How to send money to Nigeria from Swaziland with the best SZL-NGN rate

Find money transfer deals for sending money from Swaziland to Nigeria. Compare the cheapest, fastest, and most reliable providers with the best SZL to NGN exchange rates.

Read on for the best deals, expert information, and easiest ways to send money to Nigeria from Swaziland.

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

"With MoneyGram you can send money globally. Find a local MoneyGram branch near you to deposit and send cash abroad."

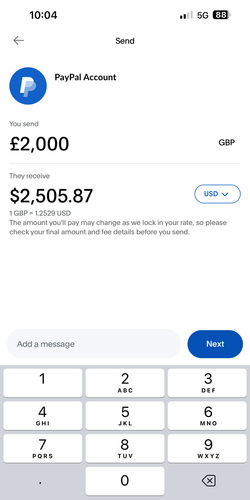

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

"If you and the person you are sending money to both have PayPal apps, you can quickly and easily send money between each other."

Alternative for Swaziland to Nigeria

While you can’t send SZL to NGN with Wise, you can transfer USD to USD.

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

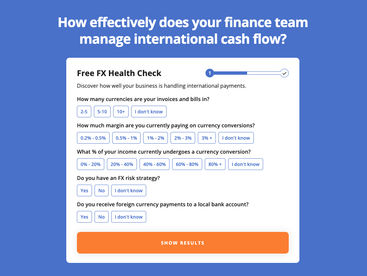

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

The best way to send money from Swaziland to Nigeria is using PayPal P2P transfer service.

With P2P transfers, if you and your recipient both have the PayPal app, you can send money between them.

You will initiate the transfer in SZL and your recipient will receive the NGN into their PayPal account.

The downside of this, is that PayPal charges higher fees and the withdrawal options can be limited depending.

How to get the best deal on sending money from Swaziland to Nigeria

Always compare rates

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates to send money from Swaziland to Nigeria.

Choose a provider

Select the provider that offers you the best value on buying NGN & service for your needs.

Click, sign up & send

Follow the steps & make your transfer. Your funds will soon be on their way to your chosen country & currency.

Considerations for money transfers from Swaziland to Nigeria

Comparing providers offering services between Swaziland and Nigeria, based on your specific needs is the best way to send money with confidence.

Our comparison includes 2 companies that provide the ability to send Lilangeni to Nigeria.

This ensures you get the best options for transfers to Nigeria from Swaziland, based on the amount you want to send.

The cheapest way to send money from Swaziland to Nigeria is a cash transfer via MoneyGram.

The cheapest way to send money to Nigeria from Swaziland is via a cash transfer through a MoneyGram Agent.

While cash transfers are usually more expensive than online options, our analysis of hundreds of money transfer companies shows that very few services currently support SZL/NGN transfers online.

The total cost of your transfer includes both the transfer fee (around 3 SZL per 4,300 SZL) and an exchange rate markup.

Ultimately, the exact price will depend on your location, payment method, and transfer amount.

The fastest way to send money to Nigeria from Swaziland is to use cash transfer via MoneyGram Agent

In most cases cash transfers with MoneyGram are instant, and your recipient will be able to collect NGN in minutes.

However, depending on how much you send, it can take a bit longer (up to a day) due to the processing time.

With the limited number of money transfer companies servicing SZL/NGN, cash transfer with MoneyGram is the fastest way.

Sending large sums of money?

Of the 2 companies tested, MoneyGram Agent is the best rated for larger transfer amounts.

Whether for a property purchase, or as a gift, sending large amounts of money to Nigeria from Swaziland can be expensive.

MoneyGram Agent is our choice for big transfers to SZL because of all round price, speed and management when making large transfers.

Understanding the cost of transferring money from Swaziland to Nigeria

The total cost of money transfers from Swaziland to Nigeria is a combination of fees and exchange rates. Get the best of both, and you will be getting a good deal.

The Mid-Market and Exchange Rates: The mid-market rate for SZL-NGN is currently 83.266 NGN per Lilangeni. Providers offering services closer to this rate will ensure more Naira for your Lilangenis.

To give a historic average, over the last 7 days the SZL-NGN mid-market rate has been 85.2056 NGN per Lilangeni, this has had a high of 85.7748 and a low of 84.0613.

From the 2 companies compared, MoneyGram Agent offers the best exchange rate on transfers to Nigeria and Swaziland.

Generally, the exchange rate you receive on converting SZL to NGN will be the biggest factor impacting the cost of sending Lilangenis to Nigeria.

Fees: Transfer fees are charged alongside a transfer. The company offering the lowest fee is MoneyGram Agent, just 3 SZL per transfer. In all cases, we recommend searching for your exact send amount as fees may change.

Amount Received: Money transfer companies will show you the amount eventually received in Naira. Simply, the higher the amount received in Swaziland, the lower the cost of sending from Nigeria.

Finding the best exchange rate for Lilangeni to Naira

Timing is essential for sending money between SZL and NGN. The exchange rate you secure impacts how much NGN you get for your SZL.

Over the last week, here’s what we’ve seen:

The exchange rate from SZL to NGN averaged 85.2056 NGN.

The highest value recorded was 85.7748 NGN, while the lowest was 84.0613 NGN.

There are currently 2 providers offering transfers between Swaziland and Nigeria close to this rate

Want to secure the best SZL-Naira exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Swaziland to Nigeria!

Swaziland to Nigeria money transfer payment methods

Bank transfers

Bank transfers are often the best payment method for money transfers from Swaziland to Nigeria.

A money transfer company like MoneyGram Agent offer bank transfers between Swaziland and Nigeria with lower fees and better exchange rates than you would get from a traditional bank.

On average, MoneyGram Agent is the cheapest provider for bank transfers of the 2 we tested when sending SZL to Nigeria.

MoneyGram Agent has a fee of 3 SZL for money transfers from Swaziland to Nigeria. Overall, they offer a great combination of competitive exchange rates and lower fees.

Debit and prepaid cards

Sending money from Swaziland to Nigeria with a debit or a prepaid card is very simple with MoneyGram Agent.

MoneyGram Agent is a leader in debit card payments for transfers from Swaziland to Nigeria, competing among a total of 2 active money transfer companies on this route.

Credit cards

We recommend avoiding credit cards where possible due to a lack of support and high fees.

If you have to use a credit card, we to find the company with the lowest fees.

Fee alert: using a credit card to transfer money can result in a fee being charged by your card issuer as it is considered as a cash advance. That's why we recommend bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between Nigeria and Swaziland.

Our comparison engine and algorithms evaluate providers based on over 25 factors, including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Swaziland to Nigeria.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send SZL to NGN.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy and review methodology.

Related transfer routes

Send money from Swaziland

Send money to Nigeria

How much money can be transferred from Swaziland to Nigeria?

Are there any tax implications to sending money from Swaziland to Nigeria?

Can I send money from Swaziland to Nigeria with MoneyTransfers.com?

What are the typical transfer fees for sending Lilangenis to Nigeria through various providers?

How long does it take to send money from Swaziland to Nigeria?

What is the best exchange rate I can get for sending money from Swaziland to Nigeria?

Are there any minimum or maximum transfer amounts for sending money from Swaziland to Nigeria?

Can I schedule regular transfers between Swaziland and Nigeria?

Tools & resources

Contributors