

AED | 3.5243 | 3.673 | -4.05% |

OMR | 0.3695 | 0.3849629 | -4.02% |

XCD | 2.5944 | 2.70255 | -4.00% |

BTN | 80.7373 | 84.0648375 | -3.96% |

TTD | 6.5152 | 6.78348276 | -3.95% |

ERN | 14.4242 | 15 | -3.84% |

UYU | 40.0523 | 41.6406413 | -3.81% |

HTG | 126.7969 | 131.606706 | -3.65% |

SAR | 3.6189 | 3.755831 | -3.65% |

CNY | 6.8436 | 7.101 | -3.62% |

FJD | 2.148 | 2.2282 | -3.60% |

NPR | 130.0914 | 134.501596 | -3.28% |

MUR | 44.9383 | 46.44 | -3.23% |

EGP | 47.3923 | 48.6218 | -2.53% |

LKR | 285.6204 | 292.8282 | -2.46% |

GTQ | 7.5623 | 7.732458 | -2.20% |

HKD | 7.6029 | 7.77005 | -2.15% |

BDT | 116.9373 | 119.491145 | -2.14% |

UAH | 40.5386 | 41.23498 | -1.69% |

INR | 82.9252 | 84.0622229 | -1.35% |

ILS | 3.6704 | 3.711765 | -1.11% |

PKR | 275.3863 | 277.620305 | -0.80% |

HNL | 24.8261 | 24.9502119 | -0.50% |

USD | 1 | 1 | 0.00% |

SCR | 14.0776 | 13.5574212 | 3.84% |

BOB | 7.6101 | 6.90587704 | 10.20% |

ARS | 1,112.91 | 980.99518 | 13.45% |

*All rates are based on conversions from 200 USD. The same currencies were removed from the list. Negative values are worse than the mid-market rate.

As you can see, SCR, BOB, and ARS actually have better rates than the mid-market rate.

In fact, if we take the average exchange rate markup per region:

Region | Avg. Markup |

|---|---|

Africa | -5.04% |

Asia | -4.27% |

Caribbean | -3.67% |

Central America | -2.17% |

Europe | -5.35% |

Middle East | -3.66% |

North America | -3.05% |

Oceania | -5.77% |

South America | -2.23% |

Central and South Americas have the best exchange rates.

To ensure full coverage of Xoom, we’ve looked at what other users have to say about their exchange rates and plotted the results on the graph below.

International transfer fees

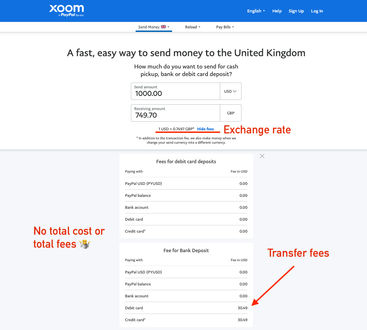

Xoom fees are based on the currency you are sending, the destination currency, the deposit method you use, and the withdrawal method.

Sending money to a debit card is the cheapest way to send money with Xoom costing only $0.22 on average.

UPI transfers on the other hand are the most expensive at $9.05 per transfer (which is only applicable to India), followed by bank deposit at $7.07.

Using PayPal US wallet (PYUSD) as a deposit is free, which makes it the cheapest way to deposit money into Xoom.

While credit cards are the most expensive way to fund your transfer, costing $10.01 on average.

Not only are credit cards more expensive, they may also come with additional cash advance fees charged by your company, as well as can have additional markup on the rate applied by your bank.

Finally, on average, Xoom charges the lowest fees for transfers to Africa and the Middle East, $3.50 and $3.24 per transfer respectively.

Here’s a bit more detail on each of the transfers:

By withdrawal method

Withdrawal Type | Average | Low | High |

|---|---|---|---|

Mobile wallet | $1.74 | $0.00 | $10.99 |

Bank deposit | $7.07 | $0.00 | $37.99 |

Cash pickup | $6.33 | $0.00 | $37.99 |

UPI transfers | $9.05 | $0.00 | $37.99 |

Debit card deposit | $0.22 | $0.00 | $4.00 |

Home delivery | $4.19 | $0.00 | $7.99 |

Pix | $4.79 | $0.00 | $6.99 |

By deposit method

By region

Free transfers

Now, if you add exchange rates and fees together, it is apparent that Central America would have the lowest fees, while the low exchange rate for South America is offset by the higher transfer fee.

To put these numbers into perspective, let’s assume you’re making a $1000 transfer from the US to a bank via bank transfer to a bank account in the following countries:

Country | Xoom fees | Wise fees | HSBC Global Money fees |

|---|---|---|---|

$0.00 + 8.17% ($81.70) | Total fee: $21.48 | Can’t send | |

$0.00 + 1.35% ($13.50) | Total fee: $8.12 | Can’t send | |

$0.00 + 5.03% ($50.30) | Total fee: $6.26 | $0 + 3.5% ($35.00) |

Similar to the rates, we’ve looked at how other users have rated Xoom in terms of their fees.

Transfer speed

Transfer speed

Most transfers by Xoom are carried out almost instantly or within minutes.

However, this also depends on the destination and the withdrawal (delivery) method.

Bank, mobile wallet, and Pix are the fastest delivery methods in general. But ultimately, they are not the cheapest.

Here’s an overview of transfer speed by the delivery method.

Method | Quickest time | Slowest time |

|---|---|---|

Bank deposit | Few minutes | 3 business days |

Cash pickup | Within hours | Within hours |

Debit card deposit | Up to 30 minutes | Up to 30 minutes |

Door to door delivery | Up to 6 hours | 2 business days |

Home delivery | Next business day | Next business day |

Mobile wallet | Few minutes | Within minutes |

Pix deposit | Few minutes | Within minutes |

And here’s an overview by the region:

Region | Quickest time | Slowest time |

|---|---|---|

Africa | Within Minutes | 3 Business Days |

Asia | Within Minutes | 2 Business Days |

Europe | Within Minutes | 2 Business Days |

Caribbean | Within Minutes | 3 Business Days |

Central America | Within Minutes | 2 Business Days |

Middle East | Within Minutes | Next Business Day |

North America | Within Minutes | Next Business Day |

Oceania | Within Minutes | 2 Business Days |

South America | Within Minutes | 2 Business Days |

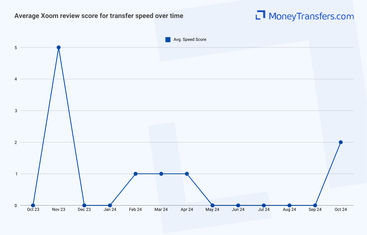

When it comes to user reviews, this is what it looks like in terms of speed.

Transfer limits

Transfer limits

Xoom’s transfer limits are very straightforward.

Xoom has 3 levels of limits, depending on your account verification status and the delivery method.

Each level has a 24-hour, 30-day, and 180-day limit, like so:

Limit Level | 24-hr limit | 30-day limit | 180-day limit | Required information and documents |

|---|---|---|---|---|

Level 1 - All transfers | 2,999 USD (or equivalent) | 6,000 USD (or equivalent) | 9,999 USD (or equivalent) | Sender profile information |

Level 2 - All transfers | 10,000 USD (or equivalent) | 20,000 USD (or equivalent) | 30,000 USD (or equivalent) | Social Security number or passport and details about the transfer. |

Level 3 - Online transfers | 50,000 USD (or equivalent) | 60,000 USD (or equivalent) | 100,000 USD (or equivalent) | Driver's license, passport, or Green Card. Either a pay stub or a bank statement with Direct Deposit and details about the transfer. |

Level 3 - Cash pickup | 10,000 USD+ (or equivalent) | 20,000 USD (or equivalent) | 50,000 USD (or equivalent) | Driver's license, passport, or Green Card. Either a pay stub or a bank statement with Direct Deposit and details about the transfer. |

We’ve also looked at online user reviews for Xoom limits.

Product offering

Product offering

Xoom primarily focuses on international transfers, but also offers these:

Mobile top-up and reload

International bill payments

Supported currencies & destinations

You can only send money from 4 currencies: CAD, EUR, GBP, and USD.

When sending USD, you can make transfers to 136 countries, and 84 currencies.

Aside from being able to send EUR to European countries, some destinations are limited to USD, XAF, XCD, and XOF transfers:

USD - Democratic Republic of the Congo, Liberia, Zimbabwe, Cambodia, Laos, Puerto Rico, US Virgin Islands, El Salvador, Nicaragua, United States, Ecuador

XAF - Cameroon, Chad, Gabon

XCD - Antigua and Barbuda, Saint Kitts and Nevis

XOF - Benin, Burkina Faso, Guinea-Bissau, Ivory Coast, Mali, Niger, Senegal, Togo

Here’s where you can send money with Xoom.

Africa

Asia

Caribbean

Central America

Europe

Middle East

North America

Oceania

South America

Transfer types

When sending money abroad with Xoom, you have these options:

Bank transfer

Money will be delivered to the recipient's bank account.

Best used for sending large amounts, but it can take a few days to arrive.

Cash transfer

You send cash (using whichever deposit method you want) and the recipient will collect it at the nearest agent.

Money will be available instantly and is a great option for those without access to the internet or bank account.

Mobile transfer

Money will be sent over to the Xoom, PayPal, or other supported wallet

Transfers are almost instant and there’s nothing the recipient needs to do.

It’s great if the recipient is planning to use their balance for payments.

Debit card transfer

Similar to a bank account, but with this method you will be sending money to the debit card details.

It’s faster but a bit pricier compared to other methods.

Money will arrive in the recipient's bank account and there’s nothing they need to do.

UPI transfers

UPI is an Indian payment service that is integrated into the banks. It is fast but is expensive.

Money will arrive into the recipient's bank account without their involvement.

Pix transfers

Similar to UPI in India, or FPS in the UK, Pix is a Brazilian payment network for faster payments.

Money will arrive into their account without them needing to do anything.

Payment methods

Xoom offers 5 deposit methods.

PayPal balance

With this you can fund your transfer with your PayPal balance.

On average it costs $3.88 for deposits with PayPal.

PayPal USD (PYUSD)

If you have a USD account in your PayPal, you can use it to fund your transfer and it’s free. Regardless of where you send money to.

Bank accounts

Deposits from your bank account will cost $3.88 on average. But does depend on where you will be sending money to.

Debit and credit cards

You can fund your transfer with a debit card or a credit card.

Both are the most expensive options $9.32 and $10.01 respectively.

Don’t use credit cards for your transfer

We recommend avoiding credit card payments where possible.

CC transfers are very expensive with Xoom, but also come with cash advance fees that may be charged by your bank, as well as, some banks may add additional markup.

Receiving methods

For money delivery (withdrawal), you have the following options available.

Bank account deposit

Money will be deposited into the bank account.

On average, the fee is $7.07, and it will take around 3 business days for the money to arrive.

Debit card deposit

Same as the bank transfer, money will be deposited to the account.

The average fee is $0.22 for debit withdrawals and it will take around 30 minutes for the money to arrive.

Mobile wallet deposit

Mobile deposits cost $1.74 on average, and money will arrive within minutes.

The mobile wallet you can use will depend on the receiving country.

Cash pickup

Cash pickup will be available within a few hours and costs $6.33 on average.

The recipient will need to visit their closest agent with a valid ID, and a transfer number.

Door-to-door cash delivery

Home delivery costs $4.19 on average and takes 1-2 business days.

Money will be delivered directly to the recipients door and they will need to have their ID ready and the transfer number.

Mobile app

Xoom app gives you multiple ways of sending money, including your PayPal balance.

The app has lots of functionalities, including:

Sending money on the go, 24/7

Transaction tracking

Checking fees and exchange rates through the built-in “Fees and Exchange Rates” calculator

“Quick send” feature for repeated transfers

Reloading airtime to prepaid mobile phones in minutes

Accessing customer support

On Google Play, the app has a rating of 4.8/5.0 and a total of 328,405 reviews, while on the App Store, Xoom has over 1 million reviews (1,118,319) and an overall rating of 4.8/5.0.

Can you load money onto the Xoom app?

You can’t load money directly to your Xoom account, because it takes money from the “linked” accounts. It is not a wallet that can store money.

However, you can load money to the PayPal app and use it to send money via Xoom.

In terms of product offering, here’s what online reviews look like from other customers.

Here's how users rated Xoom's product features.

Ease of use

Ease of use

Overall, Xoom is fairly easy to use and navigate.

I already had a PayPal account when testing it, so making a transfer was a breeze through the PayPal app.

Xoom setup was quick and easy. There isn’t much to the interface, other than making a transfer so it was all very straightforward.

I also really liked how transparent they are with the fees, you can clearly see the exchange rate, and the fees before even signing up.

However, they don’t give you the total cost or even total fees unless you initiate the transfer, which is annoying as you have to sign up to see that (but hey, we’ve done all this for you on this page).

It’s also convenient that you can use a PayPal app to send money internationally via Xoom, however, the Xoom app is not well integrated into PayPal (something you would probably expect).

Here's how other users have rated Xoom's usability and ease of use.

Customer service

If you run into issues, you can contact Xoom via:

The contact form on the website

The phone

Mail

Use the following details if you need to contact them:

Contact Method | Details |

|---|---|

US / Canada phone numbers | (877) 815-1531 (toll free) +1 (415) 395-4225 |

Xoom Customer Support P.O. Box 45950 Omaha, NE 68145-0950 | |

Email via the contact form | Use the following link. |

This is how other users have rated Xoom's support features.

Safety and trust

Safety and trust

Legitimacy of Xoom

In July 2015, it was acquired by PayPal Holdings, Inc., in a $1.09 billion deal. The company is now a private subsidiary of PayPal.

In the United States, Xoom is licensed under applicable laws such as the Money Transmission Services Act, Sale of Checks Act, Currency Transmissions Act, Check Cashing Registration Act among others.

At the federal level, Xoom is registered as a money services business and licensed by the Financial Crimes Enforcement Network (FinCEN).

Xoom is also subject to the Dodd-Frank Act which regulates consumer protection and the Gramm-Leach-Bliley Act, for handling nonpublic personal information.

Key industry partnerships

Protection of customer data

Similar to other areas of this review, we’ve analyzed what others had to say regarding Xoom's safety.

Customer feedback

User feedback

Xoom is rated as 1.7/5 on Trustpilot. However, out of 22,747 reviews, 84% are 5 stars.

It’s worth noting that the overall Trustpilot score is not an average, but rather a combination of multiple factors including the frequency, age, responses, and more.

ANALYSIS OF USER REVIEWS

Overall, while Xoom may work for smaller, non-urgent transactions, many found that it’s not great for larger or time-sensitive transfers due to the high risk of delays, fees, bad rates, and poor service.

Many found that initial transactions are often quick and easy, but subsequent transfers, especially larger ones resulted in delays due to verifications.

This is an issue, as Xoom requires extensive documentation that may be difficult or impossible to provide quickly, creating delays without the option of pre-verifying accounts.

On the positive side, a fair few mention the reach of the company, covering harder-to-reach areas. However, at the same time, many seem to complain about confusing fees and misleading quotes which lead to hidden charges.

Another issue many have raised is the exchange rates, similar to what we said in this review, they are bad and uncompetitive.

Customer service has been another pain point. Xoom’s support team is described as unresponsive, providing templated responses without addressing specific issues.

There aren’t many recent reviews, but here’s an overview of recent reviews averaged out (0s mean there were no reviews).

Review Category | Apr 24 | May 24 | Jun 24 | Jul 24 | Aug 24 | Sep 24 |

|---|---|---|---|---|---|---|

International Transfers | 0 | 0 | 0 | 0 | 0 | 0 |

Fees | 0 | 0 | 0 | 0 | 0 | 1 |

Exchange Rates | 0 | 0 | 0 | 0 | 0 | 1 |

Speed | 1 | 0 | 0 | 0 | 0 | 0 |

Limit | 0 | 0 | 1 | 0 | 3 | 1 |

Features | 0 | 1 | 1 | 1 | 1 | 0 |

Ease of Use | 0 | 0 | 0 | 0 | 0 | 0 |

Safety | 0 | 0 | 1 | 0 | 0 | 1 |

Customer Support | 1 | 1 | 2 | 1 | 1 | 1 |

Opening an account with Xoom

If you do not have an account with Xoom or PayPal, then you will need to create one.

You can register on the website or via the apps of both companies.

This is what you will need to get started:

Email and phone number

Personal details (name, surname, phone number, etc…)

SSN, government-issued ID, and a bank statement (to increase the transfer limits)

Once you have everything ready, follow these steps:

Download the app

Download the Xoom app from your app store.

Register

Open the app and click sign-up.

Follow the registration form and add all the required details.

Verify

You will receive a verification email with a verification link. Use it to activate your account.

Add additional profile information in-case you need to increase the transfer limits.

Use your PayPal account & app

If you already have a PayPal account, you can use it to make international transfers without downloading xoom.

Simply login (either through the website or the app), navigate to “Payments” and click “To a bank account”.

Making international transfers

To send money with Xoom, you will need the following:

Recipient details (name and surname, address, etc...)

Transfer details (amount, country, currency, etc…)

SSN, government-issued ID, and a bank statement (to increase the transfer limits in case you haven’t already)

If you are sending money to a bank account outside of the EU, you will also need to provide a SWIFT code.

Sending money online

Once you have all the details ready, you can send money with Xoom by following the steps below.

Login to Xoom

Navigate to the website and click Login. From there click Get Started.

Add transfer details

Next, you will need to select the country, the currency and the transfer method you want to use to send money.

Enter Recipient Details

Add your recipient details. The details you need to enter depend on what transfer method you have chosen.

For example, if you have chosen home delivery, when you will need the recipient’s address.

Review and Send

Once you have entered the information, double check that it is correct.

Once you’re happy with the transfer, click on the confirmation button.

Sending money with the app

The steps are similar regardless of your source funds and where the money is going.

Log into your Xoom app.

If you already have Xoom account, you can use the same login details.

The first time you log in you’ll need to set up the security, which might be a fingerprint or an SMS code.

Select deposit method

To start a payment you’ll need to select the funding source.

Add transfer details

Next, select where the money is being sent, the currency, and the transfer details.

You will also need to select how you want the money to be delivered (this will depend on the country you are sending money to).

Review and send

Review the transaction details to make sure you’re happy with the exchange rate and fees.

Once you’re happy, confirm and send money.

Canceling transfer

You can cancel your transfer that hasn't been deposited, picked up, or paid to the recipient.

Simply log on to your account and cancel your transfer by clicking on the Track Last Transaction link.

It can take up to four business days for your refund to be processed.

For further help, you can call the Xoom customer care toll-free number at 1-877-815-1531.

Receive international transfers

If you’re sending money to recipients' PayPal account, bank account, or a debit card, money will land in their account without them needing to do anything.

If you’re sending money to a location, the recipient will need to visit their local branch and show their ID (ensure it matches with the transfer), as well as give the transfer number.

Does the recipient need an account with Xoom or PayPal?

This depends on the delivery method that was used.

If you’re sending to PayPal, then yes, you will need to have a PayPal account.

For all other deposit methods, you don’t need to have an account with Xoom or PayPal.

How Xoom compares to other transfer services

There are better alternatives to Xoom in general. The companies below offer better exchange rates, lower fees, and quicker transfer times.

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

Xoom: Is it good for transfers abroad?

Overall, Xoom is good if you want to send money using your USD PayPal balance to a destination that has no fees, and low markup. For example, to countries in Central America.

This way, you benefit from low or no fees, and good exchange rates, and can send money in multiple ways.

In any other case, Xoom is not worth it. You will end up paying much higher fees and a very high markup on your transfer. Anything above 2.5% is not worth it, considering the additional transfer fees involved.

There are many money transfer companies that serve the same countries, offer lower (or no) markup, and have better fees.

Use our form below to find the best deal for your transfers abroad.

A bit more about Xoom

Can you pay bills with Xoom?

Is Xoom the best choice for business customers?

Will Xoom save you money compared to banks?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services

Xoom user feedback

Comments

Anonymous

you can only sign up with a paypal account , so not really an alternative

.svg)