Bancoli international business offering

Features | Insight |

|---|---|

Monthly Fee | From $29/month (waived with minimum balance) |

Exchange rate | Near interbank on major USD-funded corridors |

International transfer fees | Varies by payment rails |

Multi-currency account | ✅ Yes with 30+ currencies supported |

IBAN accounts | ✅ Yes, 1 IBAN account |

Batch payments | ✅ Yes |

Expense management and tracking | ✅ Yes |

Pay invoices | ✅ Yes |

Receive payments | ✅ Yes |

Marketplace integration | ❌ No |

API options | ✅ Yes |

Manage payroll | ✅ Yes |

Forward contracts | ❌ No |

ATM access | ❌ No |

Scoring Bancoli

Before you choose whether to transfer funds overseas with Bancoli, here’s a quick summary of benefits and drawbacks.

Pros

Cons

No time to read? Here’s a quick summary of Bancoli. Each area is covered in more detail below.

Transfer speed

Bancoli uses a tiered subscription model starting at $29/month, which can be waived by holding a minimum average balance.

FX pricing is near the interbank on major USD-funded payout corridors (often ~0% - 0.5%), but can vary significantly on more exotic currencies.

Transfer and processing fees depend on the payment rail and plan tier (e.g., wires vs ACH/SEPA).

Transfer speed

Transfer limits

Product offering

Usability

Regulations & safety

Customer feedback

Product offering

Provider

International payments

You and your business can make international payments through Bancoli, however, all outgoing international payouts must originate from USD balance.

Bancoli’s 0% FX payouts are funded from a USD source account.

Bancoli also offers a global multi-currency account, allowing businesses to hold, receive, and make payments directly from supported currency balances without conversion, as long as sufficient funds are available in the payout currency (I’ll go more over it below).

Businesses located almost anywhere in the world can open a USD account with Bancoli, receive international payments in USD, and send funds to supported local currencies at the interbank rate using local payout rails.

This setup allows non-US businesses to avoid traditional FX spreads and SWIFT conversion fees when repatriating funds to their home country.

Global business account (multi-currency account)

Bancoli offers a global business account (essentially a business multi-currency account), allowing you to get paid, hold balances, and make payouts in 30+ currencies at competitive market rates.

Dedicated currency accounts

You can open dedicated currency accounts, each held under the business’s own name, in the following currencies:

USD, EUR, GBP, MXN, CAD, AUD, HKD, SGD, NZD, PLN, CNY

Funds held in these currencies can be used directly for outgoing payments without conversion, provided sufficient balance is available.

In simple terms, these are the currencies you can hold your balance in.

This is a decent offering, but on a lower side of currencies available. For example, Equals Money provides 36 IBAN accounts, and Airwallex has 12 local accounts with local details.

Local payouts (25+ currencies)

SWIFT payouts (50+ currencies)

0% FX payouts (USD)

Global payment gateway

Bancoli offers a global payment gateway that allows businesses to accept payments through multiple rails, including

Cards

ACH

Wire transfers

Stablecoins

Bancoli network payments

You can control which payment methods are available to your customers, either restricting payments to the most cost-effective rails or allowing all supported methods and letting clients choose how they want to pay.

This flexibility helps businesses balance cost, speed, and customer preference depending on the transaction.

The gateway is designed to work alongside Bancoli’s USD accounts and multi-currency setup, making it easier to accept international payments and route incoming funds into the most appropriate account or balance.

Invoicing tools

Bancoli provides a set of integrated invoicing tools designed to reduce payment friction, improve cash flow, and automate follow-ups.

When I started testing Bancoli, I got the impression that this is their main product, because of how many features it comes with.

Yes, similar companies like Equals Money, Airwallex, Wise Business, Revolut Business, and pretty much every business platform offer invoicing tools, but Bancoli takes it to the next level.

You can issue direct e-invoices that route payments straight to a client’s bank account, helping encourage faster settlement while reducing manual errors and reconciliation issues.

Bancoli’s AI assistant, Eric, automatically incentivises on-time payments by applying rewards and discounts where configured, making it easier and more appealing for clients to pay promptly.

When needed, businesses can also tap into Guaranteed Invoices, providing access to funds before invoice maturity.

If you’re concerned about friendly fraud or chargebacks, Bancoli offers no-chargeback payment and settlement options on invoices.

This removes the risk of disputed payments, helping protect cash flow and reduce capital being tied up.

Instead of static PDFs, Bancoli uses Smart Invoices that dynamically display the exact amount paid, any discounts offered and claimed, and applicable late fees, improving transparency for both sender and recipient.

Invoices can include instant checkout options, allowing clients to complete payments directly without leaving the invoice, reducing drop-off and delays.

You can also schedule and automate invoice reminders and follow-ups, helping ensure invoices don’t go unpaid due to oversight.

Mobile app

Bancoli has no mobile app, which is not a huge deal as most of the work is likely to be done on desktop.

However, if you do need an all-in-one business solution with a mobile app, have a look at our Equals Money review, Xe business review, or Wise Business review.

Bancoli pricing, fees and exchange rates

Provider

Account fees

Bancoli combines usage-based pricing with a balance waiver model.

While plans start at $29 per month, the monthly fee is waived if you maintain a minimum average balance, making it a good option for businesses holding larger cash reserves.

Here are the subscription costs:

Plan | Monthly Fee | Fee Waived If You Hold |

|---|---|---|

Starter | $29 / month | $10,000 average balance |

Plus | $99 / month | $100,000 average balance |

Premium | $199 / month | $250,000 average balance |

Enterprise | Custom | $1,000,000+ (custom) |

In addition to the monthly fees, Bancoli applies additional FX allowances and payment processing fees based on the tier.

This pricing is very similar to Airwallex. For comparison, Airwallex starts at $29 (or $0 if you hold $5k or more) and goes all the way to $999/m for enterprises.

FX payout allowances

Bancoli applies the same monthly FX volume limits across all FX pricing options.

You can choose between interbank-rate payouts or Super Saver fixed-fee options without changing the allowance.

Plan | Interbank Rate (0% FX fee) | Super Saver 1% Fee | Super Saver 1.4% Fee |

|---|---|---|---|

Starter | 15k | 15k | 15k |

Plus | 70k | 70k | 70k |

Premium | 150k | 150k | 150k |

Enterprise | Custom | Custom | Custom |

Payment processing fees

There are also payment processing fees that apply depending on the tier you have.

Feature | Starter | Plus | Premium | Enterprise |

|---|---|---|---|---|

ACH & SEPA transfers (Named Accounts) | $1 | Free | Free | Free |

Wire transfers (Fedwire / SWIFT) | $25 | $22 | $20 | Free |

ACH Debit processing | Free | Free | Free | Free |

Bancoli Debit processing | Free | Free | Free | Free |

Depending on the plan you choose, you will get access to certain features:

Invoicing & payments

Team & account management

Cash flow and rewards

Payments & payouts

Support and security

AI & automations

Exchange rates

Bancoli’s FX rates are highly competitive for USD-funded payouts, especially across major currencies like AED, AUD, SGD, etc. where FX rates are almost as good as the interbank rates.

However, if you need access to more exotic currencies like KRW, NGN, or PHP you may want to consider an alternative like Wise Business or a currency broker like TorFX or Regency FX.

To assess Bancoli’s FX pricing, we compared Bancoli’s quoted payout rates against the mid-market rate (also known as the interbank rates).

We’ve only looked for the USD-funded payouts, since all conversions happen from the USD balance like we discussed above:

From | To | Bancoli Rate | Interbank rate | Markup |

|---|---|---|---|---|

USD | EUR | 0.9206 | 0.85002 | 8.3033% |

USD | UGX | 3,787.65 | 3559.832 | 6.3997% |

USD | CLP | 943.11 | 913.69 | 3.2199% |

USD | BWP | 13.6295 | 13.20533 | 3.2121% |

USD | PEN | 3.7927 | 3.368041 | 12.6085% |

USD | ZMW | 25.668 | 22.9715438 | 11.7382% |

USD | ZAR | 18.563 | 16.7790499 | 10.6320% |

USD | GBP | 0.7485 | 0.745325 | 0.4260% |

USD | CAD | 1.3787 | 1.376125 | 0.1871% |

USD | INR | 91.1087 | 90.9482 | 0.1765% |

USD | AED | 3.6787 | 3.6725 | 0.1688% |

USD | MXN | 18.0035 | 17.9747232 | 0.1601% |

USD | JPY | 155 | 154.793 | 0.1337% |

USD | SGD | 1.2908 | 1.289555 | 0.0965% |

USD | IDR | 16,667.66 | 16656.95 | 0.0643% |

USD | AUD | 1.5069 | 1.506603 | 0.0197% |

USD | THB | 31.497 | 31.491 | 0.0191% |

USD | BRL | 5.0235 | 5.4476 | -7.7851% |

USD | VND | 24,512.15 | 26345 | -6.9571% |

USD | PHP | 55.8891 | 58.603 | -4.6310% |

USD | NGN | 1,200.84 | 1453.61 | -17.3891% |

USD | KRW | 1,315.92 | 1475.08 | -10.7899% |

USD | GHS | 11.4914 | 11.49856 | -0.0623% |

*All data and rates collected in December 2025 from Bancoli website.

Based on the data, it is clear that there is some variance in FX rates and markup depending on the currency pair in question.

Across developed and highly liquid currency pairs, Bancoli’s FX pricing generally stays close to the mid-market rate, often within 0% - 0.5%. Especially:

Corridor | Bancoli Rate | Interbank rate | Markup |

|---|---|---|---|

AED | 3.6787 | 3.6725 | 0.17% |

AUD | 1.5069 | 1.5064 | 0.03% |

CAD | 1.3787 | 1.3761 | 0.19% |

GBP | 0.7485 | 0.7454 | 0.41% |

SGD | 1.2908 | 1.2896 | 0.09% |

JPY | 155.00 | 154.82 | 0.12% |

THB | 31.497 | 31.495 | 0.01% |

*All data and rates collected in December 2025 from Bancoli website.

This level of pricing is competitive with specialist business FX providers like Wise Business and significantly better than traditional banks.

However, for more emerging currencies, Bancoli’s FX markup starts to creep up.

In some cases, rates appear better than the mid-market rate, while in others they are meaningfully above it:

Corridor | Markup |

|---|---|

BRL | -7.75% |

KRW | -10.81% |

NGN | -17.39% |

PHP | -4.59% |

VND | -6.96% |

ZAR | 10.63% |

PEN | 12.61% |

ZMW | 11.74% |

UGX | 6.40% |

*All data and rates collected in December 2025 from Bancoli website. Positive numbers are better than the interbank rates.

This is fairly normal in less liquid FX markets, and is inline with companies like Airwallex and WorldFirst.

Transfer speed

Provider

Bancoli transfer speed depends on the payment method, destination, and currencies involved.

Generally, domestic payments and payments between Bancoli users will settle in seconds, while international payments can take a few days.

Here’s a quick summary of what you can expect:

Payment method | Typical settlement speed |

|---|---|

Bancoli in-network transfers | Instant |

Real-Time Payments (RTP) / FedNow (US) | Instant |

Global business account conversions | Instant |

Domestic wire transfers | Same day if initiated before the daily cut-off time |

ACH transfers (US) | 1-3 business days |

SEPA transfers (EUR) | Up to 1 business day |

International wire transfers (SWIFT) | 1-5 business days |

Transfer limits

Provider

Since Bancoli does not facilitate international transfers themselves, the limits will mostly depend on the payment rails used. For example:

ACH (Automated Clearing House)

Best for low-cost domestic transfers, but typically comes with lower transaction limits. Businesses are subject to daily caps depending on risk and account history.

Wire transfers

Designed for high-value payments, with significantly higher limits than ACH. Businesses can often send $1M+ per transfer, making wires suitable for large or time-sensitive transactions. These are usually a bit more expensive.

Bancoli in-network transfers & stablecoins

Transfers within the Bancoli network or via stablecoins settle instantly and can support very large amounts, as they do not rely on traditional banking rails.

Bancoli use cases & eligibility

Provider

Eligibility & use cases

Bancoli is available to businesses incorporated in most countries worldwide, with eligibility determined by regulatory and compliance requirements rather than the location of customers or payout destinations.

Businesses can generally operate from almost anywhere, provided they are not based in a restricted country. For a full list of available countries, check out this help page.

At the time of writing, Bancoli does not support businesses incorporated in the following countries or territories:

Afghanistan

Burma (Myanmar)

China

Haiti

Hungary

Iran

Iraq

Libya

Macau

Mali

North Korea

Palestine (Gaza Strip)

Russia

Somalia

South Sudan

Syria

West Bank (Palestinian Territory)

Yemen

Bancoli is best suited for international, payment-driven businesses that receive revenue in USD and need to pay globally with minimal friction.

Common use cases include:

Digital businesses

Such as SaaS companies, agencies, and online service providers managing cross-border client payments

Manufacturing

Supply-chain businesses making frequent international supplier payments

Retail and e-commerce

Businesses handling multi-currency collections and global payouts

Commodities

Trading firms operating across multiple currencies and jurisdictions

In practice, Bancoli is most valuable for businesses that prioritise efficient USD collections, low-cost outbound payments, and integrated invoicing and payout workflows, rather than consumer-style FX trading or currency holding.

Customer service

If you run into issues or need help, you can contact Bancoli via:

Email: support@bancoli.com

Support center here

Live chat throughout their website

Help center once logged in and verified

Safety and trust

Provider

Opening an account with Bancoli

To open a Bancoli account, you must complete an online onboarding and verification process. You’ll typically need the following information and documents:

Company details, including legal business name and registration number

Business registration documents (e.g. certificate of incorporation)

Business address and operating country

Details of directors and beneficial owners

Government-issued ID for authorised signatories

Proof of address where required

Basic information about your business activity and expected transaction volumes

Once you have these details, follow the steps below to open an account:

Create an account

Visit Bancoli’s website and sign up by providing your email address and setting up login credentials for your business account.

Submit company details

Enter your company information, including registration details, ownership structure, and the countries you operate in.

Complete identity verification

Verify the identity of directors or authorised users through Bancoli’s ID and liveness checks, which may include document uploads and selfie verification.

Compliance review

Bancoli reviews your application to ensure it meets regulatory and compliance requirements. This step may involve follow-up questions depending on your business model or location.

Activate your account

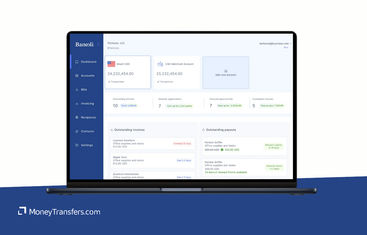

Once approved, you can access your Bancoli dashboard, instantly open currency accounts, and begin receiving and sending payments.

Customer feedback

Provider

Bancoli currently has a low number of online reviews, with a Trustpilot rating of 2.5 out of 5 based on 7 reviews.

Feedback is generally mixed but leans towards negative, with most criticism focused on the onboarding experience, compliance checks, and account approval outcomes, rather than day-to-day product functionality.

One thing I noticed is that Bancoli’s replies to negative reviews are very vague and mostly citing regulations, AML, and partner bank requirements, instead of providing real solutions.

We’ve analyzed the online reviews and summed them up below:

What customers like

Common complaints

Not keen on Bancoli?

If you are unsure of whether Bancoli is for you, here's how they stack up in the market.

Bancoli: Is it a good fit for your business?

Bancoli is a good fit for internationally focused businesses that receive funds in USD and need a cost-efficient way to send global payouts using local rails or SWIFT.

Its strength is in USD-funded payments, where FX pricing is often close to the interbank rate on major corridors, combined with a capable multi-currency account, invoicing tools, and flexible payment infrastructure.

However, onboarding can be slow, FX pricing is less predictable on more exotic currencies, and there’s no mobile app or deposit protection.

In my opinion, Bancoli works best for established businesses with USD revenue and regular outbound payments.

However, companies needing faster onboarding, broader FX consistency, or a more traditional banking experience may prefer alternatives like Wise Business or Airwallex.

As always, we suggest running a quick comparison to get the best deal for your business.

Get the latest business transfers deal

A bit more about Bancoli

Is Bancoli a bank?

Does Bancoli really offer 0% FX?

Can I hold and use multiple currencies?

Which countries are not supported?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.