Send money to South Sudan

"Moneygram is a well established service with over 80 years in the sector. They support over 200 countries worldwide and have over 440,000 retail locations."

How to get the best rate for money transfers to South Sudan

We found MoneyGram to be the best way to send money to South Sudan.

After testing and reviewing 1 money transfer providers servicing South Sudan, MoneyGram came out on top.

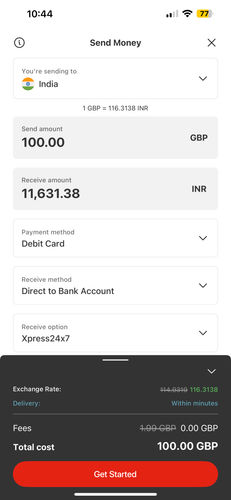

MoneyGram offers quick transfers, adds a 2% markup on SSP transfers, and costs $490.00000000000006 in fees.

This makes it the best option for a mix of cost, speed & features for SSP transfers.

MoneyGram is the cheapest way to send money to South Sudan

MoneyGram charges $490.00000000000006 per transfer and adds a 2% markup on top of the exchange rate.

bank transfer is the cheapest funding option when sending money to South Sudan. Pair it together with MoneyGram, to get the most out of your SSP transfer.

Fastest way to send money to South Sudan: MoneyGram

Our data shows that MoneyGram is the fastest way to transfer SSP right now.

With MoneyGram, the transfer time to South Sudan is minutes - 24 hours (for a $7,000 transfer).

MoneyGram charges $490.00000000000006 in fees on $7,000 transfer and adds a 2% markup.

The ‘fastest’ way to transfer money to South Sudan includes the transfer amount, deposit method, and transfer and withdrawal times.

The easiest way to send money to South Sudan: MoneyGram

They’re highly transparent with fees, charging $490.00000000000006 per transfer with a 2% markup on the SSP mid-market rate.

With multiple deposit and withdrawal options and reliable customer service, getting started with MoneyGram takes less than 10 minutes, making it a fast, cheap, and user-friendly option.

Consider this before sending money to South Sudan

Compare your transfer options to South Sudan

Always compare your options before sending , as the amount of SSP received can vary based on the deposit method, the amount of SSP sent, and your home country.

Most services include fees and markups on the SSP mid-market rate.

Our comparison of 1 providers supporting South Sudan will help you find the best fit for your needs.

Keep an eye on the SSP exchange rates

Payment and deposit methods make a difference

There may be limits on SSP transfers

Does speed matter to you?

Consider all the transfer ways

Consider the receiving options in South Sudan

Have your ID ready when receiving money

Consider taxes and transfer limits to South Sudan

Need to send over $10,000?

For transfers over $10,000, your best bet is MoneyGram.

While MoneyGram may not always be the cheapest or fastest way to send SSP, but they offer the best exchange rate, years of experience, and will offer you the peace of mind you need when sending large amounts abroad.

The costs of sending money to South Sudan

The cost of SSP transfers depends on where your location, amount, funding and withdrawal methods, transfer fees, and the markup added on top of the SSP exchange rate.

Exchange rate markup

The exchange rate markup is the percentage added to the mid-market rate (the "real" SSP rate) by the service provider.

For example, MoneyGram offers one of the best exchange rates by applying a 2% markup on the USD-SSP exchange rate.

This means you receive 0 SSP - 2% for every US Dollar sent.

Transfer fees

Transfer fees to South Sudan can be either fixed, percentage-based, or a combination of both.

Suppose you want to send $7,000 to South Sudan (SSP).

After analyzing 1 services supporting SSP, MoneyGram appears to have the lowest fee of $490.00000000000006 per transfer to South Sudan.

Deposit method

The way you fund your SSP transfers can significantly affect the cost.

bank transfer is the overall cheapest deposit method for sending money to South Sudan.

Payment methods available to fund your transfer to South Sudan

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available in South Sudan.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money to South Sudan.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to find the best service for your needs when sending money to South Sudan

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from South Sudan

Send money to South Sudan

FAQs

Find answers to the most common questions on our dedicated FAQ page.

.svg)