2016 European Fintech Awards Winner

Monese won the “best challenger bank” in the European Fintech Awards in 2016 and was among the top 20 LinkedIn's hottest startups in 2019.

With clients spanning 31 countries, Monese takes pride in its 4.0 ratings out of the highest 5 from Trustpilot.

It has an app that can be downloaded from Apple Store, Google Play, and Huawei AppGallery.

Scoring Monese

Using our unique scoring system, we’ve reviewed Monese based on transfer fees, exchange rates, transfer speed, limits, and more. Here's a quick summary of the good and the bad.

Pros

Cons

We've also looked at what users are saying about Monese online. Especially about international transfers and took the averages over time.

Monese fees and exchange rates

Fees and rates

Monese shares its latest exchange rates on its website, and it uses that rate for all transactions within the last working day.

Hence, the actual exchange rate used in a transaction may slightly differ from the breakdown on their website.

You can only send from three currencies: GBP, EUR, and RON, as implied on the money transfer page.

Monese’s money transfer services can reach 35 countries, most of which are located in the EEA, as well as the US, Hong Kong, and India.

How do Monese transfer fees compare to using a money transfer provider?

Monese has its exchange rate updated in real-time and may omit fees if a client is a Premium user.

It features a simple breakdown of fees that customers may find desirable in a money transfer.

Exchange rates

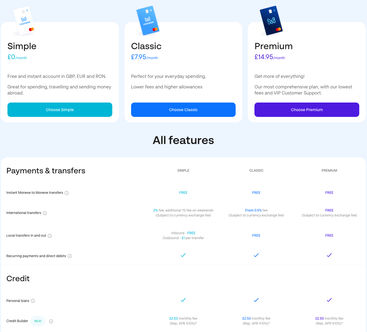

Monese’s transfer rate is based on the type of the client’s account, as follows:

Simple account: 2% of the transfer amount when sending money to a non-Monese account, or a minimum amount of 2 GBP.

Classic account: The transfer rate starts from 0.5% when sending to non-Monese accounts or a minimum of 2 GBP.

Premium account: no transfer fee

Additional costs

Unless registered with a Premium account with Monese, clients must pay a currency exchange fee that starts from 2% of the total amount or a minimum of 2 GBP, 2 EUR, or 8 RON.

Monese does not list other fees on its website regarding international money transfers.

Here's how users online are rating Monese's fees.

Transfer speed

Monese transfer speed

Monese money transfers made within the UK through Faster Payments reach the recipient account instantly.

For international SEPA transfers made before 11 a.m. CET, the money transfer will be completed within the same day; otherwise, it will take around one business day to complete the transaction.

International transfers outside SEPA countries take around 2-4 business days to get to the recipient account.

There aren't many online reviews for the speed of the service. However, those that do mention speed, seem to feel largely positive about it.

Transfer limits

Monese transfer limits

Monese has a few transfer limits in place:

40,000 GBP for UK accounts

50,000 EUR for Euro accounts

49,999 RON for Romanian accounts

Product offering

Monese product offering

You can use the Monese app to automate bill payments, make monthly budgets, divide savings according to purpose, and track payments. All this information can be exported into a PDF or an Excel sheet.

The app also contains a virtual card to increase payment options.

In addition, you can link Apple Pay, Google Pay, Avios, and PayPal to your Monese app to keep track of everything in one place.

Savings tracking

Similar to Monzo, Monese uses money pots to help in cost tracking.

These money pots allow you to save for a trip, an emergency, or other financial projects.

It does so by setting up savings categories, determining a target amount for each pot, and tracking the deposits made in each pot.

Looking at online reviews, users have mixed feelings about Monese's features.

Ease of use

Ease of use

Here's how users are rating Monese's usability.

As for the customer support, Monese can be reached through the following ways:

Monese app: You can get in touch with the Monese Customer Support team via chat in their app.

Monese email: You can also send an email to support@monese.com using their registered email linked to their account as stated in the app.

Here's how the online reviews averaged out throughout the year.

Safety and trust

Monese safety and trust

Online reviews suggest that users find Monese safe and are trusting it with their money.

Customer feedback

Monese user feedback

ANALYSIS OF USER REVIEWS

The reviews for Monese are mostly positive, with users frequently highlighting the ease of use and convenience of the banking service.

Many customers appreciate the user-friendly app, which facilitates seamless account management and quick money transfers.

The service is liked for being efficient and reliable, with several users noting that it is easy to set up, navigate, and make transfers abroad.

However, some faced issues with the support team and delays in money transfers.

Here's how user reviews look over time this year.

Jan 24 | Feb 24 | Mar 24 | Apr 24 | May 24 | Jun 24 | Jul 24 | |

|---|---|---|---|---|---|---|---|

Customer Support | 0 | 5 | 5 | 5 | 0 | 0 | 0 |

Ease of Use | 2 | 3 | 2 | 2 | 2 | 2 | 0 |

Exchange Rates | 1 | 5 | 5 | 5 | 0 | 0 | 0 |

Features | 5 | 4 | 0 | 0 | 0 | 0 | 0 |

Fees | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

International Transfers | 0 | 5 | 3 | 0 | 0 | 0 | 0 |

Limit | 0 | 0 | 5 | 5 | 5 | 5 | 5 |

Safety | 5 | 4 | 5 | 4 | 5 | 5 | 5 |

Speed | 3 | 2 | 1 | 2 | 2 | 2 | 0 |

*0s represent no reviews for the given month.

How to sign up for Monese

Getting started with Monese is simple. Follow these steps to sign up and make a transfer.

Download the app

Use the button below (or any orange button on this page) to quickly download the Monese app.

Add your details

Open the app and your details. You will need to have at least an email and a phone number.

Confirm your identity

Submit any ID to confirm your identity. This can be a passport, driving license, or any other form of government ID.

Record a confirmation video

Once you've submitted the documents, you'll need to record a quick video showing your face for the system to match it to the submitted document.

Select New Payment

Now you should be able to make payments.

In the lower-hand corner, select "New Payment" to make a payment to someone outside of your contacts.

Enter receipient details

Fill in the recipient's personal details (name and currency you will be sending).

Add transfer details

Now you will need to add the recipient's bank account details.

Confirm and send

That's it. Confirm the details in the final screen and click send.

International transfer requirements & details

To make an international transfer with Monese, you will need the following details:

Full bank details of your recipient: you’ll their name, address, and IBAN or SWIFT code.

To make a wire transfer abroad: you’ll need to have an account with Monese and their app.

Monese's SWIFT code is MNEEBEB2.

Monese alternatives

Although Monese offers a super simple app and is super easy to get started with, it lacks many features that other neobanks and money transfer providers have.

If you're primarily interested in sending money outside of EEA, we'd suggest considering these alternatives.

Monese - An innovative bank

Monese was founded in 2015 and has since beefed up its features that offer convenience.

Opening an account with Monese is hassle-free with fewer requirements and no credit score checks.

It is called a 'mobile money account' because you only need at least a registered phone number to open an account.

Monese is a challenger bank that continues to be funded for its innovative banking ideas.

It partnered with various payment channels, such as Google Pay, Apple Pay, Avios, and PayPal to offer flexible payment options and make the transaction process as smooth as possible.

A bit more about Monese

Can I use a Monese debit card when traveling abroad?

Can I use Monese for international bank transfers?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Challenger Banks