Use MONEYT2025 to get $20 sign up bonus!

Get $20 when signing to KOHO. Available only to first-time users.

Is KOHO right for you?

KOHO is generally great for making small to mid-sized international transfers from Canada. It uses interbank rates with clear upfront fees.

KOHO is good if… | Find an alternative if… |

|---|---|

|

|

Scoring KOHO

The key areas of our KOHO review are focused on the fees & exchange rates, transfer limits & speed, product offering, ease of use, safety and customer feedback.

Below is a quick summary of KOHO. Each area is covered in more detail below.

Exchange rates & fees

KOHO uses the mid-market exchange rate with no hidden FX markup.

Costs come from transparent, mostly fixed transfer fees, which are often cheaper than Wise for small to mid-sized transfers.

Transfer speed

Transfer limits

Product offering

Ease of use

Regulation and safety

Customer feedback

Before you choose whether to transfer funds overseas with KOHO, here’s a quick summary of benefits and drawbacks.

Pros

Cons

KOHO fees and exchange rates

Provider

Exchange rates

All international transfers with KOHO are made at the mid-market rate (also known as the interbank rate). This is the same as Wise and Aspora.

This is what they say on their website, but, of course we did our homework and checked all their exchange rates (just like we do with all our reviews).

Since KOHO only allows transfers from Canada, we’ve looked at all the rates from CAD to available currencies:

Destination | KOHO Rate | Mid-market rate | Markup |

|---|---|---|---|

AED | 2.6615 | 2.6620 | -0.02% |

ARS | 1051.1631 | 1051.5810 | -0.04% |

AUD | 1.0969 | 1.0973 | -0.04% |

BDT | 88.6000 | 88.6138 | -0.02% |

BRL | 4.0014 | 4.0055 | -0.10% |

CAD | 1.0000 | 1.0000 | 0.00% |

CHF | 0.5766 | 0.5768 | -0.03% |

CLP | 660.5696 | 660.7325 | -0.02% |

CNY | 5.1029 | 5.1036 | -0.01% |

COP | 2793.6200 | 2794.6290 | -0.04% |

CZK | 15.0438 | 15.0525 | -0.06% |

DKK | 4.6232 | 4.6241 | -0.02% |

EGP | 34.4518 | 34.4558 | -0.01% |

GBP | 0.5418 | 0.5420 | -0.04% |

GHS | 8.3049 | 8.3025 | 0.03% |

HKD | 5.6387 | 5.6398 | -0.02% |

IDR | 12127.6900 | 12129.5100 | -0.02% |

INR | 64.9725 | 65.0018 | -0.05% |

JPY | 114.0000 | 114.0320 | -0.03% |

KES | 93.3401 | 93.4325 | -0.10% |

KRW | 1071.4600 | 1071.8510 | -0.04% |

LKR | 224.2920 | 224.1948 | 0.04% |

MXN | 13.0607 | 13.0691 | -0.06% |

MYR | 2.9524 | 2.9535 | -0.04% |

NGN | 1055.5300 | 1055.5915 | -0.01% |

NOK | 7.3775 | 7.3801 | -0.03% |

NPR | 103.5075 | 103.6016 | -0.09% |

NZD | 1.2616 | 1.2618 | -0.02% |

PEN | 2.4397 | 2.4399 | -0.01% |

PHP | 42.5000 | 42.5100 | -0.02% |

PKR | 202.9500 | 202.8600 | 0.04% |

PLN | 2.6063 | 2.6071 | -0.03% |

SEK | 6.7519 | 6.7531 | -0.02% |

SGD | 0.9367 | 0.9371 | -0.04% |

THB | 22.7700 | 22.7800 | -0.04% |

TRY | 31.0216 | 31.0305 | -0.03% |

UGX | 2588.5934 | 2588.4338 | 0.01% |

USD | 0.7247 | 0.7248 | -0.02% |

VND | 19033.9900 | 19033.3500 | 0.00% |

ZAR | 12.1567 | 12.1614 | -0.04% |

*All data and exchange rates collected in December 2025 directly from KOHO website.

There is some variance in the rates, around 0.03%, but this is normal considering the time difference between me taking the rates and comparing to the interbank rate.

With such a small fluctuation, it is safe to say that KOHO really does make international transfers at the mid-market rate (or at least very very close to it).

Also, it’s important to know that the exchange rate itself remains stable regardless of transfer size, the main cost difference comes from fixed transfer fees, not hidden FX margins (more on that below).

International transfer fees

KOHO’s international transfer fees are transparent and mostly fixed, meaning the fee doesn’t scale much as you send more money.

What I really like about KOHO is their transparency with fees. KOHO doesn’t hide costs in the exchange rate.

Instead, it charges clear upfront fees, which makes pricing predictable and easy to compare, just like with the best money transfer companies like Wise.

In most cases, you pay a small flat fee, while the exchange rate stays near the interbank rate (as explained above).

Just like with exchange rates, we’ve looked at all the available corridors and transfer fees, open the accordion below to see the raw data.

Sending 200 CAD with KOHO

From | To | Amount | Transfer fee | Receive amount |

|---|---|---|---|---|

CAD | CNY | 200 | 5.67 | 995.31 |

CAD | INR | 200 | 1.45 | 13092.84 |

CAD | PKR | 200 | 2.1 | 40295.42 |

CAD | PHP | 200 | 1.9 | 8478.83 |

CAD | USD | 200 | 1.9 | 143.98 |

CAD | ARS | 200 | 6.75 | 202257.89 |

CAD | AUD | 200 | 1.9 | 216.49 |

CAD | BDT | 200 | 2.49 | 17469.56 |

CAD | BRL | 200 | 5.26 | 764.51 |

CAD | CAD | 200 | 1.4 | 198.6 |

CAD | CLP | 200 | 9.49 | 126639 |

CAD | COP | 200 | 8.22 | 531724.95 |

CAD | CZK | 200 | 4.77 | 2933.32 |

CAD | DKK | 200 | 2.1 | 913.49 |

CAD | EGP | 200 | 6.45 | 6672.14 |

CAD | GHS | 200 | 7.24 | 1594.32 |

CAD | HKD | 200 | 1.9 | 1120.39 |

CAD | IDR | 200 | 2.69 | 2389071 |

CAD | JPY | 200 | 7.68 | 21663 |

CAD | KES | 200 | 6.05 | 18169.61 |

CAD | MYR | 200 | 1.9 | 588.88 |

CAD | MXN | 200 | 2.1 | 2587.05 |

CAD | NPR | 200 | 2.79 | 20807.17 |

CAD | NZD | 200 | 4.08 | 245.47 |

CAD | NGN | 200 | 4.28 | 206411.54 |

CAD | NOK | 200 | 1.9 | 1456.93 |

CAD | PEN | 200 | 10.17 | 464.66 |

CAD | PLN | 200 | 3.68 | 511.9 |

CAD | SGD | 200 | 1.9 | 185.48 |

CAD | ZAR | 200 | 5.62 | 2369.9 |

CAD | KRW | 200 | 4.04 | 208951 |

CAD | LKR | 200 | 3.39 | 44155.89 |

CAD | SEK | 200 | 2.1 | 1333.8 |

CAD | CHF | 200 | 15.86 | 106.36 |

CAD | THB | 200 | 2.79 | 4502.24 |

CAD | TRY | 200 | 3.29 | 6102.46 |

CAD | AED | 200 | 15.86 | 491.38 |

CAD | UGX | 200 | 8.46 | 494995 |

CAD | GBP | 200 | 1.9 | 107.45 |

CAD | VND | 200 | 3.49 | 3753718 |

Sending 1000 CAD with KOHO

Sending 7000 CAD with KOHO

What’s interesting, is that in a lot of cases the fee is actually better with KOHO than the one offered by Wise.

For example, sending 200 CAD to PHP will get you 8435.25 PHP with KOHO vs 8,374.81 PHP with Wise. That’s around $1.03 better.

It may not seem like much, but if you’re making 20 transfers per year, with different amounts, that easily becomes a sizable saving.

In general, when sending CAD abroad with KOHO you can expect the following, depending on the amount, destination, and deposit/withdrawal methods:

Destination currency | Typical fee (CAD) |

|---|---|

USD | $1.90 – $18.90 |

INR | $1.45 – $15.05 |

PHP | $1.90 – $18.90 |

PKR | $2.10 – $25.90 |

CNY (China) | $5.67 – $56.67 |

GBP | $1.90 – $18.90 |

AUD | $1.90 – $18.90 |

EUR-linked (CHF, DKK, NOK, SEK, PLN) | ~$2 – $26 |

LATAM (MXN, BRL, ARS, COP, CLP, PEN) | ~$2 – $95 |

Africa (NGN, GHS, KES, UGX, ZAR) | ~$4 – $160 |

Asia (JPY, KRW, THB, VND, MYR, SGD) | ~$2 – $35 |

This means that:

Small transfers are cheap. Many destinations cost under $3 CAD.

Larger transfers benefit from scale. For example, sending $7,000 often costs 3-5x more than sending $200.

Transfer network matters. Faster transfers (30 minutes) are usually cheaper, using local bank transfers in Asia and Europe. While SWIFT transfers (e.g. China, Switzerland) cost more and take longer.

Additional fees for debit card deposits

In addition to the fees outlined above, KOHO also charges 3 CAD on all debit card deposits.

If you're an “Everything” member, these fees are waived.

To make it easier for you, let’s compare KOHO with other companies.

Let’s imagine you’re making a 1000 CAD transfer to these countries below. You use bank deposit and send it to a bank account.

Country | KOHO Receive | Wise Receive | Xe Receive |

|---|---|---|---|

✅ 539.59 GBP | 538.10 GBP | 537.20 GBP | |

✅ 65,431.86 INR | 65,108.18 INR | 65,391.40 INR | |

✅ 42,404.13 PHP | 42,192.56 PHP | 42,252.15 PHP | |

✅ 13,001.05 MXN | 12,948.69 MXN | 12,846.66 MXN | |

✅ 722.97 USD | 720.39 USD | 719.80 USD |

*Data collected in December 2025.

As you can see, it’s safe to say that KOHO is the cheapest option to send money from Canada.

Account fees

This is not directly related to international money transfer, however, I think it’s worth a mention.

KOHO comes with 3 subscription tiers, ranging from $0 to $14.75.

You can make international money transfers on the free tier, but if you want to make use of other services, it might be a good idea to consider paid tiers.

Feature / Fee | Essential | Extra | Everything |

|---|---|---|---|

Monthly Fee | $0 | $12 | $14.75 |

Estimated Yearly Value | $100+ | $200+ | $500+ |

Cash back on groceries, transport, food & drinks | 1% | 1.5% | 2% |

Interest Earned | 2% | 2.5% | 3.5% |

Free Credit Score | Yes | Yes | Yes |

Instant e-Transfers | Yes | Yes | Yes |

No Foreign Transaction Fees | No | Yes | Yes |

Discount on Credit Building | No | 30% | 50% |

Advanced Phone Support | No | No | Yes |

Transfer speed

Provider

KOHO claims that transfers to popular countries like India, Pakistan, and the Philippines arrive in minutes to a few hours, while most other destinations take 1-2 business days.

Similar to the above, we’ve decided to put these claims to the test and looked at all transfer times for all corridors offered by KOHO.

Based on the data we analyzed (see below), that claim holds up well.

KOHO transfer speed data

Across the corridors we reviewed, transfer speed depends mainly on whether the payout uses local bank rails or SWIFT.

It remains the same regardless of the transfer amount.

Breaking it down further, these routes consistently show delivery times of around 30 minutes, matching KOHO’s “near-instant” claims:

Destination currency | Typical delivery time |

|---|---|

INR (India) | ~30 minutes |

PKR (Pakistan) | ~30 minutes |

HKD (Hong Kong) | ~30 minutes |

SGD (Singapore) | ~30 minutes |

MYR (Malaysia) | ~30 minutes |

MXN (Mexico) | ~30 minutes |

KRW (South Korea) | ~30 minutes |

THB (Thailand) | ~30 minutes |

VND (Vietnam) | ~30 minutes |

GBP (UK) | ~30 minutes |

AUD (Australia) | ~30 minutes |

CZK (Czech Republic) | ~30 minutes |

These are local bank transfers, which explains the speed.

Most other destinations fall into the 1-2 business day range:

Destination currency | Typical delivery time |

|---|---|

USD | ~2 days |

PHP (Philippines) | ~2 days |

JPY (Japan) | ~2 days |

EUR-region currencies (DKK, SEK, NOK, PLN) | ~2 days |

LATAM (BRL, ARS, COP, CLP, PEN) | ~2 days |

Africa (NGN, GHS, KES, UGX, ZAR) | ~2 days |

A small number of corridors use SWIFT, which is slower and more expensive:

Destination currency | Typical delivery time |

|---|---|

CNY (China) | ~2 days |

CHF (Switzerland) | ~2 days |

These are expected to be longer, due to intermediary banks.

Transfer limits

Provider

KOHO keeps its international transfer limits simple and predictable, using rolling daily and monthly caps.

These limits apply across all transfers made from your account:

Limit type | Allowance |

|---|---|

Maximum per transfer | $5,000 CAD |

Daily load limit | $5,000 CAD |

Daily transfer count | Up to 3 transfers |

Monthly load limit | $15,000 CAD |

Monthly transfer count | Up to 20 transfers |

However, it’s worth keeping a few things in mind:

Daily limits are based on a rolling 24-hour window, not a calendar day.

Monthly limits run on a rolling 30-day period, not a fixed month.

Every transfer you make counts toward both the amount and transaction limits.

This means spacing out transfers can help you stay within limits.

If you’re after larger international transfers, I’d suggest looking at our Wise review, and Xe review.

Both services have much higher limits, excellent support options, and offer good deals on large transfers.

If you’re also planning to use other KOHO services, there are more limits outlined in here.

Product offering

Provider

Supported currencies & destinations

You can only send CAD with KOHO, to the following destinations and currencies:

Country name | Currency Code |

|---|---|

People's Republic of China | CNY |

India | INR |

Pakistan | PKR |

Philippines | PHP |

United States of America | USD |

Argentina | ARS |

Australia | AUD |

Bangladesh | BDT |

Brazil | BRL |

Canada | CAD |

Chile | CLP |

Colombia | COP |

Costa Rica | CRC |

Czech Republic | CZK |

Denmark | DKK |

Egypt | EGP |

Ghana | GHS |

Hong Kong | HKD |

Hungary | HUF |

Indonesia | IDR |

Israel | ILS |

Japan | JPY |

Kenya | KES |

Malaysia | MYR |

Mexico | MXN |

Nepal | NPR |

New Zealand | NZD |

Nigeria | NGN |

Norway | NOK |

Peru | PEN |

Poland | PLN |

Romania | RON |

Saudi Arabia | SAR |

Singapore | SGD |

South Africa | ZAR |

South Korea | KRW |

Sri Lanka | LKR |

Sweden | SEK |

Switzerland | CHF |

Thailand | THB |

Türkiye | TRY |

United Arab Emirates | AED |

Uganda | UGX |

United Kingdom | GBP |

Vietnam | VND |

As you’ve probably noticed, you can’t use KOHO to send money to Europe, meaning you will need an alternative.

If you need to send money somewhere else, I suggest you run a quick comparison using the form below to get the latest deals.

Get the latest deals now

Transfer Types

With KOHO you can send money abroad, make domestic transfers and send money between KOHO users.

International money transfers

KOHO lets you send money from Canada to supported countries abroad directly from the app.

Transfers use either local bank rails or SWIFT, with transparent fees, near-interbank exchange rates, and delivery times ranging from minutes to 2 business days.

Domestic transfers (K2K)

K2K is KOHO’s peer-to-peer transfer feature that lets you send money instantly and for free to other KOHO users.

Funds move in real time between KOHO accounts, making it ideal for splitting bills or sending money to friends and family in Canada.

Interac e-Transfer (Canada only)

KOHO supports fast domestic Interac e-Transfers, allowing you to send or receive money between KOHO and other Canadian banks in minutes.

This is a simple, low-cost option for everyday payments within Canada.

Deposit methods

With KOHO you can make deposits using Interac e-Transfer, debit cards, bank transfer, and even use cash deposits through Canada Post.

Interac e-Transfer

KOHO supports Interac e-Transfers, which usually arrive within a few minutes.

You can receive transfers from friends, family, or businesses using your unique KOHO e-Transfer email.

Account limits apply, and your bank must support auto-deposit for the smoothest experience.

Debit card loading

You can load funds using a Visa or Mastercard debit card, including Apple Pay. Most loads are completed in under a minute. A $3 fee applies to each load, though Everything plan members get this fee waived.

Debit card loads follow standard KOHO limits, with an additional daily cap of $1,500.

Credit cards, prepaid cards, and RBC Virtual Visa cards are not supported.

Direct deposit (Direct Load / Pre-Authorized Credit)

Direct deposit lets you receive payments from an employer, government agency, or business by sharing your KOHO account details.

Deposits must match the name on your KOHO account.

KOHO typically processes deposits the night before payday, though deposits aren’t processed on Sundays or holidays.

Cash deposit (Canada Post)

Verified KOHO users can deposit cash at Canada Post locations using a QR code generated in the app.

The minimum deposit is $10, with a maximum of $3,000 per transaction, $3,000 per 24 hours, and $10,000 per 30 days.

Deposits must be in Canadian dollars and usually appear in your KOHO account within about 10 minutes.

Payout methods

KOHO supports multiple payout options depending on the destination country, including bank transfers, local payment networks, and popular mobile wallets.

Bank transfers (most countries)

For the majority of destinations, payouts are made via local bank transfer, which is reliable and widely supported.

Bank transfers are available in:

USD, CAD, GBP, EUR, AUD, NZD, JPY, KRW, SGD, INR, PKR, PHP, MXN, BRL, ARS, CLP, COP, PEN, PLN, CZK, DKK, NOK, SEK, CHF*, AED, TRY, THB, VND, IDR, MYR, NGN, GHS, KES, UGX, ZAR, LKR, NPR, EGP, HKD

However it’s worth noting that some corridors use SWIFT instead of local rails, which is slower and a bit more expensive (check our fees section above to learn more)

SWIFT transfers

Certain countries like China, USA, and Switzerland rely on SWIFT bank transfers, which are slower and typically used where local rails aren’t available.

Mobile wallets

In supported regions, KOHO allows payouts directly to mobile wallets. This is often the fastest and cheapest way to receive money.

A few examples of supported wallets are:

Philippines: GCash, Maya, Coins.ph, GrabPay, ShopeePay, Bayad, PalawanPay, and more

Indonesia: GoPay, OVO, DANA, ShopeePay, LinkAja

Bangladesh: bKash, Rocket

Ghana: MTN, Airtel, Tigo, Vodacom

Kenya: M-PESA, Airtel, Equitel

Uganda: MTN, Airtel

Proxy / instant payment networks

Some countries support proxy-based systems, which allow near-instant transfers using identifiers instead of full bank details.

It’s available in India (UPI), Australia, Brazil, Hong Kong, Malaysia, and Singapore.

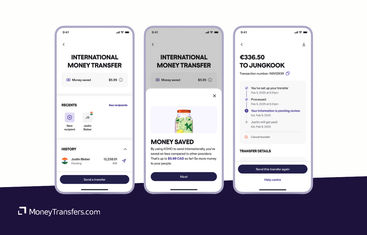

Mobile app

KOHO is mobile first company, meaning all KOHO services are used through their app, including international money transfers.

The app is rated 4.8/5 from ~82,000 reviews on the App Store, while Android ratings are more mixed, with 3.8/5 from ~71,600 reviews, mainly due to occasional stability or login issues after recent updates.

With KOHO app you get:

A prepaid Mastercard (virtual and physical)

Cash back on purchases

High-interest savings vaults

Credit building and rent reporting tools

International money transfers

Interac e-Transfers

Bill payments

Instant card controls

Built-in budgeting insights

We’ve also looked at the app reviews across both stores, and in general, users find the app easy to set up and intuitive to use, with especially good feedback around credit building and real-time spending tracking.

Other services

KOHO is somewhat a super-app, meaning it handles multiple financial services under one platform, very similar to Revolut and Starling Bank.

Aside from the international money transfers, KOHO offers:

Virtual cards

Physical cards

High interest savings accounts

Cashbacks

Borrowing money

Credit reports

And more

If you’re looking for an all rounded service with international money transfer features, it’s worth considering it.

Ease of use

Provider

I’ve downloaded the app, signed up, and made a test transfer.

Overall no complaints, the sign up process is smooth and quick, it took me a few minutes to sign up.

The verification process does take a bit of time, but I could browse around the app without it.

Making transfers is straightforward and quick, similar to other money transfer apps.

The only odd thing that I noticed, is that the app crashed once on me when I just opened it, but after re-opening it was working fine with no issues.

Customer service

If you run into any issues or have questions, there are a few ways you can get help, mainly using the:

Extensive help center here

Online chat support via the app or the website

Dedicated fraud email: fraud@koho.ca

I couldn’t find a way to call them or support email.

This is a bit concerning, but unfortunately in-line with similar app-based money transfer companies. Their support options are limited.

If you are making large transfers or need real human support, I strongly suggest checking our currency brokers. No other service beats their support options.

Safety and trust

Provider

Legitimacy of KOHO

Protection of customer data & funds

Key industry partnerships

Industry awards

Customer feedback

Provider

On Trustpilot, KOHO currently holds a low rating of 1.4 out of 5 stars from around 503 reviews, which at first glance looks concerning.

When we asked KOHO about this, they explained that many of the negative reviews relate to other products and account services, rather than their international money transfer feature specifically.

However, this is not something we can completely ignore.

Below is a quick summary of user reviews that seem to be dragging the overall ratings down.

Main positives

Main negatives

As you can see, this suggests that KOHO can work well for many users in normal day-to-day use.

But, support experiences during edge cases, such as fraud, account locks, or cancellations are where frustration tends to spike.

This helps explain why ratings skew heavily negative despite a loyal base of satisfied users.

Unfortunately, issues with support are very common for app-based money transfer companies and similar services.

For example, Wise and Revolut both have negative reviews and score the lowest on customer support in our analysis.

As I’ve already mentioned, if your main focus is international transfers, and you need real human support 24/7, I suggest having a look at the currency brokers such as Key Currency, CurrencyFlow, Regency FX, and TorFX.

Opening an account with KOHO

Before you can send money abroad, you’ll need to open an account with KOHO.

Follow these steps to get started.

Download the KOHO app

Get the KOHO app from the App Store or Google Play and start the sign-up process.

Create your account

Enter your basic details like name, email, and phone number, then set up your login and security preferences.

Verify your identity

KOHO will ask for ID verification to meet Canadian regulations. This is done directly in the app and usually takes just a few minutes.

Choose your plan

Pick the free Essential plan or upgrade to Extra or Everything for added perks like higher cashback and no foreign transaction fees.

Fund your account & start using it

Add money via e-Transfer, direct deposit, or debit card. Your virtual card is available instantly, and your physical KOHO Mastercard arrives by mail.

Making international transfers

Once you have your account verified, you can send money with KOHO by following the steps below.

Open the KOHO app

Log in and go to the Send money option.

Choose the destination and amount

Select the recipient’s country and currency, then enter how much you want to send. KOHO shows the fees upfront.

Add recipient details

Enter the recipient’s bank details and other required transfer information, depending on the country.

Review and confirm

Double-check the transfer details and confirm. The money is sent directly from your KOHO balance, with tracking available in the app.

If you are sending money to the bank account outside of the EU, you will also need to provide a SWIFT code.

Use the search box below to find your recipient’s SWIFT code.

Find your SWIFT code

Canceling transfer

You have around a 3 minute grace period to cancel your transfer within the app by clicking the “Cancel” button. However, as soon as your transfer was processed, it can no longer be cancelled.

Receive international transfers

Once you initiate the transfer, there’s nothing the recipient needs to do as money will land directly into their bank account or wallet, depending on the payout method you’ve picked.

Does the recipient need an account with KOHO?

No, your recipient doesn’t need to have a KOHO app to receive the money. Your transfer will arrive into your recipient's bank account or wallet directly.

The only time they will need the app is if you’re making a K2K payment (a transfer between KOHO accounts).

How KOHO compares to other transfer services

Other Alternatives

Alternatively, consider using one of these neobanks for international transfers.

KOHO: Is it good for transfers abroad?

KOHO is a strong option for Canadians sending money abroad, especially if you’re making regular, small to mid-sized transfers to destinations in Asia, Africa, and Latin America.

Its use of the mid-market exchange rate, combined with low, transparent transfer fees, makes it one of the cheapest ways to send money from Canada, often even beating Wise on price.

The international transfer side of KOHO is fast and reliable, where most transfers will take around 30 minutes and can take up to 2 business days.

That said, KOHO isn’t for everyone.

You can only send money from CAD, transfer limits are relatively low, and Europe is largely unsupported.

Customer support is also a clear weakness, particularly if something goes wrong and you need urgent help.

Generally speaking, KOHO works best as a cost-effective, mobile-first solution for everyday small international transfers, especially if you already use the app for banking.

If you need to send large amounts, want EU coverage, or require hands-on support, it’s worth comparing alternatives like Wise, Xe, or a currency broker before committing.

As always, we recommend comparing your options below.

The best transfer service depends on your destination, amount, and how quickly you need the money to arrive.

Find the best transfer deal

A bit more about KOHO

Is KOHO actually using the interbank exchange rate?

What fees should I expect beyond the exchange rate?

Are transfers safe despite negative reviews?

Why is KOHO’s Trustpilot rating so low?

Can my account or funds be frozen?

Help & FAQ

Get answers to the most common questions asked when sending money abroad. Covers costs, fees and the best way to compare.

More Money Transfer Services