How to send money from Canada to UAE with the best CAD/AED exchange rate

Compare and find the best ways to send money to the United Arab Emirates from Canada.

To make it easier, here are your best options:

Wise is the best way to send money from Canada to the United Arab Emirates

Key Currency is the cheapest way to send CAD to the United Arab Emirates

Currencyflow is the fastest way to transfer CAD/AED

Otherwise, keep reading to find more deals, expert information, and learn everything you need to know about CAD/AEDtransfers.

Transferring the other way? Send AED from United Arab Emirates to Canada instead."Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

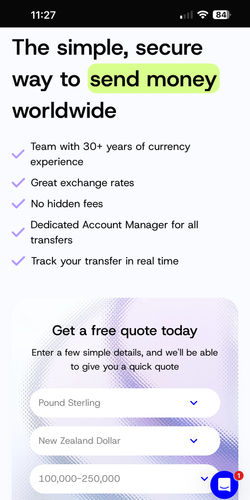

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Key Currency offers a personal service with a dedicated account manager. There are no transfer limits or fees which is perfect for larger send amounts."

"Currencyflow is a new FX broker with a focus on transparent, fair rates and accessible customer service. Contact the UK-based team for a free quote."

"Currencyflow is a new FX broker with a focus on transparent, fair rates and accessible customer service. Contact the UK-based team for a free quote."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"Regency's UK-based account management team has vast experience. Get support on all kinds of transfers, from overseas property transactions to business payments & more."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"TorFX's 5-star service handles most currency needs, especially relating to overseas property, emigration & retirement. Friendly phone support, no-obligation conversations & no max transfer limit."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"OFX have been helping individuals and businesses send money for over 25 years. Transfer in 50+ currencies to 170+ countries, with 24/7 phone access to currency experts."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"Currencies Direct have over 30 years of global money transfer expertise. Award winning service with a TrustPilot rating of 4.9. Lock-in rates for the future or trade 24/7 on web or mobile."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

"Securely send money to and from 150+ countries and 20+ currencies. Same-day transfers avaialble on most major currencies."

"Koho uses the live exchange rate and charges clear, transparent fees for their clients sending money from Canada to dozens of worldwide destinations."

"Koho uses the live exchange rate and charges clear, transparent fees for their clients sending money from Canada to dozens of worldwide destinations."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Over 16 million customers use Wise, mostly for their excellent mobile app, transparent fee structure & use of mid-market rates. Now increasingly used for larger transfers."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

"Xe has over 30 years of currency exchange experience, and is one of the most reputable names on the market. 200 countries, 100 currencies, & funds often received in seconds."

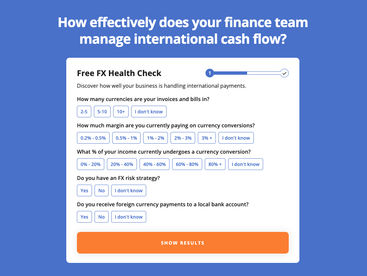

In our experience, there are always efficiencies to be made in how businesses manage international payments in and out.

Why not take our free FX health check test to see how effective your business is in managing these. It only takes a couple of minutes.

What is the best way to send money to UAE from Canada?

We’ve compared 15 money transfer companies for CAD/AED transfers.

Key Currency is currently the cheapest and the best overall option. It offers the best CAD/AED exchange rate (1 CAD = 2.6757 AED) and the lowest fees of 0 CAD.

For a 10,000 CAD transfer, you will receive 26,757.03 AED with Key Currency.

If you need money quickly, Currencyflow is the fastest way to send Canadian Dollars to the United Arab Emirates.

It will cost you 0 CAD, and AED will arrive in minutes - 24 hours.

If you didn’t find what you were looking for or have any questions, send us a quick message using the chat below or to our email contact@moneytransfers.com.

Latest CAD to AED exchange rates

Exchange rates constantly change, so it’s very important to keep an eye on the current CAD/AED mid-market rate.

This way, you will be able to get the most UAE Dirham per Canadian Dollar.

Here are the latest CAD/AED conversion rates for the most popular transfer amounts.

| CAD | AED Price |

|---|---|

| 1 CAD | 2.69 |

| 5 CAD | 13.43 |

| 10 CAD | 26.86 |

| 25 CAD | 67.16 |

| 50 CAD | 134.32 |

| 100 CAD | 268.65 |

| 150 CAD | 402.97 |

| 200 CAD | 537.30 |

| 250 CAD | 671.62 |

| 300 CAD | 805.95 |

| 400 CAD | 1074.60 |

| 500 CAD | 1343.25 |

| 600 CAD | 1611.90 |

| 700 CAD | 1880.54 |

| 800 CAD | 2149.19 |

| 1000 CAD | 2686.49 |

| 1500 CAD | 4029.74 |

| 2000 CAD | 5372.98 |

| 2500 CAD | 6716.23 |

| 3000 CAD | 8059.48 |

| 4000 CAD | 10745.97 |

| 5000 CAD | 13432.46 |

| 10000 CAD | 26864.92 |

| 15000 CAD | 40297.38 |

| 20000 CAD | 53729.84 |

| 30000 CAD | 80594.76 |

| 40000 CAD | 107459.68 |

| 50000 CAD | 134324.60 |

| 100000 CAD | 268649.20 |

| AED | CAD Price |

|---|---|

| 1 AED | 0.37 |

| 5 AED | 1.86 |

| 10 AED | 3.72 |

| 25 AED | 9.31 |

| 50 AED | 18.61 |

| 100 AED | 37.22 |

| 150 AED | 55.83 |

| 200 AED | 74.45 |

| 250 AED | 93.06 |

| 300 AED | 111.67 |

| 400 AED | 148.89 |

| 500 AED | 186.12 |

| 600 AED | 223.34 |

| 700 AED | 260.56 |

| 800 AED | 297.79 |

| 1000 AED | 372.23 |

| 1500 AED | 558.35 |

| 2000 AED | 744.47 |

| 2500 AED | 930.58 |

| 3000 AED | 1116.70 |

| 4000 AED | 1488.93 |

| 5000 AED | 1861.16 |

| 10000 AED | 3722.33 |

| 15000 AED | 5583.49 |

| 20000 AED | 7444.66 |

| 30000 AED | 11166.99 |

| 40000 AED | 14889.32 |

| 50000 AED | 18611.65 |

| 100000 AED | 37223.30 |

*Based on the mid-market rates (also known as the interbank rates or the "real" exchange rates). The actual rate offered during the transfer may vary depending on the FX markup added by the money transfer companies.

Everything you need to know about sending CAD to AED

Sending money to UAE from Canada is quick and easy, and usually takes less than 10 minutes from start to finish.

Follow these steps to get started:

Pick the company - Pick the best money transfer company for your needs (we suggest Key Currency as it’s the cheapest) and click Visit Now*.

Register and verify your account - This will require submitting your details, and you will need to provide an ID or a passport from Canada.

Start the transfer - Once all verified, start the transfer, fill in the amount, and your recipient's details. This will include personal details and UAE bank account details (where they will receive UAE Dirham).

Add payment details - Next, add your funding details. We suggest using a Bank transfer as it’s the cheapest deposit method for CAD/AED transfers.

Verify and hit “Send” - Once all is done, scan through the details to make sure everything is correct and click the “Send” button. Your CAD will convert to AED and land in UAE bank account.

*We may receive a small commission when you click “Visit” links on our website. This does not influence the order of the remittance companies.

What is the cheapest way to send money to UAE from Canada?

The cheapest way to send money from Canada to the United Arab Emirates is with Key Currency.

Key Currency adds 0.25% to the interbank rate and charges 0 CAD for a 10,000 AED transfer. This means you will receive 26,757.03 AED.

In addition, we suggest using a bank transfer to deposit your funds. Based on our CAD/AED comparison, it is the cheapest payment method.

If you want to send more or less CAD to UAE, and update the amount field.

What is the fastest way to transfer money from Canada to UAE?

The fastest way to send CAD to the United Arab Emirates is with Currencyflow.

Most money transfers between Canada and the United Arab Emirates will take minutes - 24 hours to arrive.

However, if you are sending a large amount of money (think 10,000+ CAD), it may take slightly longer depending on your bank.

Some banks may run additional checks, so if you are expecting to send or receive large amounts of money, we suggest contacting your bank in advance.

The best apps to send CAD to United Arab Emirates from Canada

Most money transfer companies have apps you can use to send money abroad.

We've compared and analyzed over 15 apps & companies for CAD/AED transfers and these are the best apps we found. All these apps are available on iOS and Android for free.

App | Rating | Mobile wallet |

|---|---|---|

iOS: 4.6 / 951 reviews Android: 3.7 / 1.06K reviews | Yes (17 currencies) | |

iOS: 4.8 / 2.6K reviews Android: 4.4 / 4.19K reviews | Yes (30+ currencies) | |

iOS: 4.8 / 158K reviews Android: 4.8 / 1.52M reviews | Yes (40+ currencies) | |

iOS: 4.8 / 108.4K reviews Android: 4.8 / 346K reviews | No |

How to get the best exchange rate for your money transfers from Canada to United Arab Emirates?

Keeping an eye on the exchange rate is extremely important, a small change in the interbank rate can get you over 100s AED more per transfer from Canada.

Our comparison above already shows you the best exchange rates on the market for sending money from Canada to UAE.

To get an even better exchange rate, we recommend creating a free account on MoneyTransfers.com and saving this search, as well as setting up CAD/AED .

This will let you quickly access this search in your dashboard, and you will receive email notifications when the rate changes.

Want to secure the best CAD-UAE Dirham exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to send your money from Canada to United Arab Emirates!

What is the best payment method for CAD/AED transfers?

bank transfer is the best deposit method to use when sending Canadian Dollars to the United Arab Emirates.

After analyzing 15 remittance companies accepting CAD/AED, we found that it is the most cost-efficient option.

As a general rule of thumb, bank transfers are usually the cheapest, debit cards are most convenient but slightly more expensive, while credit cards are the most expensive (due to cash advance fees).

What is the best withdrawal method when sending money from Canada to UAE?

A bank account is the most popular and convenient way to receive UAE from Canada.

There’s nothing for your recipient to do, UAE will land directly into their account. This usually takes minutes, but can take up to 3 days depending on the amount.

Mobile wallets and multi-currency accounts are also popular and very convenient options for receiving money in the United Arab Emirates from Canada.

If you need money urgently, we recommend cash pickup via Western Union or MoneyGram. You will deposit CAD online or in-store, and AED will be available as cash for pickup within minutes.

Our methodology

We’ve compared and analyzed 15 money transfer companies that support money transfers from Canada to the United Arab Emirates.

First of all, every single remittance provider on the list is regulated, legit, and safe to send money abroad.

When testing CAD/AED transfer specialists, we’ve rated each company on a scale of 1-10 based on the following categories:

Fees & rates

Transfer speed

Safety & trust

Product offering

Transfer limits

Ease of use

Customer feedback

In addition, each company goes through an unbiased editorial process, where we look for a comprehensive list of flaws and benefits.

To ensure this page remains up to date, we use our first-party data from our comparison engine and merge it with the live data feeds and API from the remittance companies.

This page updates daily with the latest rates and fees.

If you want to know more about our methodology and standards, check these guides:

If you want to see the full money transfer companies list, check out our company reviews page.

Related transfer routes

Send money from Canada

Send money to United Arab Emirates

Contributors

.svg)