How to Send Money to and from PayPal

Transferring money from your bank account to your PayPal balance is simple.

You can either instantly transfer it to your linked card, or do a standard transfer to a bank account.

Here, we'll explain both ways. We'll also look at how to link PayPal to your bank account, how to use it to make instant payments, and how to fund your PayPal account.

Search Now & Save On Your Transfer

Using PayPal for international transfers?

If you need to top up a PayPal account for an international transfer, we suggest avoiding it. PayPal fees are higher than both banks and money transfer companies.

Instead, we suggest using a better alternative such as Wise or running a live comparison.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

Transfer money from a bank account to PayPal

Transferring money from your bank account to PayPal is easy.

1. Set up or login to a PayPal account

You can download the PayPal app for free from Google Play and the App Store. You can also login to PayPal on any device.

You’ll need an email address and password, and on some devices, you can add a biometric login for an extra layer of security.

2. Confirm a bank account and link it to PayPal

Linking your bank account to PayPal allows you to make quick and easy transfers without needing to credit money to your PayPal account separately for each transaction. You can do this via the PayPal website or the PayPal app.

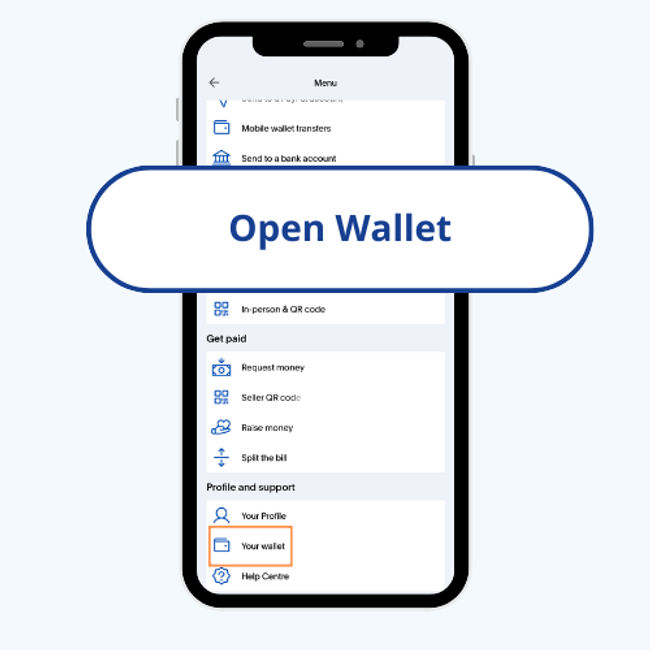

How to link a bank account to PayPal in the app

Linking a bank account to PayPal is straightforward - here’s what you need to do:

Go to your PayPal wallet

Open the PayPal app and tap ‘Wallet’.

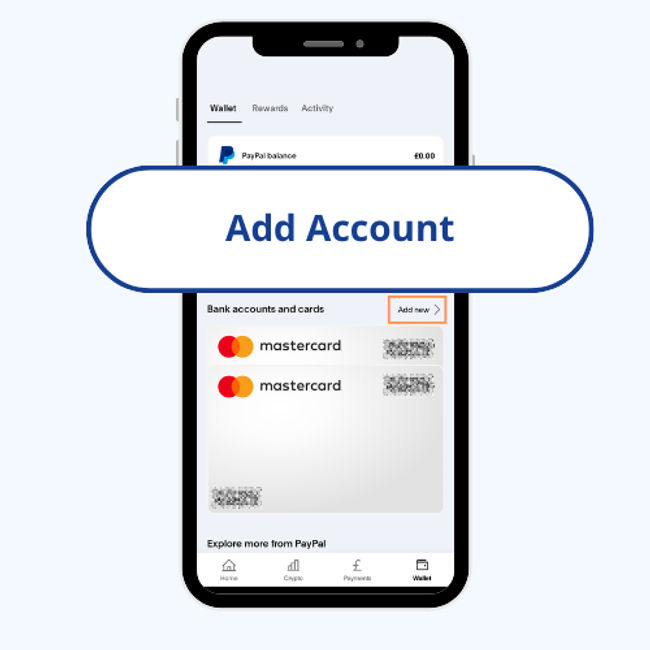

Add an account

Tap the ‘+’ symbol next to ‘Banks and cards’, then tap ‘Banks’.

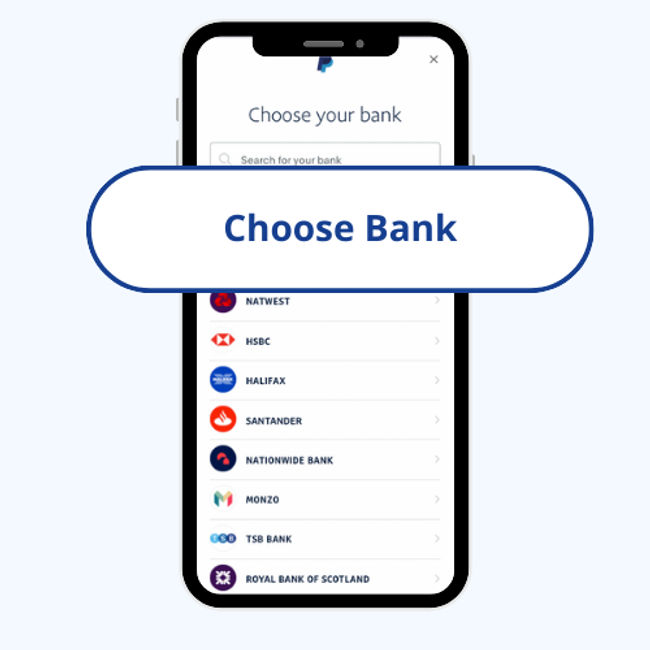

Find your bank

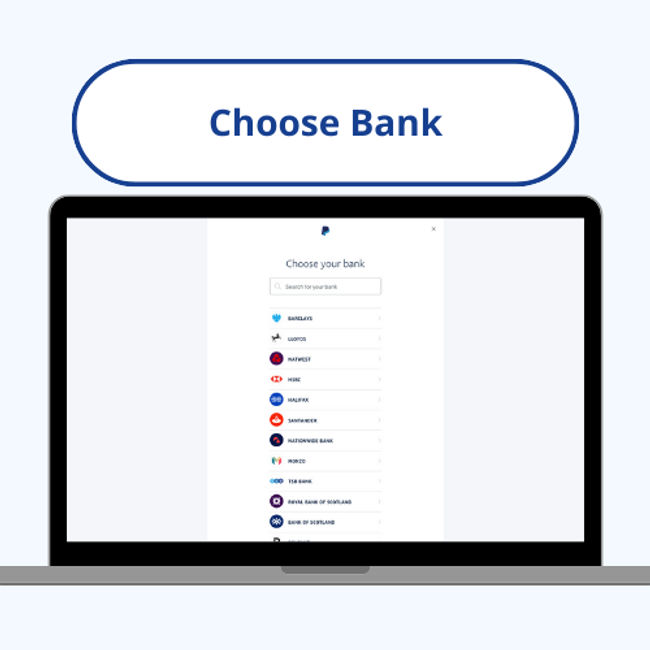

Search for your bank or select it from the list.

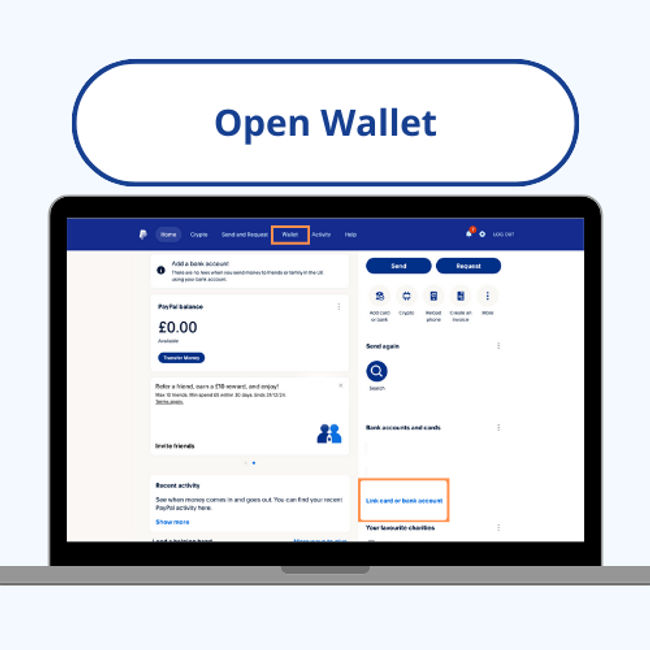

How to link a bank account to PayPal on the web

You can log in to your PayPal account via their website.

Go to your PayPal wallet

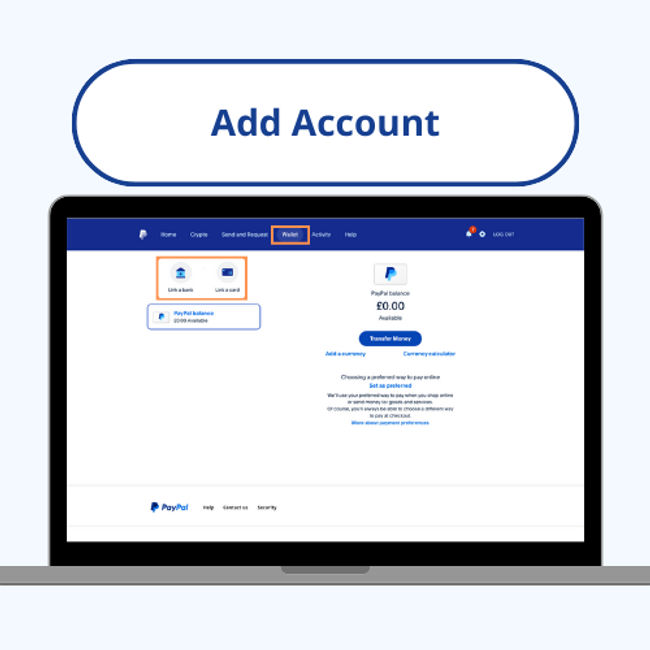

Log in to your PayPal account and click ‘Wallet’.

Add an account

Click ‘Link a card or bank', then ‘Link a bank account’

Find your bank

Search for your bank or select it from the list.

Verification

You can link your bank account instantly by entering your online banking login details. If this option isn’t available, you can enter your bank details manually and click ‘Agree and Link’.

If you don’t want to enter your login details to confirm your bank, you can click ‘Link your bank another way’. You can enter your account information here and PayPal will send you two small deposits within three business days to confirm your account. They will then debit these payments back when your account has been confirmed.

3. Transfer money to your PayPal account

Once set up, you can transfer money from your bank account to your PayPal wallet via the PayPal website or the PayPal app.

How to transfer money from a bank account to PayPal in the app

The app is available on Google Play and the App Store.

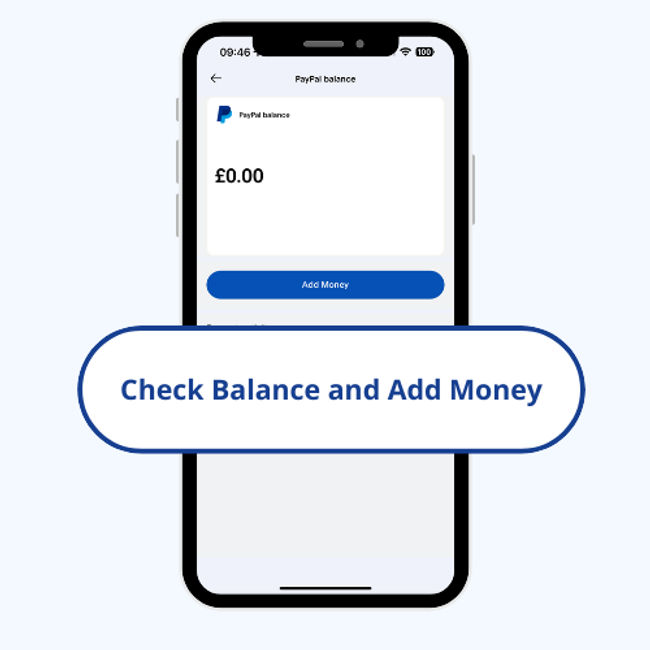

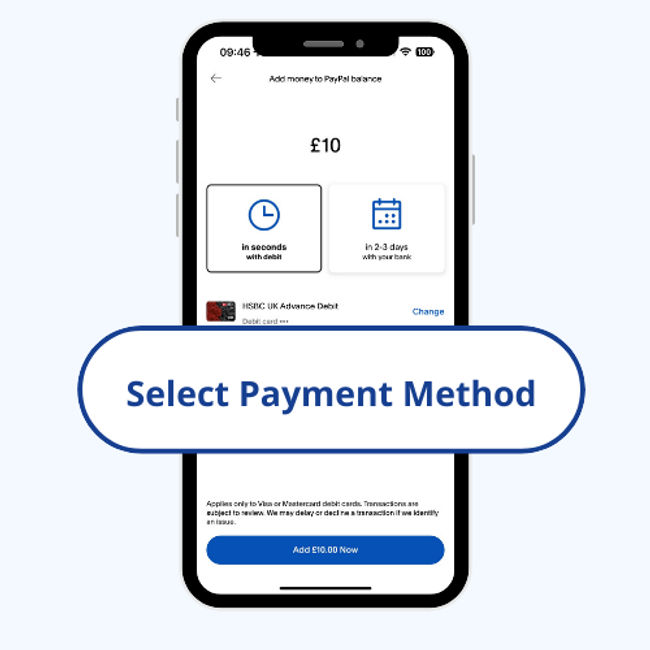

Go to 'Add money'

Open the PayPal app and tap ‘Add Money’, beside your balance.

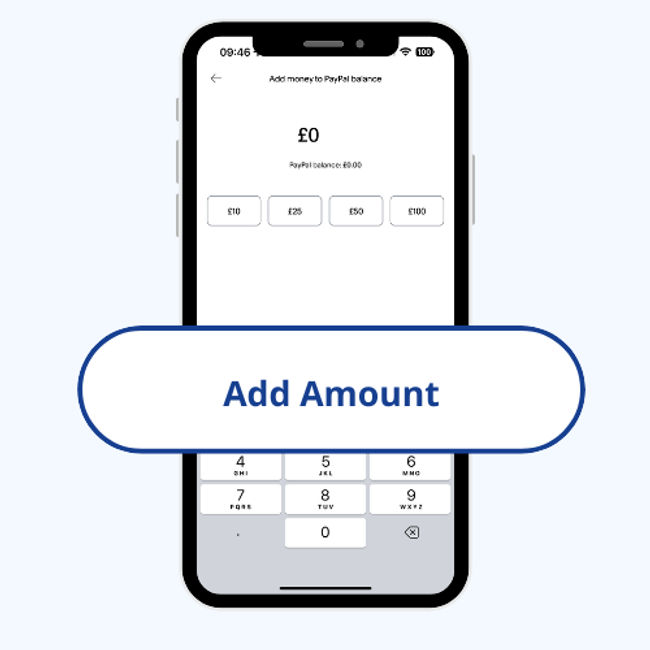

Enter the amount

Enter the amount of money you'd like to send to your PayPal balance.

Select your payment method and timeframe

Choose ‘in 3-5 days with your bank’.

How to transfer money from a bank account to PayPal on the web

You can log in to your PayPal account via their website.

Go to your PayPal wallet

Log in to your PayPal account and go to your ‘Wallet’.

Select where you'd like to transfer money from

Click ‘Transfer Money’, and then ‘Add money from your bank or debit card’.

Enter the amount

Enter the amount of money you'd like to send to your PayPal balance.

Select your payment method and timeframe

Choose ‘in 3-5 days with your bank’.

How long does it take for funds to reach your PayPal account?

Transferring money from your bank account to PayPal can take 3-5 business days.

While bank transfers to PayPal can be quite slow, you can transfer money to your PayPal account using your debit or credit card. These payments are instant.

Instant payments with PayPal

Despite it taking several working days to transfer funds from your bank account to your PayPal account, it is possible to make an instant payment with PayPal. When making an online payment or signing up for a subscription, rather than entering your card details you can choose to pay via PayPal.

The vendor will need to have this activated. Something to note here, Stripe is the second biggest payment gateway in the world with a 32% market share, and has no integration with PayPal.

When you do this, the seller or merchant will be credited immediately, while your bank processes PayPal’s request for the money.

To complete an instant transfer with PayPal, you’ll need to have linked your bank account to your PayPal account already using the steps listed above. PayPal will usually email you once the transaction is successfully completed.

Google Pay and Apple Pay

If using a mobile, or online store, to make a payment, most retailers will accept Google Pay and Apple Pay. Both of these are connected to a debit card and bank account. Using one of them removes the need to ensure a store has PayPal integration.

PayPal fees for adding money to an account

There are no fees for transferring money from your bank account to your PayPal balance, and making local purchases through PayPal are also free.

However, charges can come into play when transferring money overseas using PayPal. If you’re looking to send money abroad, it is cheaper to use international money transfer provider.

Here is how PayPal costs stack up against money transfer companies and banks for international transfers.

Method | Detail | Mid-Market Rate | Exchange Rate ($1 = €XX) | Fees | Received amount |

|---|---|---|---|---|---|

Money transfer company | A company online, or through an account manager, offering competitive rates on international transfers. | 0.9302 | 0.9378 | $6.42 | €931.73 ✅ |

Bank account | Every day banks, like Chase, offer weaker exchange rates and slower transfers. | 0.9302 | 0.9058 | $5.00 | €900.80 ❌ |

PayPal | Apps like PayPal generally offer the worst exchange rates and add a fee percentage on top. | 0.9302 | 0.8996 | $4.99 + 4.5% | €858.64 ❌ |

How to add cash to PayPal using the PayPal Debit Card

The PayPal Debit card

The PayPal Debit Mastercard lets you spend your PayPal balance anywhere Mastercard is accepted.

This can be used as a top-up method as well, including cash deposits.

You’ll need to go to one of PayPal’s participating stores to add cash to your account with your debit card. Over 90,000 locations across the US participate in the PayPal cash transfer scheme, including Rite Aid, CVS Pharmacy, GameStop, Walmart, Dollar General, and Family Dollar.

When you’re at the store:

Go to your 'Wallet'

Select where you'd like to transfer money from

Choose a store

Show the barcode at the checkout

PayPal have a cash deposit limits

The daily limit is $500, which is also the limit on each individual barcode.

You can use up to three barcodes per day, but only up to the maximum total of $500.

The maximum amount of cash deposits per month is $4,000.

The minimum deposit per barcode is typically $20.

How soon is cash available to use in my PayPal account?

The PayPal cash deposit process is very fast. Money is typically added to your PayPal balance within minutes of the transaction.

P2P PayPal payments

To send money to someone’s PayPal account, both parties will need to have PayPal accounts. You can’t transfer money from your bank account directly to someone else’s PayPal account.

This is a decent option for sending domestic payments covering:

Transfers to friends and family

Paying an invoice raised in PayPal

Signing up to a subscription

To send money to someone else’s PayPal account, you can set up your own PayPal account and add money to your balance via the method shown above. When you have a PayPal balance, you can transfer money to someone else’s PayPal account by following these steps:

Transfer money via the PayPal app

Confirm payee

Enter the recipient’s information: Name, @username, email address or mobile phone number

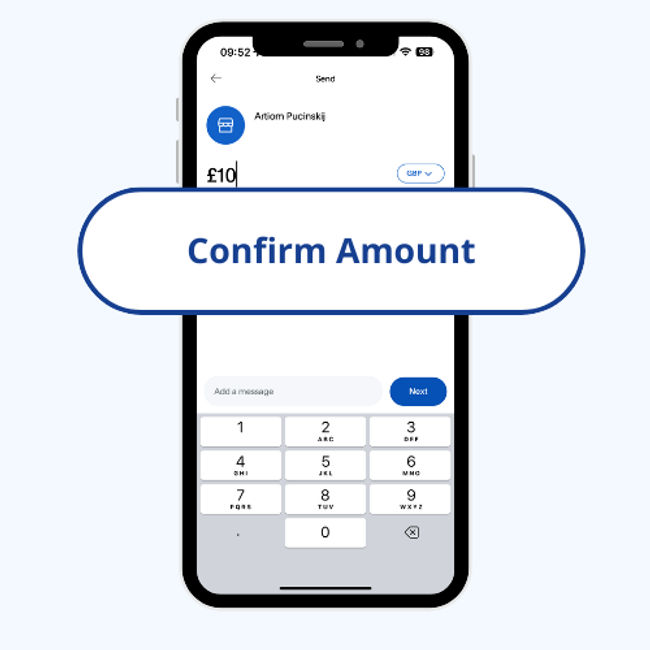

Confirm amount

Enter the amount you’d like to transfer, choose the currency, add an optional note if you wish, and tap ‘Next’

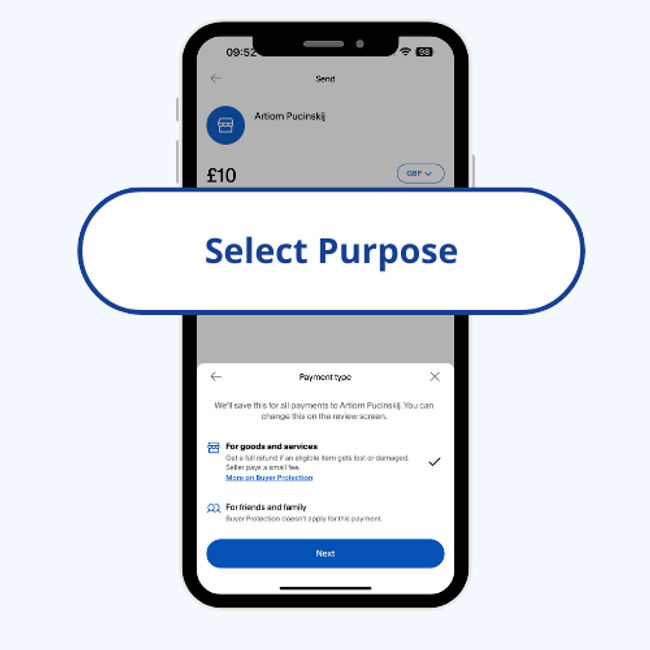

Confirm the reason

Select why you are sending the payment.

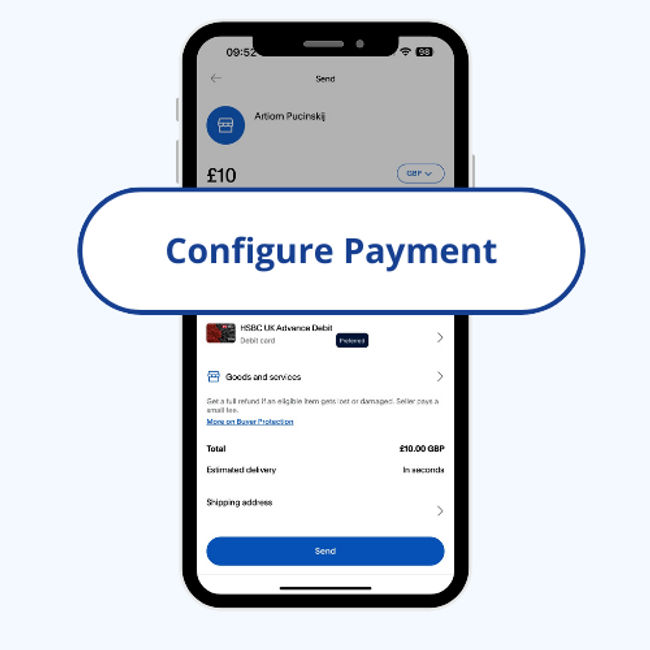

Configure payment option

Select your funding source, review the information, and tap ‘Send’

Transfer money via the PayPal website

Go to ‘Send and Request’

Enter the recipient’s information: Name, @username, email address or mobile phone number, and click ‘Next’

Enter the amount you’d like to transfer, choose the currency, add an optional note if you wish, and tap ‘Continue’

If available, choose the payment type

Choose how you want to pay and click ‘Next’

Review the information and click ‘Send Payment Now’ when you’re happy

Receiving money into your PayPal account

You can receive money through PayPal when someone sends a payment to your email address or mobile number.

When this has happened, PayPal will send you a message letting you know that your account has received some money.

You can access this money via your PayPal homepage, and either:

Transfer it to your linked bank account, or

Keep it in your PayPal balance

Sending money to PayPal - simple, but sometimes slow

PayPal is a very useful system for paying for goods and sending money to other PayPal users, but transferring money directly from your linked bank account to your PayPal balance can take some time.

You can avoid these delays by transferring funds from your debit card, or adding cash using the PayPal Debit Card.

However, despite its clear usefulness, the heavy fees charged for international transfers make it a poorer choice for sending money overseas. You’ll find a better rate using a specialist money transfer provider.

Beat PayPal costs

Transferring money from PayPal to a bank account

You can withdraw money from your PayPal account in one of two ways:

Instant transfer to your connected debit card or bank account

Standard transfer to your bank account

You can withdraw money from your PayPal account via either the website or the app.

How to withdraw money from your PayPal account via the app

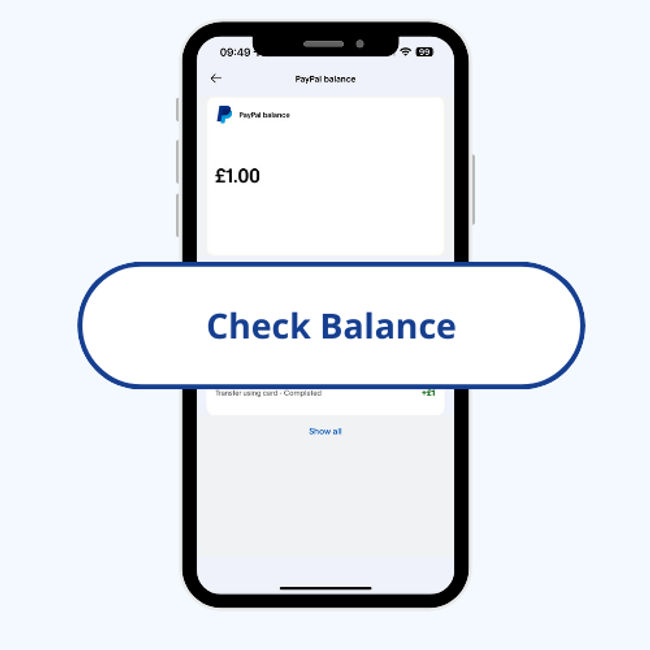

Check balance

Check the amount you have in the account.

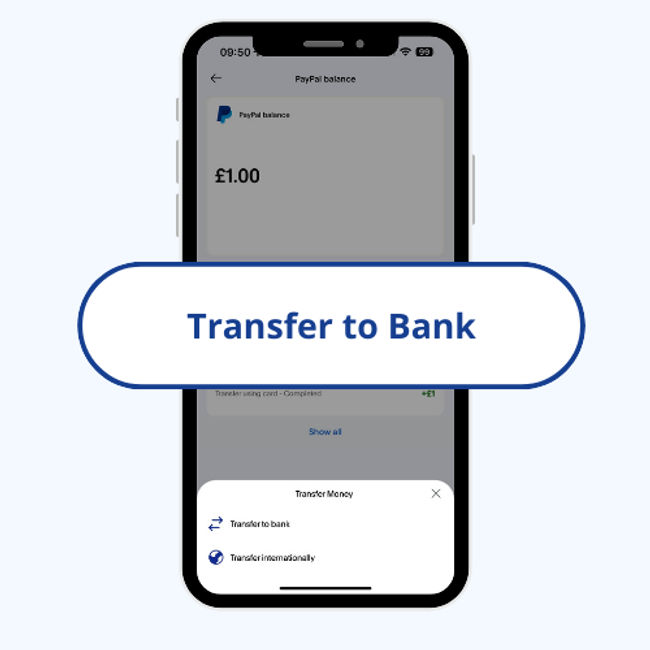

Choose where

Choose where you want to withdraw funds to.

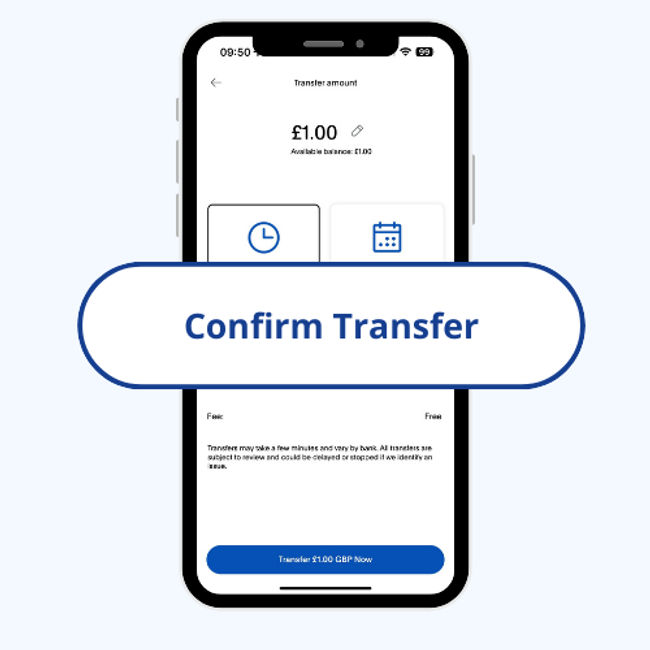

Confirm transfer

Confirm you are happy with the withdrawal.

Receive funds

Complete the transfer and receive your funds.

How to withdraw money from your PayPal account on the web

Go to your ‘Wallet’

Click ‘Transfer Money’

Click ‘Withdraw from PayPal to your bank account

Select ‘Instant (Free)’ or ‘Standard (Free)’

Follow the instructions

The Instant transfer to your bank account is quicker, typically taking just a few minutes to complete, up to a maximum of 30 minutes. The standard transfer is not quite as fast, typically completing in one working day. This also depends on your bank’s clearing process, and may take 3-5 business days.

Check before you withdraw

The name on your PayPal account must match the name on your bank account exactly. For example, if your bank account name is J W Murphy, but your PayPal account name is John William Murphy, the transfer could fail. If your PayPal account name is slightly different, you should change it to make sure it matches the name on your bank account.

PayPal only supports transfers in the local currency, so if you withdraw money in a foreign currency, they’ll charge a conversion fee.

Some banks charge fees for processing electronic payments. You should check this before submitting a withdrawal request, as we’re not able to cancel a withdrawal once we’ve started processing it.

You can’t cancel a withdrawal request

A bit more on PayPal transfers

Why can’t I transfer money from my bank account to PayPal?

Does PayPal take money from your bank account immediately?

Are PayPal transfers instant?

What is the fastest way to get money into PayPal?

Do different banks take longer to send money to PayPal?

How do you send money from Wells Fargo to PayPal?

Related Content

Contributors